Regulatory News:

SpineGuard (FR0011464452 – ALSGD), an innovative company that

deploys its DSG® (Dynamic Surgical Guidance) sensing technology to

secure and streamline the placement of bone implants, announced

today financial results for the half year ending June 30, 2023, as

approved by the Board of Directors on September 12, 2023.

Pierre JEROME, cofounder, Chairman & CEO of SpineGuard,

said: “These half year results reflect our willingness to

quickly get back to growth and reach breakeven with four great

additions recently recruited to bolster our US commercial team, and

sustained investment in R&D and marketing. The strong and

steady increase of our sales in Europe and Latin America for more

than ten quarters in a row, the traction in the field of our new

products DSG Connect and PediGuard Threaded, as well as the great

short-term potential of our innovation pipeline prompt us to pursue

our investment strategy while carefully listening to our

shareholders. With this in mind, we are currently exploring other

financing possibilities, including a capital increase with

retention of preferential subscription rights, instead of drawing

on our equity line.”

€ thousands – IFRS

H1 2023

H1 2022

Revenue

2,234

2,546

Gross margin

1,768

2,161

Gross margin (% of revenue)

79.1%

84.9%

Sales, distribution,

marketing

- 2,072

- 1,827

Administrative costs

- 996

- 835

Research & Development

- 580

- 463

Recurring operating profit /

(loss)

- 1,880

- 964

Non-recurring operating costs

- 87

- 40

Operating profit / (loss)

- 1,967

- 1,004

Financial result

- 32

- 147

Income tax

- 9

- 26

Net profit / (loss)

- 2,009

- 1,175

EBITDA

- 1,805

- 561

NB: unaudited

H1 2023 Key Financial Points

3,029 DSG units were sold in H1 2023 vs. 2,848 in H1 2022,

representing an overall growth of +6%.

Sales for H1 2023 decreased to €2,234k vs. €2,546k for the same

period in 2022, down 12% due to the temporary setback in the

United-States and the interruption of royalty income related to the

dental project. However, the product sales outside the United

States are growing 37%.

Gross margin stood at 79.1% at June 30, 2023, compared with

84.9% at June 30, 2022. This change is mainly due to a lower

contribution to sales from the United States, the market with the

highest selling prices, and to a lesser extent to the higher cost

of certain components supplied in 2022.

The Company's current operating expenses amounted to €3,734k for

the first 6 months of 2023, compared with €3,131k for the first

half of 2022, representing an increase of €604k, corresponding

to:

- the recognition of impairment losses on

trade receivables and related legal costs in connection with the

unilateral decision by Adin Dental Implant Systems, parent company

of ConfiDent ABC, for financial reasons of their own, to terminate

their DSG dental application project, - investments in sales and

marketing expenditure in the United States where the team was

strengthened by four new recruits in the first half of 2023, and -

the company's investment in Research and Development to pursue its

technological innovations.

As a result, operating income before non-recurring items came to

-€1,880k, compared with a loss of -€964k at June 30, 2022.

Working capital requirement at June 30, 2023 stood at €228k

compared with €452k at December 31, 2022, mainly due to the

decrease in trade receivables (-€290k) and trade payables (-€285k),

despite the increase in inventories (+€151k) and other receivables

(+€141k).

The company's cash and cash equivalents, classified as current

financial assets at June 30, 2023, amounted to €4,588k, compared

with €4,116k at December 31, 2022. Following the end of the

‘sauvegarde’ procedure in France and the agreement reached with

creditors, repayment of bond principal amounted to €371k for the

half-year, compared with €336k for the first half of 2022. Interest

paid to Norgine Venture and Harbert European Growth amounted to

€123k. In view of its cash position and expected recurring business

volume, SpineGuard estimates that it will be able to cover its 2024

financing needs. Including the availability of the equity line with

Nice & Green, this extends beyond 2025.

To continue to bolstering its equity, the company is currently

considering other funding opportunities, including a capital

increase with retention of preferential subscription rights, rather

than to use the Horizon equity line put in place on May 31, 2023

with Nice & Green's for an amount of €7.5 million, remained

undrawn at the date of this press release.

Post-closing events

SpineGuard has announced a large order for 448 PediGuard

Straight units from XinRong Medical Group (one of China's leading

medtech companies). At the same time, SpineGuard appointed an

independent regulatory agent, chosen in consultation with XinRong,

to complete the registration of the other versions of PediGuard not

yet registered in China: PediGuard Curved, XS, Canulated and

Threaded, all incorporating DSG (Dynamic Surgical Guidance)

technology for real-time, X-ray-free surgical guidance. To finance

this product registration effort, XinRong invested in SpineGuard's

capital, under the terms announced on May 16, 2023, by issuing

500,000 shares at a unit price of €1.00, representing a capital

contribution of €500,000, with an 18-month lock-up period.

SpineGuard’s Priorities

SpineGuard is focusing on the following priorities while

investing selectively and with rigor:

1. Boost commercial activities with PediGuard

Threaded and the DSG-Connect platform 2. Develop the DSG drill bit

for a launch beginning of 2024 3. Codevelop the Smart Screw and

Sacro-Iliac fusion DSG device with Omnia Medical 4. Implement the

three-prong agreement recently signed with XinRong Medical for

China 5. Deploy the DSG technology in the surgical robotic and

dental fields 6. Initiate new strategic partnerships

The company’s half-year financial report is available in the

Investors > Exchange filings section of the www.spineguard.com

website in French only.

Next financial press release: Third quarter 2023 revenue

on October 11, 2023, after market closing.

About SpineGuard® Founded in 2009 in France and the USA

by Pierre Jérôme and Stéphane Bette, SpineGuard is an innovative

company deploying its proprietary radiation-free real time sensing

technology DSG® (Dynamic Surgical Guidance) to secure and

streamline the placement of implants in the skeleton. SpineGuard

designs, develops and markets medical devices that have been used

in over 95,000 surgical procedures worldwide. Twenty-five studies

published in peer-reviewed scientific journals have demonstrated

the multiple benefits DSG® offers to patients, surgeons, surgical

staff and hospitals. Building on these strong fundamentals and

several strategic partnerships, SpineGuard has expanded the scope

of its DSG® technology in innovative applications such as the «

smart » pedicle screw, the DSG Connect visualization and

registration interface, dental implantology and surgical robotics.

DSG® was co-invented by Maurice Bourlion, Ph.D., Ciaran Bolger,

M.D., Ph.D., and Alain Vanquaethem, Biomedical Engineer. SpineGuard

has engaged in multiple ESG initiatives. For further information,

visit www.spineguard.com

Disclaimer The SpineGuard securities may not be offered

or sold in the United States as they have not been and will not be

registered under the Securities Act or any United States state

securities laws, and SpineGuard does not intend to make a public

offer of its securities in the United States. This is an

announcement and not a prospectus, and the information contained

herein does and shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of the

securities referred to herein in the United States in which such

offer, solicitation or sale would be unlawful prior to registration

or exemption from registration.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230912309855/en/

SpineGuard Pierre Jérôme CEO & Chairman Tel: +33 1 45

18 45 19 p.jerome@spineguard.com

SpineGuard Anne-Charlotte Millard CFO Tel: +33 1 45 18 45

19 ac.millard@spineguard.com

NewCap Investor Relations & Financial Communication

Mathilde Bohin / Aurélie Manavarere Tel: +33 1 44 71 94 94

spineguard@newcap.eu

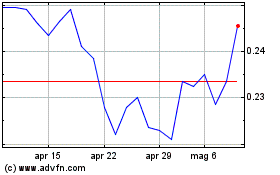

Grafico Azioni Spineguard (EU:ALSGD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Spineguard (EU:ALSGD)

Storico

Da Apr 2023 a Apr 2024