Lumibird: H1 2024 revenues

Lannion, July 22, 2024– 5:45 pm

H1 2024 REVENUES

- Slight increase to €98m

(+1%) with a base effect (H1 2023 growth of +16% vs H1

2022)

- 3-year target maintained for

revenue growth (CAGR +8%) and profitability improvement of +500

basis points

-

EBITDA1/revenues

margin expected to improve in FY 2024

The Lumibird Group (FR0000038242 -

LBIRD), the European leader in laser technologies, recorded 1%

growth in consolidated revenues in H1 2024, to €98.0m. The growth

rate for H1 2024 vs H1 2023 is impacted by the base effect linked

to the strong growth in H1 2023 vs H1 2022 (+16%). Business in H1

2024 was impacted by an occasional delay in orders in Asia

(distributors and end customers). The first six months of 2024 were

very buoyant, with numerous development opportunities. The Group is

maintaining its revenue growth target for 2024 and anticipates an

improvement in profitability compared with the 17% EBITDA margin

achieved in 2023, despite the impact of of H1 2024 revenue on

profitability for the period.

Consolidated revenues

(unaudited)

|

Revenues (€m) |

2024 |

2023 |

Reported change |

Change at constant scope and exch rates

|

|

1st quarter |

43.9 |

40.9 |

+7% |

+5% |

|

2nd quarter |

54.1 |

56.3 |

+1% |

-2% |

|

1st

half |

98.0 |

97.2 |

+1% |

-2% |

|

of which |

|

|

|

|

|

Photonics |

47.2 |

45.9 |

+3% |

-4% |

|

Medical |

50.8 |

51.3 |

-1% |

0% |

At 30 June 2024, Lumibird's consolidated

revenues came to 98.0 million euros, up 1% on a reported basis, up

2% at constant exchange rates and down 2% on a like-for-like basis

(restated for Convergent revenues included in the scope of

consolidation at 31.08.23). This compares with a particularly

dynamic first half of 2023, which saw revenues rise by 16% on a

reported basis and by 17% on a like-for-like basis.

By market segment

The Photonics division grew by

3% thanks to the integration of Lumibird Italy (Convergent). On a

like-for-like basis, revenues were down 4%. The base effect is all

the more significant given that growth in H1 2023 vs H1 2022 was

+19%.

The first business segment,

Defense/Space, with revenues of €20.6m, is up

+23.2% on H1 2023, supported by strong demand and multi-year

contracts.

The Industrial and Scientific

segment, which has been restated for the MedTech business, posted

H1 revenues of €12.0m, Down 9%, against a backdrop of reduced

demand across customer distribution channels.

MedTech activities, which were

formerly included in the Industrial and Scientific segment, are

gaining in importance, thanks in particular to the integration of

Lumibird Italy's activities. MedTech revenues came to €7.5 million

in H1, including €3.8 million contributed by Lumibird Italy,

compared with €1.8 million in H1 2023. Innovation is driving

growth, due to the increasingly widespread use of laser technology

in numerous medtech applications (diagnostics, treatments,

measurement and activation of pharmaceutical molecules and

biological analyses)..

The Environment, Topography,

Safety segment (formerly Lidar) recorded sales of €7.0m,

compared with €14.1m in H1 2023. The base effect is all the more

significant given that growth in H1 2023 vs H1 2022 was +29%.

Applications sales fell, mainly in Safety applications, with the

gradual postponement of applications for autonomous vehicles as

carmakers transferred to electric cars their investments in the

development of their ranges. Topography applications are seeing

demand for a new generation of products - higher performance and

lower cost - for which Lumibird is very well positioned with its

breakthrough fibre laser technologies. Deliveries of lasers for

environmental applications (wind turbines and 3D scanning) remain

solid, but are experiencing a decline over time as customers reduce

stocks. The implementation of a new sales organisation for

environmental Lidar systems, to accelerate development in

high-potential niche segments such as firefighting, and the

imminent arrival of new-generation systems, had an impact on sales

in H1 2024. The ramp-up of this new organization will enable to

accelerate the development of systems business from the second half

of 2024.

The Medical Division, which

focuses on the ophthalmology market, recorded revenues of €50.8

million in the first half, down slightly (-1%) on the previous

year, and up 0.4% at constant exchange rates, with adverse currency

effects in US dollars, yen and Swedish krona. The first half was

marked by a slower-than-expected recovery in Asian markets, mainly

China and Korea. The regulatory and administrative obstacles

identified at the end of 2023 are gradually being overcome, for

example with the CE mark for C-SUITE (dry eye) being obtained in

May 2024.

The breakdown of H1 sales is 21% (24% in 2023)

for diagnostic equipment and 79% (76% in 2023) for laser treatment

products.

By geography

The breakdown of H1 revenues by division and by

geographical area is as follows:

|

H1 revenues (€m) |

Photonics |

Change

/ 2023 |

Medical |

Change/ 2023 |

|

EMEA |

27.9 |

+19% |

17.4 |

+2% |

|

Americas |

6.7 |

-19% |

14.1 |

+3% |

|

APAC |

7.6 |

-32% |

13.8 |

-10% |

|

Rest of the world |

5.0 |

+77% |

5.6 |

+11% |

|

Total |

47.2 |

+3% |

50.8 |

-1% |

Unaudited data

The Photonics divisions strong growth in Europe

was driven by its activity in Defense and Space and MedTech markets

whilst the decline in the Americas and APAC was primarily driven by

Environment, Topography and Safety market applications and

systems.

The Medical division saw growth in Europe and

Americas led by laser treatment products. Asia Pacific, however

continued to be impacted by administrative blockages in China and a

reduction of stock in distributor channels impacting the diagnostic

equipment market to a greater extent.

Outlook

The Group has a solid order book, which should

be further strengthened by the signing of new multi-year contracts,

particularly in the defense sector.

Lumibird published its 2024-2026 plan in May

2024, confirming the following objectives for the period to

2026:

- an average

annual growth rate (CAGR) in sales greater than 8%. This growth

will be achieved through continued innovation, new product releases

and a commitment to deliver multi-year contracts on-time in dynamic

markets.

- an EBITDA margin

that is at least 500 basis points higher than in 2023. This EBITDA

margin improvement will be achieved by leveraging the Group's

verticalisation strategy, increasing productivity and optimising

the organisational structure thanks to recent investments.

- The Group

expects its profitability to improve in 2024 from the 17%

EBITDA/Sales margin achieved in 2023, although the EBITDA margin

expected in the first half of 2024 will be impacted by the level of

Sales for the period.

Next date:

H1 2024 results,

24/09/2024 after close of trading

LUMIBIRD is one of the world's leading laser

specialists. With 50 years' experience and expertise in

solid-state, diode and fibre laser technologies, the Group designs,

manufactures and distributes high-performance laser solutions via

two divisions: Photonics and Medical. The Photonics Division

designs and produces components, lasers and systems for the defense

and space, environment, topography and safety, industrial and

scientific, and medtech markets. The Medical branch designs and

produces medical diagnostic and treatment systems for

ophthalmology.

The result of the merger in October 2017 between the Keopsys and

Quantel Groups, LUMIBIRD, with more than 1,000 employees and over

€203.6m in sales in 2023 is present in Europe, America and

Asia.

LUMIBIRD shares are listed in compartment B of Euronext

Paris. FR0000038242 -

LBIRD www.lumibird.com

LUMIBIRD has been a member of Euronext

Tech Leaders since

2022.

Contacts

LUMIBIRD

Marc Le Flohic

Chairman and Chief Executive Officer

Tel. +33(0) 1 69 29 17 00

info@lumibird.com |

LUMIBIRD

Sonia Rutnam

Chief Financial and Transformation Officer

Tel. +33(0) 1 69 29 17 00

info@lumibird.com |

Calyptus

Mathieu Calleux

Investor Relations

Tel. +33(0) 1 53 65 37 91

lumibird@calyptus.net |

This press release contains forward-looking

statements. These forward-looking statements represent trends or

objectives, as the case may be, and should not be construed as

forecasts of the Company's results or any other performance

indicator. These statements are by their nature subject to risks

and uncertainties as described in the Company's URD filed with the

Autorité des Marchés Financiers (under number D24-0239). These

statements do not therefore reflect the Company's future

performance, which may differ materially.

1 EBITDA corresponds to current operating income restated for

provisions and depreciation net of reversals and expenses covered

by these reversals.

- 240722_Lumibird_CAS1_2024EN

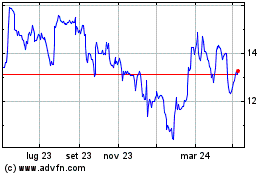

Grafico Azioni Lumibird (EU:LBIRD)

Storico

Da Gen 2025 a Feb 2025

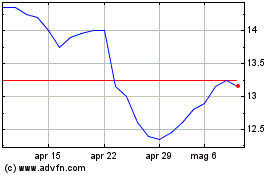

Grafico Azioni Lumibird (EU:LBIRD)

Storico

Da Feb 2024 a Feb 2025