LEXIBOOK: FISCAL Q4 22-23 BETTER THAN EXPECTED AT €7.5M VS €8.4M IN Q4 21-22. HISTORIC ANNUAL SALES UP 13.3% to €51.2M vs. €45.2M THROUGH GROWTH IN FRANCE AND ABROAD. GOOD PROSPECTS FOR THE NEW FISCAL YEAR 2023-24.

11 Maggio 2023 - 7:00AM

LEXIBOOK: FISCAL Q4 22-23 BETTER THAN EXPECTED AT €7.5M VS €8.4M IN

Q4 21-22. HISTORIC ANNUAL SALES UP 13.3% to €51.2M vs. €45.2M

THROUGH GROWTH IN FRANCE AND ABROAD. GOOD PROSPECTS FOR THE NEW

FISCAL YEAR 2023-24.

LEXIBOOK: FISCAL Q4 22-23 BETTER THAN

EXPECTED AT €7.5M VS €8.4M IN Q4 21-22. HISTORIC ANNUAL SALES UP

13.3% to €51.2M vs. €45.2M THROUGH GROWTH IN FRANCE AND ABROAD.

GOOD PROSPECTS FOR THE NEW FISCAL YEAR 2023-24.

- Q4 fiscal activity remained very dynamic. After an

exceptional Q4 21-22 with 175.8% growth, Q4 22-23 sales were better

than expected at €7.5M vs. €8.4M in 21-22. For the full fiscal

year, which grew by 66.3% in 21-22, sales rose by a further 13.3%

to €51.2M vs. €45.2M a year earlier, whereas they were expected to

be close to €50M.

- Sales growth was driven by toys, watches, musical

instruments and walkie-talkies, thanks to new products under the

Group's own brands and licensed products.

- Over the fiscal year, sales rose by 17% in the French

market, which accounted for 38% of total sales. International sales

are also growing, both on traditional networks and on the Internet,

and have significant potential.

- The Group continued its communication campaign in

Europe during the quarter, exceeding one billion digital

impressions over its fiscal year.

- Q1 22-23, which was already up 78.2% in 21-22, is

expected to be close to this level in the new year, and augurs a

new year of profitable growth for Lexibook. The Group could benefit

from the current level of the U.S. dollar if it remains at this

level for the rest of the year and from the improvement in

international freight conditions to improve its

margins.

Lexibook (ISIN FR0000033599) announces today its turnover

(unaudited) for the period ending March 31, 2023 (period from April

1er 2022 to March 31, 2023).

|

Consolidated revenues (M€) |

2021/2022 |

2022/2023 |

Var |

|

1st quarter |

5,08 |

6,93 |

+36,4% |

| Of which

FOB |

1,31 |

2,22 |

| Of which

Non FOB |

3,77 |

4,71 |

|

2nd quarter |

9,82 |

13,4 |

+36,5% |

| Of which

FOB |

2,96 |

4,32 |

|

Of which Non FOB |

6,86 |

9,08 |

| 3rd

quarter |

21,86 |

23,41 |

+7,1% |

| Of which

FOB |

2,58 |

0,72 |

|

Of which Non FOB |

19,28 |

22,69 |

| 4th

quarter |

8,44 |

7,49 |

-11,3% |

| Of which

FOB |

1,35 |

1,87 |

|

Of which Non FOB |

7,09 |

5,62 |

|

|

|

|

|

| Total

12 months |

45,2 |

51,2 |

+13,3% |

|

|

|

|

|

After a very dynamic first half of fiscal year

22-23 with growth of 36.4% and a third quarter 22-23 also up 7%,

the last quarter of the fiscal year, which was already up 175.8% in

21-22 due to the saturation of the ports at the end of 2021, was

higher than the Group's expectations at €7.49M vs €8.44M in 21-22

(-11.3%). This sustained level of activity is linked to the

excellent consumption of Lexibook products during the Christmas

season in all the countries where the Group operates, and in most

of its main segments. Customers restocked on discontinued products

at Christmas and put in place a wider assortment than in previous

years on new permanent ranges.

For the full year, sales reached €51.2 million,

up 13.3%, a historic level for the Group. FOB sales (sales invoiced

directly from HK on FOB HK deliveries by full containers) and

non-FOB sales are both up, reflecting the popularity of the Group's

products among international distributors.

Over the full fiscal year, France

accounted for 38% of sales and grew by 17%. The international

market is also driving growth and has significant growth

potential.

In terms of products, sales growth was driven by

toys, watches, musical instruments and walkie-talkies, thanks to

new products under the Group's own brands and licensed products.

Sales growth was spectacular in toys, up 29%, and now representing

44% of total sales, with the success of the Powerman® robot ranges,

Crosslander® radio-controlled vehicles, as well as educational

products and electronic games. Alarm clocks, audio and music

products are also particularly popular, with growth of +12%, +10%

and +10% respectively.

Licensed products also contributed to this

growth, both on existing, very dynamic licenses such as The Snow

Queen, Patrol, Spiderman and on new licenses such as Super Mario,

Miraculous, and Harry Potter.

Finally, the Group's digitalization is bearing

fruit: digital sales are up sharply both in France and in the

various European markets, thanks in particular to a massive,

Europe-wide digital marketing campaign on the Group's new products.

This campaign generated more than one billion digital impressions

of the Group's products, mainly in Europe, and helped to strengthen

the Lexibook brand's reputation to an unprecedented level.

Perspectives

The Group presented its 2023 collections to

international retailers and the response to the new products was

very positive. The listings for the 2023 Christmas campaign are

excellent and suggest that the 2023-24 fiscal year will be in line

with 22-23. Q1 fiscal 22-23 was up 36% on Q1 fiscal 21-22, which

was itself up 78%. The benchmark is therefore high for fiscal Q1

2023-24. Nevertheless, the order book suggests a similar level of

activity to last year in Q1 2023-24 and the Group intends to

continue its momentum of profitable growth this year.

Several extensions of license agreements are

being finalized to extend current contracts into new areas, which

could have an accelerating effect on the Group over the next few

years.

The Group could also benefit from the current

level of the U.S. dollar if it remains at this level for the rest

of the year and from the improvement in international freight

conditions to improve its margins.

Financial calendar

2022/2023

- Annual results to March 31, 2023: June 30, 2023

About Lexibook

Lexibook®, owner of more than 40 registered

brands such as Powerman®, Decotech®, Karaoke Micro Star®,

Chessman®, Cyber Arcade®, Lexitab®, iParty®, FlashBoom®, etc.,

Lexibook® is the leader in smart electronic entertainment products

for children. This success is based on a proven strategy of

combining strong international licenses with high value-added

consumer electronics products. This strategy, complemented by a

policy of constant innovation, allows the group to flourish

internationally and to continuously develop new product ranges

under the Group's brands. With more than 35 million products on the

market, the company now sells a product every 10 seconds worldwide!

Lexibook's share capital is composed of 7,763,319 shares listed on

the Alternext market in Paris (Euronext). ISIN: FR0000033599 -

ALLEX; ICB: 3743 - Consumer electronics. For more information:

www.lexibook.com and www.decotech-lights.com.

Contacts

LEXIBOOK David Martins - CFO -

01 73 23 23 45 / davidmartins@lexibook.com

- Communique T4 2022-2023 Turnover en-US

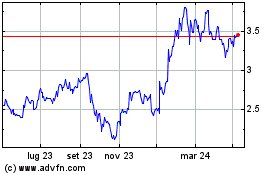

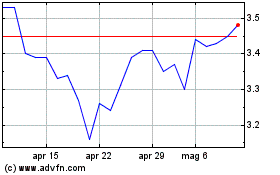

Grafico Azioni Lexibook Linguistic Elec... (EU:ALLEX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lexibook Linguistic Elec... (EU:ALLEX)

Storico

Da Apr 2023 a Apr 2024