Royal KPN Rejects Takeover Offers From KKR, EQT-Stonepeak -- Update

03 Maggio 2021 - 11:27AM

Dow Jones News

By Kim Richters and Mauro Orru

--Royal KPN rejected unsolicited takeover proposals from KKR and

EQT AB with Stonepeak Infrastructure Partners

--The company said the two offers didn't provide added value to

its strategy

--Shares opened lower in early morning trading

By Kim Richters and Mauro Orru

Royal KPN NV said Sunday that it has rejected an unsolicited

takeover offer from investment firm KKR & Co as well as a

separate one by private-equity firms EQT AB and Stonepeak

Infrastructure Partners.

The Dutch telecommunications company said its board of

management and supervisory board came to the decision after

reviewing the two approaches, adding that there haven't been

negotiations with the suitors.

"The boards concluded to reject both unsolicited approaches as

they did not provide tangible and material added value to KPN's

widely supported new strategy," the company said.

Royal KPN unveiled its new strategy in November to leverage and

expand its network, bolster its customer footprint and streamline

its operating model.

The strategy includes the acceleration of fiber rollout across

the Netherlands, a progressive dividend policy and regular dividend

per share growth between 3% and 5% per year as well as a cost

savings effort of at least 250 million euros ($300.5 million) from

2021 until 2023.

EQT declined to comment when approached by The Wall Street

Journal on Monday, while Stonepeak and KKR didn't immediately

respond to requests for comment.

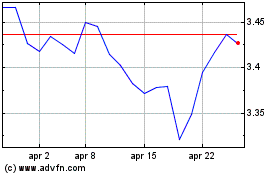

Royal KPN shares opened lower in Amsterdam on Monday, trading

3.8% down at EUR2.76 at 0847 GMT.

Write to Kim Richters at kim.richters@wsj.com and Mauro Orru at

mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

May 03, 2021 05:12 ET (09:12 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

Grafico Azioni Koninklijke KPN NV (EU:KPN)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Koninklijke KPN NV (EU:KPN)

Storico

Da Feb 2024 a Feb 2025