SCOR’s Combined General Meeting of 25 May 2023: SCOR shareholders

adopt all the proposed resolutions

Press Release25 May 2023 - N° 10

SCOR’s Combined General Meeting

of 25 May 2023

SCOR shareholders adopt all the proposed

resolutions, as the Group outlines its new strategic plan and

further strengthens its sustainable underwriting

commitments

The Combined General Meeting of SCOR SE was held

on 25 May 2023, at the Group’s headquarters at 5, avenue Kléber,

75016 Paris, and was chaired by Denis Kessler, Chairman of the

Board of Directors of SCOR SE.

All the resolutions proposed by the Board of

Directors were approved by the General Meeting.

The General Meeting approved the appointment of

SCOR SE CEO Thierry Léger as a director of SCOR SE.

The General Meeting ratified the provisional

appointment of Martine Gerow as a director.

It also approved the renewal of the director

mandates of Augustin de Romanet, Adrien Couret, Martine Gerow,

Holding Malakoff Humanis (represented by Thomas Saunier), Vanessa

Marquette, Zhen Wang, and Fields Wicker-Miurin.

Finally, the General Meeting approved the

payment of a dividend of EUR 1.40 per share for the 2022 financial

year. The coupon date is set at 30 May 2023 and the payment date at

1 June 2023.

The details of the resolution voting results

have been posted on the company’s website.

*

*

*

During the General Meeting, Thierry Léger, Chief Executive

Officer of SCOR, presented the outlines of the new strategic plan

for the period 2024 to 2026.

This new plan, which will be presented in detail

at SCOR's Investor Day on 7 September 2023, will be based on two

main areas:

- Maximizing the Group’s Economic

Value and maintaining a high level of solvency in a favorable

market environment;

- Developing the Group’s business

model to increase its competitiveness.

SCOR is in a strong position to benefit from the

current supportive environment. Its three business units will be

the Group's main drivers of growth and value creation:

- L&H: SCOR will fully leverage

its L&H reinsurance platform to generate attractive and stable

cashflows;

- P&C: SCOR will take full

advantage of the P&C reinsurance cycle to improve its risk

profile and maximize value creation;

- Investments: SCOR will pursue its

prudent investment policy while maintaining a high level of

liquidity.

The Group will evolve its business model, which

also creates value, through four levers:

- Closer and more dynamic steering of

capital allocation;

- Strengthened asset & liability

management;

- The establishment of risk

partnerships through centralized retrocession;

- Structuring the model around

data.

*

*

*

During the General Meeting, SCOR also announced

new sustainable underwriting commitments, which will take effect on

1 September 2023:

New policy on gas SCOR will

exclude standalone direct insurance and facultative reinsurance

coverage for new gas field development projects1. This complements

the similar commitment made last year on new oil field development

projects.

New policy on Arctic oil and

gasSCOR will exclude specific, standalone direct insurance

and facultative reinsurance coverage for oil and gas exploration,

production and related dedicated infrastructure projects in the

Arctic Monitoring and Assessment Programme (AMAP) Region, with the

exception of the Norwegian Arctic Region.

New policy on oil sandsSCOR

will not provide any new (or increase its commitments on existing)

standalone direct insurance and facultative reinsurance coverage in

respect of oil sands operations1 (both extraction and

upgraders).

New policy on coalSCOR will

exclude standalone direct insurance and facultative reinsurance

coverage for new dedicated thermal coal mining infrastructure

(e.g., ports, washing and handling facilities).SCOR will not write

any new business in respect of:

- standalone thermal coal mines

- standalone unabated coal-fired

power plants.

*

*

*

Contact details

Media RelationsAlexandre

Garciamedia@scor.com

Investor RelationsYves

Cormier ycormier@scor.com

www.scor.com

LinkedIn: SCOR | Twitter: @SCOR_SE

SCOR, a Global Tier 1

Reinsurer

SCOR, a leading global reinsurer, offers its

clients a diversified and innovative range of reinsurance and

insurance solutions and services to control and manage risk.

Applying “The Art & Science of Risk”, SCOR uses its

industry-recognized expertise and cutting-edge financial solutions

to serve its clients and contribute to the welfare and resilience

of society.

SCOR offers its clients a Tier 1 reinsurer

rating from Standard & Poor’s, AM Best, Moody’s and Fitch.

The Group generated premiums of EUR 19.7 billion

in 2022 and serves clients in more than 160 countries from its 35

offices worldwide.

For more information, visit: www.scor.com

1 Exceptions may be made for specific,

standalone direct insurance and facultative reinsurance coverage

for insureds with a verified strategy that is aligned with a

credible Net-zero by 2050 transition plan and will be based on the

Science Based Targets initiative (SBTi), once available, or

comparable third-party issued science-based target setting guidance

for the upstream oil and gas sector.

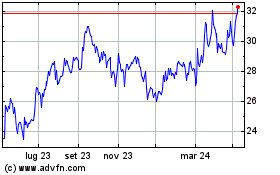

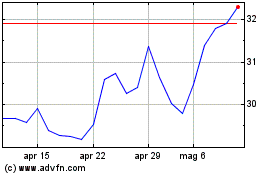

Grafico Azioni Scor (EU:SCR)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Scor (EU:SCR)

Storico

Da Mag 2023 a Mag 2024