Capgemini launches its eleventh Employee Share Ownership Plan

11 Settembre 2024 - 5:45PM

UK Regulatory

Capgemini launches its eleventh Employee Share Ownership Plan

Media relations:

Victoire Grux

Tel.: +33 6 04 52 16 55

victoire.grux@capgemini.com

Investor relations:

Vincent Biraud

Tel.: +33 1 47 54 50 87

vincent.biraud@capgemini.com

Capgemini launches its eleventh Employee

Share Ownership Plan

Paris,

September 11, 2024

– Capgemini announces

the launch of

its eleventh

Employee Share

Ownership Plan

(ESOP).

This new employee share ownership plan is

offered to approximately 97% of the employees and is part of the

Group’s policy to associate all employees with its development and

performance. This ESOP will be implemented through a capital

increase reserved for the Capgemini employees for a maximum of

2,700,000 shares (i.e. 1.56% of outstanding shares). As the 2019

ESOP reaches its term at the end of the year, this eleventh plan

will help maintain employee shareholding at around 8% of Capgemini

SE’s share capital.

As in 2023, the Board of Directors of Capgemini

SE at its meeting of June 12 and 13, 2024 decided to authorize a

dedicated share buyback envelope. This envelope could be used

within the next 12 months1 to neutralize all or part of

the dilutive effect of this capital increase.

According to the planned schedule, the

reservation period will be opened from September 12 to October 1,

2024 (inclusive) and will be followed by a subscription/revocation

period from November 12 to November 14, 2024 (inclusive). The

subscription price of the new shares will be set on November 7,

2024 and the capital increase will be completed on December 19,

2024.

Employees will be able to subscribe to Capgemini

shares within the framework of subscription leveraged and

guaranteed formulas. These formulas will ensure that employees will

be safeguarded against any potential loss during the period when

the shares are non-tradable. The voting rights will be exercised by

the holders who – depending on the formula and the context – will

be an FCPE (Fonds Commun de Placement d’Entreprise), the

employees via direct shareholding and/or the financial institution

structuring the offer or its counterparties.

The implementation of the leveraged guaranteed

offering implies hedging transactions entered into by the financial

institution structuring the offer (Crédit Agricole Corporate and

Investment Bank), on market or off- market, through purchases

and/or sales of shares, purchase of call options and/or any other

transactions, at any time, including during the Reference

Price2 fixing period, i.e. from October 10 to November

6, 2024, and over the entire course of the plan, i.e. until

December 19, 2029.

DISCLAIMER

This press release may contain forward-looking statements. Such

statements may include projections, estimates, assumptions,

statements regarding plans, objectives, intentions and/or

expectations with respect to future financial results, events,

operations and services and product development, as well as

statements, regarding future performance or events. Forward-looking

statements are generally identified by the words “expects”,

“anticipates”, “believes”, “intends”, “estimates”, “plans”,

“projects”, “may”, “would”, “should” or the negatives of these

terms and similar expressions. Although Capgemini’s management

currently believes that the expectations reflected in such

forward-looking statements are reasonable, investors are cautioned

that forward-looking statements are subject to various risks and

uncertainties (including without limitation risks identified in

Capgemini’s Universal Registration Document available on

Capgemini’s website), because they relate to future events and

depend on future circumstances that may or may not occur and may be

different from those anticipated, many of which are difficult to

predict and generally beyond the control of Capgemini. Actual

results and developments may differ materially from those expressed

in, implied by or projected by forward-looking statements.

Forward-looking statements are not intended to and do not give any

assurances or comfort as to future events or results. Other than as

required by applicable law, Capgemini does not undertake any

obligation to update or revise any forward-looking statement.

This press release does not contain or constitute an offer of

securities for sale or an invitation or inducement to invest in

securities in France, the United States or any other

jurisdiction.

IMPORTANT NOTICE

This press release does not constitute an offer

to sell or a solicitation of offers to subscribe to Capgemini

shares. The capital increase of Capgemini reserved for employees

will be conducted only in countries where such an offering has been

registered with or notified to the competent local authorities

and/or following the approval of a prospectus by the competent

local authorities or in consideration of an exemption of the

requirement to prepare a prospectus or to proceed to a registration

or notification of the offering.

More generally, the offering will only be conducted in countries

where all required filing procedures and/or notifications have been

completed and the required authorizations have been obtained.

ABOUT CAPGEMINI

Capgemini is a global business and technology

transformation partner, helping organisations to accelerate their

dual transition to a digital and sustainable world while creating

tangible impact for enterprises and society. It is a responsible

and diverse group of 340,000 team members in more than 50

countries. With its strong over 55-year heritage, Capgemini is

trusted by its clients to unlock the value of technology to address

the entire breadth of their business needs. It delivers end-to-end

services and solutions leveraging strengths from strategy and

design to engineering, all fuelled by its market-leading

capabilities in AI, cloud and data, combined with its deep industry

expertise and partner ecosystem. The Group reported 2023 global

revenues of €22.5 billion.

Get the future you want | www.capgemini.com

1 As from June 13, 2024, subject to renewal by

the Shareholders’ Meeting of the share buyback authorization

currently in force.

2 The Reference Price corresponds, in accordance with the

provisions of Article L.3332-19 of the French Labor Code, to the

arithmetic average of the volume-weighted average daily trading

prices of Capgemini SE shares on Compartment A of Euronext Paris

over the 20 trading days preceding the setting of the subscription

price.

-

Capgemini_-_2024-09-11_-_Capgemini_launches_its_eleventh_employee_shareholding_plan

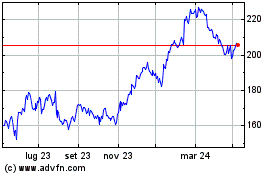

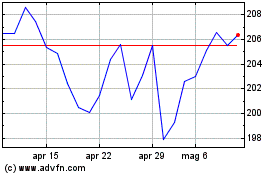

Grafico Azioni Capgemini (EU:CAP)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Capgemini (EU:CAP)

Storico

Da Dic 2023 a Dic 2024