- Revenue growth in 2022 of +12% to €51.6 million and EBITDA

margin of 12%

- Strong cash position of €11.5 million as at December 31,

2022

- Confirmation of the Group's financial objectives for

2024

Regulatory News:

Groupe Berkem (Paris:ALKEM), a leading player in bio-based

chemistry (ISIN code: FR00140069V2 - ticker: ALKEM), announces

its consolidated results for the year ended December 31, 2022, as

approved by its Board of Directors on May 16, 2023. The audit

procedures on the annual accounts have been conducted and the

auditors' report is being issued. Groupe Berkem also provided an

update on its recent business trends and outlook.

Olivier Fahy, Chairman and Chief Executive Officer of Groupe

Berkem stated: “The geopolitical context combined with the

general increase in our operating expenses due to the inflation we

are experiencing weighed heavily on our margins during the fiscal

year 2022. Despite these adverse conditions, we continued to

structure the Group to best support its growth dynamic. As proof of

the resilience of our model, Groupe Berkem managed to recover its

pre-crisis level of normative margin. In 2023, we intend to further

streamline our cost structure through the synergies offered by our

recent acquisitions. Also, with a preserved cash position, we keep

all the necessary latitude to carry out new external operations and

confirm our financial objectives for 2024.”

2022 FULL-YEAR RESULTS

2022 income statement

In thousands of euros – IFRS standards

31/12/2022

31/12/2021

Revenue

51,566

46,049

Cost of goods and services sold

(35,613)

(28,645)

Gross profit

15,953

17,404

Research & Development

(1,731)

(387)

Sales and Marketing

(7,483)

(6,266)

General and administrative expenses

(5,585)

(4,235)

Recurring operating income

1,154

6,516

Other operating income

713

418

Other operating expenses

(2,395)

(1,347)

Operating income

(527)

5,587

Financial income

147

225

Financial expenses

(1,018)

(3,719)

Financial income

(871)

(3,494)

Corporate tax

(169)

(899)

Net income

(1,567)

1,193

Growth of +12% in revenue and EBITDA margin of 12% in

2022

As of December 31, 2022, Groupe Berkem's Full-Year revenue

reached €51.8 million, up 12.4% compared to the 2021 financial

year. Over the year, the Plant Extraction division contributed

30.9% of revenue to December 31, 2022, or €15.9 million. The

revenue of the Formulation division amounted to €35.8 million,

representing 69.1% of the Group's total revenues in 2022. This

revenue from the formulation division rose sharply in 2022, thanks

in particular to the acceleration of demand for bio-based solutions

in the construction sector, but also in the pest control

market.

In 2022, the costs of products and services sold amounted to

€35.6 million, up +24% compared with 2021. This increase is due to

the rise in the price of raw materials, direct labor, and energy,

all of which are due to the geopolitical context. As a result,

the Group's gross profit was €15.9 million in 2022.

Groupe Berkem made significant investments in R&D and

regulatory affairs to strengthen its "product" innovations and

secure marketing authorizations. €1.7 million was invested in 2022,

which is 4.5 times the amount invested in 2021.

At the same time, Groupe Berkem increased its marketing and

sales expenses to promote the Group's products and activities to

target audiences and has also strengthened its teams with a number

of recruitments to support the Group's growth.

As a result, in 2022, recurring operating income amounted to

€1.1 million, compared with €6.5 million in 2021, and operating

income to €0.5 million.

The Group's EBITDA1 reached €6.19 million compared to

€9.4 million in 2021 and the EBITDA margin was 12%.

In 2022, financial income and expenses amounted to -€0.87

million and corporate income tax to -€0.17 million. As a result,

the Group's share of net income will be -€1.57 million in

2022, compared with €1.20 million in 2021.

Cash position as at December 31, 2022

On July 26, 2022, the Group strengthened its financial structure

by setting up a €70 million financing, including €63.5 million in

senior debt with a pool of 6 French banks and €6.5 million in

Recovery Bonds2. These financial resources provide the Group with

greater resources to carry out external growth operations. As of

December 31, 2022, only €21 million of the €70 million had been

drawn down.

As of December 31, 2022, Groupe Berkem held a strong cash

position of €11.5 million.

2022 AND POST-CLOSING HIGHLIGHTS

M&A operations

In February 2023, Groupe Berkem announced the completion of the

acquisition of i.Bioceuticals, Inc. from the Dutch company INC

(International Nutrition Company), the leading North American

distributor of nutritional ingredients. The acquisition of this

subsidiary enables the Group to distribute directly in North

America its complete range of antioxidant active ingredients and to

broaden its offer by addressing the Nutraceutical segment.

Also, in early April 2023, the Group announced the strategic

acquisition of Biopress, a French producer of 100% vegetable oils

and proteins. With this transaction, the Group now benefits from a

local supply of technical vegetable oils, consolidates its offer

for the "Health, Beauty & Nutrition" business segment and

secures new commercial opportunities in the food market.

Activity

In March 2022, Groupe Berkem launched its range of 100%

bio-based resins for the building paint market. This range has been

developed from raw materials of bio-based and renewable origin,

which can be substituted for raw materials of petrochemical

origin.

In June 2022, Groupe Berkem and the SOPREMA Group signed a

collaboration agreement to market an insulating panel incorporating

a bio-based antifungal solution developed by Groupe Berkem.

International and Regulatory Affairs

In October 2022, Groupe Berkem announced an exclusive

partnership in North America with the company Barentz, for the

distribution of the Group's sustainable ingredients in the "Health,

Beauty & Nutrition" market. This exclusive collaboration was

extended in November 2022, with Barentz also becoming the exclusive

distributor of Groupe Berkem's sustainable ingredients in Germany,

Austria and German-speaking Switzerland.

In March 2023, the Group announced the extension of the

distribution agreement with Unipex, already a distributor of the

Group's plant extracts in France, to the territories of Benelux and

French-speaking Switzerland for all its ingredients dedicated to

the cosmetics and personal care market.

In April 2023, Groupe Berkem continued to strengthen its

international expansion strategy by signing a partnership with

Kreglinger for the distribution of its cosmetic ingredients in the

United Kingdom.

At December 31, 2022, the Group held 189 marketing approvals and

a further 73 applications were currently under review.

2023 First-Quarter Revenue

On April 27, 2023, Groupe Berkem reported its revenue for the

first quarter of 2023 and presented the new breakdown of its

revenue between its four business segments:

- Construction & Materials;

- Hygiene & Protection;

- Health, Beauty & Nutrition and

- Industry.

As at March 31, 2023, Groupe Berkem's revenue for the first

three months of 2023 reached €14.5 million, compared with €13.8

million in the first quarter of 2022, reflecting an increase of

5.1%.

OUTLOOK

Confirmation of financial targets for 2024

The Group confirms its ambition to achieve revenue of at least

€85 million by 2024, following the external growth transactions

carried out. By the same date, the Group's objective is to achieve

an EBITDA margin of around 25%.

Publication of the 2022 annual report

The 2022 annual report is available on the Company’s website and

was filed with the AMF this day.

Next financial reports:

- Annual General Meeting: June 22, 2023 (as opposed to the date

announced on April 27, 2023)

- 2023 First-Half Revenue: July 31, 2023 (after market

close)

ABOUT GROUPE BERKEM

Founded in 1993 by Olivier Fahy, Chairman and Chief Executive

Officer, Groupe Berkem is a leading force in the bio-based

chemicals market. Its mission is to advance the environmental

transition of companies producing the chemicals used in everyday

life (Construction & Materials, Health, Beauty & Nutrition,

Hygiene & Protection, and Industry). By harnessing its

expertise in both plant extraction and innovative formulations,

Groupe Berkem has developed bio-based boosters—unique high-quality

bio-based solutions augmenting the performance of synthetic

molecules. Groupe Berkem achieved revenue of €51.6 million in 2022.

The Group has almost 200 employees working at its head office

(Blanquefort, Gironde) and 3 production facilities in Gardonne

(Dordogne), La Teste-de-Buch (Gironde), and Chartres

(Eure-et-Loir).

Groupe Berkem has been listed on Euronext Growth Paris since

December 2021 (ISIN code: FR00140069V2 - ALKEM).

www.groupeberkem.com

_________________________________ 1 Earnings Before Interest,

Taxes, Depreciation and Amortization (EBITDA), corresponds to the

operating resources generated by the Group taking into account

other operating income and other operating expenses, but excluding

depreciation and amortization and the Group's financing policy. 2

See press release issued on 26 July 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230516005900/en/

Groupe Berkem Olivier Fahy,

Chairman and CEO Anthony Labrugnas, Chief Financial Officer Phone:

+33 (0)5 64 31 06 60 investisseurs@berkem.com

NewCap Investor Relations

Mathilde Bohin / Nicolas Fossiez Phone: +33 (0)1 44 71 94 94

berkem@newcap.eu

NewCap Media Relations

Nicolas Merigeau / Antoine Pacquier Phone: +33 (0)1 44 71 94 94

berkem@newcap.eu

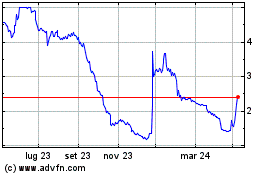

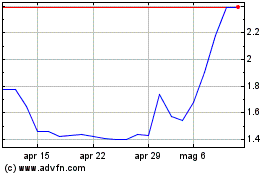

Grafico Azioni Groupe Berkem (EU:ALKEM)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Groupe Berkem (EU:ALKEM)

Storico

Da Mag 2023 a Mag 2024