BUREAU VERITAS - Excellent 2023 performance: strong growth and

record earnings; Confident of strong growth in 2024

PRESS RELEASE

Neuilly-sur-Seine, France – February 22, 2024

Excellent 2023 performance: strong growth

and record earnings; Confident of strong growth in

2024

2023 Key

Figures1

- Revenue of EUR 5,867.8 million for

the full year 2023, up 8.5% organically and up 3.8% on a reported

basis (including a positive 0.6% scope effect and a negative 5.3%

currency fluctuations)

- In the fourth quarter, organic

revenue growth achieved 9.4%

- Adjusted operating profit of EUR

930.2 million, up 3.1% versus EUR 902.1 million in 2022,

representing an adjusted operating margin of 15.9%, down c.10 basis

points on a reported basis, and up 20 basis points organically at

16.2% (of which +c.50bps in H2 2023)

- Operating profit of EUR 824.4

million, up 3.1% versus EUR 799.3 million in 2022

- Attributable net profit of EUR

503.7 million, up 7.9% versus EUR 466.7 million in 2022

- Adjusted net profit of EUR 574.7

million (adjusted EPS of EUR 1.27 per share), up 7.6% versus EUR

533.9 million in 2022 and up 17.6% at constant currency

- Free cash flow of EUR 659.1 million

(11% of Group revenue), up 0.3% year-on-year and 5.5% at constant

currency, led by disciplined capex policy and working capital

management

- Adjusted net debt/EBITDA ratio2

reduced to 0.92x as of December 31, 2023, versus 0.97x last

year

- Proposed dividend of EUR 0.83 per

share3, up 7.8% year-on-year, payable in cash

2023 Highlights

- Appointment of a new CEO and

strengthening of the Executive Committee to support future growth

ambitions

- 2023 financial targets exceeded on

all metrics

- Over 80% of the portfolio delivered

at least mid-to-high single digit or double-digit organic revenue

growth driven by good momentum in the sales pipeline

- Strong growth in every region

(Americas, Middle East, Europe, Africa and Asia-Pacific),

substantially outperforming many underlying markets

- Strong momentum maintained for

Sustainability and energy transition solutions across the entire

portfolio

- Acquisition of two bolt-on

companies further diversifying Consumer Products Services adding

annualized revenue of c. EUR 28 million. This includes ANCE, the

leading player in Mexico for Electrical and Electronics products

(c. EUR 21 million of revenue), announced today

- Good progress towards the

achievement of the 2025 CSR ambitions; commitment recognized by

several non-financial rating agencies, including a first ranking in

the 2023 S&P Global rating (DJSI); mid-term GHG emissions

targets approved by the Science Based Targets initiative

(SBTi)

2024 OutlookLeveraging a

healthy and growing sales pipeline, high customer demand for ‘new

economy services’ and strong underlying market growth, Bureau

Veritas expects to deliver for the full year 2024:

- Mid-to-high single-digit organic

revenue growth;

- Improvement in adjusted operating

margin at constant exchange rates;

- Strong cash

flow, with a cash conversion above 90%.

The Group expects H2 organic revenue growth

above H1 (with stronger comparables in H1).

Hinda Gharbi, Chief Executive Officer,

commented:

“We delivered very strong results in 2023,

reflecting our robust business fundamentals, our consistent

execution and our customer centricity around the globe. We achieved

organic growth of 8.5%, a healthy organic margin of 16.2%, and

record earnings per share of EUR 1.27, up over 17% at constant

exchange rates.

I would like to warmly thank all our colleagues

around the world for their dedication and hard work to deliver this

outstanding performance.

I also want to thank our shareholders for their

continued support. As a result of our robust cash flow generation

and financials, the Board is recommending a dividend increase of 8%

compared to last year.

I am convinced that we can take Bureau Veritas

to higher levels of performance and achievement. Our portfolio of

leading global business lines, strong execution track record and

exposure to positive secular trends are key contributors to our

current performance and a great foundation for future

outperformance.

Specifically, we expect powerful demand for

services supporting transition to sustainable development models,

evolving buildings integrity needs, growing infrastructure

investment and increased spending in low-carbon energy development.

Our current pipeline of opportunities in these business areas is a

testament to this durable growth dynamic. I look forward to

updating the market with our vision and new strategy at our Capital

Markets Day on March 20th.

For 2024, we expect Bureau Veritas to deliver

another strong year of organic revenue growth, margin expansion4

and strong cash conversion.”

The Board of Directors of Bureau Veritas met on

February 21, 2024, and approved the financial statements for full

year 2023. The main consolidated financial items are:

|

IN EUR MILLIONS |

2023 |

2022 |

CHANGE |

CONSTANT CURRENCY |

|

Revenue |

5,867.8 |

5,650.6 |

+3.8% |

+9.1% |

|

Adjusted operating

profit(a) |

930.2 |

902.1 |

+3.1% |

+10.5% |

|

Adjusted operating margin(a) |

15.9% |

16.0% |

(11)bps |

+21bps |

|

Operating profit |

824.4 |

799.3 |

+3.1% |

+10.8% |

|

Adjusted net profit(a) |

574.7 |

533.9 |

+7.6% |

+17.6% |

|

Attributable net profit |

503.7 |

466.7 |

+7.9% |

+18.1% |

|

Adjusted EPS(a) |

1.27 |

1.18 |

+7.4% |

+17.4% |

|

EPS |

1.11 |

1.03 |

+7.7% |

+17.9% |

|

Operating cash flow |

819.7 |

834.9 |

(1.8)% |

+3.7% |

|

Free cash flow(a) |

659.1 |

657.0 |

+0.3% |

+5.5% |

|

Adjusted net financial debt(a) |

936.2 |

975.3 |

(4.0)% |

|

|

Adjusted net debt/EBITDA ratio(b) |

0.92x |

0.97x |

+5.2% |

|

|

(a) Alternative performance indicators are presented, defined and

reconciled with IFRS in appendices 6 and 7 of this press

release. |

|

(b) Ratio of adjusted net financial debt divided by consolidated

EBITDA (earnings before interest, tax, depreciation, amortization

and provisions), adjusted for any entities acquired over the last

12 months. |

-

2023 FINANCIAL HIGHLIGHTS

Strong organic revenue growth in the

full year

Group revenue increased by 8.5% organically in

2023, benefiting from very solid trends across most businesses and

geographies. In the fourth quarter, organic growth stood at a

strong 9.4%.

This is reflected as follows by business:

- Half of the

portfolio (Buildings & Infrastructure and Agri-Food &

Commodities) achieved mid-single- digit revenue growth. Buildings

& Infrastructure (up 6.3% organically) was driven by both

in-service and new build activity. Agri-Food & Commodities (up

5.7% organically) was supported by strong growth in both Agri-Food

and Government services;

- More than a third

of the portfolio (Industry, Certification and Marine &

Offshore) delivered double digit organic revenue growth, benefiting

from strong decarbonization trends (Marine & Offshore), energy

transition (led by Renewables) and the rising demand for

Sustainability and ESG-driven services (for Certification

notably);

- An eighth of the

portfolio (Consumer Products Services) was broadly stable

organically, down 0.5% (including a 3.8% organic revenue recovery

in the fourth quarter), attributed to fewer new product launches,

and high inventory specifically in consumer electronics.

Solid financial position

At the end of December 2023, the Group's

adjusted net financial debt decreased compared with the level at

December 31, 2022. Bureau Veritas has a solid financial structure

with most of its maturities to be refinanced after 2024. The Group

had EUR 1.2 billion in available cash and cash equivalents and EUR

600 million in undrawn committed credit lines.

At December 31, 2023, the adjusted net financial

debt/EBITDA ratio was further reduced to 0.92x (from 0.97x at

December 31, 2022) and the EBITDA/consolidated net financial

expense ratio was 44.33x. The average maturity of the Group’s

financial debt was 3.7 years, while the average gross cost of debt

during the year was 2.7% excluding the impact of IFRS 16 (compared

to 2.1% in 2022, excluding the impact of IFRS 16). On September 7,

2023, the Group redeemed at maturity a €500 million bond program

issued in 2016.

Proposed dividend

The Board of Directors of Bureau Veritas is

proposing a dividend of EUR 0.83 per share for 2023, up 7.8%

compared to the prior year. This corresponds to a payout ratio of

65% of its adjusted net profit.

This is subject to the approval of the

Shareholders’ Meeting to be held on June 20, 2024, at 3:00pm at the

Bureau Veritas Headquarters, Immeuble Newtime, 40-52 Boulevard du

Parc, 92200, Neuilly-sur-Seine, France. The dividend will be paid

in cash on July 4, 2024 (shareholders on the register on July 3,

2024, will be entitled to the dividend and the share will go

ex-dividend on July 2, 2024).

-

ACTIVE PORTFOLIO MANAGEMENT IN 2023

During 2023, Bureau Veritas has redefined its

M&A strategy, rebuilt its acquisition pipeline and added

dedicated resources to resume acquisitions and support its growth

in the near future.

Resuming selective bolt-on

M&A

In the second half of the year, the Group

completed two transactions in strategic areas to further diversify

its Consumer Products Services business line representing c. EUR 28

million in annualized revenue.

|

|

ANNUALIZED REVENUE |

COUNTRY/AREA |

DATE |

FIELD OF EXPERTISE |

|

Consumer Products Services |

|

|

|

|

|

Impactiva Group S.A. |

c. EUR 7m |

Asia |

Nov. 2023 |

Quality assurance for the footwear industry |

|

ANCE S.A de C.V (Associacón de Normalización y

Certificación) |

c. EUR 21m |

Mexico |

Dec. 2023 |

Testing and certification services for electrical and electronic

products |

Bureau Veritas also announced a strategic

collaboration and investment in OrbitMI (more information by

clicking here). Aimed at accelerating the development of both

existing and new data-driven solutions, the collaboration will

leverage combined strengths to address the dual opportunities of

the digital transformation and the decarbonization of

shipping.

Consumer Products Services

Since its establishment in 2003, Impactiva has

become a strategic partner for its broad portfolio of top-tier

footwear, apparel and leather goods retailers and brand owners. The

company provides support and guidance to hundreds of factories and

tanneries across Asia, Europe and Africa, ensuring the highest

levels of quality in production. Known for its innovative

solutions, Impactiva optimizes the use of raw materials, minimizes

waste, and eliminates finished product defects through process

improvements at its clients’ third-party factories. This

acquisition marks a milestone for Bureau Veritas' Consumer Products

Services division, as it strengthens its presence in upstream

services to the footwear and apparel manufacturing industry,

augmenting its capacity to deliver supply chain services in line

with economic, quality, and sustainability objectives. The

acquisition of Impactiva by Bureau Veritas signifies a key move in

the realm of quality assurance for the footwear and apparel

industry.

- ANCE S.A de C.V. (Asociación de

Normalización y Certificación)

ANCE is the Mexican leader for conformity

assessment covering many segments including electrical products,

household appliances, lighting products, electronic products,

wireless products. ANCE is a strategic partner to a wide portfolio

of domestic clients including manufacturers, retailers, importers,

and brands in Mexico, but also worldwide. The company employs

around 400 people across its various laboratories in the country.

This acquisition significantly enhances Bureau Veritas’ Consumer

Products Services presence in the Americas, entering a large and

growing domestic market with increasing regulatory requirements for

quality. It positions Bureau Veritas Consumer Products Services as

the market leader in Mexico. It could also serve as a springboard

for expansion into North America.

Divestments

In July 2023, the Group sold its non-core

automotive inspection business in the US, representing less than

EUR 20 million of annualized revenue.

-

STRENGTHENING OF THE EXECUTIVE COMMITTEE TO SUPPORT FUTURE

GROWTH AMBITIONS

Hinda Gharbi appointed Chief Executive

Officer of Bureau Veritas

On June 22, 2023, following the Annual

Shareholders’ Meeting, the Board of Directors appointed

Hinda Gharbi as Chief Executive Officer. She joined Bureau

Veritas on May 1, 2022, as Chief Operating Officer and

became a member of the Group Executive Committee. On January 1,

2023, she was appointed Deputy Chief Executive Officer of Bureau

Veritas.For more information, the press release is available by

clicking here

Key operational

appointments

In 2023, Bureau Veritas also announced the

reshaping and strengthening of its Executive Committee. Designed to

align the organization with its strategic imperatives, this

evolution ideally positions Bureau Veritas to seize key future

growth opportunities. First, the Group aims to leverage the full

potential of regional market opportunities, and to facilitate

scaling of solutions and improved resource utilization. Second, it

embeds Sustainability at the very heart of Bureau Veritas and

accelerates the development and execution of its strategy. Third,

these changes will further drive innovation through broad digital

enablement to capture increased efficiency and productivity, and to

develop new solutions and provide differentiated customer

experience.

- Marc

Roussel appointed Executive Vice-President Commodities, Industry

and Facilities division in France and Africa

For more information, the press release is

available by clicking here.

- Vincent

Bourdil appointed Executive Vice-President Global Business Lines

and Performances

For more information, the press release is

available by clicking here.

- Juliano

Cardoso appointed Executive Vice-President Corporate Development

& Sustainability

For more information, the press release is

available by clicking here.

- Surachet

Tanwongsval appointed Executive Vice-President Commodities,

Industry and Facilities division in Asia-Pacific

For more information, the press release is

available by clicking here.

- Philipp

Karmires appointed Executive Vice-President, Group Chief Digital

Officer

For more information, the press release is

available by clicking here.

-

COMMITMENT TOWARDS NON-FINANCIAL PERFORMANCE

To support the execution of the Group’s CSR

strategy, the Board of Bureau Veritas has created a CSR Committee

to oversee Sustainability issues. The Committee reviews CSR

strategic directions and monitors CSR programs implementation and

policy effectiveness, in line with Bureau Veritas' strategic

plan.

In addition, Bureau Veritas continued its

efforts to be exemplary in terms of Sustainability, around all

environmental, social and governance practices.

Bureau Veritas’ GHG emissions targets

approved by the SBTi and enrolled in the CAC 40 SBT 1.5°

index

On June 1, 2023, Bureau Veritas announced that

its near-term targets had been approved by the Science Based

Targets initiative (SBTi).

This approval is an important step, in line with

Bureau Veritas’ Climate Transition Plan. It marks the Group’s

strong commitment to following a CO2 emissions reduction pathway

consistent with global warming of 1.5°C.

As a consequence, Bureau Veritas joined the CAC

40 SBT 1.5° index on September 18, 2023.

Strong recognition by non-financial

rating agencies

Bureau Veritas ranks first among 184 companies

in the S&P Global Corporate Sustainability Assessment (CSA) for

the Professional Services Industry category - encompassing the TIC

sector - with a score of 83/100 for 2023. This achievement

illustrates the engagement of its 82,000 Trust Makers, at all

levels of the company, who are having a positive impact on Society

and the planet.

The Group is also listed in the S&P Global

Sustainability Yearbook 2024, in the Top 1% S&P Global CSA

Score in the Professional Services industry.

Finally, Bureau Veritas has been recognized by

research and advisory firm Verdantix as a “specialist” for

environmental, social and governance (ESG) services and

sustainability consulting services. Bureau Veritas is listed in its

latest report “Green Quadrant: ESG & Sustainability Consulting

2024”.

Corporate Social Responsibility (CSR) key

indicators

|

|

UN SDGs |

FY 2023 |

FY 2022 |

2025 TARGET |

|

SOCIAL & HUMAN CAPITAL |

|

|

|

|

|

Total Accident Rate (TAR)5 |

#3 |

0.25 |

0.26 |

0.26 |

|

Proportion of women in leadership positions6 |

#5 |

29.3% |

29.1% |

35% |

|

Number of training hours per employee (per year) |

#8 |

36.1 |

32.5 |

35.0 |

|

NATURAL CAPITAL |

|

|

|

|

|

CO2 emissions per employee (tons per year)7 |

#13 |

2.42 |

2.32 |

2.00 |

|

GOVERNANCE |

|

|

|

|

|

Proportion of employees trained to the Code of Ethics |

#16 |

97.4% |

97.1% |

99% |

Leveraging a healthy and growing sales pipeline,

high customer demand for ‘new economy services’ and strong

underlying market growth, Bureau Veritas expects to deliver for the

full year 2024:

- Mid-to-high single-digit organic

revenue growth;

- Improvement in adjusted operating

margin at constant exchange rates;

- Strong cash flow, with a cash

conversion above 90%8.

The Group expects H2 organic revenue growth

above H1 (with stronger comparables in H1).

2024 Capital Markets Day

Bureau Veritas will host a Capital Markets Day

on March 20th, 2024, in Paris. This will be an opportunity to

reveal the Group's new strategy and ambitions. This event offers

attendees to gain insights into Bureau Veritas’ business and to

engage with the company’s leaders (contact the IR Team to register:

cmd2024@bureauveritas.com).

-

ANALYSIS OF THE GROUP'S RESULTS AND FINANCIAL

POSITION

Revenue up 3.8% year on year (+9.1% at

constant currency)

Revenue in 2023 amounted to EUR 5,867.8 million,

a 3.8% increase compared with 2022. The organic increase was 8.5%,

benefiting from very solid trends across most businesses and most

geographies.

Three businesses delivered double-digit organic

revenue growth, with Industry up 16.5%, Marine & Offshore 14.4%

and Certification 12.4%. Two businesses delivered mid-single-digit

organic revenue growth, with Buildings & Infrastructure

(B&I) up 6.3% and Agri-Food & Commodities up 5.7%. Consumer

Products Services saw a nearly stable organic revenue growth, down

0.5% (including a 3.8% recovery in Q4 2023).

By geography, activities in the Americas

strongly outperformed the rest of the Group (28% of revenue; up

10.3% organically), led by a 24.0% increase in Latin America.

Europe (35% of revenue; up 7.3% organically) was primarily led by

strong activity levels in Southern Europe. Activity in Asia-Pacific

(28% of revenue; up 5.2% organically) benefited from robust growth

in Australia and South Asia. Finally, in Africa and the Middle East

(9% of revenue), business increased by 18.2% on an organic basis,

essentially driven by energy investments in the Middle East.

The scope effect was a positive 0.6% reflecting

the bolt-on acquisitions realized in the previous year partly

offset by a small disposal in the third quarter (explaining a

negative impact of 0.4% in the last quarter).

Currency fluctuations had a negative impact of

5.3% (including a negative impact of 6.4% in the fourth quarter),

mainly due to the strength of the Euro against the US dollar and

pegged currencies and some emerging countries’ currencies.

Adjusted operating profit up 3.1% to EUR

930.2 million (+10.5% at constant currency)

Adjusted operating profit increased by 3.1% to

EUR 930.2 million. The 2023 adjusted operating margin decreased by

11 basis points to 15.9%, including a 32 basis-point negative

foreign exchange impact and a 1 basis point positive scope impact.

Organically, the adjusted operating margin increased by 20 basis

points to 16.2% (of which c.50 basis point was delivered in the

second half of 2023). This illustrates good progress in operational

excellence programs, and the disciplined execution of pricing

programs.

|

CHANGE IN ADJUSTED OPERATING MARGIN |

|

|

IN PERCENTAGE AND BASIS POINTS |

|

|

2022 adjusted operating margin |

16.0% |

|

Organic change |

+20bps |

|

Organic adjusted operating margin |

16.2% |

|

Scope |

+1bp |

|

Adjusted operating margin at constant

currency |

16.2% |

|

Currency |

(32)bps |

|

2023 adjusted operating margin |

15.9% |

Four businesses experienced higher organic

margins thanks to operational leverage in a context of strong

revenue growth, contract selectivity and a positive mix effect:

Industry (14.0%, margin up 250 basis points organically), Marine

& Offshore (23.8%, margin up 94 basis points), Agri-Food &

Commodities (14.9%, margin up 70 basis point) and Certification

(18.9%, margin up 26 basis points). Two businesses saw a margin

decline, namely Consumer Products Services and Buildings &

Infrastructure, respectively impacted by lower consumer demand and

mix effects.

Other operating expenses increased to EUR 105.8

million versus EUR 102.8 million in 2022. These include:

- EUR 57.1 million in

amortization of intangible assets resulting from acquisitions (EUR

65.7 million in 2022);

- EUR 22.1 million in

write-offs of non-current assets related to laboratory

consolidations (EUR 10.2 million in 2022);

- EUR 30.3 million in

restructuring costs (EUR 31.2 million in 2022);

- EUR 3.7 million in

net gains on disposals and acquisitions (net gains of EUR 4.3

million in 2022).

Operating profit totaled EUR 824.4 million, up

3.1% from EUR 799.3 million in 2022.

Adjusted EPS reached EUR

1.27, up 7.4% year on year (up 17.4% at constant

currency)

Net finance costs decreased to EUR 46.0 million

(vs. EUR 72.4 million in 2022), reflecting mainly the increases in

the income from cash and cash equivalents and interest rate

increases.

The foreign exchange impact is a positive EUR

6.9 million (vs. a positive EUR 4.6 million in 2022) due to the

depreciation of the US dollar against the Euro and the appreciation

of the US dollar and the Euro against most emerging market

currencies.

Other items (including interest cost on pension

plans and other financial expenses) stood at a negative EUR 29.4

million, from a negative EUR 13.6 million in 2022.

As a result, net financial expenses decreased to

EUR 68.5 million in full-year 2023 compared with EUR 81.4

million in 2022.

Income tax expense totaled EUR 240.7 million in

2023, compared with EUR 233.4 million in 2022.

This represents an effective tax rate (ETR -

income tax expense divided by profit before tax) of 31.8% for the

period, compared with 32.5% in 2022. The adjusted ETR is down 50

basis points at 31.1%, compared with 2022. The decrease is mainly

due to the decrease in the contribution on added value of

enterprises (CVAE - Cotisation sur la valeur ajoutée des

entreprises) in France.

Attributable net profit in 2023 was EUR 503.7

million, up +7.9% vs. EUR 466.7 million profit in 2022.

Earnings per share (EPS) stood at EUR 1.11 vs.

EUR 1.03 in 2022, up +7.7% year on year.

Adjusted attributable net profit totaled EUR

574.7 million, up +7.6% vs. EUR 533.9 million in 2022.

Adjusted EPS stood at EUR 1.27, a 7.4% increase

vs. EUR 1.18 in 2022.

Very robust free cash flow at EUR 659

million (up 5.5% at constant currency)

Full year 2023 operating cash flow decreased by

1.8% to EUR 819.7 million vs. EUR 834.9 million in 2022. The

increase in profit before income tax was largely offset by higher

income taxes. Despite the strong revenue performance in the fourth

quarter, the working capital outflow remained under control (at EUR

53.6 million, compared to a EUR 12.5 million outflow the previous

year).

The working capital requirement (WCR) stood at

EUR 379.8 million on December 31, 2023, compared to EUR 341.1

million on December 31, 2022. As a percentage of revenue, WCR

increased slightly by 50 basis points to 6.5%, compared to 6.0% in

2022, which was a record low. This showed the continued strong

focus of the entire organization on cash metrics, in a context of

rapid topline growth. Key initiatives were implemented under the

“Move For Cash” program (optimizing the “invoice to cash” process,

accelerating billing and cash collection processes throughout the

Group reinforced by a central task force, and daily monitoring of

cash inflows).

Purchases of property, plant and equipment and

intangible assets, net of disposals (Net Capex), amounted to EUR

143.5 million in 2023, an increase compared to EUR 125.4 million in

2022. This showed disciplined control, with the Group’s net

capex-to-revenue ratio of 2.4%, broadly stable compared to the

level in 2022.

Free cash flow (operating cash flow after tax,

interest expenses and capex) was EUR 659.1 million, compared to EUR

657.0 million in 2022, up 0.3% year on year, notably led by

operating performance, offset by currency moves. At constant

exchange rates, growth was 5.5%. On an organic basis, free cash

flow increased by 4.9% year on year.

|

CHANGE IN FREE CASH FLOW |

|

|

IN EUR MILLIONS |

|

|

Free cash flow at December 31, 2022 |

657.0 |

|

Organic change |

32.3 |

|

Organic free cash flow |

689.3 |

|

Scope |

4.1 |

|

Free cash flow at constant currency |

693.4 |

|

Currency |

(34.3) |

|

Free cash flow at December 31, 2023 |

659.1 |

At December 31, 2023, adjusted net financial

debt was EUR 936.2 million, i.e. 0.92x EBITDA as defined in the

calculation of the bank covenant, compared with 0.97x at December

31, 2022. The decrease in adjusted net financial debt of EUR 39.1

million versus December 31, 2022 (EUR 975.3 million) reflects:

- Free cash flow of

EUR 659.1 million;

- Dividend payments

totaling EUR 396.3 million;

- Acquisitions (net)

and repayment of amounts owed to shareholders, accounting for EUR

71.0 million;

- Lease payments

(related to the application of IFRS 16), accounting for EUR 141.9

million;

- Other items that

increased the Group's debt by EUR 10.8 million (including foreign

exchange).

MARINE & OFFSHORE

|

IN EUR MILLIONS |

2023 |

2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Revenue |

455.7 |

418.3 |

+8.9% |

+14.4% |

- |

(5.5)% |

|

Adjusted operating profit |

108.6 |

100.7 |

+7.8% |

|

|

|

|

Adjusted operating margin |

23.8% |

24.1% |

(24)bps |

+94bps |

- |

(119)bps |

The Marine & Offshore business was among the

best performing businesses within the Group’s portfolio in the full

year 2023 with organic growth of 14.4% (including 13.4% in the

fourth quarter) led by all geographies and activities:

-

Double-digit organic revenue growth in New

Construction (40% of divisional revenue), reflecting the

solid backlog and acceleration of new order conversion over the

year, boosted by sector trends across the shipping industry

(renewal of the world’s ageing fleet and decarbonization

regulations). Activity from shipyards in China and South Korea was

particularly strong in Q4.

-

Double-digit organic revenue growth in the Core

In-service activity (45% of divisional revenue), still led

by a sustained high level of occasional surveys, especially on old

ships, combined with price increases and the growth of the classed

fleet. On December 31, 2023, the fleet classified by Bureau Veritas

comprised 11,705 ships (up 0.8% on a yearly basis), representing

148.7 million of Gross Register Tonnage (GRT).

-

Double-digit organic revenue growth for Services

(15% of divisional revenue, including Offshore) was driven by the

good commercial development of non-classification services,

including consulting services related to energy efficiency.

Bureau Veritas new orders reached 9.3 million

gross tons at December 31, 2023, bringing the order book to

22.4 million gross tons at the end of the year, up 11.4%

compared to 20.1 million gross tons at end 2022. It is composed of

a variety of LNG-fueled ships, container ships and specialized

vessels.

Marine & Offshore continued to focus on

efficiency levers through digitalization and high added-value

services. In September 2023, the Group announced a strategic

partnership with OrbitMI, a New York-based maritime software

company, formalized through Bureau Veritas investment in OrbitMI.

Aimed at accelerating the development of both existing and new

data-driven solutions to optimize ships journey the collaboration

will leverage combined strengths to address the dual opportunities

of the digital transformation, and the decarbonization of shipping

(access more information by clicking here).

Adjusted operating margin for the full year

declined by 24 basis points to a still healthy 23.8% on a reported

basis compared to FY 2022, negatively impacted by foreign exchange

effects (119 basis points). Organically, the margin rose by 94

basis points, benefiting from a positive mix and operational

excellence.

Sustainability achievements

In 2023, Bureau Veritas continued to address the

challenges of Sustainability and energy transition by providing

rules and guidelines for the safety, risk and performance

requirements for innovation in fuels and propulsion systems. The

Group helped its clients comply with environmental regulations,

implement sustainable solutions on board, and measure progress in

decarbonization.

Among the services and solutions delivered, in

the last quarter of 2023, Bureau Veritas was selected to class the

world’s largest ammonia carriers for Naftomar Shipping to be built

by Hanwha Ocean in China. It will support the adoption of

carbon-neutral fuels by the shipping industry, and the development

of supply chains for green hydrogen.

The Group also issued its Approval in Principle

(AiP) to Greek company Erma First for its Blue Connect system. This

system has been designed for a specific maximum load capacity

according to individual vessel specifications and to meet specific

port requirements. Connection to shore power will be a requirement

for containerships and cruise ships in European ports from 2030 and

may be requested by other customers looking to eliminate or reduce

emissions while in port.

AGRI-FOOD & COMMODITIES

|

IN EUR MILLIONS |

2023 |

2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Revenue |

1,233.6 |

1,224.8 |

+0.7% |

+5.7% |

- |

(5.0)% |

|

Adjusted operating profit |

184.0 |

176.0 |

+4.6% |

|

|

|

|

Adjusted operating margin |

14.9% |

14.4% |

+55bps |

+70bps |

- |

(15)bps |

The Agri-Food & Commodities business

delivered organic revenue growth of 5.7% over the year 2023, with

progress across all activities. The fourth quarter recorded organic

growth of 7.5%.

Oil & Petrochemicals

(O&P, 31% of divisional revenue) recorded mid-single digit

organic revenue growth overall in 2023, with a robust performance

in the fourth quarter. Europe was driven by market share gains,

while the Middle East benefited from stronger activity at the end

of the year on the back of beneficial shifts in routes. O&P

Trade was impacted in North America and Asia by tough competition.

Non-trade related services and value-added segments continued to

expand across O&P. The Group maintained strong traction around

its new initiatives such as biofuels and OCM (Oil Condition

Monitoring) especially in the USA and in Benelux.

Metals & Minerals (M&M,

32% of divisional revenue) achieved low single-digit organic growth

over the full year including mid-single-digit growth in Q4.

Upstream activity (nearly two-thirds of M&M) benefits from

solid underlying trends, with good momentum in gold and green

metals (copper, nickel, etc). The on-site laboratories’ strategy

remains a strong growth driver with important wins in the

Asia-Pacific region during the last quarter. In mining-related

testing, the Group started to benefit from its recent investment

and diversification in the Middle East. Trade activities recorded

high-single digit organic revenue growth, led by sustained strong

volumes in Asia.

Agri-Food (22% of divisional

revenue) activities achieved high-single-digit organic growth,

including a stellar double-digit performance in the fourth quarter.

This growth was mainly driven by Agricultural products, as the year

was marked by exceptionally good harvests for different food

commodities in South America (mainly Brazil, with a record

production in soybean) and for corn overall.

The good momentum on biodiesel in Latin America

also supported growth. Within the Food business, which grew

mid-single digit organically, testing activities in Australia

improved as they gradually diversify their customer base. The North

America and Middle East regions also strongly benefited from the

ramp-up of new labs.

Government services (15% of

divisional revenue) recorded another strong year in 2023 with high

single-digit organic revenue growth. The growth was broad-based and

driven by the solid ramp-up of new VOC (Verification of Conformity)

contracts in the Middle East, in Africa and the Caspian area.

The adjusted operating margin for the Agri-Food

& Commodities business rose to 14.9%, up 55 basis points

compared to last year, and up 70 basis points on an organic basis.

This was driven by operational leverage and a positive business

mix.

Sustainability achievements

In the second half of 2023, the Group provided

cargo inspection and sampling services on biofuel products made

from multi-seed crush and vegetable oils on behalf of an American

global food corporation in Belgium. The Group was also

awarded a Sustainability data assurance contract for one of the

world’s largest Food companies. In the last quarter, Bureau Veritas

was selected to deliver carbon-related services for a large crop

science company in Germany to improve its agricultural

practices.

INDUSTRY

|

IN EUR MILLIONS |

2023 |

2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Revenue |

1,249.5 |

1,181.0 |

+5.8% |

+16.5% |

(1.0)% |

(9.7)% |

|

Adjusted operating profit |

174.8 |

139.1 |

+25.6% |

|

|

|

|

Adjusted operating margin |

14.0% |

11.8% |

+217bps |

+250bps |

+9bps |

(43)bps |

Industry was the best performing business within

the Group’s portfolio in 2023, with very strong organic revenue

growth of 16.5% in the year including 18.7% in the fourth

quarter.

All segments and most geographies contributed to

the divisional growth, with Americas, Middle East and Africa

outperforming. Energy transition commitments and policies remained

a key growth catalyst overall and triggered low carbon energy

investment and the creation of decarbonation solutions which

benefited the division.

By market, Power &

Utilities (14% of divisional revenue) remained a growth

driver for the portfolio with a double-digit organic performance.

In Latin America, the Group continues to benefit from its leading

grid Opex platform and contract wins with various Power

Distribution clients, although growth was moderated by the Group’s

focus on profitable contracts. In Europe, the nuclear power

generation segment enhanced growth, primarily driven by new

projects in the UK and the EDF power plants renovation programs in

France.

Renewable Power Generation

activities (solar, wind, hydrogen) maintained strong momentum

during the whole year, with a high double-digit organic performance

delivered across most geographies. Strong growth was recorded in

the US, fueled by Bureau Veritas’ Bradley Construction Management

for solar, onshore wind and high-voltage transmission projects. In

2023, Bureau Veritas launched two certification schemes dedicated

to renewable hydrogen and Ammonia, ensuring such products are

produced with safe and sustainable practices, using renewable

energy sources.

In Oil & Gas (33% of

divisional revenue), double-digit organic revenue growth was

maintained in 2023. Two-thirds of the business related to Opex

services recorded an organic growth of 20.4% led by the conversion

of a solid sales pipeline. Capex-related activities, including

Procurement Services, grew double-digit organically, benefiting

from the startup of new projects in the gas sector (LNG). Large

contracts ramped up in Australia, Middle East, Africa and Latin

America through 2023.

The non-energy activities

performed well in both Opex and Capex services. These activities

benefited from a number of drivers including ageing assets,

tightening regulations, and the adoption of more sustainable and

decarbonized asset management practices in different industries.

During the year, as part of its active portfolio management, the

Group further reduced its exposure to the Automotive business

through the disposal in July 2023 of its non-core automotive

inspection business in the US, representing below EUR 20 million of

annualized revenue (3.7% of divisional revenue).

Adjusted operating margin for 2023 increased by

217 basis points to 14.0% (of which 250 basis points is organic).

This is attributable to more contract selectivity, and some

operational leverage through the ramp-up of contracts.

Sustainability achievements

During 2023, Bureau Veritas continued to develop

and execute many new services to support its industry customers as

they transition and decarbonize from co-developed plug-and-play

decarbonization solutions to quality control services for various

offshore windfarm construction projects (during the fabrication,

manufacture and installation phases). In the last quarter, the

Group was selected for the engineering and Quality Assessment

support on Woodside Energy’s H2OK hydrogen plant in the US. The

Group was also involved in a Project management assistance (PMA)

mission for the creation of a 125 miles green energy transmission

line connecting California and Arizona.

BUILDINGS &

INFRASTRUCTURE

|

IN EUR MILLIONS |

2023 |

2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Revenue |

1,753.3 |

1,664.0 |

+5.4% |

+6.3% |

+1.4% |

(2.3)% |

|

Adjusted operating profit |

229.3 |

228.7 |

+0.3% |

|

|

|

|

Adjusted operating margin |

13.1% |

13.7% |

(63)bps |

(70)bps |

+12bps |

(5)bps |

The Buildings & Infrastructure (B&I)

business achieved an organic growth of 6.3% in 2023 against strong

comparables in the previous year. This included a fourth quarter

organic revenue growth recovery as expected to 4.4%.

During the period, the building-in service

activity outperformed the construction-related activities.

The Americas region (27% of

divisional revenue) delivered different performance by geography.

In Latin America, strong growth was recorded, led by Brazil and

Mexico, driven by wins of large Capex contracts in the

transportation sectors. In North America, activity was slightly

lower after strong results in 2022 and efforts to improve revenue

mix through selectivity on some contracts. While the commercial

real estate transactions business remained subdued due to high

interest rates, the Group benefited from its very diversified

portfolio (by service, asset and driver). Double digit growth was

achieved in data center commissioning services thanks to continued

geographical expansion and growth in cloud computing services. In

addition, code compliance activities remained robust as the

business benefits from exposure to the high population growth in

Southern states (including Texas and Florida).

Europe (50% of divisional

revenue) delivered strong growth across the board with particularly

high performances in Italy, the UK and the Netherlands. More

stringent regulation continued to benefit both Opex and Capex

activities around energy efficiency and building safety.

Mid-single-digit growth (including a strong fourth quarter) was

achieved in France (39% of divisional revenue) led by its Opex

business (three quarters of the country’s revenue) thanks to

continued price increases and productivity gains. The capex related

activities grew slightly against a declining market, as they are

more weighted towards infrastructure and public works (including

the Olympic Games 2024) versus residential buildings. The French

government stimulus plan ‘Plan de relance’ also contributed to the

growth.

The Asia-Pacific region (19% of

divisional revenue) reached high-single digit organic growth in

2023. While outstanding performances were delivered in India,

Southeastern Asia, Australia and Saudi Arabia, Chinese activity

only slowly recovered from unfavorable comparables (following the

reopening of the Chinese market the previous year). In China, the

energy transition drive stimulated power-related construction

activities while the spend for infrastructure projects in the

transportation field remained low.

The Middle East & Africa

region (4% of divisional revenue) was the best-performing

area, recording a strong double-digit organic revenue increase in

2023. In the Middle East, the performance was led by the roll-out

of numerous development projects. In Saudi Arabia, the Group is

still strongly engaged in delivering QA/QC Services for the NEOM

smart city project.

Adjusted operating margin for the full year

declined by 63 basis points to 13.1% from 13.7% in the prior year

mainly driven by a negative mix effect.

Sustainability achievementsIn

the fourth quarter of 2023, the Group was awarded several contracts

in the field of energy audits and sustainability requirements. This

ranges from Green Building audit campaigns according to internal

Sustainable Construction standards for a leading retail real estate

owner and energy audits for Michigan schools.

CERTIFICATION

|

IN EUR MILLIONS |

2023 |

2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Revenue |

465.0 |

428.3 |

+8.6% |

+12.4% |

- |

(3.8)% |

|

Adjusted operating profit |

88.0 |

81.4 |

+8.0% |

|

|

|

|

Adjusted operating margin |

18.9% |

19.0% |

(7)bps |

+26bps |

- |

(33)bps |

The Certification business recorded strong

organic growth of 12.4% in the full year 2023 (including 15.1% in

the fourth quarter).

This was supported by both volume and price

increases. The acceleration of the Group’s portfolio

diversification also continued to drive growth.

The growth was broad-based across schemes and

geographies. Americas, Asia-Pacific and the Middle East and Africa

region delivered the strongest organic revenue performances thanks

to business development efforts and exposure to new services

including Sustainability and CSR-driven solutions.

During the period, the business continued to be

led by increased client demand for more brand protection,

traceability, and social responsibility commitments all along the

supply chains. Double-digit growth was recorded for QHSE

schemes, Supply Chain &

Sustainability and Food Safety. Bureau Veritas

also won a public outsourcing contract with the Direction Générale

de l’Alimentation to provide services around food safety

inspections in France.

Sustainability-related services

delivered strong double-digit organic revenue growth in 2023 fueled

by a continuing high demand for verification of greenhouse gas

emissions and supply chain audits on ESG topics. In the

medium term, the business is expected to benefit from several

regulatory changes (CS3D -Corporate Sustainability Due Diligence

Directive, EU Deforestation Regulation, EU CSRD -Corporate

Sustainability Reporting Directive) which will require more audits

and certification services than today.

Momentum remained strong for solutions dedicated

to companies around IT Service Management and information security.

The Cybersecurity business posted very high

double-digit organic performance. This is due to extremely robust

business development and rising demand for more verifications

around enterprise cyber risks.

The adjusted operating margin for the full year

was a very healthy 18.9%, compared to 19.0% in the previous year.

This reflects a 26 basis points organic increase, attributed to

productivity gains, offset by a negative foreign exchange effect of

33 basis points.

Sustainability achievements

During 2023, Bureau Veritas won numerous

contracts in the Sustainability field. For instance, in the last

quarter, the Group was selected by Mondelez International for

sustainability data assurance and social audits. The Group was also

awarded a contract by a European power company for the measurement

of the organizational level carbon footprint and commitment to

SBTi.

At COP 28 in Dubai, Bureau Veritas,

Environmental intelligence services company Kayrros, and one of the

world's leading suppliers of traceability systems OPTEL, announced

the signing of a strategic partnership to provide companies with a

solution to combat deforestation. The partnership is designed to

help companies comply with the European Union Deforestation

Regulation (EUDR), which aims to combat deforestation caused by the

import of certain products. A first contract has been signed with a

wood importer to ensure the traceability of its products and comply

with this directive, which came into force on January 1st, 2024.

For more information, the press release is available by clicking

here.

CONSUMER PRODUCTS SERVICES

|

IN EUR MILLIONS |

2023 |

2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Revenue |

710.7 |

734.2 |

(3.2)% |

(0.5)% |

+3.1% |

(5.8)% |

|

Adjusted operating profit |

145.5 |

176.2 |

(17.5)% |

|

|

|

|

Adjusted operating margin |

20.5% |

24.0% |

(355)bps |

(258)bps |

(51)bps |

(46)bps |

The Consumer Products Services division recorded

an organic revenue contraction of 0.5%, including a recovery in the

fourth quarter of 2023 (+3.8% organic growth) with varying

geographical and service trends.

During 2023 (including Q4), Asia remained the

region most impacted by the weak consumer spending backdrop, while

the Americas (US and Latin America) continue to benefit from the

diversification strategy implemented over the recent years

(especially in healthcare in the US).

Softlines, Hardlines & Toys

(49% of divisional revenue) recorded low-single-digit organic

growth in full year 2023. Softlines showed good resilience

throughout the year and benefited in the fourth quarter from a

restart of goods production as stocks deplete. Hardlines & Toys

posted a low-single-digit organic contraction in 2023, with a

rebound in Q4 which is expected to continue in the first quarter

2024 as toy sales and new contracts resume. China improved

sequentially, and Southern Asia maintained a strong momentum (in

Bangladesh, India and Indonesia) -led by the sourcing shift outside

of China. Growth was moderate in South-Eastern Asia.

Health, Beauty & Household

(8% of divisional revenue) recorded solid double-digit organic

growth in 2023 (including Q4), led by the Americas and new contract

wins. Advanced Testing Laboratory (ATL) and Galbraith Laboratories

Inc., which were both acquired last year in the US, progressed well

with a promising sales pipeline.

Inspection & Audit services

(13% of divisional revenue) maintained their growth thanks to

strong momentum for Sustainability services over the course of

2023, which grew 17% organically. This includes organic products,

recycling, social audits and green claim verification across most

geographies.

Lastly,

Technology9 (30% of divisional

revenue), as expected, recorded a mid-single-digit organic

contraction, and is still affected by the global decrease in demand

for electrical and wireless equipment, as well as the resulting

temporary reduction in new product launches. The New

Mobility sub-segment however delivered double-digit

growth, led by both Asia and the US, thanks to the ramp-up of a new

lab in Detroit, Michigan. This reflected good traction of testing

on electric vehicle systems and associated components. During the

year, the Group opened a new lab in Hanoi fully dedicated to

connectivity and wireless testing. It also opened an electronic

ATEX (European Directives for controlling explosive atmospheres)

regulated lab in Brazil.

During the fourth quarter of 2023, the Consumer

Products Services division continued its diversification

strategy:

-

Services diversification with the acquisition of Impactiva, a

leader in quality assurance for the footwear industry, positioned

upstream in the value chain;

-

Geographic diversification with the acquisition of ANCE, the leader

in testing and certification services for electrical and electronic

products in Mexico.

Adjusted operating margin for the full year

declined by 355 basis points to 20.5% from 24.0% in the prior year.

Organically, it decreased by 258 basis points. This was attributed

to negative operational leverage.

Sustainability achievements

During 2023, Bureau Veritas was awarded numerous

contracts in the Sustainability field. For instance, in the last

quarter, the Group was selected for contracts ranging from social

audits, CSR compliance to environmental testing and chemical social

audits. The Group also entered into a contract with one of the

world's leading sportswear and footwear brands to help them in

their supply chain decarbonization efforts through SBTI &

greenhouse gas reduction programs.

-

PRESENTATION

- Full year 2023

results will be presented on Thursday, February 22, 2024, at 3:00

p.m. (Paris time)

- An audio conference

will be webcast live. Please connect to: Link to audio

conference

- The presentation

slides will be available on: https://group.bureauveritas.com

- All supporting

documents will be available on the website

- Live dial-in

numbers:

- France: +33 (0)1 70 37 71 66

- UK: +44 (0)33 0551 0200

- US: +1 786 697 3501

- International: +44 (0)33 0551 0200

- Password: Bureau Veritas

-

FINANCIAL CALENDAR

- Capital Markets

Day: March 20, 2024

- Q1 2024 revenue:

April 25, 2024

- Shareholders’

Meeting: June 20, 2024

- Half Year 2024

Results: July 26, 2024

- Q3 2024 revenue:

October 23, 2024

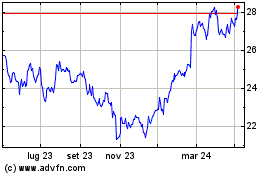

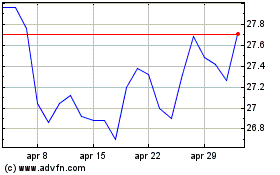

About Bureau Veritas Bureau

Veritas is a world leader in laboratory testing, inspection and

certification services. Created in 1828, the Group has circa 82,000

employees located in nearly 1,600 offices and laboratories around

the globe. Bureau Veritas helps its 400,000 clients improve their

performance by offering services and innovative solutions in order

to ensure that their assets, products, infrastructure and processes

meet standards and regulations in terms of quality, health and

safety, environmental protection and social responsibility.Bureau

Veritas is listed on Euronext Paris and belongs to the CAC 40 ESG,

CAC Next 20, CAC 40 SBT 1.5, and SBF 120 indices. Compartment A,

ISIN code FR 0006174348, stock symbol: BVI.For more information,

visit www.bureauveritas.com, and follow us on Twitter

(@bureauveritas) and LinkedIn.

|

|

Our information is certified with blockchain technology.Check that

this press release is genuine at www.wiztrust.com. |

|

|

| |

|

|

|

|

ANALYST/INVESTOR CONTACTS |

|

MEDIA CONTACTS |

|

|

|

Laurent Brunelle |

|

Anette Rey |

|

|

|

+33 (0)1 55 24 76 09 |

|

+ 33 (0)6 69 79 84 88 |

|

|

|

laurent.brunelle@bureauveritas.com |

|

anette.rey@bureauveritas.com |

|

|

|

|

|

|

|

|

|

Colin Verbrugghe |

|

|

|

|

|

+33 (0)1 55 24 77 80 |

|

|

|

|

|

colin.verbrugghe@bureauveritas.com |

|

|

|

|

|

Karine Ansart+33 (0)1 55 24 76

19karine.ansart@bureauveritas.com |

|

|

|

|

This press release (including the appendices)

contains forward-looking statements, which are based on current

plans and forecasts of Bureau Veritas’ management. Such

forward-looking statements are by their nature subject to a number

of important risk and uncertainty factors such as those described

in the Universal Registration Document (“Document d’enregistrement

universel”) filed by Bureau Veritas with the French Financial

Markets Authority (“AMF”) that could cause actual results to differ

from the plans, objectives and expectations expressed in such

forward-looking statements. These forward-looking statements speak

only as of the date on which they are made, and Bureau Veritas

undertakes no obligation to update or revise any of them, whether

as a result of new information, future events or otherwise,

according to applicable regulations.

-

APPENDIX 1: Q4 AND FY 2023 REVENUE BY BUSINESS

|

IN EUR MILLIONS |

Q4/FY 2023 |

Q4/FY 2022(a) |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Marine & Offshore |

117.1 |

109.0 |

+7.4% |

+13.4% |

- |

(6.0)% |

|

Agri-Food & Commodities |

316.5 |

312.9 |

+1.2% |

+7.5% |

- |

(6.3)% |

|

Industry |

322.2 |

313.7 |

+2.7% |

+18.7% |

(2.1)% |

(13.9)% |

|

Buildings & Infrastructure |

470.7 |

459.0 |

+2.6% |

+4.4% |

- |

(1.8)% |

|

Certification |

130.5 |

117.9 |

+10.6% |

+15.1% |

- |

(4.5)% |

|

Consumer Products |

182.8 |

187.6 |

(2.5)% |

+3.8% |

- |

(6.3)% |

|

Total Q4 revenue |

1,539.8 |

1,500.1 |

+2.6% |

+9.4% |

(0.4)% |

(6.4)% |

|

Marine & Offshore |

455.7 |

418.3 |

+8.9% |

+14.4% |

- |

(5.5)% |

|

Agri-Food & Commodities |

1,233.6 |

1,224.8 |

+0.7% |

+5.7% |

- |

(5.0)% |

|

Industry |

1,249.5 |

1,181.0 |

+5.8% |

+16.5% |

(1.0)% |

(9.7)% |

|

Buildings & Infrastructure |

1,753.3 |

1,664.0 |

+5.4% |

+6.3% |

+1.4% |

(2.3)% |

|

Certification |

465.0 |

428.3 |

+8.6% |

+12.4% |

- |

(3.8)% |

|

Consumer Products |

710.7 |

734.2 |

(3.2)% |

(0.5)% |

+3.1% |

(5.8)% |

|

Total full year revenue |

5,867.8 |

5,650.6 |

+3.8% |

+8.5% |

+0.6% |

(5.3)% |

(a) Q4 and FY 2022 figures by business have been

restated following a c. €4.0 million reclassification of activities

previously reported in Industry to the Buildings &

Infrastructure business.

-

APPENDIX 2: 2023 REVENUE BY QUARTER

| |

2023 REVENUE BY QUARTER |

|

IN EUR MILLIONS |

Q1 |

Q2 |

Q3 |

Q4 |

|

Marine & Offshore |

113.1 |

115.6 |

110.0 |

117.1 |

|

Agri-Food & Commodities |

302.7 |

308.9 |

305.5 |

316.5 |

|

Industry |

295.3 |

323.0 |

309.0 |

322.2 |

|

Buildings & Infrastructure |

431.6 |

437.2 |

413.8 |

470.7 |

|

Certification |

106.9 |

120.9 |

106.7 |

130.5 |

|

Consumer Products |

154.9 |

194.2 |

178.8 |

182.8 |

|

Total revenue |

1,404.5 |

1,499.8 |

1,423.8 |

1,539.8 |

-

APPENDIX 3: ADJUSTED OPERATING PROFIT AND MARGIN BY BUSINESS

|

|

ADJUSTED OPERATING PROFIT |

ADJUSTED OPERATING MARGIN |

|

2023 |

2022 |

CHANGE(%) |

2023 |

2022 |

CHANGE |

|

IN EUR MILLIONS |

(BASIS POINTS) |

|

Marine & Offshore |

108.6 |

100.7 |

+7.8% |

23.8 % |

24.1% |

(24)bps |

|

Agri-Food & Commodities |

184.0 |

176.0 |

+4.6% |

14.9 % |

14.4% |

+55bps |

|

Industry |

174.8 |

139.1 |

+25.6% |

14.0 % |

11.8% |

+217bps |

|

Buildings & Infrastructure |

229.3 |

228.7 |

+0.3% |

13.1 % |

13.7% |

(63)bps |

|

Certification |

88.0 |

81.4 |

+8.0% |

18.9 % |

19.0% |

(7)bps |

|

Consumer Products |

145.5 |

176.2 |

(17.5)% |

20.5 % |

24.0% |

(355)bps |

|

Total Group |

930.2 |

902.1 |

+3.1% |

15.9 % |

16.0% |

(11)bps |

-

APPENDIX 4: EXTRACTS FROM THE FULL YEAR CONSOLIDATED FINANCIAL

STATEMENTS

Extracts from the full year consolidated

financial statements audited and approved on February 21, 2024by

the Board of Directors. The audit procedures for the full year

accounts have been undertaken and theStatutory Auditors’ report has

been published.

|

CONSOLIDATED INCOME SATEMENT |

|

|

|

IN EUR MILLIONS |

2023 |

2022 |

|

Revenue |

5,867.8 |

5,650.6 |

|

Purchases and external charges |

(1,642.3) |

(1,620.5) |

|

Personnel costs |

(3,061.8) |

(2,929.4) |

|

Taxes other than on income |

(48.9) |

(53.4) |

|

Net (additions to)/reversals of provisions |

(22.4) |

0.5 |

|

Depreciation and amortization |

(291.5) |

(297.1) |

|

Other operating income and expense, net |

23.5 |

48.6 |

|

Operating profit |

824.4 |

799.3 |

|

Share of profit of equity-accounted companies |

0.7 |

0.1 |

|

Operating profit after share of profit of equity-accounted

companies |

825.1 |

799.4 |

|

Income from cash and cash equivalents |

45.0 |

12.5 |

|

Finance costs, gross |

(91.0) |

(84.9) |

|

Finance costs, net |

(46.0) |

(72.4) |

|

Other financial income and expense, net |

(22.5) |

(9.0) |

|

Net financial expense |

(68.5) |

(81.4) |

|

Profit before income tax |

756.6 |

718.0 |

|

Income tax expense |

(240.7) |

(233.4) |

|

Net profit |

515.9 |

484.6 |

|

Non-controlling interests |

(12.2) |

17.9 |

|

Attributable net profit |

503.7 |

466.7 |

|

Earnings per share (in euros): |

|

|

|

Basic earnings per share |

1.11 |

1.03 |

|

Diluted earnings per share |

1.10 |

1.02 |

|

CONSOLIDATED STATEMENT OF FINANCIAL POSITION |

|

IN EUR MILLIONS |

DEC. 31, 2023 |

DEC. 31, 2022 |

|

Goodwill |

2,127.4 |

2,143.7 |

|

Intangible assets |

360.0 |

392.5 |

|

Property, plant and equipment |

389.0 |

374.8 |

|

Right-of-use assets |

391.5 |

381.3 |

|

Non-current financial assets |

108.9 |

108.1 |

|

Deferred income tax assets |

136.6 |

122.6 |

|

Total non-current assets |

3,513.4 |

3,523.0 |

|

Trade and other receivables |

1,584.5 |

1,553.2 |

|

Contract assets |

325.9 |

310.3 |

|

Current income tax assets |

33.5 |

42.2 |

|

Derivative financial instruments |

4.1 |

6.3 |

|

Other current financial assets |

9.1 |

22.1 |

|

Cash and cash equivalents |

1,173.9 |

1,662.1 |

|

Total current assets |

3,131.0 |

3,596.2 |

|

TOTAL ASSETS |

6,644.4 |

7,119.2 |

|

|

|

|

|

Share capital |

54.5 |

54.3 |

|

Retained earnings and other reserves |

1,881.6 |

1,807.8 |

|

Equity attributable to owners of the Company |

1,936.1 |

1,862.1 |

|

Non-controlling interests |

57.7 |

65.9 |

|

Total equity |

1,993.8 |

1,928.0 |

|

Non-current borrowings and financial debt |

2,079.7 |

2,102.0 |

|

Non-current lease liabilities |

319.7 |

308.4 |

|

Other non-current financial liabilities |

73.7 |

99.1 |

|

Deferred income tax liabilities |

85.0 |

88.1 |

|

Pension plans and other long-term employee benefits |

147.2 |

141.7 |

|

Provisions for other liabilities and charges |

72.2 |

72.9 |

|

Total non-current liabilities |

2,777.5 |

2,812.2 |

|

Trade and other payables |

1,273.4 |

1,267.4 |

|

Contract liabilities |

257.2 |

255.0 |

|

Current income tax liabilities |

98.5 |

103.7 |

|

Current borrowings and financial debt |

31.2 |

535.4 |

|

Current lease liabilities |

107.5 |

99.4 |

|

Derivative financial instruments |

3.3 |

6.3 |

|

Other current financial liabilities |

102.0 |

111.8 |

|

Total current liabilities |

1,873.1 |

2,379.0 |

|

TOTAL EQUITY AND LIABILITIES |

6,644.4 |

7,119.2 |

|

CONSOLIDATED STATEMENT OF CASH FLOWS |

|

|

|

IN EUR MILLIONS |

2023 |

2022 |

|

Profit before income tax |

756.6 |

718.0 |

|

Elimination of cash flows from financing and investing

activities |

30.8 |

50.5 |

|

Provisions and other non-cash items |

35.7 |

11.8 |

|

Depreciation, amortization and impairment |

291.5 |

297.1 |

|

Movements in working capital requirement attributable to

operations |

(53.6) |

(12.5) |

|

Income tax paid |

(241.3) |

(230.0) |

|

Net cash generated from operating activities |

819.7 |

834.9 |

|

Acquisitions of subsidiaries, net of cash acquired |

(58.9) |

(76.6) |

|

Impact of sales of subsidiaries and businesses, net of cash

disposed |

17.5 |

(1.2) |

|

Purchases of property, plant and equipment and intangible

assets |

(157.6) |

(130.1) |

|

Proceeds from sales of property, plant and equipment and intangible

assets |

14.1 |

4.7 |

|

Purchases of non-current financial assets |

(11.7) |

(11.5) |

|

Proceeds from sales of non-current financial assets |

5.8 |

15.0 |

|

Change in loans and advances granted |

2.8 |

(0.3) |

|

Dividends received from equity-accounted companies |

- |

0.1 |

|

Net cash used in investing activities |

(188.0) |

(199.9) |

|

Capital increase |

5.7 |

8.6 |

|

Purchases/sales of treasury shares |

(1.9) |

(49.8) |

|

Dividends paid |

(396.3) |

(280.9) |

|

Increase in borrowings and other financial debt |

0.9 |

201.8 |

|

Repayment of borrowings and other financial debt |

(500.4) |

(82.9) |

|

Repayment of debts and transactions with shareholders |

(29.6) |

(17.3) |

|

Repayment of lease liabilities and interest |

(141.9) |

(139.0) |

|

Interest paid |

(17.1) |

(52.5) |

|

Net cash used in financing activities |

(1,080.6) |

(412.0) |

|

Impact of currency translation differences |

(36.7) |

22.3 |

|

Net increase (decrease) in cash and cash

equivalents |

(485.6) |

245.3 |

|

Net cash and cash equivalents at beginning of the period |

1,655.7 |

1,410.4 |

|

Net cash and cash equivalents at end of the

period |

1,170.1 |

1,655.7 |

|

o/w cash and cash equivalents |

1,173.9 |

1,662.1 |

|

o/w bank overdrafts |

(3.8) |

(6.4) |

-

APPENDIX 5: DETAILED NET FINANCIAL EXPENSE

|

NET FINANCIAL EXPENSE |

|

|

|

IN EUR MILLIONS |

2023 |

2022 |

|

Finance costs, net |

(46.0) |

(72.4) |

|

Foreign exchange gains/(losses) |

6.9 |

4.6 |

|

Interest cost on pension plans |

(5.1) |

0.3 |

|

Implicit return on funded pension plan assets |

1.4 |

0.4 |

|

Other |

(25.7) |

(14.3) |

|

Net financial expense |

(68.5) |

(81.4) |

-

APPENDIX 6: ALTERNATIVE PERFORMANCE INDICATORS

|

ADJUSTED OPERATING PROFIT |

|

|

|

IN EUR MILLIONS |

2023 |

2022 |

|

Operating profit |

824.4 |

799.3 |

|

Amortization of intangible assets resulting from acquisitions |

57.1 |

65.7 |

|

Impairment and retirement of non-current assets |

22.1 |

10.2 |

|

Restructuring costs |

30.3 |

31.2 |

|

Gains (losses) on disposals of businesses and other income and

expenses related to acquisitions |

(3.7) |

(4.3) |

|

Total adjustment items |

105.8 |

102.8 |

|

Adjusted operating profit |

930.2 |

902.1 |

|

CHANGE IN ADJUSTED OPERATING PROFIT |

|

|

IN EUR MILLIONS |

|

|

2022 adjusted operating profit |

902.1 |

|

Organic change |

88.8 |

|

Organic adjusted operating profit |

990.9 |

|

Scope |

6.3 |

|

Adjusted operating profit at constant

currency |

997.2 |

|

Currency |

(67.0) |

|

2023 adjusted operating profit |

930.2 |

|

ADJUSTED EFFECTIVE TAX RATE |

|

|

|

IN EUR MILLIONS |

2023 |

2022 |

|

Profit before income tax |

756.6 |

718.0 |

|

Income tax expense |

(240.7) |

(233.4) |

|

ETR(a) |

31.8% |

32.5% |

|

Adjusted ETR |

31.1% |

31.6% |

|

(a) Effective tax rate (ETR) = Income tax expense / Profit before

income tax |

|

ATTRIBUTABLE NET PROFIT |

|

|

|

IN EUR MILLIONS |

2023 |

2022 |

|

Attributable net profit |

503.7 |

466.7 |

|

EPS(a) (€ per share) |

1.11 |

1.03 |

|

Adjustment items |

105.8 |

102.8 |

|

Tax impact on adjustment items |

(27.7) |

(26.2) |

|

Non-controlling interest on adjustment items |

(7.1) |

(9.4) |

|

Adjusted attributable net profit |

574.7 |

533.9 |

|

Adjusted EPS(a) (€ per share) |

1.27 |

1.18 |

|

(a) Calculated using the weighted average number of shares:

453,009,724 in 2023 and 452,140,348 in 2022 |

|

CHANGE IN ADJUSTED ATTRIBUTABLE NET PROFIT |

|

|

IN EUR MILLIONS |

|

|

2022 adjusted attributable net profit |

533,9 |

|

Organic change and scope |

94,0 |

|

Adjusted attributable net profit at constant

currency |

627.9 |

|

Currency |

(53.2) |

|

2023 adjusted attributable net profit |

574.7 |

|

FREE CASH FLOW |

|

|

|

IN EUR MILLIONS |

2023 |

2022 |

|

Net cash generated from operating activities (operating cash

flow) |

819.7 |

834.9 |

|

Net purchases of property, plant and equipment and intangible

assets |

(143.5) |

(125.4) |

|

Interest paid |

(17.1) |

(52.5) |

|

Free cash flow |

659.1 |

657.0 |

|

CHANGE IN NET CASH GENERATED FROM OPERATING ACTIVITIES |

|

IN EUR MILLIONS |

|

|

Net cash generated from operating activities at December

31, 2022 |

834.9 |

|

Organic change |

26.5 |

|

Organic net cash generated from operating

activities |

861.4 |

|

Scope |

4.3 |

|

Net cash generated from operating activities at constant

currency |

865.7 |

|

Currency |

(46.0) |

|

Net cash generated from operating activities at December

31, 2023 |

819.7 |

|

ADJUSTED NET FINANCIAL DEBT |

|

|

|

IN EUR MILLIONS |

DEC. 31, 2023 |

DEC. 31, 2022 |

|

Gross financial debt |

2,110.9 |

2,637.4 |

|

Cash and cash equivalents |

1,173.9 |

1,662.1 |

|

Consolidated net financial debt |

937.0 |

975.3 |

|

Currency hedging instruments |

(0.8) |

- |

|

Adjusted net financial debt |

936.2 |

975.3 |

-

APPENDIX 7: DEFINITION OF ALTERNATIVE PERFORMANCE INDICATORS AND

RECONCILIATION WITH IFRS

The management process used by Bureau Veritas is

based on a series of alternative performance indicators, as

presented below. These indicators were defined for the purposes of

preparing the Group’s budgets and internal and external reporting.

Bureau Veritas considers that these indicators provide additional

useful information to financial statement users, enabling them to

better understand the Group’s performance, especially its operating

performance. Some of these indicators represent benchmarks in the

testing, inspection and certification (“TIC”) business and are

commonly used and tracked by the financial community. These

alternative performance indicators should be seen as a complement

to IFRS-compliant indicators and the resulting changes.

GROWTH

Total revenue growth

The total revenue growth percentage measures

changes in consolidated revenue between the previous year and the

current year. Total revenue growth has three components:

- organic

growth;

- impact of changes

in the scope of consolidation (scope effect);

- impact of changes

in exchange rates (currency effect).

Organic growth

The Group internally monitors and publishes

“organic” revenue growth, which it considers to be more

representative of the Group’s operating performance in each of its

business sectors.

The main measure used to manage and track

consolidated revenue growth is like-for-like, or organic growth.

Determining organic growth enables the Group to monitor trends in

its business excluding the impact of currency fluctuations, which

are outside of Bureau Veritas’ control, as well as scope effects,