Exor Buys 15% Stake in Philips

14 Agosto 2023 - 7:49AM

Dow Jones News

By Joe Hoppe

Exor and Royal Philips jointly said that they have entered a

relationship agreement, with Exor picking up a 15% stake in Philips

for an undisclosed sum, but worth around 2.58 billion euros ($2.82

billion).

Investment company Exor, which holds stakes in a number of

companies such as car makers Ferrari and Stellantis, said Monday

that its investment is fully supportive of Dutch health-technology

company Philips' leadership, strategy and value creation potential,

and gives it the ability to nominate one member to Philips'

supervisory board.

As of Friday's closing, Philips had a market cap of around

EUR17.18 billion.

Exor said it was committed to being a long-term minority

investor, and while it doesn't plan to buy more shares in Philips

in the short-term, over time the agreement allows for Exor to

increase its participation to a maximum limit of 20% of Philips'

outstanding share capital.

"Exor's investment in Philips, their long-term outlook and

increased focus on healthcare and technology, fit well with our

strategy and substantial value creation potential," Philips Chief

Executive Roy Jakobs said.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

August 14, 2023 01:34 ET (05:34 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

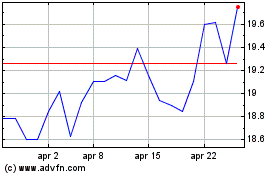

Grafico Azioni Koninklijke Philips NV (EU:PHIA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Koninklijke Philips NV (EU:PHIA)

Storico

Da Apr 2023 a Apr 2024