Polygon Records Over 1 Million Active Addresses – Impact On MATIC Price

10 Luglio 2024 - 11:30AM

NEWSBTC

The Layer-2 scaling solution for Ethereum, Polygon (MATIC), is

currently going through a strange circumstance. The quantity of

network activity has increased significantly, but the

cryptocurrency’s price is still unpredictable. It’s stuck in a rut,

held back by both a possible technical breakthrough and a

chronically pessimistic outlook. Related Reading: Mass Adoption?

NEAR Protocol Sees 17 Million Unique Addresses In 30 Days Polygon:

Can Active Addresses Raise The Bar? Polygon’s network was humming

on July 8th, with an astounding 1.18 million active addresses. For

the same period, this easily outpaced Ethereum (365K) and Bitcoin

(594K). The increase in user activity stoked expectations of a

positive breakout, especially as MATIC was trading over a crucial

$0.50 barrier level. Co-founder of Polygon Mihailo Bjelic excitedly

provided this statistics, emphasising the increasing use of the

network. Some cryptocurrency fans, meanwhile, were quick to label

this as a “vanity metric.” They contended that robust economic

fundamentals or important transactions are not always correlated

with raw address count. Number of active addresses (24h): Polygon:

1.18M Bitcoin: 594k Ethereum: 365k Not too shabby, I guess.. —

Mihailo Bjelic (@MihailoBjelic) July 8, 2024 Although resistance

lingers, the falling wedge pattern suggests a breakout. Taking into

consideration the technological aspects, it seems that things are

getting better for MATIC. As the token has been moving in a falling

wedge formation, which is commonly seen as a sign that an upswing

in the market is about to occur, the pattern has been observed. In

addition, as a result of a recent spike in price, MATIC came

dangerously close to crossing the threshold of $0.50 for a brief

while. It is probable that this is an indication of a future

breakout, particularly if the volume of trade grows. MATIC market

cap at nearly $5 billion today. Chart: TradingView.comBut the bulls

are up against an unyielding obstacle. As the mark has shown to be

a strong resistance level in the past, a clear break above it is

essential to the validation of the falling wedge breakout.

Moreover, the general mood of the market is still biassed towards

the bears. At the time of writing, MATIC was down 10% in the weekly

timeframe, data from Coingecko show. Bullish Binance, But Can They

Move The Market? Meanwhile, the biggest cryptocurrency exchange in

the world, Binance offers some optimism. When it comes to MATIC,

Binance, users seem to be far more optimistic than the whole

market. With a solid long to short position ratio of 3.2052, they

appear to have a high conviction in the potential of MATIC going

forward. Related Reading: XRP Stages A Comeback: Aims To Reclaim

$0.50 After Recent Plunge It’s encouraging to see such strong

enthusiasm on a significant exchange. But it’s not clear if it will

be sufficient to counter the general pessimism. For MATIC, the next

several days will be critical. A falling wedge breakthrough might

occur if it can generate enough volume to break over the $0.50

barrier and maintain the momentum. But if the barrier holds and the

bearish attitude persists, MATIC can experience more downside

pressure. Featured image from cryptodnes.bg, chart from TradingView

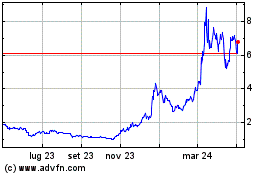

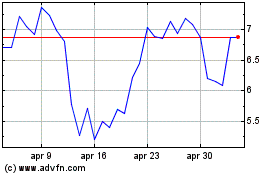

Grafico Azioni NEAR Protocol (COIN:NEARUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni NEAR Protocol (COIN:NEARUSD)

Storico

Da Dic 2023 a Dic 2024