- Q1 2024 revenue at €5.4 million as of March 31, 2024, with

growth expected for the remainder of 2024.

- Order backlog as of March 31, 2024: €68.2 million, an increase

in backlog as of December 31, 2023 (€66.8 million), the highest

order backlog ever.

- Cash position as of March 31, 2024: €20.9 million, financial

horizon through to Q2 2025.

Regulatory News:

Median Technologies (FR0011049824, ALMDT, PEA-PME scheme

eligible, “Median” or the “Company”) today reported its 2023

consolidated annual financial results, as of December 31, 2023, and

provided financial information (unaudited) for the first quarter of

2024, as of March 31, 2024. The consolidated financial statements

for the financial year ended December 31, 2023, were audited and

approved by the Company’s Board of Directors on April 24, 2024.

Fredrik Brag, Chief Executive Officer and Founder of Median

Technologies said: “In 2024, we expect strong growth in our

backlog in the USA and in Europe and a return to normal in China,

driven by successful recent collaborations with global CROs as well

as significant traction with leading pharmaceutical companies. A

major trend in the pharmaceutical industry is the wide-scale impact

expected from AI (Artificial Intelligence). Our AI-powered Imaging

Lab offering is a key differentiator and a robust growth driver. We

are in advanced discussions with global-leading pharmaceutical

companies to implement our proprietary AI-powered solutions in

oncology drug development. Imaging Lab’s AI technologies will

enable pharmaceutical companies to develop personalized treatments,

delivering better patient outcomes. In Quarter 1, our revenues were

impacted by the postponement to Quarter 2 of some studies due to

late patient recruitment. We expect to recoup most of the delay in

the coming quarters to resume revenue growth for the iCRO (imaging

Contract Research Organization) business unit in 2024.”

Fredrik Brag added: “In 2024, eyonis™ activity

will focus on the pivotal clinical studies of our SaMD eyonis™ Lung

Cancer Screening (LCS) CADe/CADx as well as partnering with major

strategic players to enable market access. We expect to obtain both

510(k) FDA clearance and CE marking for eyonis™ LCS in 2025. In

early 2024, we announced the preliminary results from the

independent eyonis™ LCS verification study Run 1. The results

showed that eyonis™ LCS could have one of the strongest impacts

ever on lung cancer care by identifying cancers at an early stage

when they can be cured. The verification study achieved excellent

results, with an area under the curve (AUC) value of 0.93 at the

patient level. These results are substantially higher than the

primary endpoint’s acceptance value discussed with the FDA for the

Standalone study which is an AUC of 0.80. Our Standalone and MRMC

clinical studies will continue throughout the year. Furthermore,

health-economic studies will be conducted in the second half of

2024 to secure reimbursements for eyonis™ LCS, initially in the

United States”.

First-quarter 2024 financial information (unaudited)

As of March 31, 2024, Median's quarterly revenue was €5.4

million, comparable to Q1 2023 revenue. Median's revenue is

achieved entirely by the iCRO1 business, which delivers services to

the global biopharmaceutical industry for image management in

oncology clinical trials.

The order backlog2 stood at €68.2 million as of March 31, 2024,

an increase from December 31, 2023 (€66.8 million). The Company’s

order backlog is at an all-time high.

As of March 31, 2024, the Company’s cash position was €20.9

million. On January 4, 2024, the Company’s cash position increased

with the €8.5 million drawdown of the final tranche of the loan

granted by the European Investment Bank (EIB) in December 2019.

Historically, the first quarter is characterized by higher external

and internal expenses, which generate significant cash outflows for

the period. Cash consumption over this period is not indicative of

quarterly cash consumption averaged over the year.

The Company considers that it is positioned to meet the

financing needs of operations until Q2 2025.

As a reminder, on July 3, 2023, Median signed a Securities

Purchase Agreement with Celestial Successor Fund, LP (“CSF”), a

long-lasting partner and its second biggest shareholder (7% of

outstanding shares). Consequently, and concurrently with a capital

increase of €11.6 million, on July 19, 2023, CSF subscribed to €10

million in convertible bonds issued by Median, with a maturity of

seven (7) years, and a fixed conversion price of €6.458.

Following conversations on the interpretation of the Securities

Purchase Agreement, CSF and Median have agreed to adjust the

conversion price of the bonds to €5.00. Consistent with the

long-lasting partnership between CSF and Median, this agreement

strengthens the future relationship between CSF and Median.

2023 Financial Highlights

Consolidated statement of cash

flows

Cash flow (€k)

12/31/2023

(12 months)

12/31/2022

(12 months)

Operating cash flow

(19,160)

(14,206)

Change in operating working capital

(660)

(955)

Net cash flow from operating

activities

(20,236)

(15,793)

Net cash flow from investing

activities

(1,253)

(1,387)

Net cash flow from financing

activities

19,722

(277)

Impact of changes in exchange rates

(203)

(80)

Net change in cash and cash

equivalents

(1,971)

(17,538)

Cash and cash equivalents at end of the

period

19,495

21,467

- Net cash flow consumption from operating activities increased

from (€15.8) million in 2022 to (€20.2) million in 2023. This

increase was mainly driven by lower sales of iCRO, investments

related to Median’s Software as Medical Device (SaMD) eyonis™ LCS,

and additional IT resources.

- Cash and cash equivalents at end of period (end-2023) totaled

€19.5 million, compared to €21.5 million at end-2022. The Company’s

cash position was bolstered in July 2023, with refinancing of

€21.6m, comprising a capital increase of €11.6m with a subscription

price of €4.70 per share, and the issue of €10m in fixed-rate

convertible bonds. The Cash position was further strengthened in

early January 2024 with the drawdown of a €8.5m tranche of the 2019

EIB loan.

Net income statement under IFRS accounting

rules

Net profit (loss) (€k)

12/31/2023

(12 months)

12/31/2022

(12 months)

Revenue

22,226

23,670

Income from ordinary activities

22,780

23,945

Staff costs

(25,485)

(28,061)

External expenses

(19,657)

(18,846)

Operating profit (loss)

(23,116)

(23,356)

Net financial income

211

3,664

Net profit (loss)

(22,982)

(20,213)

- 2023 net loss reached €23.0 million i.e., a €2.8 million

increase on the 2022 net loss.

- Full-year 2023 revenue was impacted by slow order intake in

China during H2 2022 and H1 2023, for a total of €22.2m, i.e., a

year-on-year decline of 6.7% (full-year 2022 revenue: €23.7m).

- Operating loss amounted to €23.1 million, comparable to the

Company’s 2022 operating loss.

- External expenses were up by €0.9 million, an increase driven

by new investments in IT services and fees related to technology

infrastructure, primarily for eyonis™.

- Staff costs were down €2.6 million, compared to 2022 staff

costs, mainly due to the decrease in share-based payments from

€7.9m in 2022 versus €2.8m in 2023. Actual payroll costs increased

by 12%, consistent with the increase in personnel, up to an average

of 241 people in 2023.

2023 operating highlights

eyonis™ - AI-driven patient care

innovation: in 2023, the Company made significant strides

regarding its eyonis® portfolio development and launched the SaMD

eyonis™ Lung Cancer Screening (LCS) pivotal clinical plan, a key

milestone in Median’s roadmap to obtain marketing authorizations

for the US and Europe markets. All US and European clinical sites

involved in the SaMD eyonis™ LCS pivotal clinical plan were

initiated in July 2023.

In the second half of 2023, the Company performed an independent

verification study on a version of the SaMD eyonis™ LCS,

incorporating an algorithm developed in H2 2023. The tested SaMD

achieved excellent verification results, with an area under the

curve (AUC) value of 0.93 at patient level versus an AUC of 0.80 –

the acceptance value of the primary endpoint in the Standalone

study. Topline preliminary results of the independent verification

studies were issued in January 2024.

Regarding the SaMD eyonis™ HCC (Hepatocellular Carcinoma),

initial results for Median’s eyonis™ HCC AI model based on the

PHELICAR clinical data registry (AP-HP Hospital, Paris, France)

were presented at the European Society of Medical Oncology (ESMO)

annual congress held October 2023, in Barcelona (Spain). Designed

to detect hepatocellular carcinoma (HCC) lesions as small as 10 mm

(0.4 in”) in diameter, the HCC AI model showcased promising

results, achieving a sensitivity rate of 92% on the set test data.

This notable achievement significantly outperformed the average

sensitivity rate of 69% observed among radiologists without AI and

Machine Learning (ML) computer-aided detection software.

iCRO – AI-driven drug development and

therapeutic innovation: in Q3

2023, Median’s iCRO business was successfully inspected by the US

Food and Drug Administration (FDA) and the Chinese National Medical

Products Administration (NMPA) for a phase I/II oncology study with

one of the global-leading pharma companies. To date, the Company

has been successfully inspected 4 times by the FDA, and 13 times by

the Chinese NMPA, continuing its best-in-class track record.

As of December 31, 2023, Median had supported 249 oncology

studies, including 93 Phase III studies. Phase III studies

represent the fastest growing segment for Median’s iCRO business.

In Q3 and Q4 2023, iCRO business accelerated in China, with a

robust ramp-up in new requests for proposals and contracts, on the

back of a declining order intake during the first half of 2023 and

in 2022 on a full-year basis.

Imaging Lab, Median's AI-powered imaging offering for drug

development, continued to attract strong interest from

biotechnology and pharmaceutical companies, particularly large

corporations based in the United States. AI supports the

development of precision medicine in oncology and Imaging Lab is

Median’s most prominent technology asset to ramp up iCRO business,

creating a unique point of differentiation compared to imaging

vendors providing only classical imaging readouts.

Median Technologies informs its shareholders

and the financial community that its annual financial report on the

accounts for the year ended December 31, 2023, has been made

available and filed with the French financial market authority

(Autorité des Marchés Financiers). The annual financial report is

available on the Company’s website:

https://mediantechnologies.com/investors/financial-results-and-reports/

Forward-looking statements: This press release contains

forward-looking statements. These statements are not historical

facts. They include projections and estimates as well as the

assumptions on which these are based, statements concerning

projects, objectives, intentions, and expectations with respect to

future financial results, events, operations, services, product

development and potential, or future performance. These

forward-looking statements can often be identified by the words

"expects," "anticipates," "believes," "intends," "estimates" or

"plans" and similar expressions. Although Median's management

believes that these forward-looking statements are reasonable,

investors are cautioned that forward-looking statements are subject

to numerous risks and uncertainties, many of which are difficult to

predict and generally beyond the control of Median Technologies,

that could cause actual results and events to differ materially

from those expressed in, or implied or projected by, the

forward-looking information and statements. These risks and

uncertainties include, but are not limited to, the uncertainties

inherent in research and development, future clinical data and

analysis, and decisions by regulatory authorities. Median

Technologies' ability to take advantage of external growth

opportunities and to complete related transactions and/or obtain

regulatory approvals, risks associated with intellectual property,

changes in foreign exchange rates and interest rates, volatility in

economic conditions the impact of cost containment initiatives and

their evolution, the average number of shares outstanding, as well

as those developed or identified in Median Technologies' public

filings with the AMF, including those listed under "Risk Factors"

and "Forward-Looking Statements" in Median Technologies' 2023 FY

report providing financial results as of December 31, 2023 and

released on April 25, 2024. Median Technologies does not undertake

to update any forward-looking information or statements, subject to

applicable regulations, in particular Articles 223-1 et seq. of the

General Regulation of the Autorité des Marchés Financiers.

About Median Technologies: Pioneering in innovative imaging

solutions and services, Median Technologies harnesses cutting-edge

AI to elevate the accuracy of early cancer diagnoses and cancer

treatments. Median's offerings, including iCRO for medical image

analysis and management in oncology trials and eyonis™, AI/ML

tech-based suite of software as medical devices (SaMD), empower

biopharmaceutical entities and clinicians to advance patient care

and expedite novel therapies. The French-based company, with a

presence in the U.S. and China, is listed on the Euronext Growth

market (ISIN: FR0011049824, ticker: ALMDT). Median is eligible for

the French SME equity savings plan scheme (PEA-PME). For more

information: www.mediantechnologies.com

1 Imaging Contract Research Organization 2 The order backlog is

the sum of orders received but not yet fulfilled. An increase or

decrease in the order backlog corresponds to the order intake of

the reporting period, net of invoiced services, completed or

cancelled contracts, and currency impact for projects in foreign

currency (re-evaluated at the exchange rate on closing date).

Orders are booked once the customer confirms, in writing, its

retention of the Company’s services for a given project. The

contract is usually signed a few months after written

confirmation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240425540320/en/

Median Technologies Emmanuelle Leygues Head of Corporate

Marketing & Financial Communications +33 6 10 93 58 88

emmanuelle.leygues@mediantechnologies.com

Press - ALIZE RP Caroline Carmagnol +33 6 64 18 99 59

median@alizerp.com

Investors - ACTIFIN Ghislaine Gasparetto +33 6 21 10 49

24 ghislaine.gasparetto@seitosei-actifin.com

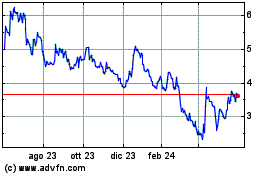

Grafico Azioni Median Technologies (EU:ALMDT)

Storico

Da Nov 2024 a Dic 2024

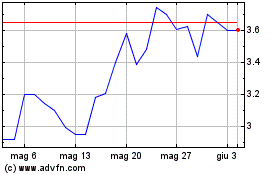

Grafico Azioni Median Technologies (EU:ALMDT)

Storico

Da Dic 2023 a Dic 2024