HighCo : Q4 2023 GROSS PROFIT

Aix-en-Provence, 24 January 2024

(6 p.m.)

HIGHCO: BUSINESS DECLINE IN 2023 (GP: Q4

DOWN 10.4% LFL; 12-MONTH DOWN 2.7% LFL); FURTHER GROWTH IN

OPERATING MARGIN FORECAST AT 22.1%; UNCERTAIN CONTEXT IN 2024 WITH

THE CLIENT CASINO

Business slowdown in Q4 2023 as anticipated

- Q4 2023 gross

profit1 of €17.82 m, down 10.4% LFL2.

- FY 2023 gross

profit1 of €74.35 m, down 2.7% LFL2.

- Digital businesses

holding up well (Q4 down 1.3% LFL; 12-month up 1.2% LFL) and sharp

decline in offline businesses (Q4 down 29.3% LFL; 12-month down

10.6% LFL).

- Drop in business

in France (Q4 down 11.6% LFL; 12-month down 3% LFL) and less

significant decline in International business (Q4 down 0.4% LFL;

12-month down 0.6% LFL), with Belgium holding up well.

- Discontinuation of

High Connexion activities in Italy (Mobile).

Growth in 2023 financial

performance

- Operating margin

(headline PBIT/gross profit)3 forecast at 22.1%.

- Adjusted earnings

per share4 forecast with double-digit growth.

Casino: uncertain context in

2024

Stock markets: HighCo remains eligible

for France’s SME equity savings plans (“PEA-PME”)

|

Gross Profit (€ m)1 |

2023 |

2022 LFL2 |

2023/2022LFL2

change |

|

Q1 |

18.77 |

18.63 |

+0.7% |

|

Q2 |

19.15 |

19.28 |

-0.7% |

|

Q3 |

18.62 |

18.62 |

0% |

|

Q4 |

17.82 |

19.88 |

-10.4% |

|

12-month total |

74.35 |

76.41 |

-2.7% |

1 Data currently being audited.2 Like for like:

Based on a comparable scope and at constant exchange rates (i.e.

applying the average exchange rate over the period to data from the

compared period).Furthermore, in application of IFRS 5 –

Non-current Assets Held for Sale and Discontinued Operations, the

activities of High Connexion Italy were reported as discontinued

operations as of the fourth quarter of 2023. For reasons of

consistency, the data reported for 2022 and for the first nine

months of 2023 has been restated to account for the impact of High

Connexion Italy. As a result, like-for-like data is equal to

restated data in 2022.3 Headline PBIT: Profit before interest, tax

and restructuring costs. Operating margin: Headline PBIT/Gross

profit.4 Adjusted earnings per share (EPS): Earnings per share

excluding other operating income and expenses and excluding net

after-tax income from assets held for sale and discontinued

operations based on an average number of shares.

Didier Chabassieu, Chairman of the Management

Board, stated, “In 2023, the consumer goods market was impacted by

several factors, such as inflation on food products, tension

between retailers and brands, and operations under way in the food

retail sector. Given this context, the Group’s gross profit fell by

2.7% over the year. However, sound cost control enabled us to

maintain high profitability and achieve a further rise in earnings

in 2023.

2024 is expected to be even more challenging due

to the uncertainty surrounding Casino group, which is likely to

have a significant negative impact on performance over the

financial year. Through the strength of its teams, HighCo will

nevertheless be able to build on its strongest and most successful

activities, and on its solid financial position to pursue its

development.”

BUSINESS SLOWDOWN IN Q4 2023 AS

ANTICIPATED

As announced last October, HighCo

recorded a slowdown in its business in Q4 2023 with gross

profit of €17.82 m (down 10.4% LFL). This decrease in

Q4 is primarily due to the sharp decline in marketing and

communication consulting businesses and in multi-retailer ad

selling.

In these conditions, the Group’s

businesses were down 2.7% in 2023 to €74.35 m,

with:

- Growth in the volumes of

coupons cleared (up 4%) thanks to the strong

growth of this business in France at the end of the year;

- A slight slowdown in

Mobile businesses (down 1.5% like for like);

- Businesses holding up well in

Belgium (down 0.9% like for like);

- Sharp decline in marketing and

communication consulting businesses and in multi-retailer ad

selling.

Digital showed 1.2%

growth for the full year 2023. Its share in total Group

gross profit continued to grow, rising from 67% in 2022 (reported)

to 69.3% in 2023. Meanwhile, offline businesses fell 10.6%

over the financial year.

The Group’s revenue for FY 2023 came to

€145.4 m.

Business decline in France

|

FRANCE |

Gross Profit (€ m) |

2023/2022 LFL change |

% Total gross profit |

|

2023 |

2022 LFL |

|

Q1 |

16.30 |

16.09 |

+1.4% |

86.9% |

|

Q2 |

16.87 |

17.00 |

-0.7% |

88.1% |

|

Q3 |

16.37 |

16.41 |

-0.3% |

87.9% |

|

Q4 |

15.72 |

17.77 |

-11.6% |

88.2% |

|

12-month total |

65.26 |

67.27 |

-3.0% |

87.8% |

In France, Q4 2023 gross profit

fell sharply by 11.6% to €15.72 m. This decrease is

mainly due to the sharp decline in marketing and communication

consulting businesses and in multi-retailer ad selling, which was

partly offset by the strong performance of coupon

clearing at the end of the year.Digital businesses were down

slightly by 0.9% in Q4 2023. Offline businesses posted a sharp

decline over the quarter (down 34.4%).

Business fell by 3% for the full year

2023, with France accounting for 87.8% of the Group’s

gross profit. Digital businesses were on a positive trend,

rising 1.8% over the financial year, and their share

increased significantly to 70.8% of gross profit. Accounting for

one-quarter of business activities in France,

Mobile has tapered slightly since the beginning of

the year (down 1.5%) against a challenging 2022 comparative base

(double-digit growth in 2022). Offline businesses showed a 13%

decline over the year.

Less significant decline in International business, with

Belgium holding up well

|

INTERNATIONAL |

Gross Profit (€ m) |

2023/2022 LFL change |

% Total gross profit |

|

2023 |

2022 LFL |

|

Q1 |

2.46 |

2.54 |

-3.1% |

13.1% |

|

Q2 |

2.28 |

2.28 |

-0.3% |

11.9% |

|

Q3 |

2.25 |

2.21 |

+1.9% |

12.1% |

|

Q4 |

2.10 |

2.11 |

-0.4% |

11.8% |

|

12-month total |

9.09 |

9.14 |

-0.6% |

12.2% |

International gross profit in

Q4 2023 remained virtually stable (down 0.4%) at

€2.1 m.In Belgium, gross

profit was stable (down 0.1%) and consolidated its

positive pathway in Q3 (up 1.7%) after several quarters of decline,

confirming the upward trend of the traditional promotion management

business.

For the full year 2023, International

business fell slightly by 0.6% to €9.09 m, accounting

for 12.2% of the Group’s gross profit. Down 3.6% like for like, the

share of Digital in International businesses represented 58.7% of

gross profit.Business in Spain was positive (up

2.8% like for like) and now accounts for 1.2% of the Group’s gross

profit, following the discontinuation of operations in Italy (see

below).

Discontinuation of High Connexion

activities in Italy (Mobile)

After losing the main Mobile client in Italy,

HighCo decided to discontinue its operations in the country and

redeploy its international SMS push notifications activities

directly from France, where HighCo intends to consolidate its

position as leader in SMS solutions (nearly 1.4 bn SMS sent in

2023).As these operations in Italy were discontinued, its

subsidiary, which generated €0.57 m in gross profit in 2022

and employed two people, was deconsolidated (IFRS 5 – Discontinued

Operations).

GROWTH IN 2023 FINANCIAL

PERFORMANCE

Based on the year-end closing in progress, very sound cost

control resulted in a further increase in headline

PBIT (reported 2022 headline PBIT: €16.22 m).

Consequently, the Group forecasts an operating margin of

22.1%, up by more than 100 basis points (reported

2022 operating margin: 21%).

Adjusted earnings per share is

expected to show double-digit growth (reported

adjusted 2022 EPS: €0.45).

2023 annual earnings will be released on

27 March after market close. A conference call is

scheduled for Thursday, 28 March at 10.00 a.m.

CASINO: UNCERTAIN CONTEXT IN 2024

As announced last July, HighCo is carefully

watching to see how the situation will play out with its

long-standing client Casino.

To date, the Group does not have any information

on Casino other than news available from the press: reshuffled

share ownership structure, restructured debt, and sales of Casino

supermarkets and hypermarkets.

Despite the existing contracts between HighCo

and Casino, the announced sales of all the food retailer’s

supermarkets and hypermarkets could have a significant negative

impact on the Group’s business in 2024. However, this impact cannot

be measured at this stage.

Under these circumstances, performance in recent

years cannot be extrapolated to 2024. The uncertainty associated

with Casino group’s current situation therefore calls for caution.

HighCo is nevertheless maintaining its focus on its innovation

strategy and continues to develop growth drivers. The Group can

also build on its strongest and most successful activities (in

particular promotion issuing and clearing, Mobile) and on its solid

financial position.

STOCK MARKETS: HIGHCO REMAINS ELIGIBLE FOR FRANCE’S SME

EQUITY SAVINGS PLANS

In line with regulations (France’s Action Plan

for Business Growth and Transformation, or PACTE, of 22 May

2019), HighCo remains eligible for France’s government

initiative supporting SME equity savings plans

(“PEA-PME”). Eligibility means that HighCo shares can be

included in these individual equity savings plans (“PEA-PME”).

About HighCo

As an expert marketing and

communication, HighCo supports brands and retailers in accelerating

the transformation of retail.Listed in compartment

C of Euronext Paris, and eligible for SME equity savings plans

(“PEA-PME”), HighCo has nearly

500 employees.HighCo has achieved a Gold

rating from EcoVadis, meaning that the Group is ranked in the top

5% of companies in terms of CSR performance and responsible

purchasing.

Your contacts

Cécile

Collina-Hue Nicolas

CassarManaging

Director Press

Relations+33 1 77 75 65

06 +33

4 88 71 35

46comfi@highco.com n.cassar@highco.com

Upcoming events

Publications take place after market

close.

2023 Annual Earnings: Wednesday, 27 March

2024Conference call on 2023 annual earnings: Thursday, 28 March

2024 at 10 a.m.Q1 2024 Gross Profit: Wednesday, 24 April

2024Q2 and H1 2024 Gross Profit: Thursday, 18 July 20242024

Half-year Earnings: Wednesday, 11 September 2024Conference call on

2024 half-year earnings: Thursday, 12 September 2024 at

10 a.m.Q3 and 9-month YTD 2024 Gross Profit: Wednesday, 16

October 2024Q4 and FY 2024 Gross Profit: Wednesday, 22 January

2025

HighCo is a component stock of the indices CAC®

Small (CACS), CAC® Mid&Small (CACMS), CAC® All-Tradable (CACT),

Euronext® Tech Croissance (FRTPR) and Enternext® PEA-PME 150

(ENPME).ISIN: FR0000054231 Reuters: HIGH.PA Bloomberg: HCO FP For

further financial information and press releases, go to

www.highco.com.

This English

translation is for the convenience of English-speaking readers.

Consequently, the translation may not be relied upon to sustain any

legal claim, nor should it be used as the basis of any legal

opinion. HighCo expressly disclaims all liability for any

inaccuracy herein.

- HighCo CP T4 2023_FR_VDEF_EN

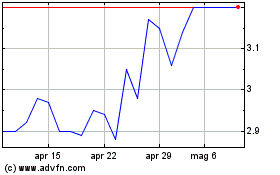

Grafico Azioni High (EU:HCO)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni High (EU:HCO)

Storico

Da Nov 2023 a Nov 2024