Ordina successfully completes refinancing

19 Maggio 2015 - 6:00PM

Nieuwegein, 19 May 2015

Ordina has agreed a new financing facility of EUR 30 million under

more favourable conditions:

- The margin has been cut to 1.00%, compared to the

margin of 2.25% - 3.75%, depending on the leverage ratio, for the

previous facility;

- The covenant related to the ratio of net debt to

corrected EBITDA has been relaxed;

- The financing has a term of five years with an

initial term of three years and an option to extend twice for a

period of one year.

The revolving facility has been fully committed by

ABN AMRO and ING and replaces the previous facility of EUR 35

million extended by ABN AMRO, ING and NIBC, which was due to expire

in November 2016. ABN AMRO acted as lead arranger for the

facility.

Ordina will provide further details of the new facility in its

interim report.

# # #

ABOUT

ORDINA

Ordina is the largest independent IT services provider in the

Benelux, with more than 2,900 employees. We design, build and

maintain IT solutions for organisations in the public sector, in

financial services, industry and the healthcare sector. We aim to

design IT solutions that help people, IT that matters and that is

produced without wasting precious resources. We do this by forging

Partnerships in Sustainable Innovation with our

clients.

Ordina was founded in 1973. The company's shares have been listed

on the NYSE Euronext Amsterdam since 1987 and are included in the

Small Cap Index (AScX). In 2014, Ordina recorded turnover of EUR

367 million. For more information visit the company's website at

www.ordina.com.

For more

information:

Media:

Annemieke den Otter, Investor Relations

Mail: annemieke.den.otter@ordina.nl

Telephone: +31 (0)30 663 7468

Jeroen Hellenberg, Communications

Mail: jeroen.hellenberg@ordina.nl

Telephone: +31 (0)30 663 8557

This document contains pronouncements forecasting the future

financial performance of Ordina N.V. and outlines certain plans,

targets and ambitions based on current insights. Obviously, such

forecasts are not without risk; they entail a relative degree of

uncertainty since no guarantees exist on future circumstances.

There are many factors that could potentially affect the actual

performance and forecasts, causing them to deviate from the

situation described in this document. Such factors include: general

economic trends, the pace of the globalisation of the solutions, IT

and consulting markets, the growing number of projects with

responsibility for deliverables, scarcity on the labour market, and

future acquisitions and disposals.

Ordina successfully completes

refinancing

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Ordina via Globenewswire

HUG#1922450

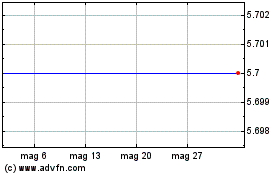

Grafico Azioni Ordina NV (EU:ORDI)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Ordina NV (EU:ORDI)

Storico

Da Mag 2023 a Mag 2024