Regulatory News:

SpineGuard (FR0011464452 – ALSGD), an innovative company that

deploys its DSG (Dynamic Surgical Guidance) sensing technology to

secure and streamline the placement of bone implants announced

today that they implemented an innovative equity line financing of

a maximum of €7.5M with Nice & Green, an investment firm

partnering with the Company since 2017.

In a volatile macroeconomic context, this innovative financing

(the "Horizon Program") aims at securing the Company's long-term

financing and to provide it additional resources to implement its

strategy. It is made possible by the Company's strong performance

in 2022 and the first quarter of 2023.

The company intends to use the Horizon Program in a targeted and

selective manner to:

- accelerate the commercial, marketing and

logistics reorganization of its subsidiary in the United States, to

support the growth in both the world's and SpineGuard’s largest

market;

- redeem the Company’s venture debt to

strengthen its balance sheet while also significantly reducing its

financial expenses; and

- build a financing envelope that could be

mobilized for future growth and innovation opportunities and thus

creating shareholder’s value.

The Horizon Program was authorized by the Board of Directors

according to the delegation received from the 11th and 12th

resolutions granted at the Extraordinary Shareholders Meeting held

on June 30, 2022, to proceed with the gradual issuance, in

tranches, of bonds convertible into shares (The “Horizon Bonds”),

which will entitle the holder, upon exercise, to the issuance

and/or allotment of new and/or existing shares, for a total nominal

value of up to €7,500,000.

SpineGuard estimates that, given the existing cash position as

of April 30, 2023, of €5.3M, its business plan including the

recently announced agreements with its partner in China, the debt

reduction project and the total amount of this equity line that its

cash runway stands at least until the end of 2026.

Pierre Jérôme, Chairman, CEO and Co-founder of

SpineGuard, says: “This financing provides us with the

visibility and leeway necessary to amplify our commercial

deployment, particularly in the United States, make the most of the

tremendous clinical innovation potential of our DSG technology and

lead us towards profitability."

Additional information regarding the Horizon Program:

innovative aspects

SpineGuard and Nice & Green share the common objectives of

implementing a financing tool that clearly aligns the interests of

the Company, the investment company and all the shareholders.

Therefore, the Horizon Program includes binding clauses

regarding:

a- the limitation of stock trades resulting

from the exercise of the Horizon Program to 15% of the daily net

amounts exchanged; b- the existence of a minimum trading price; c-

the monthly communication on the company's website of a statement

of the transaction carried out by Nice & Green S.A. in order to

verify the respect of these binding clauses; d- the drawings being

at the initiative of the Company subject to certain conditions

relating to the stock market price.

The subscription of the Horizon Bonds is reserved to Nice &

Green SA, a Swiss company, specializing in the structuring and the

financing of small and medium-sized listed companies. The Horizon

Bonds, with a nominal value of 10,000 euros, have a maturity of 36

months and will not give rise to interest payments.

Based on the share price as at May 30, 2023, i.e. €0.6440 and

should the 750 Horizon Bonds be drawn and converted, the total

dilution induced would be 23%.

The first tranche of €2,500,000 will be drawn in June 2023.

This financing does not require a prospectus subject to the

approval of the French “Autorité des marchés financiers”. The

characteristics and dilutive impact of the transaction are detailed

in the appendix to this press release. The Company draws the

public's attention that the conversion or exercise of the

securities issued under this program may take place at the request

of the holder in accordance with the provisions of the contract for

the issue and subscription of the Horizon Bonds. The shares

resulting from such exercises and conversions will freely trade on

the Euronext Growth market (Paris), in compliance with applicable

legal and regulatory provisions.

The Company will post on its website a monthly table providing

for the details of the conversions of the Horizon Program (section

"Investors", "Documentation" and "Regulated Information" tab).

The detailed specifications of the Horizon Program are presented

in the appendix to this press release.

Information regarding the debt restructuring

improvement

The Company submitted to the Commercial Court of Créteil a

project to improve its safeguard plan (“plan de sauvegarde”)

validated in 2021. The proposed plan would improve creditors'

repayment terms by two years, allows to repay all of its

bondholder’s debt, saves over €300K in interest (rate close to 10%)

and provides improved leeway for non-dilutive financing. On the

date of publication of this news release, the effective

implementation of this debt restructuring operation remains subject

to the approval of the Commercial Court of Créteil in France.

Information regarding the DSG Dental project

Despite significant progress and a functional prototype under

development, Adin Dental Implant Systems, parent company of

ConfiDent ABC, has unilaterally decided to halt their DSG dental

application project for financial reasons. SpineGuard has taken

note of this decision, remains convinced of the potential of this

very advanced and extremely promising project and is studying

different options to continue it. The Company will communicate

further details to its shareholders during the webinar on June

1.

Information regarding the CFO transition

Effective, June 1st, Anne-Charlotte Millard replaces Manuel

Lanfossi as Chief Financial Officer of SpineGuard. Anne-Charlotte

knows the Company extensively as she held the position of Deputy

Finance Director from 2009 until 2019. Since 2019, Anne-Charlotte

was CFO at Biomodex a French private medtech company. After a

transition period, Manuel will leave the Company in November to

pursue new endeavors.

Manuel Lanfossi, Chief Financial Officer of SpineGuard,

says: “I am very pleased to have the opportunity to end my tenure

at SpineGuard with the implementation of a financing that clearly

aligns both the shareholders and the company’s interest while

securing SpineGuard’s long term financial resources. Since 2017,

the collaboration with Nice & Green has been exemplary."

Anne-Charlotte Millard, new Chief Financial Officer of

SpineGuard, adds: “This is a tremendous time to join

SpineGuard, I look forward to leading our finance and

administration organization while partnering with Pierre, Stéphane

and the entire team as we look to grow the brand, drive innovation

and maximize value for shareholders."

Pierre Jérôme, Chairman, CEO and Co-founder of

SpineGuard, concludes: “On behalf of SpineGuard’s Board of

Directors, I would like to warmly thank Manuel for his excellent

work over the past twelve years and his impeccable handover to Anne

Charlotte whom I am delighted to welcome back to the team following

a successful CFO experience at one of our industry peers."

About SpineGuard® Founded in 2009 in France and the USA

by Pierre Jérôme and Stéphane Bette, SpineGuard is an innovative

company deploying its proprietary radiation-free real time sensing

technology DSG® (Dynamic Surgical Guidance) to secure and

streamline the placement of implants in the skeleton. SpineGuard

designs, develops and markets medical devices that have been used

in over 95,000 surgical procedures worldwide. Twenty-four studies

published in peer-reviewed scientific journals have demonstrated

the multiple benefits DSG® offers to patients, surgeons, surgical

staff and hospitals. Building on these strong fundamentals and

several strategic partnerships, SpineGuard has expanded the scope

of its DSG® technology in innovative applications such as the «

smart » pedicle screw, the DSG Connect visualization and

registration interface, dental implantology and surgical robotics.

DSG® was co-invented by Maurice Bourlion, Ph.D., Ciaran Bolger,

M.D., Ph.D., and Alain Vanquaethem, Biomedical Engineer. SpineGuard

has engaged in multiple ESG initiatives. For further information,

visit www.spineguard.com

About Nice & Green Nice & Green is a leading

privately held Swiss funding firm, active in the European market

providing smart funding solutions to listed Micro-, Small- and

Mid-Cap companies supporting their growth as partners. Find out

more at nicengreen.ch.

Disclaimer

The SpineGuard securities may not be offered or sold in the

United States as they have not been and will not be registered

under the Securities Act or any United States state securities

laws, and SpineGuard does not intend to make a public offer of its

securities in the United States. This is an announcement and not a

prospectus, and the information contained herein does and shall not

constitute an offer to sell or the solicitation of an offer to buy,

nor shall there be any sale of the securities referred to herein in

the United States in which such offer, solicitation or sale would

be unlawful prior to registration or exemption from

registration.

APPENDIX HORIZON PROGRAM

Legal Framework

The Extraordinary Shareholders Meeting held on June 30, 2022

has, in accordance with Articles L. 225-129 et seq., L. 225-138, L.

228-91 et seq., and L. 22-10-49 et seq. of the French Commercial

Code and pursuant to its 11th and 12th resolutions, delegated to

the Board of Directors its competence, for a period of eighteen

(18) and twenty-six (26) months respectively, the authority to

issue financial securities and/or transferable securities giving

immediate or future access to a proportion of the capital, with

cancellation of shareholders' preferential subscription rights

(“droit préférentiel de souscription”) to the benefit of categories

of persons within a nominal maximum limit of capital increases set

at 750,000 euros.

By virtue of this delegation, the Board of Directors authorized

a equity line facility of €7,500,000 in the form of convertible

bonds to be subscribed exclusively by Nice & Green, an

independent Swiss company specialized in corporate financing.

Key Features of the HORIZON Program

- the Horizon Bonds will be issued at the Company’s request for a

maximum amount of seven million five hundred thousand euros

(€7,500,000) in 5 tranches of which the first tranche is two

hundred and fifty (250) Horizon Bonds, and each of the following

four tranches will consist in one hundred and twenty-five (125)

Horizon Bonds;

- the Horizon Program has a duration of 36 months starting at the

signing date of the program;

- The Company may only draw a new tranche when (i) since the

subscription of the previous tranche, 15% of the total value of the

cumulative transactions carried out on Euronext Growth represents

at least 80% of the nominal amount of the previous tranche. By way

of exception, the second Tranche may be drawn when i) the sale of

Shares by the Investor add up to 80% of the amount of the first

Tranche; or (ii) four (4) months after the conversion of the first

Tranche;

- The Horizon Bonds will be issued only if and when certain

contractual obligations are met, Nice & Green being entitled to

waive them.

- One Horizon Bond has a value of ten thousand (10,000)

euros,

- The Horizon Bonds will not accrue interest and will have a

maximum maturity of eighteen (18) months from their issue date

("Maturity Date");

- The outstanding Horizon Bonds may be fully or partially

redeemed in advance at any time at the Company's request and at its

sole discretion at the price of 103% of their nominal value. The

Agreement may also be terminated ahead of schedule and the

outstanding Horizon Bonds redeemed under the same conditions by

either the Company at its sole discretion and with no liability

incurred, or by Nice & Green following an Event of Default as

provided for in the Agreement (list in Note 1);

- The Horizon Bonds may be converted at Nice & Green's

request through to the Maturity Date;

- The conversion of the Horizon Bonds is dependent on Nice &

Green having sold 80% of the shares resulting from the previous

conversion of the Horizon Bonds. In addition, Nice & Green will

not be able to convert a number of Horizon Bonds representing a

nominal amount higher than the total amount of the Company’s shares

sold by Nice & Green since the previous conversion;

- The number of shares to be issued by the Company to Nice &

Green upon conversion of one or more Horizon Bonds is calculated as

follows:

N = Vn /P

Where:

"N" is equal to the number of Company shares to be issued

to Nice & Green per the conversion of a Horizon Bond;

"VN": is the nominal value of one Horizon Bond, i.e. ten

thousand (10,000) euros each independently from their subscription

value;

"P" is equal to the Conversion Price equal to one hundred

percent (100%) of the Investor VWAP but shall not be less than (i)

50% of the weighted average of the last twenty (20) trading

sessions preceding the day setting the issue price and (ii) 99% of

the VWAP calculated over the current Reference Period (the

"Conversion Price").

In the event that, during a trading session, the 5 days VWAP

including the current session would be equal to 50% of the weighted

average prices of the last twenty (20) trading sessions preceding

the day setting the issue price, the Investor has an “acceleration

option” allowing him to freely convert a number of Horizon Bonds

equal to the number of shares sold on the market since the last

conversion or, in the case of the first Tranche, since its

Subscription Date.

The Conversion Price is determined in accordance with Euronext

Growth's tick size rules and rounded down to the nearest decimal

place.

In no circumstances, the Conversion Price can be lower than the

nominal value of the Issuer's Share (currently €0.05).

In the event that the Conversion Price is equal to or lower than

the par value of the Issuer's Share, the Investor can only convert

any of the Issuer's outstanding OCAs at a price equal to the

nominal value until the Conversion Price becomes higher again than

the par value of the Issuer's Share,

Should the issuance of New Shares results in fractions, the

Issuer shall round down this fraction to the nearest

whole-number.

The Horizon Bonds will constitute registered securities by name

(“valeurs mobilières nominatives”) in the stock registers of the

Company and will not apply for admission to trading on any

financial market and therefore will not be listed.

The newly issued shares upon conversion of the Horizon bonds

will provide an immediate right to dividends. They bear the same

rights as those attached to the Company's existing ordinary shares

and will be admitted to the Euronext Growth market on the same

listing line as the existing shares (ISIN code: FR0011464452). The

Company will maintain on its website a tracking table of the number

of outstanding Horizon Bonds and shares issued upon conversion of

Horizon Bonds.

Nice & Green may not sell a number of shares representing

more than 15% of the daily volume of transactions carried out on

Euronext Growth and the Company may in any event set a minimum sale

price.

Nice & Green will send the Company, on a monthly basis, a

summary of the transaction demonstrating the compliance with the

contractual agreements with regard to the traded volume and price

of the shares and the Company will publish this summary on its

website.

The Company has the right, at its sole discretion, at any time,

upon payment of compensation of five thousand (5,000) euros and the

redemption in cash of all outstanding HORIZON BONDS subscribed by

Nice & Green and not converted at 103% of their nominal value

(i.e. €10,300 each), to terminate the Contract without liability

incurred whatsoever.

Fees and Commissions

The Company will pay Nice & Green one or two commissions

depending on the conversions made:

1- a structuring fee of an amount

equal to 7% of the maximum nominal amount of the financing, i.e. a

total commission of 525,000 euros. This commission will be paid

through the issuance of Horizon Bonds and;

2- in case of a conversion, a potential

execution fee equal to 5% of the nominal value of the Horizon

bonds actually converted by Nice & Green.

Main risks associated to the Company

The key risks associated with the Company were presented in the

2022 Annual Financial Report. The main risks associated with the

issuance of Horizon bonds in connection with the transaction are as

follows:

- a conversion of Horizon bonds resulting in the issuance of new

shares would dilute the % held by an existing shareholder before

such conversion;

- in the event of conversion of Horizon bonds by issuance of new

shares, the volatility and liquidity of SpineGuard shares could

fluctuate significantly;

- in the event of conversion of Horizon Bonds by issuance of new

shares, the sale of SpineGuard shares by holders of Horizon Bonds

could have an adverse impact on the price of SpineGuard

shares;

- should the SpineGuard stock price drop to an amount equal to or

lower than the par-value of the share (i.e. 0,05 EUR), the Company

may have to engage in one or more reduction(s) of the said

par-value in order to maintain the possibility to convert the

outstanding Horizon Bonds;

- in the event of non-completion of all the tranches, (reminding

that the total potential amount is not guaranteed), the Company's

cash runway announced would be reduced in proportion.

DILUTION THEORETICAL EFFECT FOR A NON-PARTICIPATING

SHAREHOLDER

As an indication, the effect of the full issue of the Horizon

Bonds on the equity per share would be as follows. The bases being

i) the equity as reporting in the audited financial statements as

at 31 December 2022 et ii) of the issued shares as of 30 April 2023

i.e. 39,080,723

Equity per share (in euros)

Base non diluted

Base diluted (*)

Number of shares

Equity as of

31.12.2022

Before the issue of the Horizon bonds

resulting from this transaction

€0.13

€0.11

39,080,723

€5,141,210

After the issue of 750 Horizon bonds

resulting from this transaction

€0.10

€0.09

50,726,685

The diluted base includes the exercise of all the equity

instruments existing as of today and that might result in the

issuance of an indicative maximum total number of new shares of

5,997,434.

(*) The calculation is based on 99% of the stock price as of 30

May 2023 closing, hence a conversion price of the Horizon Bonds of

0,6440 €. This theoretical dilution does not prejudge either the

final number of shares to be issued or their issue price, which

will be set according to the stock market price, as described

above.

Incidence of the issue on a 1% stake of a shareholder: As

an indication and in the event of the exercise of 100% of the

Horizon Bonds, the impact on the equity of a shareholder holding 1%

of the Company's share capital prior to the increase of capital

(calculations made on the basis of the number of shares making up

the Company's share capital on June 1, 2021) and not participating

in the transaction would be as follows:

Equity per share (%)

Base non diluted

Base diluted (*)

Number of shares

Equity

Before the issue of new shares from the

exercise of the Horizon Bonds

1.00%

0.87%

39,080,723

€1,954,036

After issuing 750 Horizon Bonds

representing the exercise of 100% of the Horizon Bonds

0.77%

0.69%

50,726,685

€2,536,334

The diluted base includes the exercise of all the equity

instruments existing as of today and that might result in the

issuance of an indicative maximum total number of new shares of

5,997,434.

(*) The calculation is based on 99% of the stock price as of 30

May 2023 closing, hence a conversion price of the Horizon Bonds of

0,6440 €. This theoretical dilution does not prejudge either the

final number of shares to be issued or their issue price, which

will be set according to the stock market price, as described

above.

Note 1: Event of Default

"Event of Default" refers to the occurrence of any of the

following events that were not resolved within thirty (30) Working

Days of the earlier of the following dates: (i) The date when Nice

& Green SA receives the Event of Default Notification issued by

the Company and (i) the date when the Company receives the

Notification from Nice & Green indicating the infringement and

asking for resolution:

(i) The Company does not pay an amount due to

Nice & Green SA under the Agreement upon its due date. (ii) Any

breach of any its commitments by the Company; not waived in writing

by Nice & Green and resulting in actual damages in excess of

one hundred thousand (100,000) euros or higher, as duly established

by an independent third party (“expert judiciaire” listed at the

Court of Appeals (Cour d'Appel) and appointed , by the President of

the competent Court issuing an interim order and called on by Nice

& Green SA within a maximum of eight (8) Working Days following

the end of the period of thirty (30) Working Days granted to the

Company to resolve an Event of Default or, when such a timeframe is

not applicable, from the first of the Notification dates referred

to in the definition of the "Event of Default". (iii) Within the

agreed timeframe to cure, the absence of a meeting, vote or

approval by an extraordinary shareholders meeting of a stock split

or a capital reduction with a view to reducing the Share's par

value will be considered as an "Event of Default" even if it has

been convened by the Company; (iv) The delisting of the shares from

Euronext Growth at the Company's request unless this delisting is

carried out in connection with a transfer of the listing of the

Company's shares to another market managed by Euronext Paris; (v)

Any refusal to certify the financial statements by the Company's

statutory auditors that is not resolved within thirty (30) Working

Days of the date by which the Company's accounts shall be certified

in compliance with the applicable regulations; (vi) In the event

that the shareholders meeting does not resolve the reduction of the

par-value of the shares as agreed in the Contract. (vii) A material

unfavorable event or a change of control has occurred; (viii) The

Issuer voluntarily suspends or interrupts its activities, sells or

transfers its main assets needed for its activity unless these

assets are sold (i) subject to fair compensation or (il) under

market conditions; (ix) In the event that the Company does not

satisfy the “Obligation d’Ajustement” required by the Agreement;

(x) In the event that the Company files for a bankruptcy procedure;

(xi) A final court decision requiring the payment of a total amount

exceeding two million (2,000,000) euros is issued by a competent

court against the Company, and the Company i) does not pay said sum

or ii) does not ensure its payment in accordance with its terms or

iii) does not file a request to suspend the decision within thirty

(30) calendar days (or any longer period during which the

suspension of the enforcement could validly be introduced by the

Company) following the date of notification to the Company or does

not appeal or ensure that the enforcement of the Court Decision is

suspended during the appeal.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230531005742/en/

SpineGuard Pierre Jérôme CEO & Chairman Tel: +33 1 45

18 45 19 p.jerome@spineguard.com

SpineGuard Manuel Lanfossi CFO Tel: +33 1 45 18 45 19

m.lanfossi@spineguard.com

NewCap Investor Relations & Financial Communication

Mathilde Bohin / Aurélie Manavarere Tel: +33 1 44 71 94 94

spineguard@newcap.eu

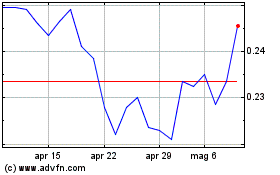

Grafico Azioni Spineguard (EU:ALSGD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Spineguard (EU:ALSGD)

Storico

Da Apr 2023 a Apr 2024