Valeo completes a €600 million debut green bond and welcomes the

European Investment Bank for its important participation.

PRESS RELEASEParis, October 6 ,

2023

Valeo completes a €600 million

debut green bond and welcomes the European Investment Bank for its

important participation.

Valeo today announces the successful completion

of its inaugural green bond, raising 600m worth of bonds. The

European Investment Bank (EIB) has subscribed in the amount of 150m

euros in what is the first green bond issued by Valeo.

A key feature of this operation is the

establishment of a pioneering green and sustainability-linked

financing framework covering both reporting, governance and

verification, which Valeo has put in place to guarantee the funds

are applied solely to activities which satisfy the EU Green and

Sustainability Taxonomy. These include projects related to both

production systems and the introduction of new technology in the

relevant categories including clean transportation, renewable

energy, energy efficiency, sustainable water and waste water

management, and circular economy. Valeo has so far identified a

pipeline of circa 2bn euros of eligible projects. Examples include

smart heat pumps, battery terminal management systems, electric

motors, and compact and quiet front-end cooling modules.

Valeo has committed to achieving carbon

neutrality by 2050 covering its entire value chain – including

suppliers, operating activities and the end use of products sold by

the Group (direct and indirect emissions, i.e., Scopes 1, 2 and 3

emissions). By 2030, Valeo's emissions will have decreased by 45%,

in absolute terms*, compared with 2019. On the journey to carbon

neutrality, 2030 is an important and fast-approaching

milestone.

The bond will enable Valeo to continue to expand

its portfolio of technologies that contribute to low-carbon

mobility, in particular its solutions for vehicle electrification,

a field in which the Group is a world leader.

Valeo joined the new "CAC 40 ESG" index, in

March 2021, which includes 40 companies that have demonstrated best

practices from an environmental, social and governance

perspective.

Valeo is regularly recognized for its

comprehensive sustainable development (environmental, social and

governance) approach.**

The European Investment Bank is a long-term

partner of Valeo’s, having provided a total of 750 million euros in

funding for investments into technologies designed to reduce carbon

emissions and improve active vehicle safety since 2020.

These green bonds fully comply with the Bank's

framework and eligibility criteria for climate action and

environmental sustainability. This green bond financing offer

complements the Bank's existing long-term bank loan offering.

This operation, which is a first for the EIB in

France, should help attract long-term financing on the public debt

markets for green investments.

"We are pleased with the success of this

inaugural green bond. It is an endorsement of the progress we have

made in establishing our Group as a leader in the development of

electric vehicles in particular and sustainable mobility in

general. We are particularly pleased that the EIB, which is playing

a key role in financing the European Union’s climate goals, has

been willing to support this transaction” said Christophe Perillat

Valeo CEO.

Ambroise Fayolle, Vice-President of the EIB,

commented: “I am delighted with this transaction, carried out with

a long-standing partner of the bank, which has made the green

transition the priority of its investments. This first

participation by the EIB as a leading investor in a senior green

bond issue in France demonstrates the strong innovative capacity of

our teams. A pioneer in the issuance of green bonds since 2007, the

European Union’s Climate Bank is proud to contribute to attracting

more private sector financing for the energy transition by

underwriting this green bond issue.”

*taking into account the positive impact of the electrification

benefits of Valeo's solutions in terms of CO2 emissions reduction,

also known as the "Adjusted target”.

**in reference to ESG ratings from extra-financial agencies,

2022 URD page 45

About Valeo

As a technology company and partner to all

automakers and new mobility players, Valeo is innovating to make

mobility cleaner, safer and smarter. Valeo enjoys technological and

industrial leadership in electrification, driving assistance

systems, reinvention of the interior experience and lighting

everywhere. These four areas, vital to the transformation of

mobility, are the Group's growth drivers.

Valeo in figures: 20 billion euros in sales in 2022 | 109,900

employees at December 31, 2022 | 29 countries, 183 plants, 21

research centers, 44 development centers, 18 distribution

platforms.

Valeo is listed on the Paris Stock Exchange.

Media Relations

Dora Khosrof | +33 7 61 52 82 75Caroline De Gezelle | + 33 7 62

44 17 85press-contact.mailbox@valeo.com

Investor Relations

+33 1 40 55 37 93

valeo.corporateaccess.mailbox@valeo.com

About EIB

The European Investment Bank (EIB) is the EU's

long-term financing institution, whose shareholders are the 27

member states. It provides financing for quality investments that

help to achieve Europe's key objectives, such as the European Green

Pact, which aims to make the EU carbon neutral by 2050. As the EU's

climate bank, it aims to encourage the emergence and deployment of

new technologies to meet the challenges of the energy transition to

a new low-carbon growth model. In 2022, EIB investment in France in

renewable energies, clean mobility and energy efficiency amounted

to 5.9 billion euros, representing 70% of its financing.

Media Relations

Christophe Alix | +33 6 11 81 30 99 - c.alix@bei.org

Transaction details

- First EUR benchmark issue in accordance with Valeo’s Green and

Sustainability-Linked Financing Framework

- 5.5 year bond with coupon of 5.875%

- 600m euros raised

Credit Agricole CIB acted as Sole ESG

Structuring Advisor. BNP Paribas and Credit Agricole CIB acted as

Joint Global Coordinators, and with Citi, MUFG, Natixis and Société

Générale as Joint Active Bookrunners.

The Green Bond offering has been issued in

accordance with Valeo’s Green and Sustainability-Linked Financing

Framework dated September 2023. A Second Party Opinion dated 25

September 2023 has been delivered by ISS Corporate Solutions.

The bond, a EUR Benchmark, RegS Bearer, senior

unsecured, offering off the EMTN Programme, is expected to be rated

Baa3 by Moody’s, and BB+ by S&P.

In 2022, 20% of Valeo Sales was eligible under

the EU Taxonomy regulation (in reference to 2022 URD page 275)

which illustrates the attractiveness of Valeo’s products to

contribute to a greener mobility.

- 20231006_PR EIB-Valeo -Green Bond

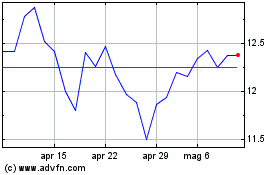

Grafico Azioni Valeo (EU:FR)

Storico

Da Mar 2024 a Apr 2024

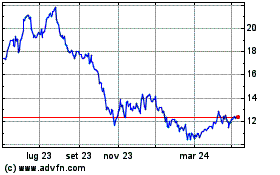

Grafico Azioni Valeo (EU:FR)

Storico

Da Apr 2023 a Apr 2024