Highlights and Key Figures for Q3 2018

08 Novembre 2018 - 7:00AM

Highlights:

-

High sales activity in closing and pursuing

monopile projects for 2019-2021 timeframe

-

Appointment and start of CEO Fred van

Beers

-

Production resumed in August after 4-month

black-out period

-

Successful testing of blue piling

innovation

-

Material supplies and load-outs delayed beyond

Sif's control

Key figures:

-

Year-to-Date contribution decreased to €57.0

million (€104.7 million YTD 2017)

-

Adjusted EBITDA Year to Date fell to €13.0

million (€44.9 million YTD 2017)

-

Operating Working Capital at end of Q3 2018

€28.4 million (€32.7 million at end of Q2 2018)

-

Net Debt at end of Q3 2018 €43.1 million (€52.5

million at end of Q2 2018)

-

Throughput of 19 Kton brings Year to Date

production to 100 Kton (167 Kton YTD Q3 201

-

Order book 45 Kton for Q4 2018, 200 Kton

for 2019 and 90 Kton for 2020

Highlights and Key Figures for Q3

2018.fin

This

announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Sif Holding NV via Globenewswire

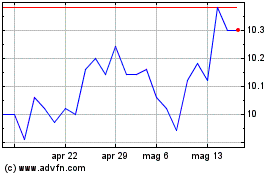

Grafico Azioni Sif Holding NV (EU:SIFG)

Storico

Da Feb 2025 a Mar 2025

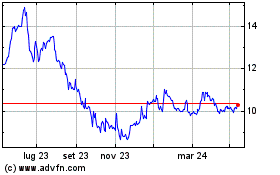

Grafico Azioni Sif Holding NV (EU:SIFG)

Storico

Da Mar 2024 a Mar 2025

Notizie in Tempo Reale relative a Sif Holding NV (Euronext (Parigi)): 0 articoli recenti

Più Sif Holding NV Articoli Notizie