WINFARM : Q1 2023 revenue up 24% (of which 6% organic growth).

10 Maggio 2023 - 6:00PM

WINFARM : Q1 2023 revenue up 24% (of which 6% organic growth).

PRESS RELEASE Loudéac, 10 May

2023

Q1 2023 revenue up 24%

(of which 6% organic growth)

WINFARM (ISIN: FR0014000P11 - ticker:

ALWF), the number one French distance seller of

goods and solutions and provider of advisory and

other services for the farming

and breeding industry, today

released its Q1 2023 revenue.

|

In millions of euros, unaudited |

Q1 2022 |

Q1 2023 |

Change |

Change at constant scope 1 |

|

Farming supplies |

27.5 |

35.1 |

+27.4% |

+7.5% |

|

Farming production2 |

3.0 |

2.7 |

-9.9% |

-9.9% |

|

Other |

0.3 |

0.5 |

+42.4% |

+42.4% |

|

TOTAL |

30.8 |

38.2 |

+24.0% |

+6.2% |

WINFARM made consolidated revenue in Q1 2023 of

€38.2m, up 24% compared with Q1 2022 (+6% at constant scope1). This

performance is all the more remarkable given the sharp increase in

activity already recorded in Q1 2022 of +20%, of which 9% at

constant scope.

Over the period, the Farming

Supplies business (92% of total revenue),

marketed under the Vital Concept brand, posted revenue of €35.1m,

an increase of 27%. WINFARM benefited during the quarter from the

€5.5m contribution from the Kabelis Group companies, whose activity

has been consolidated within the Group's scope since August 2022.

At constant scope, excluding Kabelis, activity was up 7.5% in the

first three months of the year, confirming solid momentum in a

context of gradually easing prices.

The Kabelis Group companies, acquired in July

2022, and BTN de Haas, acquired in the Netherlands in July 2021,

contributed significantly to growth for the period, with both

activities showing growth of 10% in Q1 2023. These performances

reflect the relevance of the acquisitions made by WINFARM in recent

years, and the Group's ability to successfully integrate them.

Revenue from the Farming

Production business (7% of total

revenue), marketed under the Alphatech brand, came to €2.7m, down

9.9%. After a sharp increase of 25% in 2022, of which 42% in the

fourth quarter, this activity showed a one-off decline in the first

three months of the year, reflecting the Group's ongoing strategy

of building its own production capacities with a view to increasing

the quality of its products while limiting purchases of processed

materials from mix producers. Against this backdrop, the gradual

ramp-up of its industrial set-up temporarily weighed on

available-for-sale volumes.

The first quarter also brought temporary

difficulties in achieving exports in euros. The Group generates a

significant proportion of its revenue in Pakistan, Bangladesh and

Egypt, three countries that are occasionally affected by a

limitation of their purchases in euros. WINFARM is currently seeing

an improvement in this situation.

The "other activities" which comprise Farming

Advisory and Farming Innovation, recorded a sharp increase in

sales.

2023: Continued growth and an

improvement in margins

In 2023, WINFARM expects growth to continue,

with a gradual return to more normative price levels. As it did in

2022, the Group will work on maintaining strict financial

discipline to limit the weight of certain operating expenses (such

as fuel) in order to improve its margins.

After the successful acquisition of BTN of Haas

in 2021 and the Kabelis Group companies in 2022, WINFARM continues

to explore external growth opportunities, outside France in

particular, to strengthen its positions and establish a stronger

foothold at the European level.

In the longer term, the Group has reasserted its

ambition of achieving revenue of around €200m and EBITDA margin of

around 6.5% by 2025.

Next release:H1 2023 revenue on

5 September 2023, after market.

About WINFARM

Founded in Loudéac, in the heart of Brittany, at

the beginning of the 1990s, the Winfarm group is today the leading

French player offering the agricultural, livestock, horse-breeding

and landscape markets a range of consultancy, service and distance

selling products and global, unique and integrated solutions to

help them meet the new technological, economic, environmental and

social challenges of the new generation of agriculture.

With a vast catalogue of more than 35,000

product references (seeds, phytosanitary, harvesting products,

etc.), two-thirds of which are marketed under own brands, WINFARM

has more than 45,000 customers in France, Belgium and the

Netherlands.

By 2025, WINFARM aims to achieve revenue of

around €200m and an EBITDA margin of about 6.5%.

For more information about the company:

www.winfarm-group.com

Contacts:

|

WINFARMinvestisseurs@winfarm-group.com |

|

|

ACTIFIN, Financial CommunicationsBenjamin

Lehari+33 (0) 1 56 88 11 11winfarm@actifin.fr |

ACTIFIN, Financial Press RelationsJennifer

Jullia+33 (0)1 56 88 11 19jjullia@actifin.fr |

1 excluding the consolidation of Kabelis Group

companies in revenue2 revenue from Farming Advisory (under the

Agritech brand) and Farming Innovation (under the Bel Orient brand)

services

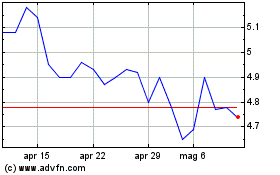

Grafico Azioni Winfarm (EU:ALWF)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Winfarm (EU:ALWF)

Storico

Da Apr 2023 a Apr 2024