Unilever Raises 2022 Sales Guidance on Robust Pricing Despite Volume Drop

26 Luglio 2022 - 8:57AM

Dow Jones News

By Michael Susin

Unilever PLC said Tuesday that it expects underlying sales

growth for the full year to exceed previous guidance, driven by

higher prices, although volumes are forecast to be under

pressure.

The Anglo-Dutch retailer--which owns consumer brands such as Ben

& Jerry's ice cream, Dove soap and Cif and Domestos cleaning

products--said it currently sees underlying sales growth ahead of

the previously guided range of 4.5% to 6.5%.

"The medium-term macroeconomic and cost inflation outlooks are

uncertain and volatile, but delivering growth remains our first

priority. Against this backdrop, we continue to expect to improve

margin in 2023 and 2024, through pricing, mix and savings," it

said.

The company posted underlying sales growth of 8.1% for the first

half of the year, with a decrease of 1.6% in volumes and an

increase of 9.8% in prices. Analysts' consensus for underlying

sales growth was 7.2%, according to a forecast taken from the

company's website.

For the second quarter, sales growth came in at 8.8%, beating

the company's compiled consensus of 7%.

The company said first-half pretax profit was 4.36 billion euros

($4.46 billion) compared with EUR4.37 billion a year earlier.

Turnover came in at EUR29.6 billion, including EUR15.8 billion

in the second quarter. Analysts expected half year and second

quarter turnover of EUR29.04 billion and EUR15.26 billion,

respectively.

The board declared a quarterly dividend of 42.68 European cents

a share, the same amount as for the first half of 2021.

Write to Michael Susin at michael.susin@wsj.com

(END) Dow Jones Newswires

July 26, 2022 02:42 ET (06:42 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

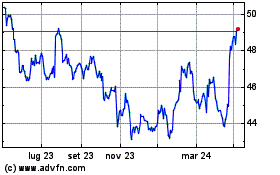

Grafico Azioni Unilever (EU:UNA)

Storico

Da Mar 2024 a Apr 2024

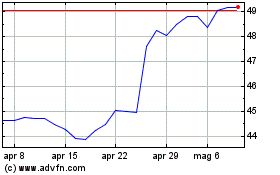

Grafico Azioni Unilever (EU:UNA)

Storico

Da Apr 2023 a Apr 2024