Wendel welcomes the sale of Stahl’s wet-end division that marks an important step in the Group’s strategic journey

18 Novembre 2024 - 8:46AM

UK Regulatory

Wendel welcomes the sale of Stahl’s wet-end division that marks an

important step in the Group’s strategic journey

PRESS RELEASE – NOVEMBER 18, 2024

Wendel welcomes the sale of Stahl’s wet-end

division that marks an important step in the Group’s strategic

journey

Stahl, the global leader in specialty coatings for flexible

materials, announces the proposed divestment of its wet-end leather

chemicals business to an affiliate of Syntagma Capital. The

proposed transaction is subject to customary closing conditions,

including the completion of the works council consultation

process.

The proposed sale completes Stahl’s

transformation into a pure-play specialty coatings formulator for

flexible materials. This transaction, which follows the acquisition

of Weilburger Graphics this year and that of ICP Industrial

Solutions Group in 2023, is fully in line with Stahl's strategy to

refocus on the fast-growing sector of premium coatings. Following

these strategic moves, Stahl is now the global leader in specialty

coatings for flexible materials, with a balanced profile between

performance coatings, leather coatings and packaging coatings, and

a recognized ESG leader in its space well ahead of competitors and

environmental legislation. Stahl provides the finishing touch on

every material used in daily life enhancing consumer experience,

while complying with the highest ESG standards, as evidenced in

particular by the Company's Ecovadis Platinum award.

The announced proposed divestment of the wet-end

leather chemicals business will include 428 employees, the full

wet-end portfolio and manufacturing facilities in Italy and

India.

Pro forma for the sale of the wet-end chemicals

business and the acquisition of Weilburger Graphics, Stahl's 2023

sales would amount to €786 million, EBITDA to €182 million (i.e., a

23.1% margin) and net debt would stand at €336 million. These

transactions will thus have an accretive impact on Stahl's EBITDA

margin and strengthen its growth profile.

Maarten Heijbroek, CEO of Stahl: “In recent

years, Stahl has made a deliberate strategic shift towards premium

coatings, establishing ourselves as the market leader in coatings

for flexible materials. The divestment of our wet-end leather

chemicals business completes this transformation. Stahl is now a

pure-play coatings formulator, which will allow us to accelerate

innovation and sustainability to enhance consumer experiences and

live our purpose: ‘Touching lives, for a better world.’”

“At the same time, we are accelerating

investments in growth, with a new manufacturing plant in Singapore,

doubling our capacity in China and investments in new Centers of

Excellence in Asia, the US and Europe.”

“I’d like to thank all Stahl wet-end

employees for their considerable contribution to Stahl over the

years and wish them every success under their new ownership,”

Heijbroek concludes.

Agenda

Friday, December 6, 2024

2024 Investor Day

Wednesday, February 26, 2025

Full-Year 2024

Results – Publication of NAV as of December 31, 2024, and

Full-Year consolidated financial statements (post-market

release)

Thursday, April 24, 2025

Q1 2025 Trading

update – Publication of NAV as of March 31, 2025

(post-market release)

Thursday, May 15, 2025

Annual General Meeting

Wednesday, July 30, 2025

H1 2025 results – Publication

of NAV as of June 30, 2025, and condensed Half-Year consolidated

financial statements (post-market release)

- Wendel welcomes the sale of Stahl’s wet-end division

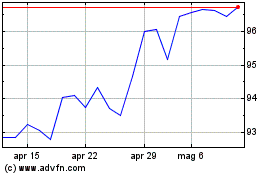

Grafico Azioni Wendel (EU:MF)

Storico

Da Ott 2024 a Nov 2024

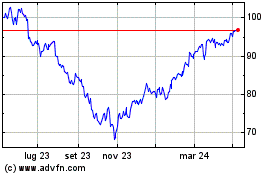

Grafico Azioni Wendel (EU:MF)

Storico

Da Nov 2023 a Nov 2024