Solvay successfully completes its inaugural EUR 1.5 billion dual tranche bond issuance

26 Marzo 2024 - 7:01PM

Solvay successfully completes its inaugural EUR 1.5 billion dual

tranche bond issuance

Brussels, March 26, 2024, 19:00 CET

Solvay today successfully completed the placement of its

inaugural bond transaction, which represents another important

milestone after the partial demerger of its Specialty Businesses in

December 2023.

“This key transaction strengthens the capital structure of

Solvay and gives the company the financial stability to

execute its strategy in this new phase of its journey,” said

Alexandre Blum, Solvay CFO. “We are particularly pleased with the

exceptional participation of more than 250 and 300 investors in the

4-year tranche and the 7.5-year tranche respectively. This

contributed to a transaction nearly 6 times oversubscribed, a clear

testimony of the continuous support and confidence from

institutional investors in Solvay's vision and strategy".

The 4-year €750m bond maturing on April 3rd, 2028, and the

7.5-year €750m bond maturing on Oct 3rd, 2031, will have coupons of

3.875% and 4.250% respectively. Both bonds will be rated BBB- by

S&P, matching Solvay's long-term credit rating. Bond settlement

is scheduled for April 3, 2024, with trading expected to begin on

the Euro MTF market of the Luxembourg Stock Exchange around the

same time.

In alignment with its prudent financial policy, the proceeds

will be used for general corporate purposes, including the

refinancing of the EUR 1.5b bridge facility set up at the end of

2023 in relation to the partial demerger.

BNP Paribas, BofA Securities, J.P. Morgan and Morgan Stanley

acted as Global Coordinators for the transaction and as Joint

Bookrunners together with Commerzbank, Crédit Agricole CIB, ING and

KBC Bank.

Disclaimer

THIS COMMUNICATION IS NOT INTENDED FOR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN OR INTO THE UNITED STATES OR ANY OTHER JURISDICTION

WHERE SUCH DISTRIBUTION IS PROHIBITED UNDER APPLICABLE LAW.The

issue, exercise or sale of securities in the offering are subject

to specific legal or regulatory restrictions in certain

jurisdictions. The information contained herein shall not

constitute or form part of an offer to sell or the solicitation of

an offer to buy, nor shall there be any sale of the securities

referred to herein, in any jurisdiction in which such offer,

solicitation or sale would be unlawful. Solvay SA assumes no

responsibility in the event there is a violation by any person of

such restrictions.This press release does not constitute an offer

to sell, or a solicitation of offers to purchase or subscribe for,

securities in the United States or any other jurisdiction. The

securities referred to herein have not been, and will not be,

registered under the Securities Act of 1933, as amended, and may

not be offered, exercised or sold in the United States or to, or

for the account or benefit of, U.S. persons, except pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act of 1933. There is

no intention to register any portion of the offering in the United

States or to conduct a public offering of securities in the United

States.This communication may only be communicated, or caused to be

communicated, to persons in the United Kingdom in circumstances

where the provisions of Section 21 of the Financial Services and

Markets Act 2000, as amended (the “Financial Services and Markets

Act”) do not apply to Solvay SA and is directed solely at persons

in the United Kingdom who (i) have professional experience in

matters relating to investments, such persons falling within the

definition of “investment professionals” in Article 19(5) of the

Financial Services and Markets Act (Financial Promotion) Order

2005, as amended (the “Order”) or (ii) are persons falling within

Article 49(2)(a) to (d) of the Order or other persons to whom it

may lawfully be communicated (all such persons together being

referred to as “relevant persons”). This communication is directed

only to relevant persons and must not be acted on or relied on by

persons who are not relevant persons.The securities referred to

herein are not intended to be offered, sold or otherwise made

available to, and should not be offered, sold or otherwise made

available to, any retail investor in the European Economic Area

(“EEA”). For these purposes, a retail investor means a person who

is one (or more) of: (i) a retail client as defined in point (11)

of Article 4(1) of Directive 2014/65/EU, as amended (“MiFID II”) or

(ii) a customer within the meaning of Directive (EU) 2016/97, as

amended, where that customer would not qualify as a professional

client as defined in point (10) of Article 4(1) of MiFID II.The

securities referred to herein are not intended to be offered, sold

or otherwise made available to, and should not be offered, sold or

otherwise made available to, any retail investor in the United

Kingdom (“UK”). For these purposes, a retail investor means a

person who is one (or more) of: (i) a retail client as defined in

point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms

part of domestic law by virtue of the European Union (Withdrawal)

Act 2018 (“EUWA”) or (ii) a customer within the meaning of the

provisions of the Financial Services and Markets Act and any rules

or regulations made under the Financial Services and Markets Act to

implement Directive (EU) 2016/97, where that customer would not

qualify as a professional client as defined in point (8) of Article

2(1) of Regulation (EU) No 600/2014 as it forms part of domestic

law by virtue of the EUWA.The securities referred to herein are

also not intended to be offered, sold or otherwise made available,

and should not be offered, sold or otherwise made available, in

Belgium to consumers (consumenten/consommateurs) within the meaning

of the Belgian Code of Economic Law (Wetboek van economisch

recht/Code de droit économique), as amended.The securities referred

to herein may be held only by, and transferred only to, eligible

investors referred to in Article 4 of the Belgian Royal Decree of

26 May 1994, holding their securities in an exempt securities

account that has been opened with a financial institution that is a

direct or indirect participant in the securities settlement system

operated by the National Bank of Belgium or any successor

thereto.This press release is not a prospectus nor an advertisement

for the purpose of Regulation (EU) 2017/1129.

- 20240326_Bonds issuance_EN

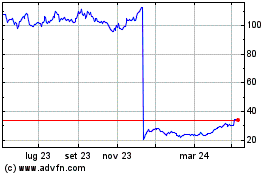

Grafico Azioni Solvay (EU:SOLB)

Storico

Da Dic 2024 a Gen 2025

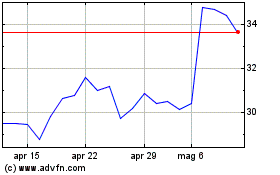

Grafico Azioni Solvay (EU:SOLB)

Storico

Da Gen 2024 a Gen 2025