McPhy Energy: McPhy 2023 Annual Results

- Annual revenue up +17% to €18.8 million, within expected

range

- Higher growth for the electrolyzer business of +25%,

representing 73% of total revenue

- EBITDA of €(44.6) million driven by R&D programs and

customer projects

- Cash position of €63.0 million as of December 31, 2023

- Strengthening of financial liquidity through implementation of

a financing plan for around €60 million in total

- Commitments by EDF Pulse Holding and the French Tech

Souveraineté fund to subscribe to a proposed convertible bond

issuance for €15 million each, for a total of €30 million

Grenoble, March 7, 2024 - 6:00 pm CET -

McPhy Energy, specialized in low-carbon hydrogen

production and distribution equipment (electrolyzers and refueling

stations), today announces its consolidated results for the

financial year 2023, ended December 31, approved today by the

Company’s Board of Directors1.

Simplified P&L2

| (€

million) |

2023 |

2022 |

Change |

|

Revenue |

18.8 |

16.1 |

+17% |

| Other operating

income |

1.1 |

1.9 |

-40% |

|

Income from Operating Activities |

19.9 |

17.9 |

+11% |

|

Purchases consumed |

(16.0) |

(15.9) |

n.s. |

| Personal costs |

(24.1) |

(17.7) |

+37% |

|

External costs |

(24.4) |

(21.1) |

+15% |

|

EBITDA |

(44.6) |

(36.8) |

+21% |

|

Depreciation, amortization and net provisions |

(5.6) |

(1.6) |

n.s. |

|

Operating Income (EBIT) |

(50.2) |

(38.4) |

+31% |

|

Other income and expenses |

- |

0.4 |

n.s. |

|

Financial Result |

2.8 |

0.4 |

n.s. |

|

Income Tax |

(0.0) |

(0.1) |

n.s. |

| Net Result |

(47.4) |

(38.2) |

+24% |

Jean-Baptiste Lucas, Chief Executive

Officer McPhy, states: “2023 has been a contrasted year

for McPhy. Top line once again suffered from delays which penalized

order intake, bringing it below our ambitions. On the positive

side, the Group achieved several important strategic milestones

during the year, including the partnership with the Indian

multinational company Larsen & Toubro, the first contracts for

the industrial sector, major progress in the transition to

industrial scale, and the refocusing on our core business as an

electrolyzer manufacturer. Recent developments in the market, with

the strong momentum of low-carbon hydrogen applications in

industry, the rapid increase in the size of projects in tendering

and the increased specialization observed in the business

activities, reinforce the choices we have made. In 2024, we are

committed to transforming the commercial opportunities of the

low-carbon hydrogen market, by driving forward the technological

development of our new range of high-capacity electrolyzers, the

ramp-up of our industrial footprint and the execution of our first

large-scale projects.”

Revenue within expected

range

Revenue for the 2023 financial

year amounts to €18.8 million, up

+17% versus 2022, in line with the double-digit growth

range given at the half-year results publication. Growth was fueled

by major projects currently under execution, and the initial

benefits of contracts signed in the industrial sector, such as the

"green metal" project with the Plansee Group3 and the low-carbon

steel production project with ArcelorMittal and VEO4. In addition,

as part of its partnership with L&T, McPhy recorded the first

revenue from the lump-sum part of the transfer of its pressurized

alkaline electrolysis technology.

The annual 2023 revenue for the

continued electrolyzer business reaches

€13.7 million, up +25%. The

station business, held for sale, reports

steady revenue of €5.1

million.

Update on current business and

projects

Firm order intake have been

negatively impacted by the postponement of the major 20 MW Djewels

project, for which the final investment decision has not yet been

taken, although the contract has been signed with HyCC during the

second half of 2023. Order intake thus dropped by

56% to €13.0 million, of which €12.6

million for the electrolyzer business alone.

However, McPhy has noted a significant increase

in tenders for the supply of large-scale electrolyzers over the

course of 2023, with a portfolio of tenders of 2.2 GW by

2030, a two-fold increase on last year

and an average size per project rising from around 40 megawatts in

2022 to 70 megawatts in 2023.

Operating result reflecting the Group's

continued restructuring

In fiscal year 2023, the Group pursued its

recruitment and structuring plans, resulting in an increase in

current expenses related to:

- Innovation and R&D expenditure linked to the optimization

of current products and the development of its new range of very

large-scale electrolyzers;

- The strengthening of its engineering and service resources

dedicated to customer projects.

Hence, personnel costs increased by €6.4

million in 2023, due to the recruitment

of 72 new employees and reached €24.1 million.

Other external costs amounted to €24.4 million, and mainly

comprised the purchase of subcontracting services and technical

studies required for the Group's ongoing industrial,

engineering and R&D development.

EBITDA stands at

€(44.6) million in 2023, compared

to €(36.8) million in 2022. It includes for an amount of €4.5

million the share of IPCEI grant5 applicable to the eligible

expenses over the period.

The Operating Result, €(5.6)

million below EBITDA, amounts to €(50.2) million

in 2023. The sharp increase in depreciation,

amortization and net provisions, from €(1.6) to €(5.6) million,

reflects the investments made over the past few years and an

increase in provisions recorded on certain legacy projects, linked

in particular to the stations business. As a reminder, the 2022

financial year benefited from a €2.6 million reversal of the

provision related to the Energiedienst incident.

Active cash management to take full advantage of

the rising interest rate environment has resulted in a positive

financial result of €2.8 million

in 2023, bringing Net Result to

€(47.4) million, compared with €(38.2) million in

2022.

Cash position of €63.0 million as of

December 31, 2023

Net cash consumption was

€(72.4) million in fiscal year

2023, including:

- Cash flow from operating activities of

€(51.4) million, due to the change in EBITDA and a €(5.4)

million rise in working capital requirements, mostly explained by

an increase in inventory resulting from the start-up of more

projects;

- Investments necessary for the Group’s

industrial scale-up amounting to €(24.5) million,

of which €(17.6) million are dedicated to the Belfort

Gigafactory.

As a result, McPhy holds a cash position

of €63.0 million as of December 31, 2023 compared to

€135.5 million as of December 31, 2022.

Continuing industrial

scale-up

McPhy has reached key milestones in the

scaling-up of its industrial set-up, especially

with the completion of construction of its

Gigafactory at the Belfort site.

The Gigafactory was delivered on schedule during this 1st quarter

of 2024, and operations will begin at the end of the 2nd

quarter.

The site will be gradually ramped up, with the

aim of reaching an annual production capacity of 1

GW. McPhy has also increased production capacity

to 300 MW (in two shifts) at its San Miniato site.

Progress on the contemplated sale of the

refueling station business

Following the entry into exclusive negotiations

for the sale of its station business with

Atawey6 in December 2023, McPhy has received

a binding offer, announced on February 19,

2024.

The price for the sale is composed of a fixed

part between €11 and €12 million euros, plus a variable part that

could amount, up to several million euros. This earn-out would be

implemented from the date of completion of the transaction and

would be conditional on the future order intakes relating to the

scope of business covered by the contemplated transaction.

The transaction is expected to be finalized

during the 2nd quarter of 2024, subject to consultation with

McPhy's employee representatives, a process which is ongoing,

completion of financing, and fulfillment of usual

prerequisites.

Implementation of a financing plan for

around €60 million, of which €30 million through the proposed

issuance of convertible bonds

In order to finance its working capital

requirements and general cash needs, in particular the development

of its commercial activity, its industrial facilities and its

research and development activity, McPhy intends to

propose to its shareholders, at the Combined

General Meeting to be held on May 30, 2024 (the

"CGM"), the authorization of an issuance of bonds

convertible into new shares and/or exchangeable for existing shares

(the "Convertible Bonds").

The key financial terms of the Convertible Bonds

would be as follows:

- The Convertible Bonds would be issued and redeemed at par, bear

interest at 8% per annum, payable annually, and have a maturity of

5 years;

- The conversion price of the Convertible Bonds would represent a

premium of 20% over the price determined on the issuance date;

- Conversion (in whole or in part) may be requested by

bondholders at any time from the date of issuance until maturity.

In the event of a conversion request, the issuer may deliver new

and/or existing shares and/or a cash amount (based on the share

price at the time of the conversion request).

The legal documentation for the Convertible

Bonds would also include the standard clauses for this type of

market instrument: in particular, early redemption at the option of

the bondholders (after 3 years or if certain events occur) or the

issuer in certain cases, and adjustments in the event of financial

transactions.

McPhy has already received commitments to

subscribe for a total of €30 million. EDF Pulse

Holding ("EDF Pulse"), an existing shareholder,

and the Bpifrance EPIC7 (Public Institution of an Industrial and

Commercial Nature), acting on behalf of the French State under the

French Tech Souveraineté Agreement dated December 11, 2020

("French Tech Souveraineté"8), have thus

undertaken to subscribe to the Convertible Bonds for an amount of

€15 million each. McPhy will investigate the

possibility of issuing an additional amount to other investors

depending on market conditions.

Both EDF Pulse and French Tech Souveraineté have

informed the McPhy of their intention not to exceed, alone or in

concert, the threshold of 30% of the company's capital and/or

voting rights.

Along with the approval by the CGM of the

necessary resolutions, the offering of the Convertible Bonds will

be subject to the approval of the prospectus, by the AMF, prepared

for the admission to trading on Euronext Paris of the new shares

resulting from the conversion of the Convertible Bonds, and to the

reappointment of an EDF Pulse's second Board of Directors’

member.

In conjunction with the planned issuance of

Convertible Bonds, McPhy continues to secure new financing

to strengthen its working capital in the course of

2024.

In addition to the potential proceeds from the

sale of its station business and the implementation of an equity

financing line with Vester Finance9, the Group has signed, with a

banking pool, a notice to proceed to a lease

financing for its Belfort Gigafactory,

representing a financing of €16 million.

This new financing amounts together to around

€30 million, totaling up to

around €60 million including the proceeds

of the Convertible Bonds.

Based on the business plan and the various

financing options mentioned above, McPhy will have the required

financial resources to finance its growth and working capital

requirements until the beginning of 2026 on its scope refocused on

the electrolyzer business. McPhy will therefore be able to

establish itself as a key manufacturer of equipment for low-carbon

hydrogen production.

Next Financial events:

- Combined General Meeting on May 30,

2024

- Publication of 2024 half-year results on

July 30, 2024, after market close

The annual financial report will be made

available as part of its 2023 Universal Registration Document no

later than April 30, 2024, on the Company's Investor website

(www.mcphy-finance.com).

ABOUT MCPHY

Specialized in hydrogen production and

distribution equipment, McPhy is contributing to the global

deployment of low-carbon hydrogen as a solution for energy

transition. With its complete range of products dedicated to the

industrial, mobility and energy sectors, McPhy offers its customers

turnkey solutions adapted to their applications in industrial raw

material supply, recharging of fuel cell electric vehicles or

storage and recovery of electricity surplus based on renewable

sources. As designer, manufacturer and integrator of hydrogen

equipment since 2008, McPhy has three development, engineering and

production centers in Europe (France, Italy, Germany). Its

international subsidiaries provide broad commercial coverage for

its innovative hydrogen solutions. McPhy is listed on Euronext

Paris (compartment C, ISIN code: FR0011742329, MCPHY).

CONTACTS

|

NewCap |

|

|

Investor RelationsEmmanuel

HuynhT. +33 (0)1 44 71 94 99mcphy@newcap.eu |

Press RelationsNicolas

MerigeauT. +33 (0)1 44 71 94 98Gaëlle FromaigeatT.+33 (0)1 44 71 98

52mcphy@newcap.eu |

Follow us on@McPhyEnergy

APPENDICES

Cash-flow Statement

| |

|

|

|

|

| (€ million) |

|

2023 |

2022 |

|

|

|

|

|

|

| Net

result |

|

(47.4) |

(38.2) |

| Cash-flow from

operations |

|

(41.0) |

(35.9) |

| Working capital

requirement |

|

(5.9) |

(7.8) |

| Operating

subsidies |

|

(4.5) |

26.9 |

| |

|

|

|

|

|

Net cash-flow from operating activities |

|

(51.4) |

(16.9) |

| |

|

|

|

|

|

Net cash-flow from investing activities |

|

(20.8) |

(23.0) |

| |

|

|

|

|

|

Net cash-flow from financing activities |

|

(0.3) |

(1.6) |

| |

|

|

|

|

| Change in cash and

cash equivalents |

|

(72.4) |

(41.7) |

| |

|

|

|

|

|

Closing cash position |

|

63.0 |

135.5 |

The audit procedures are in progress.

Balance Sheet

| ASSETS |

|

|

|

| (€ million) |

|

2023 |

2022 |

|

|

|

|

|

|

| |

Goodwill |

1.7 |

2.5 |

| |

Intangible assets |

2.5 |

0.0 |

| |

Tangible assets |

33.7 |

0.7 |

| |

Other non-current

assets |

14.5 |

0.0 |

|

NON-CURRENT ASSETS |

52.4 |

41.1 |

| |

Inventories |

7.6 |

12.0 |

| |

Trade and other

receivables |

20.1 |

10.2 |

| |

Current tax assets |

2.0 |

1.1 |

| |

Cash and cash

equivalents |

63.0 |

0.0 |

|

CURRENT ASSETS |

92.8 |

167.7 |

|

|

|

|

|

|

| ASSETS

HELD FOR SALE |

19.2 |

0.0 |

| |

|

|

|

|

|

TOTAL ASSETS |

164.4 |

208.8 |

| |

|

|

|

|

|

LIABILITIES |

|

|

|

| (€ million) |

|

2023 |

2022 |

|

|

|

|

|

|

| |

Share capital |

3.4 |

3.4 |

| |

Premium issued |

171.5 |

191.6 |

| |

Treasury shares |

(0.6) |

(0.9) |

| |

Retained earnings |

(86.0) |

(59.2) |

|

SHAREHOLDERS' EQUITY |

88.2 |

134.9 |

| |

Investment grants |

6.8 |

2.5 |

| |

Provisions - over 1

year |

3.7 |

2.5 |

| |

Financial debit &

borrowings - over 1 year |

4.3 |

4.5 |

| |

Deferred tax

liabilities |

1.8 |

0.7 |

|

NON-CURRENT LIABILITIES |

16.6 |

10.2 |

| |

Provisions - under 1

year |

7.4 |

5.7 |

| |

Financial debit &

borrowings - under 1 year |

0.6 |

1.6 |

| |

Trade and other

payables |

13.4 |

18.2 |

| |

Other current

liabilities |

36.5 |

38.2 |

|

CURRENT LIABILITIES |

57.9 |

63.7 |

| |

|

|

|

|

|

LIABILITIES HELD FOR SALE |

1.7 |

0.0 |

| |

|

|

|

|

|

TOTAL SHAREHOLDERS' EQUITY AND LIABILITIES |

164.4 |

208.8 |

The audit procedures are in progress.

1 Estimated results: Group's consolidated financial statements

will be formally approved by the Board of Directors on April 2,

2024.

2 The audit procedures are in progress.

3 “McPhy Awarded a Landmark Contract in the

Industrial Field for Green Metal Project for Plansee Group in

Austria”, on May 9, 2023

4 “On the Road to Decarbonisation with Hydrogen:

ArcelorMittal, VEO and McPhy to Build Pilot Electrolysis Plant in

Eisenhüttenstadt”, on April 5, 2023

5 Subject of a public aid contract by the French

State within the framework of the PIIEC ("Projet Important

d'Intérêt Européen Commun") or IPCEI ("Important Project of Common

European Interest") scheme known as "Hy2Tech" approved by the

European Commission, concluded with Bpifrance on October 28,

2022.

6 “McPhy enters into exclusive negotiations with

Atawey for the sale of its hydrogen refueling station business” and

“McPhy receives a binding offer from Atawey for the sale of its

station business”, on December 14, 2023 and February 19, 2024.

7 “Établissement Public à Caractère Industriel

et Commercial” in French

8 French Tech Souveraineté is an investment fund

managed by Bpifrance, with both an offensive and defensive role. It

already has an initial investment of €150 million to support French

technology companies in sovereign technologies of the future, which

could be targeted by large foreign players or be overtaken by

competitors with better financing.

9 “McPhy renews an equity financing line with

Vester Finance”, on December 19, 2023.

- PR_McPhy_2023 Results_EN_VF_07032024

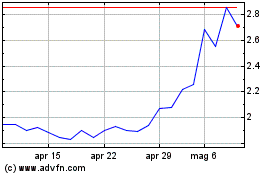

Grafico Azioni Mcphy Energy (EU:MCPHY)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Mcphy Energy (EU:MCPHY)

Storico

Da Feb 2024 a Feb 2025