Vetoquinol: Annual Sales 2023: €529 Million

24 Gennaio 2024 - 5:45PM

Business Wire

Annual Sales of Essential products: €313 million (up 4.5%

at constant exchange rates)

Regulatory News:

Matthieu Frechin, Chairman and CEO of Vetoquinol

(Paris:VETO), said: "In an animal health market with flat

volumes, our 2023 sales reflect our company’s resilience and

agility. Sales were driven by the strong performance of our

Essentials products in the second half of the year; their sustained

growth has enabled us to continue to improve our product mix and

increase the efficiency of our operations. We are therefore

actively pursuing the implementation of our strategy, and in

particular our ambitious program of innovation, registration and

launch of Essentials products."

Vetoquinol recorded sales of €529 million, stable at constant

exchange rates and down -1.9% on a reported basis. Foreign

exchange had a negative impact of €10 million, linked to the

Americas and Asia-Pacific/Rest of World territories.

Rationalization of the non-Essentials product portfolio had a

negative impact of around €10 million on sales for the year. The

good level of sales in the 2nd half of 2023, up +4.5% at constant

exchange rates, offset a first half disrupted by cyclical factors,

notably the impact of the ERP changeover in the second quarter.

At the end of December 2023, sales of Essentials products

totalled €313 million, up +4.5% at constant exchange rates and

+2.9% on a reported basis. The second half of the year was

particularly dynamic, with organic growth of +10% for Essentials

products, which benefited notably from the strong performance of

the launches of Felpreva®, a parasiticide product for cats in

Europe, and Simplera®, a drug indicated for the treatment of otitis

in dogs in the United States. By the end of December 2023, sales of

Essentials products accounted for more than 59% of the Group’s

sales, compared with 56% for the same period in 2022.

Over the full 12 months of 2023 and at constant exchange rates,

the Americas strategic territory grew by +5.1% (vs. +2.3% in H1

2023). Europe's territory was stable at -0.3% (vs. -5.5% in H1

2023), while Asia Pacific/Rest of World was down -10.0% (vs. -16.3%

in H1 2023), mainly due to the distributor business.

Sales of products for companion animals (€372m) rose by +3.6% at

constant exchange rates (vs. -0.4% in H1 2023) and accounted for

70.2% of the Vetoquinol’s total sales; these rose by +7.5% in the

2nd half. Sales of farm animal products came to €157m, down -7.6%

at constant exchange rates (vs. -13.8% in H1 2023); these sales

were down slightly by -1.7% in the 2nd half.

In Q4 2023, all territories - Europe, Americas and

Asia-Pacific/Rest of World - achieved like for like growth of

+6.6%, +1.6% and +2.4% respectively. Group sales were up +3.9% at

constant exchange rates and +1.7% on a reported basis.

The Group's cash position was up at the end of December 2023

compared with June 30, 2023.

Full-year sales for 2023 have not been audited by the Statutory

Auditors.

Next update: Annual results 2023, March 20, 2024 after

market close.

ABOUT VETOQUINOL Vetoquinol is a leading global animal health

company, with operations in Europe, the Americas and Asia/Pacific.

Independent and a pure player, Vetoquinol innovates, develops and

markets veterinary medicines and non-medicated products for

livestock (cattle, pigs) and companion animals (dogs, cats). Since

its creation in 1933, Vetoquinol has combined innovation and

geographic diversification. The strengthening of the product

portfolio and acquisitions made in high-potential territories

ensure hybrid growth for the Group. At December 31, 2023,

Vetoquinol employed 2,483 people.

Vetoquinol has been listed on Euronext Paris since 2006 (symbol:

VETO). The Vetoquinol share is eligible for the French PEA and

PEA-PME personal equity plans.

€m

2023

2022

Change (reported data)

Change (constant exchange

rates)

Q1 Sales

145.4

135.0

+7.7%

+7.2%

Q2 Sales

110.8

135.8

-18.3%

-16.3%

Q3 Sales

135.8

134.1

+1.3%

+5.1%

Q4 Sales

137.3

134.9

+1.7%

+3.9%

Aggregate 12-month sales*

529.3

539.8

-1.9%

-0.1%

* non-audited data

ALTERNATIVE PERFORMANCE INDICATORS Vetoquinol Group

management considers that these indicators, which are not defined

by IFRS, provide additional information that is relevant for

shareholders seeking to analyze underlying trends and Group

performance and financial position. They are used by management for

performance analysis.

Essentials products: The products referred to as

“Essentials” comprise veterinary drugs and non-medical products

sold by the Vetoquinol Group. They are existing or potential

market-leading products designed to meet the daily requirements of

vets in the companion animal or livestock sector. They are intended

for sale worldwide and their scale effect improves their economic

performance.

Constant exchange rates: Application of the previous

period’s exchange rates to the current financial year, all other

things remaining equal.

Like-for-like (LFL) growth: Year-on-year sales growth in

terms of volume and/or price at constant consolidation scope and

exchange rates.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240124321002/en/

FOR MORE INFORMATION, CONTACT:

VETOQUINOL

Investor Relations Fanny Toillon Tel.: +33 (0)3 84

62 59 88 relations.investisseurs@vetoquinol.com

KEIMA COMMUNICATION

Investor & Media Relations Emmanuel Dovergne

Tel.: +33 (0)1 56 43 44 63 emmanuel.dovergne@keima.fr

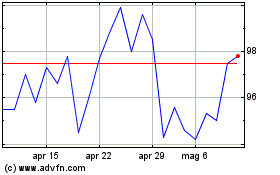

Grafico Azioni Vetoquinol (EU:VETO)

Storico

Da Mar 2024 a Apr 2024

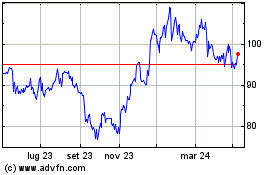

Grafico Azioni Vetoquinol (EU:VETO)

Storico

Da Apr 2023 a Apr 2024