Nyxoah Raises $27 Million through its At-the-Market Offering

07 Ottobre 2024 - 11:00PM

INSIDE

INFORMATIONREGULATED INFORMATION

Nyxoah Raises $27 Million through its

At-the-Market Offering

Investment by a new U.S.-based healthcare

investor, strengthening the balance sheet and reinforcing U.S.

focus

Mont-Saint-Guibert, Belgium – October 7,

2024, 11:00pm CET / 5:00pm ET – Nyxoah SA (Euronext

Brussels/Nasdaq: NYXH) (“Nyxoah” or the “Company”), a medical

technology company that develops breakthrough treatment

alternatives for Obstructive Sleep Apnea (OSA) through

neuromodulation, today announced that the Company has sold 3.0

million shares raising $27.0 million in gross proceeds pursuant to

the Company’s $50 million at-the-market ("ATM") offering at a price

per share equal to the market price on the Nasdaq Global Market at

the time of sale. The shares were sold, based on interest received,

to a single U.S.-based healthcare investor. Cantor Fitzgerald &

Co. is acting as the sales agent for the ATM offering.

The ordinary shares described above were sold by

the Company pursuant to the Company’s shelf registration statement

on Form F-3 (File No. 333-268955), filed with the Securities and

Exchange Commission (“SEC”) on December 22, 2022, which became

effective on January 6, 2023, and which included a prospectus

supplement and accompanying prospectus related to the ATM offering.

Copies of the prospectus supplement and accompanying prospectus

related to the ATM offering may be obtained from Cantor Fitzgerald

& Co., attention: Capital Markets, 110 East 59th Street, 6th

Floor, New York, New York 10022; email: prospectus@cantor.com.

Electronic copies of the prospectus are also available on the SEC's

website at http://www.sec.gov.

Olivier Taelman, Chief Executive Officer of

Nyxoah, commented: “After relocating to the United States with my

family this past summer, this investment reinforces our United

States focus, builds on our compelling DREAM pivotal study data

presented at the International Surgical Sleep Society (ISSS)

congress and strengthens our financial position, providing

additional opportunities as we are preparing for the launch of

Genio® in the United States.”

About NyxoahNyxoah is

reinventing sleep for the billion people that suffer from

obstructive sleep apnea (OSA). We are a medical technology company

that develops breakthrough treatment alternatives for OSA through

neuromodulation. Our first innovation is Genio®, a battery-free

hypoglossal neuromodulation device that is inserted through a

single incision under the chin and controlled by a wearable.

Through our commitment to innovation and clinical evidence, we have

shown best-in-class outcomes for reducing OSA burden.

Following the successful completion of the BLAST

OSA study, the Genio® system received its European CE Mark in 2019.

Nyxoah completed two successful IPOs: on Euronext Brussels in

September 2020 and NASDAQ in July 2021. Following the positive

outcomes of the BETTER SLEEP study, Nyxoah received CE mark

approval for the expansion of its therapeutic indications to

Complete Concentric Collapse (CCC) patients, currently

contraindicated in competitors’ therapy. Additionally, the Company

announced positive outcomes from the DREAM IDE pivotal study for

FDA and U.S. commercialization approval.

Caution – CE marked since 2019.

Investigational device in the United States. Limited by U.S.

federal law to investigational use in the United States.

FORWARD-LOOKING STATEMENTS

Certain statements, beliefs and opinions in this

press release are forward-looking, which reflect the Company's or,

as appropriate, the Company directors' or managements' current

expectations regarding the Genio® system; planned and ongoing

clinical studies of the Genio® system; the potential advantages of

the Genio® system; Nyxoah’s goals with respect to the development,

regulatory pathway and potential use of the Genio® system; the

utility of clinical data in potentially obtaining FDA approval of

the Genio® system; and reporting data from Nyxoah’s DREAM U.S.

pivotal trial; receipt of FDA approval; entrance to the U.S.

market; and the anticipated closing and use of the proceeds from

the offering. By their nature, forward-looking statements involve a

number of risks, uncertainties, assumptions and other factors that

could cause actual results or events to differ materially from

those expressed or implied by the forward-looking statements. These

risks, uncertainties, assumptions and factors could adversely

affect the outcome and financial effects of the plans and events

described herein. Additionally, these risks and uncertainties

include, but are not limited to, the risks and uncertainties set

forth in the “Risk Factors” section of the Company’s Annual Report

on Form 20-F for the year ended December 31, 2023, filed with the

Securities and Exchange Commission (“SEC”) on March 20, 2024,

and subsequent reports that the Company files with the SEC. A

multitude of factors including, but not limited to, changes in

demand, competition and technology, can cause actual events,

performance or results to differ significantly from any anticipated

development. Forward looking statements contained in this press

release regarding past trends or activities are not guarantees of

future performance and should not be taken as a representation that

such trends or activities will continue in the future. In addition,

even if actual results or developments are consistent with the

forward-looking statements contained in this press release, those

results or developments may not be indicative of results or

developments in future periods. No representations and warranties

are made as to the accuracy or fairness of such forward-looking

statements. As a result, the Company expressly disclaims any

obligation or undertaking to release any updates or revisions to

any forward-looking statements in this press release as a result of

any change in expectations or any change in events, conditions,

assumptions or circumstances on which these forward-looking

statements are based, except if specifically required to do so by

law or regulation. Neither the Company nor its advisers or

representatives nor any of its subsidiary undertakings or any such

person's officers or employees guarantees that the assumptions

underlying such forward-looking statements are free from errors nor

does either accept any responsibility for the future accuracy of

the forward-looking statements contained in this press release or

the actual occurrence of the forecasted developments. You should

not place undue reliance on forward-looking statements, which speak

only as of the date of this press release.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy the securities in the

offering, nor shall there be any sale of these securities in any

jurisdiction in which an offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of such jurisdiction.

Contacts:

NyxoahLoïc Moreau, Chief

Financial OfficerIR@nyxoah.com

For MediaIn United StatesFINN

Partners – Glenn Silverglenn.silver@finnpartners.com

In Belgium/FranceBackstage Communication –

Gunther De Backergunther@backstagecom.be

In International/GermanyMC Services – Anne

Henneckenyxoah@mc-services.eu

- ENGLISH_ATM Transaction Release

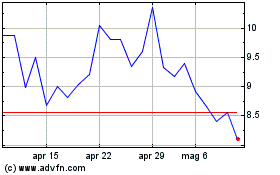

Grafico Azioni Nyxoah (EU:NYXH)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Nyxoah (EU:NYXH)

Storico

Da Dic 2023 a Dic 2024