Trending: Philips Gains After Exor Picks Up 15% Stake

14 Agosto 2023 - 11:42AM

Dow Jones News

0910 GMT - Royal Philips is among the most mentioned companies

across news items over the past four hours, according to Factiva

data. The Dutch health-technology and investment company Exor said

in a joint statement Monday that they have entered a relationship

agreement, with Exor picking up a 15% stake in Philips for an

undisclosed sum, but worth around 2.58 billion euros ($2.82

billion). As of Friday's closing, Philips had a market cap of

around EUR17.18 billion. Exor said it was committed to being a

long-term minority investor, and while it doesn't plan to buy more

shares in Philips in the short-term, over time the agreement allows

for Exor to increase its participation to a maximum limit of 20% of

Philips' outstanding share capital. Exor's own shareholders might

be cautious about the deal, however, ING analysts said in a

research note. Investors don't typically back minority investments

in listed assets--though investment company Exor's track record

with this strategy is good--and there are doubts related to the

U.S. litigation's overhang on the share and the influence of Exor

at Philips's board level, ING analysts says. Philips shares are up

5.1% at EUR19.44, while Exor is down 0.4% at EUR81.08. Dow Jones

& Co. owns Factiva. (joseph.hoppe@wsj.com)

(END) Dow Jones Newswires

August 14, 2023 05:27 ET (09:27 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

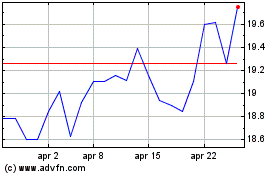

Grafico Azioni Koninklijke Philips NV (EU:PHIA)

Storico

Da Mar 2024 a Apr 2024

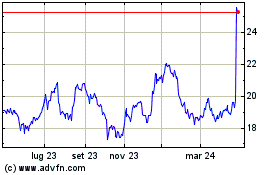

Grafico Azioni Koninklijke Philips NV (EU:PHIA)

Storico

Da Apr 2023 a Apr 2024