LACROIX : A strong first quarter with revenue up 17.9%, driven by the Electronics activity. Confirmation of activity and profitability targets for 2023.

09 Maggio 2023 - 5:57PM

LACROIX : A strong first quarter with revenue up 17.9%, driven by

the Electronics activity. Confirmation of activity and

profitability targets for 2023.

09/05/2023

A strong first

quarterwith revenue up

17.9%,

driven by the Electronics

activity

Confirmation of activity

and profitability targets for 2023

|

Revenue in millions of euros |

Q1 2023 |

Q1 2022 |

Change |

|

Electronics activity |

152.5 |

122.1 |

+ 24.9 % |

| City

activity |

23.3 |

23.4 |

- 0.5 % |

|

Environment activity |

18.9 |

19.6 |

- 3.4 % |

|

Total |

194.8 |

165.1 |

+ 17.9

% |

“LACROIX has made a remarkable start to the

year, fuelled by a strong commercial dynamic in the Electronics

activity, benefiting in part from a favourable basis for comparison

with the first quarter of 2022. This very good performance, in line

with our expectations, confirms LACROIX's confidence in meeting the

objectives set for the current financial year, with the aim of

achieving revenue on a like-for-like basis of more than €750

million, together with an EBITDA of more than €50 million",

comments Vincent Bedouin, Chairman and CEO of LACROIX.

A very dynamic organic

growth at the begining of the year

In the first quarter of the year, LACROIX posted

solid growth in its revenue. Over the period, sales amounted to

€194.8 million, up 17.9% compared to the first quarter of 2022. As

Firstronic has been consolidated since January 1, 2022, this

performance was achieved entirely at constant scope.

It also includes a positive currency effect of

+€0,5 million, due to the appreciation of the dollar, partially

offset by PLN depreciation.

At constant scope and exchange rates(1), the

LACROIX revenue increased by 17.6% in the first quarter.

(1) At constant scope of

consolidation and exchange rates : the currency effect is

calculated by applying the exchange rates of the previous period to

current period revenues. The effect of changes in the scope of

consolidation is calculated by (i) eliminating the revenues for the

current period and/or the comparable period of companies acquired

during the period or the comparable period (ii) eliminating the

revenues for the current period and/or the comparable period of

companies sold during the period or the comparable period.

Electronics

activity

Over the period, the Electronics activity

recorded a revenue of €152.5 million, up 24.9% compared to the

first quarter of 2022 (+24.5% at constant exchange rates). This

very strong momentum was driven by the EMEA perimeter (+32.7%),

with growth over the period being less sustained in North America

(ex-Firstronic), at +7.8% (+3.1% at constant exchange rates).

Overall, the Electronics activity benefited from

a favorable base effect compared to the start of 2022, which was

affected by difficulties in the supply of components and was also

marked by the gradual move of the teams to the Symbiose plant. All

segments of the Electronics activity grew in the first quarter;

momentum was particularly strong in the Industry and Automotive

sectors, while the recovery in the Avionics segment continued at a

sustained pace.

This positive trend also benefited from

re-invoicing of additional supply costs to customers in the amount

of €3.8 million over the period, slightly down over a one-year

period (€4.3 million recorded in Q1 2022).

City

activity

City activity recorded stable revenue (-0.5%) in

the first quarter of 2023, at €23.3 million. This change is the

result of a continuing contrasted performance between the three

markets addressed: business was stable in the road signs segment,

down in the Traffic segment due to projects delay, and very strong

in Smart Lighting, whose growth (+26% in the first quarter) is not

weakening after its remarkable performance in 2022 (+27.1%).

Environment

activity

This activity generated a revenue of €18.9

million in the first quarter of 2023, compared with €19.6 million a

year earlier, a decline of -3.4% reflecting a particularly

demanding base effect - the first quarter of 2022 having seen

strong growth (+14.0%). The Smart Grids segment showed a slight

increase. The Water segment, stable in France, was down in

international markets.

Apart from the base effect, it should be noted

that the trend over a quarter is not very significant, particularly

in international markets, as it is strongly impacted by the

inclusion or not of projects over the period.

For the Environment activity as a whole, the

order book is up and the market dynamics remain very favorable,

driven by long-term trends.

Targets are confirmed

With this very positive start to the year,

LACROIX is maintaining its annual targets. The group anticipates a

revenue of over €750 million on a like-for-like basis, i.e. growth

of at least 6%, accompanied by a further increase in its current

EBITDA to over €50 million.

Upcoming reportsRevenue for the

second quarter and first half of 2023: 28 august 2023 after market

closes

Visit our investor relations

page to find financial

informationhttps://www.lacroix-group.com/investors

About

LACROIX

Convinced that technology should contribute to

making our living environments simpler, more sustainable and safer,

LACROIX supports its customers in the construction and management

of intelligent living ecosystems, thanks to connected equipment and

technologies. As a publicly listed family-owned mid-cap,

with a turnover of €708 million in 2022, LACROIX combines the

essential agility required to innovate in an ever-changing

technological sector with the ability to industrialize robust and

secure equipment, cutting-edge know-how in industrial IoT solutions

and electronic equipment for critical applications and the

long-term vision to invest and build for the

future. LACROIX designs and manufactures its customers’

electronic equipment, in particular in the automotive, home

automation, aerospace, industrial and health sectors. LACROIX also

provides safe, connected equipment for the management of critical

infrastructures such as smart roads (street lighting, traffic

signs, traffic management, V2X) and the management and operation of

water and energy systems. Drawing on its extensive

experience and expertise, the Group works with its customers and

partners to build the connection between the world of today and the

world of tomorrow. It helps them to create the industry of the

future and to make the most of the opportunities for innovation

that surround them, supplying them with the equipment for a smarter

world.

|

Contacts

LACROIX COO & Executive

VP FinanceNicolas Bedouin investors@lacroix.group

Tél. : +33 (0)2 72 25 68 80 |

ACTIFIN

Press relationsJennifer Jullia jjullia@actifin.fr

Tél. : +33 (0)1 56 88 11 19 |

ACTIFIN

Financial communicationMarianne Pympy@actifin.fr

Tél. : +33 (0)6 88 78 59 99 |

- CP LACROIX CP CA T1 VDEF_EN

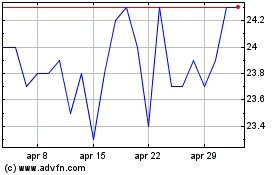

Grafico Azioni Lacroix (EU:LACR)

Storico

Da Mar 2024 a Apr 2024

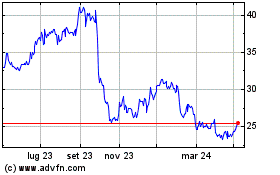

Grafico Azioni Lacroix (EU:LACR)

Storico

Da Apr 2023 a Apr 2024