Strong 2021 annual results driven by all solutions, confirming a

solid return to sustainable and profitable growth

Key

highlights

-

Consolidated sales of €1,024 million,

a 4.3% organic0F0F1

growth versus 2020

- Software

revenues now exceed €200

million

- Stable

EBITDA margin at 23.9% thanks to active cost

management

-

Current EBIT1F1F2 of

€147 million, up

6.0% on

an organic basis

- Net

attributable income of

€88 million, up

c.120%

- Free

cash flow2F2F3 of €104 million,

consolidating the Group’s robust liquidity position to

€887 million3F3F4 as of

31 January 2022

- Stable

net debt of €504 million

as of 31 January 2022, confirming the low level of

leverage at 0.4x

excluding leasing4F4F5

-

Continued progress in

Back to

Growth strategy with further

reshaping of the portfolio of activities and sustained growth in

subscription-related revenue

- Proposed

dividend payment

€0.55

per share in respect of financial year 2021, up

10% versus 2020

Outlook

- 2022

organic sales growth expected over

2%

- 2022

current EBIT2 organic

growth5F5F6 expected at low- to

mid-single digit rate

- Minimum

3% organic sales growth CAGR expected over 2021-2023

- Minimum

mid-single digit organic growth CAGR of current

EBIT2 expected over

2021-2023

Paris, 28 March 2022,

Quadient (Euronext Paris: QDT),

a leader in business solutions for meaningful customer connections

through digital and physical channels, announces today its 2021

fourth-quarter consolidated sales and full-year results (period

ended on 31 January 2022).

Geoffrey Godet, Chief Executive Officer of

Quadient, stated: “2021 marks the first year of the second phase of

Quadient’s Back to Growth strategy. A year ago, we hosted a Capital

Markets Day to present our sustainable growth outlook to 2023. As

we close 2021, we are proud to report solid results driven by

revenue growth in all three solutions. Growth was supported by

strong acquisition of new customers across our SaaS solutions, a

firm rebound in mailing equipment sales outpacing competition again

and a strong increase of our parcel lockers installed base. In an

environment driven by further digitalization and automation of both

communication and financial processes, the usage of our cloud-based

platforms recorded a sharp 25% increase. Finally, we continue to

benefit from the expansion of e-commerce that is generating higher

parcel volumes as evidenced by the greater usage of our growing

installed base of connected parcel lockers.

Quadient’s subscription-based business model

proved resilient and the transformation to a more recurring and

predictable revenue generation continues with a 4.3% year-over-year

organic growth in sales and a 6.0% organic growth in current EBIT,

surpassing our initial guidance, and such despite challenging

supply chain and Covid-related disruptions. Profitability

remains high with a stable EBITDA margin of 23.9% thanks to a more

efficient organization and active cost management, while we

continued to increase investments in R&D and Go-to-market. Free

Cash Flow generation, at €104 million, continued to be strong and

drives a healthy financial position with a low level of leverage at

0.4x excluding leasing. Quadient will therefore propose, for

approval by the shareholders at the next Annual General Meeting, a

dividend of €0.55per share, above the floor set under the dividend

policy outlined in its "Back to Growth" strategic plan. On the back

of this strong set of results, we are confidently confirming our

prospects: our software solutions are generating an increasingly

strong base of annual recurring revenue that will soon exceed €250

million, the profitability of our mail solutions remains well under

control at close to 45%, and we are well on track to reach more

than 25,000 parcel lockers installed by 2023.”

ORGANIC

REVENUE GROWTH ACROSS ALL

SOLUTIONS AND ALL REGIONS

Group sales stood at

€1,024 million in 2021, supported by a solid organic sales

growth of 4.3% driven by positive growth from all solutions and all

geographical areas. The acceleration of the company towards a

subscription-based model continues to materialize with

subscription-related revenues up 2.8% on an organic basis versus

2020 and now accounting for 67% of the total Group sales.

On a reported basis, Group sales went down 0.5%

compared to 2020, including a negative currency impact of -0.8% and

a negative scope effect of -3.9%. In line with the Company’s

strategy to reshape its portfolio, changes of scope are related to

the divestments of ProShip in February 2020, the acquisition of

YayPay in July 2020, the divestment from the Graphics activity in

Australia and New Zealand in January 2021, the acquisition of

Beanworks in March 2021 and the disposal of Automated Packaging

Systems and the Netherland-based folder-inserters production site

in July 2021.

Consolidated sales

|

In million euros |

2021 |

2020 |

Change |

Change at constant rates |

Organic

change(1) |

|

Major Operations |

942 |

919 |

2.4% |

3.4% |

3.0% |

|

Intelligent Communication Automation(a,b) |

201 |

183 |

9.4% |

9.5% |

7.3% |

|

Mail-Related Solutions(b) |

659 |

653 |

0.9% |

1.8% |

1.8% |

|

Parcel Locker Solutions |

83 |

83 |

-0.7% |

2.6% |

2.6% |

|

Additional Operations |

82 |

110 |

-25.7% |

-26.1% |

23.2% |

|

Group total |

1,024 |

1,029 |

-0.5% |

0.2% |

4.3% |

|

In million euros |

2021 |

2020 |

Change |

Change at constant rates |

Organic change(1) |

|

Major Operations |

942 |

919 |

2.4% |

3.4% |

3.0% |

|

North America |

519 |

501 |

3.5% |

5.5% |

4.7% |

|

Main European countries(a) |

371 |

367 |

1.1% |

0.4% |

0.4% |

|

International(b) |

52 |

51 |

1.8% |

4.2% |

4.2% |

|

Additional Operations |

82 |

110 |

-25.7% |

-26.1% |

23.2% |

|

Group total |

1,024 |

1,029 |

-0.5% |

0.2% |

4.3% |

|

(a) Including Austria, Benelux, France, Germany,

Ireland, Italy, Switzerland and the United

Kingdom.(b) International includes the activities of

Parcel Locker Solutions in Japan and of Intelligent Communication

Automation outside of North America and the Main European

countries. |

Major Operations

Sales from Major Operations

reached €942 million (92% of total sales) in 2021, a 3.0%

year-over-year organic growth. All three solutions and all regions

contributed to this positive performance.

Sales in North America (55% of

Major Operations) were up 4.7% organically to €519 million. This

was mainly driven by the double-digit increase from cloud-based

solutions, Intelligent Communication Automation, with strong

customer gains from cross-selling and the deployment of

newly-acquired SaaS fintech companies (Beanworks and YayPay). Solid

hardware sales from Mail-Related Solutions also contributed to the

positive performance, whilst Parcel Locker Solutions suffered from

a high comparison basis with Lowe’s contract roll-out last

year.

Main European countries (39% of

Major Operations) recorded an organic sales growth of 0.4% to €371

million. Intelligent Communication Automation and Parcel Locker

Solutions posted solid sales growth in the main European markets,

with Parcel Locker Solutions delivering the fastest growth thanks

to on-going deployment of existing contracts with retailers and the

gain of new ones. Sales from Mail-Related Solutions were stable,

proving their resilience.

The International segment (6%

of Major Operations) delivered a solid organic sales growth

(+4.2%), with Parcel Locker Solutions being the main driver of

performance thanks to a steady increase of the installed base in

Japan.

Intelligent Communication

Automation

Sales from Intelligent Communication

Automation cloud-based

solutions (21% of Major Operations) were

up 7.3% organically reaching for the first time more than €200

million (€201 million in 2021), a solid performance helped by

strong customer acquisition. The number of Intelligent

Communication Automation net new (after churn) customers grew by

over 2,800 over the course of 2021, closing the year in excess of

11,800. The recent acquisition of Beanworks as well as the

deployment of YayPay helped drive this dynamic customer acquisition

trend with around 350 new AP/AR customers, including strong

cross-selling opportunities. Cross-selling accounted overall for

two thirds of new Intelligent Communication Automation

customers.

In line with the Company's strategy, the shift

in revenue model continues to accelerate, driven by the growing

demand for cloud-based solutions. Subscription-related revenue went

up 17.1% organically, now representing 67% of Intelligent

Communication Automation sales compared to 59% in 2020. Share of

SaaS customers reached 76% at the end of 2021 and annual recurring

revenue stood at €147 million at the end of 2021, up from €123

million at the end of 2020. Conversely, license sales went down

26.7% organically, despite one large deal booked in the second

quarter of 2021, with Q4 license decline reaching -45%. License

sales now account for only 14% of the Solution’s total sales.

The Solution profit

margin6F6F7 for Intelligent Communication

Automation was down 3.9 points year-over-year to 14.7%, on an

organic basis. Change of business model, recent targeted

acquisitions and planned increased investments related to

cloud-platform expansion, additional go-to-market and marketing are

transitionally weighing on the profitability of the Solution.

Mail-Related Solutions

Mail-Related Solutions sales

(70% of Major Operations) stood at €659 million in 2021, up

1.8% organically compared to 2020. This solid performance was

driven by a dynamic 12.5% organic growth in hardware sales:

placements of new hardware recovered strongly in 2021 thanks to

product renewal (launch of the new iX-9 in the US) and a clear

focus on customer acquisition and retention. 2021 also turned out

to be a record year for high-end production mail

folder-inserters.

Meanwhile, the Company recorded a limited 2.0%

organic decrease in subscription-related revenues (71% of

Mail-Related Solutions sales). The resilience of both the installed

base and subscription-related revenues remains strong, thanks to

multi-year contracts.

Overall, thanks to customer acquisition and

retention, Mail-Related Solutions growth stood c.3 points above the

global market performance7F7F8. This outperformance was most

noticeable in the North American market.

The Solution Profit

Margin6 for Mail-Related Solutions was

slightly down 1.0 point organically to 44.2% mainly due to the

higher freight costs and supply chain disruptions. Overall, higher

freight and sourcing costs amounted to an additional €6million in

costs.

Parcel Locker Solutions

Parcel Locker Solutions sales

(9% of Major Operations) stood at €83 million in 2021, a 2.6%

organic increase compared to 2020. Performance was impacted by the

demanding comparison base in hardware sales from the Lowe’s

contract in 2020. Hardware sales were sharply down but

subscription-related revenues were up 19.1% organically thanks to

the roll-out of existing contracts with retailers and carriers in

Europe and, to a lesser extent, to the increased installed base in

Japan. The lockers’ usage rate continues to improve, reaching 61%

at the end of 2021 (versus 57% a year ago), also contributing to

the solid performance in subscription-related revenues.

Quadient closed the year with over 15,800

lockers installed globally, well on track to deliver the Company’s

2023 target to reach 25,000 lockers. Over 2,800 lockers were

installed in 2021 with over 650 being installed in the fourth

quarter of 2021 despite supply chain issues.

Solution profit

margin6 for Parcel Locker Solutions stood

at -4.5% in 2021, a 10.1 points year-over-year organic decline.

This was mainly due to the sharp increase in freight costs for new

installations and to planned increased R&D and go-to-market

investments, whilst the profitability of the installed base

remained high at 27%.

Additional Operations

Revenue from Additional

Operations stood at €82 million in 2021, down 25.7%

year-over-year. This decline is mainly due to the disposal of

Graphics activities in Australia and New Zealand, and the

divestment of the Automated Packing Systems. Additional Operations

now only account for 8% of total sales. On an organic basis,

however, Additional Operations sales were up 23.2% thanks to a good

performance in Parcel Locker Solutions in Sweden while Automated

Packing Systems also had a positive contribution before the

divestment took place at end-July 2021.

Q4 2021

SALES

Consolidated sales stood at

€273 million in the fourth quarter of 2021, down 5.0% on a

reported basis and down 3.3% on an organic basis compared to the

fourth quarter of 2020. This organic decline in revenue is

essentially due to a high basis of comparison as the fourth quarter

of 2020 coincided with the peak of the roll-out of the Lowe’s

contract in Parcel Locker Solutions. In the meantime, thanks to its

efforts and agility, the Company succeeded to mitigate the impact

of increasing supply chain tensions on hardware manufacturing and

shipping delays to ultimately deliver its clients in a timely

manner.

Major Operations sales stood at

€253 million in the fourth quarter of 2021, down 4.4%

organically compared to the fourth quarter of 2020.

Intelligent Communication

Automation sales were up 0.6% organically to €54 million

impacted by the change in business model with license declining by

-45% in Q4. Mail-Related Solutions sales continued

to show strong resilience, reaching €178 million, down by 1.1%

only on an organic basis. Parcel Locker Solutions

sales stood at €21 million in fourth quarter of 2021, a

sharp 32.1% decline on an organic basis due to the very high

comparison basis of the Lowe’s contract deployment.

Additional Operations sales

stood at €20 million in the fourth quarter of 2021, down

40.9% on a reported basis due to the changes in scope, but up 12.9%

on an organic basis.

REVIEW OF 2021

FULL-YEAR RESULTS

Simplified P&L

|

In € million |

2021 |

2020 |

Change |

|

Sales |

1,024 |

1,029 |

(0.5)% |

|

Gross profit |

744 |

743 |

+0.1% |

|

Gross margin |

72.6% |

72.2% |

|

|

EBITDA |

245 |

246 |

(0.4)% |

|

EBITDA margin |

23.9% |

23.9% |

|

|

Current operating income before acquisition-related

expenses |

147 |

152(a) |

(3.3)% |

|

Current operating income margin (before acquisition related

expenses) |

14.4% |

14.7%(a) |

|

|

Current operating income |

135 |

132 |

+2.3% |

|

Net attributable income |

88 |

40 |

+117% |

|

Earnings per share |

2.32 |

0.92 |

+152% |

|

Diluted earnings per share |

2.17 |

0.92 |

+136% |

|

(a) Including Parcel Pending’s earn-out reversal for an amount of

€6.5 million. Excluding this earn-out reversal, the current

operating income before acquisition-related expenses amounts to

€145 million and the associated margin stands at 14.1%. |

Current operating

income8F8F9 up

6.0% organically

| |

2021 |

2020 |

|

In € million |

MajorOperations |

Additional Operations |

Group total |

Major Operations |

Additional Operations |

Group total |

|

Revenue |

942 |

82 |

1,024 |

919 |

110 |

1,029 |

|

Current operating income before

acquisition-related expenses |

147 |

0 |

147 |

153(a) |

(1) |

152(a) |

|

(a) Including Parcel Pending’s earn-out reversal for an amount of

€6.5 million. Excluding this earn-out reversal, the current

operating incomes before acquisition-related expenses of Major

Operations and of the Group respectively amount to €146 million and

€145 million |

Gross margin

improved slightly to 72.6% in 2021 compared to 72.2% in 2020,

despite higher freight costs. Gross margin benefited from higher

activity, a more favourable revenue mix effect in Intelligent

Communication Automation SaaS solution as well as from a tight

control over costs of sales.

Current operating income

before acquisition-related expenses stood at

€147 million in 2021 up 6.0% on an organic basis compared to

€145 million in 2020 (€152 million including the one-off

Parcel Pending earn-out reversal). This is mainly reflecting the

organic growth in revenue, the improved gross margin, the sustained

profitability of the installed base and active management of

operating expenses, in particular savings in G&A expenses

resulting from further simplification and integration of the

organization as well as a reduction of the Group’s real estate

footprint. In the meantime, as Quadient continues to invest in its

three solutions, planned increased spending in go-to-market and

R&D weighed on the profitability, so did the dilutive impact of

recently acquired and fast-growing businesses dedicated to

financial process automation (YayPay and Beanworks). In addition,

the continuous shift in revenue model towards SaaS subscription (as

opposed to perpetual licenses) is also impacting the mix in

operating income.

Current operating

margin before acquisition-related expenses stood at 14.4%

of sales in 2021 compared to 14.1% in 2020 excluding Parcel Pending

earn-out reversal (14.7% including the earn-out reversal).

Acquisition-related expenses

stood at €12 million in 2021 compared to €20 million in

2020 mainly due to lower M&A activity. Consequently,

current operating income stood at

€135 million in 2021, compared to €132 million in

2020.

Optimization and other

operating expenses stood at €19 million in

2021, a lower amount than in 2020, which stood at €36 million. The

improvement reflects the progresses already made by the Group in

its repositioning and a signal that the phase II of the Back

to Growth strategy is well under way. As a result,

operating income stood at

€116 million in 2021, a significant improvement on the

€96 million recorded in 2020.

Net attributable income

up

c.120%

Active debt management, including the early

repayment of $85 million USPP in September 2020 and the early

repayment of €163 million bond in March 2021, has led to a

significant reduction in the net cost of

debt for the year. 2021 net cost of debt

was €25 million compared to €33 million in 2020.

With the €20 million increase in the fair value

of its investments in the X’ange 2 and Partech Entrepreneurs

private equity funds, the Group recorded €17 million in

currency gains and other

financial items compared to €1 million in 2020.

Overall, net financial result

was limited to a loss of €9 million in 2021 compared to a loss

of €32 million in 2020.

Income tax was down to €20

million in 2021 from €24 million in 2020, which had been impacted

by exceptional bookings to cover for potential tax risks in the UK.

In 2021, the Group benefited from tax loss carry-back measures in

the US in the context of Covid-19 pandemic as well as non-taxable

VC capital gains. Consequently, the corporate tax

rate stood at 18% in 2021 compared to 36% in 2020.

Net attributable

income therefore amounted to €88 million in 2021

compared to €40 million in 2020, a

c.120%

increase.

Earnings per

share stood at €2.32 in 2021 compared to €0.92 in 2020,

while fully diluted EPS was €2.17 in 2021 (€0.92 in 2020).

Strong

cash flow generation

EBITDA9F9F10 stood at

€245 million in 2021 compared to €246 million in 2020.

EBITDA margin remained stable year-over-year at

23.9% in 2021, thanks to a high contribution from the installed

base of customers, for each of the 3 solutions, active cost

management and a leaner organization, offsetting the ongoing supply

chain issues, the dilutive impact of recent acquisitions and

increased investments.

The change in working capital

was negative by €8 million in 2021 compared to a net cash inflow of

€2 million in 2020. The decrease in receivables could not

fully offset the significant inventory increase to mitigate supply

chain disruptions.

Lease

receivables decreased by €39 million in 2021 compared to a

decrease of €62 million in 2020, thanks to a slowdown in the

decline of the leasing portfolio.

The leasing portfolio and other

financing services remained stable year-over-year at

€595 million as of 31 January 2022 compared to

€598 million as of 31 January 2021 which represents an

organic decrease of 6.4% versus an organic decline of 8.7% in 2020.

At the end of the financial year 2021, the default rate of the

leasing portfolio stood at around 1.7%, a level stable versus

2020.

Interest and taxes paid

increased sharply to €66 million in 2021 from €37 million

in 2020. Whilst interests paid were stable year-over-year, income

tax paid rose significantly due to a normalization after the

exceptional measures the Group benefited from in 2020 during the

Covid-19 related crisis.

Capital expenditure was down

marginally at €88 million in 2021 compared to €90 million

in 2020. Development capex was up to €37 million in 2021 (it was

€30 million in 2020) focusing on R&D investments for software

developments and higher spending linked with the recent

acquisitions. Rented equipment capex was stable year-over-year

although reflecting a different mix with higher parcel lockers and

lower mail equipment. Maintenance capex was also stable. Of note is

the lower renewal of real estate lease as further cost optimization

are implemented. This drove down IFRS 16 capex.

Cash flow after capital

expenditure for the year was down to €104 million in

2021 compared to €167 million in 2020.

IMPROVED LEVERAGE AND ROBUST LIQUIDITY

POSITION

Net debt was down slightly,

despite the acquisition of Beanworks, to €504 million as of

31 January 2022 from €512 million as of 31 January

2021 . The issuance of a €270 Schuldschein in November 2021 has

allowed the immediate repayment of €130 million of Schuldschein

debt maturing in 2022 and 2023. Post closing (in February 2022), it

has allowed the further repayment of €83 million of Schuldschein

debt maturing in 2022 and 2023, whilst the remaining will partly

contribute to the repayment of the €265 million ODIRNANE11 bonds by

June 2022. The Group has no other

significant debt maturity before

its €325 million 2.25% bond maturing in 2025.

The leverage ratio (net

debt/EBITDA) remained stable at 2.1x10F10F11. The Group’s net debt

is entirely backed by future cash flows generated from its rental,

leasing and other financing activities. Excluding leasing, the

leverage ratio remained low at 0.4x10 as of 31 January 2022,

unchanged year-over-year. And taking ODIRNANE11F11F12 into account

as debt, the leverage ratio excluding leasing stands at 2.0x10

EBITDA versus 1.9x10 at the end of 2020.Shareholders’

equity stood at €1,359 million as of 31 January

2022 compared to €1,240 million as of 31 January 2021.

The gearing ratio12F12F13 went down to 37% from

41% as of 31 January 2021.

As of 31 January 2022, the Group had a robust

liquidity position of €887 million, split

between €487 million in cash and a €400 million undrawn

credit line, the latter maturing in 2024.

OUTLOOK

Good prospects expected in

2022

- Double-digit

organic sales growth is expected in Intelligent Communication

Automation. Customer growth is expected to remain strong, supported

by cross-selling and the Beanworks and YayPay deployment outside

North America. Increase in SaaS subscriptions and in the use of

cloud platforms is anticipated to continue driving further growth

in annual recurring revenue.

- Organic sales

decline in Mail-Related Solutions is expected to remain contained.

At the end of 2021, backlog levels remain high thanks to solid

bookings and due to supply chain longer deliveries time.

- Double-digit

organic sales growth is expected in Parcel Locker Solutions

supported by the roll-out of existing contracts and by the ongoing

positive momentum with carriers in Europe and Japan. New deals have

also been signed in the retail and residential sectors, including a

good start in the UK. The pipeline of projects is promising with

exciting opportunities ahead in a market which is fast

developing.

2022 Guidance

- At Group level,

full-year 2022 organic sales growth is therefore expected over 2%

thanks to solid performances expected from new solutions combined

with ongoing resilience of Mail-Related Solutions despite the

current uncertainties of the geopolitical situation and ongoing

supply chain disruptions.

- Low to

mid-single digit current EBIT2 organic growth13F13F14 is

anticipated with margins expected to rise as the profitability of

the installed base is expected to continue to improve for both the

SaaS activity and parcel lockers, whilst Mail-Related profit margin

will be maintained. The Group will continue to benefit from a

leaner organization with continuous focus on costs

optimization.

2023 guidance confirmed

- Both sales and

current EBIT2 organic growth CAGR guidance over 2021-2023 are

confirmed i.e., a minimum 3% organic sales growth CAGR and a

minimum mid-single digit organic growth CAGR of current EBIT before

acquisition-related expenses.

BUSINESS HIGHLIGHTS

Quadient

receives 'AA' MSCI ESG Rating Recognizing

Efforts and Achievements Over the Past Years Paris

On January 24, 2022, Quadient announced that it

has been awarded an AA rating in the MSCI ESG Ratings dated

December 2021. MSCI is a leading provider of critical decision

support tools and services for the global investment community. On

a AAA to CCC ratings scale, MSCI ESG Ratings measure over 8,500

companies’ resilience to long-term, industry material

environmental, social and governance (ESG) risks.

The AA rating places Quadient in the Leaders

category alongside peer organizations that show strong management

of their most significant ESG risks and opportunities. In the MSCI

ESG Ratings report, Quadient falls into the highest scoring range

relative to global peers in terms of corporate governance, with an

independent board majority and the alignment of its governance

practices with shareholder interests.

Quadient

introduces the iX-9, a High-output Mailing

and Shipping System Combined with All-in-one Mail Center

Software

August 9, 2021, Quadient announced the general

availability in the U.S. of the latest addition to its successful

iX-Series: the iX-9 Series high-volume mailing system, available

both standalone and integrated with the company’s S.M.A.R.T.®

cloud-based mail center software. The iX-9 expands Quadient’s

intelligent iX-Series mailing and shipping systems first introduced

in the U.S. in 2020, with more than 15,000 units shipped since

launch. The iX-Series includes Quadient’s most advanced shipping,

mailing, accounting and reporting software suite, available in the

iX-3, iX-5, iX-7 and now iX-9 models, to meet the needs of

businesses of all sizes. Ideally fit for high volumes, the iX-9

Series automatically seals, weighs, measures, meters and stacks

large mail runs in minutes. Additionally, the iX-9 also meets the

latest USPS Intelligent Mail Indicia (IMI) and Dimensional Weighing

(DIM) requirements.

Quadient

increases its Commitment to ESG by Joining

the United Nations Global Compact14F14F15

as a Signatory Member

On 25 March 2021, Quadient announced it has

joined the United Nations Global Compact, the world’s largest

corporate sustainability initiative. Quadient joins more than

12,000 companies across the globe in aligning strategies and

operations with the UN Global Compact’s ten universal principles on

human rights, labor, environment and anti-corruption.

Quadient's approach to corporate responsibility

is based on improving working conditions, promoting a culture of

integrity, reducing its environmental footprint, providing

innovative, reliable and sustainable solutions, and supporting the

communities in which the company operates. These pillars have been

aligned with the UN Global Compact principles that Quadient commits

to respect, support and promote by joining the initiative. Becoming

a signatory member also implies taking action to advance the UN

Sustainable Development Goals (SDGs), eight of which Quadient is

already committed to.

This decision demonstrates Quadient’s commitment

to corporate social responsibility and will support further

advancement of the company’s strategic initiatives on

Environmental, Social and Corporate Governance (ESG).

POST-CLOSING EVENTS

Quadient helps DHL expand delivery

network in Sweden with smart outdoor parcel lockers

On 16 March 2022, Quadient announced that DHL,

world's leading logistics company will be rolling out a significant

number of Quadient’s smart parcel lockers in 2022, in outdoor

locations in the largest regions of Sweden. For Quadient, this

strategic partnership with DHL in the region will help both

companies reach their common goal of providing better and more

sustainable delivery services to business customers and consumers.

Parcel Pending by Quadient smart parcel lockers provide the

customer significantly greater flexibility in when and where they

want to pick up their parcels and this reduces the shipping cost

considerably for both carrier and customer.

Purolator

installs Parcel Pending by Quadient Smart

Lockers to Enhance Customer Experience and Meet Increased Package

Delivery Demands

On February 22, 2022, Quadient announced that

Purolator, one of Canada’s leading integrated freight, package and

logistics solutions providers, has installed more than 20 Parcel

Pending by Quadient smart locker systems at its busiest terminals

in Canada. The automated smart lockers provide Purolator’s

customers with a convenient and secure way to retrieve their

packages, any time, day or night. The new locker systems are part

of Purolator’s ongoing investments to enhance customer experience

while meeting the demand of increased e-commerce package volumes.

Smart parcel lockers are emerging as a logistics solution that

speeds up delivery times, improves the delivery experience and

increases package visibility.

Parcel Pending by Quadient’s smart lockers

supported Purolator through its busy 2021 holiday season, during

which more than 12,000 shipments were kept safe from bad weather

and from being stolen. It took customers approximately 15 seconds

to collect their packages.

Quadient

launches its Accounts Payable Automation

Solution Beanworks in UK and France Amidst Rising

Demand

On February 16, 2022, Quadient announced the

launch of Beanworks by Quadient in the United Kingdom (UK) and

France. The leading accounts payable (AP) automation solution

provides accounting teams with a faster, more secure and easier way

to approve invoices and pay vendors from anywhere.

Beanworks by Quadient has been growing in North

America since 2012, with businesses now processing more than €14

billion a year through the platform. The cloud-based AP workflow

provides a multitude of benefits to accounting and financial teams

looking to simplify time-consuming invoice management processing,

reduce fraud risks and manage AP with remote workforces. The

solution offers teams robust features such as automatic data

capture, multi-level invoice approval channels and purchase order

matching. Users also benefit from real-time status updates on

invoices, access to AP inboxes, payment approvals and workflows

that reduce the need for time consuming and error-prone data

entry.

The Beanworks AP solution currently integrates

with market-leading financial software including QuickBooks, Sage

50, Sage 100, Sage 200, Sage 300, Sage Intacct, Microsoft Dynamics

GP, Xero, and NetSuite. Accelerated by the global pandemic and the

increase of remote work, the global market for AP automation is

experiencing significant growth. Adroit Market Research predicts

the AP automation market will reach $4 billion by 2025.

UK and French businesses of all sizes are

beginning to reflect on the benefits of digitizing their financial

processes and shifting to electronic payments with the emerging

e-invoicing regulations in these countries.

To know more about Quadient’s newsflow, previous

press releases are available on our website at the following

address: https://invest.quadient.com/en-US/press-releases.

CONFERENCE CALL

& WEBCAST

Quadient will host a

conference call and webcast today at 6:00 pm Paris time (5:00 pm

London time).To join the webcast, click on the following link:

Webcast.To join the conference call, please use one of the

following phone numbers:▪ France: +33 (0) 1 70 37 71 66;▪ United

States: +1 202 204 1514;▪ United Kingdom (standard international):

+44 (0) 33 0551 0200.Password: QuadientA replay of the webcast will

also be available on Quadient’s Investor Relations website for 12

months.

CALENDAR

- 7 June 2022:

Q1 2022

sales release (after close of trading on the

Euronext Paris regulated market).

***

About Quadient®

Quadient is the driving force behind the world’s

most meaningful customer experiences. By focusing on three key

solution areas, Intelligent Communication Automation, Parcel Locker

Solutions and Mail-Related Solutions, Quadient helps simplify the

connection between people and what matters. Quadient supports

hundreds of thousands of customers worldwide in their quest to

create relevant, personalized connections and achieve customer

experience excellence. Quadient is listed in compartment B of

Euronext Paris (QDT) and is part of the CAC® Mid & Small and

EnterNext® Tech 40 indices.For more information about Quadient,

visit https://invest.quadient.com/

Contacts

|

Catherine Hubert-Dorel,

Quadient+33 (0)1 45 36 61

39c.hubert-dorel@quadient.comfinancial-communication@quadient.com

Caroline Baude, Quadient+33 (0)1 45 36 31

82c.baude@quadient.com |

OPRG FinancialIsabelle Laurent / Fabrice Baron+33

(0)1 53 32 61 51 /+33 (0)1 53 32 61

27isabelle.laurent@oprgfinancial.frfabrice.baron@oprgfinancial.fr |

Appendices

Change in

Q4 2021

sales

|

In € million |

Q4 2021 |

Q4 2020 |

Change |

Change at constant rates |

Organic change(1) |

|

Major Operations |

253 |

254 |

-0.4% |

-4.0% |

-4.4% |

|

Intelligent Communication Automation(a,b) |

54 |

51 |

+6.5% |

+3.0% |

+0.6% |

|

Mail-Related Solutions(b) |

178 |

173 |

2.8% |

-1.1% |

-1.1% |

|

Parcel Locker Solutions |

21 |

30 |

-29.9% |

-32.1% |

-32.1% |

|

Additional Operations |

20 |

33 |

-40.9% |

-41.7% |

+12.9% |

|

Group total |

273 |

287 |

-5.0% |

-8.3% |

-3.3% |

|

In € million |

Q4 2021 |

Q4 2020 |

Change |

Change at constant rates |

Organic

chang1(1) |

|

Major Operations |

253 |

254 |

-0.4% |

-4.0% |

-4.4% |

|

North America |

141 |

135 |

4.7% |

-1.2% |

-2.1% |

|

Main European countries(c) |

98 |

105 |

-6.9% |

-8.0% |

-8.0% |

|

International(d) |

14 |

14 |

-0.3% |

-0.4% |

-0.4% |

|

Additional Operations |

20 |

33 |

-40.9% |

-41.7% |

+12.9% |

|

Group total |

273 |

287 |

-5.0% |

-8.3% |

-3.3% |

|

(a) Intelligent Communication Automation gathers

Business Process Automation and Customer Experience Management

activities formerly presented within Major

Operations(b) Product reclassification from Intelligent

Communication Automation to Mail-Related

Solutions.(c) Including Austria, Benelux, France,

Germany, Ireland, Italy, Switzerland and the United

Kingdom.(d) International includes the activities of

Parcel Locker Solutions in Japan and of Customer Experience

Management outside of North America and the Main European

countries. |

FULL-YEAR

2021

Consolidated income

statement

|

In € million |

2021(period ended on

31 January 2022) |

2020(period ended on

31 January 2021) |

|

Sales |

1,024 |

1,029 |

|

Cost of sales |

(280) |

(286) |

|

Gross margin |

744 |

743 |

|

R&D expenses |

(52) |

(55) |

|

Sales expenses |

(270) |

(252) |

|

Administrative and general expenses |

(175) |

(194) |

|

Maintenance and other expenses |

(99) |

(91) |

|

Employee profit-sharing and share-based payments |

(1) |

1 |

|

Current operating income before acquisition-related

expenses |

147 |

152 |

|

Acquisition-related expenses |

(12) |

(20) |

|

Current operating income |

135 |

132 |

|

Optimization expenses and other operating income &

expenses |

(19) |

(36) |

|

Operating income |

116 |

96 |

|

Financial income/(expense) |

(8) |

(32) |

|

Income before taxes |

108 |

64 |

|

Income taxes |

(20) |

(24) |

|

Share of results of associated companies |

1 |

1 |

|

Net income |

89 |

41 |

|

Minority interests |

1 |

1 |

|

Net attributable income |

88 |

40 |

Simplified consolidated balance

sheet

|

AssetsIn € million |

31 January 2022 |

31 January 2021 |

|

Goodwill |

1,020 |

1,026 |

|

Intangible fixed assets |

138 |

128 |

|

Tangible fixed assets |

186 |

207 |

|

Other non-current financial assets |

99 |

65 |

|

Leasing receivables |

595 |

598 |

|

Other non-current receivables |

6 |

3 |

|

Deferred tax assets |

20 |

17 |

|

Inventories |

73 |

71 |

|

Receivables |

227 |

231 |

|

Other current assets |

95 |

100 |

|

Cash and cash equivalents |

487 |

514 |

|

TOTAL ASSETS |

3,046 |

2,960 |

|

LiabilitiesIn € million |

31 January 2022 |

31 January 2021 |

|

Shareholders’ equity |

1,359 |

1,240 |

|

Long-term provisions |

19 |

27 |

|

Non-current financial debt |

914 |

821 |

|

Other non-current liabilities |

2 |

3 |

|

Current financial debt |

77 |

205 |

|

Deferred tax liabilities |

158 |

148 |

|

Deferred income |

193 |

187 |

|

Financial instruments |

2 |

1 |

|

Other current liabilities |

322 |

328 |

|

TOTAL LIABILITIES |

3,046 |

2,960 |

Simplified cash flow

statement

|

In €millions |

2021(period ended on

31 January 2022) |

2020(period ended on

31 January 2021) |

|

EBITDA |

245 |

246 |

|

Other elements |

(18) |

(16) |

|

Cash flow before net cost of debt and income

tax |

227 |

230 |

|

Change in the working capital requirement |

(8) |

2 |

|

Net change in leasing receivables |

39 |

62 |

|

Cash flow from operating activities |

258 |

294 |

|

Interest and tax paid |

(66) |

(37) |

|

Net cash flow from operating activities |

192 |

257 |

|

Capital expenditure |

(88) |

(90) |

|

Net cash flow after investing activities |

104 |

167 |

|

Impact of changes in scope |

(61) |

(9) |

|

Net cash flow after capex &

acquisitions |

43 |

158 |

|

Disposals of fixed assets |

0 |

0 |

|

Others |

9 |

1 |

|

Net cash flow after acquisitions and

disposals |

52 |

159 |

|

Capital increase |

(3) |

(1) |

|

Dividends paid |

(17) |

(12) |

|

Change in debt and others |

(50) |

(118) |

|

Net cash flow from financing activities |

(70) |

(131) |

|

Cumulative translation adjustments on cash |

(9) |

(12) |

|

Change in net cash position |

(28) |

16 |

1 FY 2021 sales are compared to FY 2020

sales, from which is deducted revenue pro rata temporis from

Proship, the graphics activities in Australia, the APS business and

production facility in the Netherlands and to which is added

revenue prorata temporis from YayPay and Beanworks, for a

consolidated amount of -€40 million, and are restated after a

€8 million negative currency impact over the

period.Q4 2021 sales are compared to Q4 2020 sales, from

which is deducted revenue from ProShip, the graphics activities in

Australia and New Zealand and the APS business and production

facility in the Netherlands and to which is added revenue from

YayPay and Beanworks, for a consolidated amount of

-€15 million, and are restated after a €9 million

positive currency impact over the period.2 Current operating income

before acquisition-related expenses.3 Cash flow after capital

expenditure.4 €487 million of cash and €400 million of

undrawn credit line, the latter maturing in 2024.5 Including

IFRS 16.6 On the basis of 2020 current operating income before

acquisition-related expenses excluding Parcel Pending’s earn-out

reversal, i.e. €145 million, with a scope effect resulting in a

€140 million proforma.7 In order to monitor the financial

performance of its three Major Solutions in a consistent and

comparable way, Quadient has introduced a new profitability metric

per solution called solution profit margin. These solution profit

margins are calculated as revenues minus cost of goods sold as well

as all sales, services, marketing, product and R&D expenses.8

Market being defined as the aggregate of the 3 main global

players.9 Before acquisition-related expenses10 EBITDA = current

operating income + provisions for depreciation of tangible and

intangible fixed assets.11 Including IFRS 16.12 ODIRNANE bonds

amount to €265 million, maturing in 2022. Since there is no

contractual obligation to repay the nominal or to pay coupons to

holders of the bonds, ODIRNANE bonds have been recognized as an

equity instrument.13 Net debt / shareholders’ equity14 On the basis

of 2020 current operating income before acquisition-related

expenses excluding Parcel Pending’s earn-out reversal i.e., €145

million, with a scope effect resulting in a €140 million

proforma.15 To learn more about the UN Global Compact, visit:

https://www.unglobalcompact.org/.

- 2021 FY - Quadient - PR VA DEF

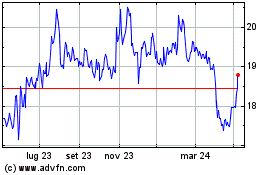

Grafico Azioni QUADIENT (EU:QDT)

Storico

Da Mar 2024 a Apr 2024

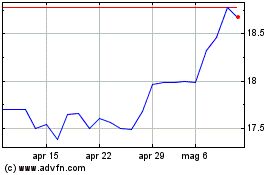

Grafico Azioni QUADIENT (EU:QDT)

Storico

Da Apr 2023 a Apr 2024