Nyxoah Reports Third Quarter Financial and Operating Results

REGULATED

INFORMATION

Nyxoah

Reports

Third

Quarter

Financial and

Operating Results

FDA approval

on track for

first quarter

2025, U.S.

commercial team build out

in progress

Company fully funded

with cash

until mid

2026

Mont-Saint-Guibert, Belgium

– November

6,

2024,

10:05pm

CET /

4:05pm

ET –

Nyxoah SA

(Euronext

Brussels/Nasdaq:

NYXH) (“Nyxoah” or the

“Company”), a medical technology

company that develops breakthrough treatment

alternatives for Obstructive Sleep Apnea (OSA)

through neuromodulation, today

reported financial and

operating results for

the third quarter of

2024.

Recent

Financial and Operating Highlights

- Presented

compelling DREAM data results at

International Surgical Sleep Society in

September.

- Raised

€24.6 million

through an ATM program from a

single U.S.

healthcare-dedicated fund providing incremental

flexibility as we shift into

U.S.

commercialization and extending

cash runway until mid

2026.

- Strengthened

U.S.

organization with the hiring of John Landry as

Chief Financial Officer and the

addition of several key commercial

leaders in the U.S.

- Reported

third quarter sales of

€1.3 million,

representing 30% growth versus

third quarter 2023.

- Total cash

position of €71.0 million at the end of

the quarter, €95.6 million

proforma including the €24.6

million raised.

“Our actions in the third

quarter have further positioned us

well for a successful

U.S. commercial

launch. On the back of the robust

DREAM data presented in September, we have

raised additional capital and are actively focused on

building up our

U.S. commercial

team,” commented Olivier

Taelman, Nyxoah’s

Chief Executive Officer. “I am more

confident than ever that we have

set Genio up for a

strong commercial start in the U.S. immediately after

FDA approval.”

Third Quarter

2024

Results

CONSOLIDATED STATEMENTS OF LOSS AND

OTHER COMPREHENSIVE

LOSS (unaudited)

(in thousands)

|

|

For the three months ended

September

30,

|

|

For the

nine months

ended September

30,

|

|

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

Revenue

|

1,266

|

|

976

|

|

3,258

|

|

2,524

|

|

Cost of goods sold

|

(482)

|

|

(336)

|

|

(1,217)

|

|

(930)

|

|

Gross

profit

|

€ 784

|

|

€ 640

|

|

€ 2,041

|

|

€ 1,594

|

|

Research and Development Expense

|

(7,902)

|

|

(6,568)

|

|

(22,573)

|

|

(19,330)

|

|

Selling, General and Administrative

Expense

|

(8,042)

|

|

(5 058)

|

|

(20,396)

|

|

(16,794)

|

|

Other income/(expense)

|

180

|

|

−

|

|

430

|

|

265

|

|

Operating loss for the

period

|

€(14,980)

|

|

€(10,986)

|

|

€(40,498)

|

|

€(34,265)

|

|

Financial income

|

1,138

|

|

2,178

|

|

4,615

|

|

3,592

|

|

Financial expense

|

(3,043)

|

|

(1,033)

|

|

(5,480)

|

|

(2,765)

|

|

Loss for the period before

taxes

|

€(16,885)

|

|

€(9,841)

|

|

€(41,363)

|

|

€(33,438)

|

|

Income taxes

|

(173)

|

|

2,229

|

|

(724)

|

|

1,119

|

|

Loss for the

period

|

€(17,058)

|

|

€(7,612)

|

|

€(42,087)

|

|

€(32,319)

|

|

|

|

|

|

|

|

|

|

|

Loss attributable to equity

holders

|

€(17,058)

|

|

€(7,612)

|

|

€(42,087)

|

|

€(32,319)

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive

income/(loss)

|

|

|

|

|

|

|

|

|

Items that may not be subsequently reclassified to

profit or loss (net of tax)

|

|

|

|

|

|

|

|

|

Currency translation differences

|

(209)

|

|

(10)

|

|

(221)

|

|

(88)

|

|

Total comprehensive loss for the year, net of

tax

|

€(17,267)

|

|

€ (7,622)

|

|

€(42,308)

|

|

€(32,407)

|

|

Loss attributable to equity

holders

|

€(17,267)

|

|

€ (7,622)

|

|

€(42,308)

|

|

(32,407)

|

|

|

|

|

|

|

|

|

|

|

Basic loss per share (in EUR)

|

€(0.496)

|

|

€(0.266)

|

|

€(1.346)

|

|

€(1.166)

|

|

Diluted loss per share (in EUR)

|

€(0.496)

|

|

€(0.266)

|

|

€(1.346)

|

|

€(1.166)

|

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

(unaudited)

(in thousands)

|

|

|

|

As at

|

|

|

|

|

September

30,

2024

|

|

December

31,

2023

|

|

ASSETS

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

|

Property, plant and equipment

|

|

|

4,461

|

|

4,188

|

|

Intangible assets

|

|

|

49,558

|

|

46,608

|

|

Right of use assets

|

|

|

3,635

|

|

3,788

|

|

Deferred tax asset

|

|

|

53

|

|

56

|

|

Other long-term receivables

|

|

|

1,475

|

|

1,166

|

|

|

|

|

€

59,182

|

|

€

55,806

|

|

Current assets

|

|

|

|

|

|

|

Inventory

|

|

|

5,272

|

|

3,315

|

|

Trade receivables

|

|

|

2,504

|

|

2,758

|

|

Other receivables

|

|

|

2,992

|

|

3,212

|

|

Other current assets

|

|

|

1,837

|

|

1,318

|

|

Financial assets

|

|

|

42,299

|

|

36,138

|

|

Cash and cash equivalents

|

|

|

28,678

|

|

21,610

|

|

|

|

|

€

83,582

|

|

€

68,351

|

|

Total assets

|

|

|

€

142,764

|

|

€

124,157

|

|

|

|

|

|

|

|

|

EQUITY AND LIABILITIES

|

|

|

|

|

|

|

Capital and reserves

|

|

|

|

|

|

|

Capital

|

|

|

5,908

|

|

4,926

|

|

Share premium

|

|

|

290,906

|

|

246,127

|

|

Share based payment reserve

|

|

|

8,943

|

|

7,661

|

|

Other comprehensive income

|

|

|

(84)

|

|

137

|

|

Retained loss

|

|

|

(200,966)

|

|

(160,829)

|

|

Total equity attributable to

shareholders

|

|

|

104,707

|

|

€

98,022

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

Financial debt

|

|

|

19,143

|

|

8,373

|

|

Lease liability

|

|

|

2,636

|

|

3,116

|

|

Pension liability

|

|

|

47

|

|

9

|

|

Provisions

|

|

|

398

|

|

185

|

|

Deferred tax liability

|

|

|

12

|

|

9

|

|

|

|

|

€22,236

|

|

€

11,692

|

|

Current liabilities

|

|

|

|

|

|

|

Financial debt

|

|

|

399

|

|

364

|

|

Lease liability

|

|

|

1,151

|

|

851

|

|

Trade payables

|

|

|

7,109

|

|

8,108

|

|

Current tax liability

|

|

|

2,495

|

|

1,988

|

|

Other payables

|

|

|

4,667

|

|

3,132

|

|

|

|

|

€

15,821

|

|

€

14,443

|

|

Total liabilities

|

|

|

€

38,057

|

|

€

26,135

|

|

Total equity and liabilities

|

|

|

€

142,764

|

|

€

124,157

|

Revenue

Revenue was €1.3 million

for the third quarter ending

September 30,

2024, compared to

€1.0 million for the

third quarter ending

September 30,

2023.

Cost of Goods Sold

Cost of goods sold was

€482,000 for the three months

ending September

30, 2024, representing

a gross profit of €0.8 million, or gross

margin of 62.0%. This compares to total

cost of goods sold of €336,000 in

the third quarter of

2023, for a gross profit of

€0.6 million,

or gross margin of 66.0%.

Research and

Development

For the third

quarter ending September

30, 2024,

research and

development expenses were

€7.9 million, versus

€6.6 million for the

third quarter ending

September 30,

2023.

Operating Loss

Total operating loss for the third

quarter ending September

30, 2024,

was

€15.0

million versus €11.0 million in

the third quarter

ending September

30, 2023.

This increase was primarily driven by expanded commercial

activities, higher R&D investments, and ongoing clinical

activities.

Cash Position

As of September 30,

2024, cash and financial assets totaled

€71.0 million, compared to

€57.7 million on December

31, 2023. Total cash burn

was approximately

€5.6 million per

month during the third

quarter 2024.

Third

Quarter 2024

Nyxoah’s financial report for the

third quarter

2024, including details of the

consolidated results, are available on the investor page of

Nyxoah’s website

(https://investors.nyxoah.com/financials).

Conference call and webcast

presentation

Company management will host a conference call to discuss

financial results on Wednesday,

November 6, 2024,

beginning at 10:30pm CET / 4:30pm ET.

A webcast of the call will be accessible

via the Investor Relations page of the Nyxoah website or through

this link: Nyxoah's Q3 2024 earnings call

webcast. For those not planning to ask a question of

management, the Company recommends listening via the

webcast.

If you plan to ask a question, please use

the following link: Nyxoah’s Q3 2024

earnings call. After registering, an email will be

sent, including dial-in details and a unique conference call access

code required to join the live call. To ensure you are connected

prior to the beginning of the call, the Company suggests

registering a minimum of 10 minutes before the start of the

call.

The archived webcast will be available for

replay shortly after the close of the call.

About Nyxoah

Nyxoah is reinventing sleep for the billion people that

suffer from obstructive sleep apnea (OSA). We are a medical

technology company that develops breakthrough treatment

alternatives for OSA through neuromodulation. Our first innovation

is Genio®, a battery-free hypoglossal neuromodulation device that

is inserted through a single incision under the chin and controlled

by a wearable. Through our commitment to innovation and clinical

evidence, we have shown best-in-class outcomes for reducing OSA

burden.

Following the successful completion of the

BLAST OSA study, the Genio® system received its European CE Mark in

2019. Nyxoah completed two successful IPOs: on Euronext Brussels in

September 2020 and NASDAQ in July 2021. Following the positive

outcomes of the BETTER SLEEP study, Nyxoah received CE mark

approval for the expansion of its therapeutic indications to

Complete Concentric Collapse (CCC) patients, currently

contraindicated in competitors’ therapy. Additionally, the Company

announced positive outcomes from the DREAM IDE pivotal study for

FDA and U.S. commercialization approval.

Caution – CE

marked since 2019. Investigational device in the United States.

Limited by U.S. federal law to investigational use in the United

States.

FORWARD-LOOKING

STATEMENTS

Certain statements, beliefs and opinions

in this press release are forward-looking, which reflect the

Company's or, as appropriate, the Company directors' or

managements' current expectations regarding the Genio® system;

planned and ongoing clinical studies of the Genio® system; the

potential advantages of the Genio® system;

Nyxoah’s goals with respect to the development,

regulatory pathway and potential use of the Genio® system; the

utility of clinical data in potentially obtaining FDA approval of

the Genio® system; and reporting data from

Nyxoah’s DREAM U.S. pivotal trial;

receipt of FDA approval; entrance to the U.S.

market; and the anticipated

closing and use of the proceeds from the

offering. By their nature, forward-looking statements

involve a number of risks, uncertainties, assumptions and other

factors that could cause actual results or events to differ

materially from those expressed or implied by the forward-looking

statements. These risks, uncertainties, assumptions and factors

could adversely affect the outcome and financial effects of the

plans and events described herein. Additionally, these risks and

uncertainties include, but are not limited to, the risks and

uncertainties set forth in the “Risk Factors” section of the

Company’s Annual Report on Form 20-F for the year ended December

31, 2023, filed with the Securities and

Exchange Commission (“SEC”) on

March 20,

2024, and subsequent reports that the

Company files with the SEC. A multitude of factors including, but

not limited to, changes in demand, competition and

technology, can cause actual events, performance or results to

differ significantly from any anticipated development. Forward

looking statements contained in this press release regarding past

trends or activities are not guarantees of future performance and

should not be taken as a representation that such trends or

activities will continue in the future. In addition, even if actual

results or developments are consistent with the forward-looking

statements contained in this press release, those results or

developments may not be indicative of results or developments in

future periods. No representations and warranties are made as to

the accuracy or fairness of such forward-looking statements. As a

result, the Company expressly disclaims any obligation or

undertaking to release any updates or revisions to any

forward-looking statements in this press release as a result of any

change in expectations or any change in events, conditions,

assumptions or circumstances on which these forward-looking

statements are based, except if specifically required to do so by

law or regulation. Neither the Company nor its advisers or

representatives nor any of its subsidiary undertakings or any such

person's officers or employees guarantees that the assumptions

underlying such forward-looking statements are free from errors nor

does either accept any responsibility for the future accuracy of

the forward-looking statements contained in this press release or

the actual occurrence of the forecasted developments. You should

not place undue reliance on forward-looking statements, which speak

only as of the date of this press release.

This press release does not constitute an

offer to sell or a solicitation of an offer to buy the securities

in the offering, nor shall there be any sale of these securities in

any jurisdiction in which an offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of such jurisdiction.

Contacts:

Nyxoah

Loïc Moreau

IR@nyxoah.com

For Media

In United States

FINN Partners – Glenn Silver

glenn.silver@finnpartners.com

In Belgium/France

Backstage Communication – Gunther De Backer

gunther@backstagecom.be

In

International/Germany

MC Services – Anne Hennecke

nyxoah@mc-services.eu

- ENGLISH_Q3 2024 Earnings PR

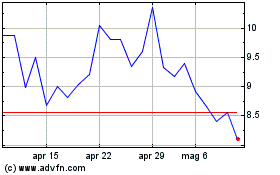

Grafico Azioni Nyxoah (EU:NYXH)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Nyxoah (EU:NYXH)

Storico

Da Dic 2023 a Dic 2024