Regulatory News:

Gecina (Paris:GFC):

Record level of rental activity in the third

quarter 2023-2024 pipeline fully pre-let

- Gross rental income up +7.3% on a current basis and +6.1%

like-for-like

- Positive reversion on the leases signed in 2023, with +26% for

offices in Paris (+14% overall) and +13% for residential

- 2023-2024 pipeline fully pre-let, with two major projects

recently let in Paris’ Central Business District: “Mondo” (30,000

sq.m) and “35 Capucines” (6,300 sq.m)

- €111m of additional sales covered by preliminary agreements

(+7.7% higher than the end-2022 appraisals)

- Ranked 1st out of all 100 European listed real estate companies

in the GRESB

- 2023 recurrent net income per share target confirmed at €5.9 to

€6.0

Strong rental income growth over the

first nine months of the year

- Growing contribution from indexation (+4.6%)

- Occupancy rate up +130bp for offices and +110bp

overall

- Significant rental uplift captured, particularly at the

heart of Paris (+26% in Paris City and +14% overall for offices)

and +13% for residential

- Pipeline’s net rental contribution of +€16.4m,

reflecting the impact of the deliveries of the l1ve building (Paris

CBD) and 157-CdG (Neuilly) in 2022, Boétie (Paris CBD) in 2023 and

a residential building in Ville d’Avray

Major pre-lettings in Paris’ CBD

projects to be delivered in 2024

- All office space in the “Mondo” building (30,000 sq.m) now

pre-let to a CAC 40 Group

- Finalization of the letting of office space in “35 Capucines”

(6,300 sq.m)

- All building deliveries in 2023-2024 already let or

pre-let

€1.1bn of sales completed or secured

since the start of the year

- €111m of additional disposals under preliminary agreements

since the start of July, with a +7.7% premium above the end-2022

appraisals and a loss of rental income of less than 3%, with two

Parisian buildings occupied and two non-strategic assets currently

vacant in Paris and the Paris Region’s Inner Rim.

- Operations that further strengthen the Group’s balance sheet

and consolidate its long-term outlook in a significantly slower

investment market environment

2023 guidance confirmed

- Recurrent net income (Group share) is expected to reach

€5.9 to €6.0 per share in 2023, up +6% to +8%

With the letting of “Mondo”,

136,000 sq.m let since the start of the year (52,000 sq.m

since end-June 2023)

Since the start of the year, Gecina has let, relet or

renegotiated nearly 136,000 sq.m, representing around €85m of

headline rent of which 52,000 sq.m since the end of June 2023.

These transactions include iconic lettings at the heart of Paris

with prime rents in Paris’ Central Business District at around

€1,000/sq.m/year today. For instance, Gecina let the entire 35

Capucines building and the 24-26 Saint-Dominique

building, adding to the list of buildings recently let in line with

these levels of rent (3 Opéra, 16 Capucines, 44 Champs

Elysées).

In terms of retail, several transactions illustrate the good

commercial trend for central sectors, with several leases signed in

the past few months for premium locations on the Champs

Elysées or Boulevard des Capucines with Luxury and

Fashion retailers.

- Nearly two thirds of these transactions concern relettings

or renewals of leases primarily in Paris City, where

significant rental reversion has been captured (+26% in Paris, +14%

overall).

- The remaining third concern new leases signed for

buildings that were vacant, under development or delivered

recently. Specifically, these rental transactions are reflected in

a significant increase in the pre-letting rate for assets that are

currently being developed.

Since the start of July, Gecina has completed the pre-letting of

two buildings under development and scheduled for delivery in 2024,

with:

- The pre-letting of all the 30,000 sq.m office space in

“Mondo” in Paris’ CBD, under a firm lease for over 11 years

with a group from the CAC 40. “Mondo” is expected to be delivered

during the second half of 2024 and will benefit from the highest

environmental certification standards (HQE Excellent, LEED Gold,

BiodiverCity, BBCA), as well as the WELL and WiredScore labels with

a Gold rating.

- The “35 Capucines” building in Paris-CBD (6,300 sq.m),

which is scheduled for delivery during the first half of 2024, let

to a French luxury group and a law firm. All of the office space is

now fully pre-let.

To date, 100% of the office pipeline delivered in 2023 or

scheduled for delivery in 2024 is now pre-let, with rent levels

that are higher than initially expected.

The office pipeline’s main rental challenges now concern

operations that will be delivered in 2025 in Paris City

(Icône-Marbeuf and 27 Canal-Flandre).

Gross rental income up +7.3% (vs. +2% in 2022)

Strong organic trend and contribution from the pipeline

Gross rental income

Sep 30, 2022

Sep 30, 2023

Change (%)

In million euros

Current basis

Like-for-like

Offices

368.5

398.3

+8.1%

+6.5%

Traditional residential

80.1

82.7

+3.2%

+4.3%

Student residences (Campus)

14.7

15.8

+7.8%

+7.1%

Total gross rental income

463.2

496.9

+7.3%

+6.1%

On a current basis, rental income is up +7.3% (+8.1% for

offices), reflecting an acceleration compared with 2022 (+2%),

benefiting from not only the robust like-for-like rental

performance, but also the pipeline’s strong net rental

contribution, with two major deliveries of office buildings in 2022

in Paris (l1ve) and Neuilly (157 CdG), as well as the “Boétie”

building in Paris’ Central Business District and the “Ville

d’Avray” residential building in 2023.

Like-for-like, the acceleration in performance exceeded

the levels reported at end-2022, with rental income growth up +6.1%

overall (vs. +4.4% at end-2022) and +6.5% for offices (vs. +4.6% at

end-2022).

This trend follows on from the previous quarters. All of the

components contributing to like-for-like rental income growth are

trending up.

- The gradual impacts of the acceleration in indexation

contributed +4.6%

- The increase in the occupancy rate represents a

contribution of +0.7%. With the occupancy rate gradually improving

in 2022, and particularly during the second half of the year, the

base effect is naturally easing over the second part of the

year.

- Rental reversion was captured for both offices and

residential, contributing +0.8% to organic rental income

growth.

With these positive trends, like-for-like office rental income

growth of around +6% can be expected for the full year in 2023.

Guidance confirmed: 2023 recurrent net income growth of

+6% to +8% expected (between €5.90 and €6.00)

The results published at end-September 2023 reflect the very

good level of the rental markets in Gecina's preferred sectors.

This robust operational performance is being further strengthened

by the trend for indexation and the pipeline’s positive

contribution to the Group’s rental income growth.

Alongside this, Gecina’s long debt maturity and active rate

hedging policy will enable it to limit the impact of interest rate

rises on the Group’s financial expenses in 2023.

As a result, Gecina is confirming its growth forecast for 2023,

with recurrent net income (Group share) expected to reach €5.90

to €6.00 per share, delivering +6% to +8% growth.

About Gecina

As a specialist for centrality and uses, Gecina operates

innovative and sustainable living spaces. The Group owns, manages

and develops Europe’s leading office portfolio, with nearly 97%

located in the Paris Region, and a portfolio of residential assets

and student residences, with over 9,000 apartments. These

portfolios are valued at 18.5 billion euros at end-June 2023.

Gecina has firmly established its focus on innovation and its

human approach at the heart of its strategy to create value and

deliver on its purpose: “Empowering shared human experiences at

the heart of our sustainable spaces”. For our 100,000 clients,

this ambition is supported by our client-centric brand YouFirst. It

is also positioned at the heart of UtilesEnsemble, our program

setting out our solidarity-based commitments to the environment, to

people and to the quality of life in cities.

Gecina is a French real estate investment trust (SIIC) listed on

Euronext Paris, and is part of the SBF 120, CAC Next 20, CAC Large

60 and CAC 40 ESG indices. Gecina is also recognized as one of the

top-performing companies in its industry by leading sustainability

benchmarks and rankings (GRESB, Sustainalytics, MSCI, ISS-ESG and

CDP).

www.gecina.fr

Appendices

Offices: rental trends still positive

Gross rental income - Offices

Sep 30, 2022

Sep 30, 2023

Change (%)

In million euros

Current basis

Like-for-like

Offices

368.4

398.3

+8.1%

+6.5%

Central areas (Paris, Neuilly,

Southern Loop)

268.5

289.0

+7.6%

+4.7%

Paris City

214.5

228.4

+6.5%

+4.9%

- Paris CBD & 5-6-7

132.1

145.4

+10.0%

+5.9%

- Paris CBD & 5-6-7 - Offices

107.0

122.4

+14.3%

+6.0%

- Paris CBD & 5-6-7 - Retail

25.1

23.0

-8.3%

+5.2%

- Paris - Other

82.4

83.0

+0.7%

+3.5%

Core Western Crescent

54.0

60.6

+12.2%

+3.8%

- Neuilly-Levallois

20.7

25.5

+23.0%

+3.0%

- Southern Loop

33.3

35.0

+5.4%

+4.2%

La Défense

47.6

53.6

+12.7%

+12.7%

Other locations (Péri-Défense,

Inner / Outer Rims and Other regions)

52.4

55.7

+6.5%

+8.7%

Like-for-like office rental income

growth came to +6.5% year-on-year (vs. +4.6% at

end-2022), benefiting from a positive indexation effect, which

is continuing to ramp up (+5.1%), passing on the return of an

inflationary context, as well as the impact of the positive

reversion captured in the last few years (+0.5%) and the

improvement in our portfolio’s occupancy rate, primarily achieved

in 2022 and confirmed since then (+0.8%).)

- In the most central sectors

(85% of Gecina’s office portfolio), like-for-like rental income

growth continues to show a robust trend. In Paris’ Central Business

District it came to +6%. Including Neuilly-Levallois and

Boulogne-Issy, it represents +4.7%, linked mainly to the combined

impact of the indexation of rents and the positive reversion

captured at the end of leases.

- On the La Défense market (8%

of the Group’s office portfolio), Gecina’s rental income is up

by nearly +13% like-for-like.

- More than half of this performance is linked to a significant

increase in the occupancy rate for the

Group’s buildings, resulting from the major rental transactions

secured in 2021 and 2022 on buildings that were previously vacant

(Carré Michelet, Adamas) and that gradually ramped up the Group’s

rental income in this sector during 2022.

- The rest is linked mainly to indexation. Reversion

had only a marginally positive impact on this sector, since

Gecina’s portfolio in this area is fully let and therefore not

subject to tenant rotations.

Rental income growth on a current

basis came to nearly +8% for offices, reflecting

the impact of the pipeline’s positive net contribution,

which has been particularly significant this year (+€16.4m net of

tenant departures from buildings to be redeveloped), taking into

account the delivery of the l1ve and Boétie buildings in Paris’ CBD

and 157 CdG in Neuilly.

These deliveries have largely offset the buildings that were

vacated mid-2022 and are currently being redeveloped, with their

delivery scheduled for 2025 (Icône-Marbeuf and Flandre-27 Canal in

Paris).

Residential: reversion potential confirmed and excellent

level of operational activity

Gross rental income

Sep 30, 2022

Sep 30, 2023

Change (%)

In million euros

Current basis

Like-for-like

Residential

94.8

98.5

+3.9%

+4.8%

Traditional residential

80.1

82.7

+3.2%

+4.3%

Student residences (Campus)

14.7

15.8

+7.8%

+7.1%

YouFirst Residence (traditional

residential): acceleration in operational performance

levels

Like-for-like, rental income for traditional residential

properties is up +4.3%, marking an acceleration compared

with 2022 (+2.0%), under the impact of indexation that is

taking shape (+2.7%) and rental reversion that is ramping up

(+1.6%). Rents for new arrivals are around +13% higher than

levels for the previous tenants on average since the start of the

year. This performance has been achieved thanks to Gecina’s ability

to continuously adapt its rental offering to the needs of its

clients.

On a current basis, rental income is up +3.2%, slightly

lower than the like-for-like performance due to the sales completed

this year (particularly in Courbevoie).

YouFirst Campus (student

residences): strong upturn in business

Rental income from student residences shows a significant

like-for-like increase of +7.1%, linked primarily to the high level

of positive reversion captured thanks to the quick rotation of

tenants with this type of product.

Occupancy rate: progress since the start of 2022

Average financial occupancy rate (YTD)

Sep 30, 2022

2022

H1 2023

Sep 30, 2023

Offices

92.3%

92.8%

93.8%

93.6%

Traditional residential

96.5%

96.7%

96.3%

95.9%

Student residences

82.7%

86.0%

86.8%

84.2%

Group total

92.5%

93.1%

93.9%

93.6%

The average financial occupancy rate is up +110bp

year-on-year to 93.6%, primarily reflecting the +130bp increase

for offices. This improvement in the office portfolio concerns all

sectors, and particularly La Défense, where it reached 98%,

benefiting from the arrival of the final tenants in the Carré

Michelet building midway through the second half of 2022.

Alongside this, the spot occupancy rate for student residences

was 97% at end-September (up +2.5pts vs. end of September 2022)

Disposals: €111m of additional sales under preliminary

agreements

After completing nearly €1bn of sales during the first half of

this year, Gecina secured €111m of additional sales, currently

covered by preliminary agreements, achieving an average premium

versus the end-2022 appraisals of around +7.7%, with an average

rate for the loss of rental income of less than 3% for the occupied

buildings.

These latest sales concern two Parisian buildings occupied and

two non-strategic assets currently vacant in Paris and the Paris

Region’s Inner Rim.

Since the start of the year, Gecina has therefore sold or

secured sales for €1.1bn of buildings, achieving an average

premium of around +9.4% versus the end-2022 appraisal

values, with a loss of rental income of around

+2.5%.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231018593705/en/

GECINA CONTACTS Financial communications Samuel

Henry-Diesbach Tel: +33 (0)1 40 40 52 22

samuelhenry-diesbach@gecina.fr

Sofiane El Amri Tel: +33 (0)1 40 40 52 74

sofianeelamri@gecina.fr

Press relations Glenn Domingues Tel: +33 (0)1 40 40 63 86

glenndomingues@gecina.fr

Armelle Miclo Tel: +33 (0)1 40 40 51 98

armellemiclo@gecina.fr

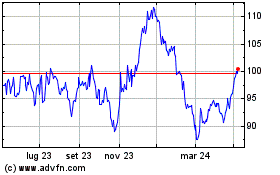

Grafico Azioni Gecina Nom (EU:GFC)

Storico

Da Mar 2024 a Apr 2024

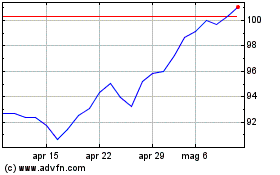

Grafico Azioni Gecina Nom (EU:GFC)

Storico

Da Apr 2023 a Apr 2024