Vranken-Pommery Monopole - 2024 Half Year Results - Current

Operating income up 22.8%

2024 HALF YEAR RESULTS

Current Operating income up

22.8%

|

CONSOLIDATED TURNOVER |

CURRENT

OPERATING INCOME |

NET INCOME |

NET FINANCIAL

DEBT* |

|

€ 109,6 million |

€ 15,1 million |

€ -1,9 million |

€ 679,5 million |

|

-8,1% |

+2,8€M |

-0,9€M |

|

|

vs H1 2024 |

*excluding IFRS16 : 661,3 €M

Reims, september 12, 2024

The Board of Directors of Vranken-Pommery

Monopole met on September 12, 2024 under the chairmanship of Mr.

Paul François Vranken, and in the presence of the Statutory

Auditors, to approve the Group's financial statements for the half

year 2024.

The limited review procedures on the half-yearly financial

statements have been performed by the statutory auditors. Their

limited review report is being issued.

|

|

|

|

|

|

Vs published |

Vs restated |

|

Consolidated data in €M |

06/2024 |

06/2023 published |

06/2023

restated (*) |

|

Change in €m |

Change in % |

Change in €m |

Change in % |

|

Turnover |

109,6 |

117,7 |

117,7 |

|

-8,1 |

-6,9% |

-8,1 |

-6,9% |

|

Current Operating Income |

15,1 |

11,0 |

12,3 |

|

+4,1 |

+37,3% |

+2,8 |

+22,8% |

|

Operating Income |

14,7 |

11,2 |

12,6 |

|

+3,5 |

+31,3% |

+2,1 |

+16,7% |

|

Financial result |

-16,4 |

-12,8 |

-12,8 |

|

-3,6 |

|

-3,6 |

|

|

Net Income |

-1,9 |

-2,0 |

-1,0 |

|

+0,1 |

|

-0,9 |

|

|

Attributable to equity holders of the

parent |

-1,9 |

-1,9 |

-1,0 |

|

0,0 |

|

-0,9 |

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity |

410,9 |

404,9 |

401,5 |

|

+6,0 |

+1,5% |

+9,4 |

+2,3% |

|

Minority interests |

5,3 |

5,1 |

5,1 |

|

+0,2 |

|

+0,2 |

|

|

Net financial debt |

729,5 |

701,2 |

701,2 |

|

+28,3 |

+4,0% |

+28,3 |

+4,0% |

|

Net bank and bonds debt |

679,5 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(*) At the close of the 2023 financial year,

an error was identified in the valuation of inventories relating to

the 2019 to 2022 financial years. This error was corrected in the

second half of 2023, but was still present when the consolidated

financial statements at June 30, 2023 were published. In

application of IAS 8 “Accounting policies, changes in accounting

estimates and errors”, VPM's consolidated financial statements have

therefore been treated retrospectively for this error correction.

The comparative income statement for 2023 has been restated, with a

positive impact of 1 million euros on the published net income for

the six months to June 30, 2023. These corrections have no impact

on the income statement for fiscal 2024.

Sales down slightly

Half-year consolidated sales for Vranken-Pommery

Monopole were down 6.9% at €109.6 million.

France (37% of consolidated

sales), where the Group relies on strong positions notably in all

networks, was stable compared with the first half

of 2023.

Exports were down 8.9%, representing 63%

of Group sales.

After two particularly dynamic years, the wine

market is experiencing a slowdown worldwide, due to the climate of

economic and geopolitical uncertainty that has prevailed since the

end of 2023. Champagne expeditions are following this trend,

falling by 15.2% in volume at the end of June (source Comité

Champagne).

Against this backdrop, the most prestigious

cuvées - Cuvée Louise from Champagne Pommery & Greno and Cuvée

Diamant from Champagne Vranken - managed to hold their own, with a

favorable impact on margins.

Operating income: value creation

strategy confirmed

The strategy of moving brands upmarket and

internationalizing them produced results in the first half of 2024,

reflected in improvements in EBITDA margin and operating margin

before non-recurring items. EBITDA for H1 2024

rose by 14.2% to €22.3m (vs. €19.2m in restated H1

2023).

- Current operating income came to

€15.1m (+€2.8m), up +22.8%.

- The operating margin on ordinary activities was 13.8%, compared

with 10.4% in 2023.

- Operating income rose by

+16.7% to €14.7 million.

- The increase in margins partly offset the rise in interest

rates in the first half of 2024 and the a €3.6 million decrease in

net financial income.

- Net income came to -1.9

M€.

A stable financial

structure

Shareholders' equity rose by

€9.4m to €410.9m, representing

31.2% of the balance sheet total.

Net financial debt rose by 28.3 M€ to 729.5 M€

(711.2 M€ excluding IFRS 16 impact). This increase is due to :

- the seasonal nature of champagne sales

- higher inventories (+20.5 M€).

During the first half of the year, the Group

repaid the June 19, 2024 bond maturity of €50 million with a

current account advance from parent company Compagnie Vranken for

the same amount.

With this injection of stable capital,

net financial debt (bank and bond) has been reduced to 679.5 M€

(661.2 M€ excluding IFRS 16). On this occasion, the

Vranken family reaffirms its commitment to strengthening the

Group's financial structure and pursuing its debt reduction

strategy.

The Group's next bond maturity is in July

2025.

Post-closing, the Group has renewed almost €235

million of ageing loans, the maturity of which has been extended to

July 2026.

During the summer, the Group hedged a

significant portion of its variable-rate debt against interest-rate

trends.

Société à Mission « La Vérité du

Terroir »

The Mission Committee is continuing its work on

the preservation of biodiversity, and in particular on the

construction of relevant indicators on this subject.

The Group is also committed to a global approach

to reducing its carbon footprint and promoting renewable energies.

It was against this backdrop that last June, the sailboat Grain de

Sail left the port of Saint-Malo with a prestigious cargo:

the first pallet of Maison Pommery's Apanage Brut 1874

cuvée, bound for the United States. The ship arrived in

New York in September.

This exceptional sea voyage revives an historic

tradition. Just 120 years ago, on the occasion of the World's Fair

in Saint-Louis (Missouri), Champagne Pommery arrived in America by

sailboat.

This initiative to transport its champagnes by

sailboat is a perfect illustration of Maison Pommery's commitment

to sustainable, environmentally-friendly practices.

Forecast

In Champagne, the harvest has

just begun and the appellation yield has been set at 10,000 kg/ha.

Poor weather conditions in 2024 have reduced harvest potential

without compromising quality. The Champagne regulation mechanism

(release of reserve wines) will cushion the effects of these

climatic hazards.

In Provence, harvesting at

Château La Gordonne is underway. The maximum AOP Côtes de Provence

yield of 45 hl/ha will be reached.

In Camargue, the harvest is

drawing to a close, and the yield for AOP Sable de Camargue will be

18% lower than in 2023

In Douro Valley, harvesting

began in mid-August, with yields and grape quality on target

The Group believes that after two years of

strong post-covid growth, 2024 will be a year of business

normalization.

Next communication :

Publication of 2024 sales on January 28, 2025 after close of

trading

About Vranken-Pommery

Monopole

Vranken-Pommery Monopole manages 2,600 hectares

of land, owned outright or under lease and spread over four

vineyards in Champagne, Provence, Camargue and Douro. The group’s

wine-making activities range from production to marketing, with a

strong commitment to the promotion of terroirs, sustainable

wine-growing and environmental conservation.

Its brand portfolio includes:

- the

Vranken, Pommery & Greno, Heidsieck & Co Monopole, Charles

Lafitte and Bissinger & Co champagnes;

- the

Rozès and Sao Pédro port wines and the Terras do Grifo Douro

wines;

- the

Domaine Royal de Jarras and Pink Flamingo Camargue wines and the

Château La Gordonne Provence wines;

- the

Sparkling wines, the Louis Pommery California, Louis Pommery

England, Brut de France and Pink Flamingo sparkling wines.

Vranken-Pommery Monopole is a company listed

on NYSE Euronext Paris and Brussels.

(code "VRAP" (Paris), code "VRAB" (Brussels); ISIN code:

FR0000062796).

Contacts

Vranken-Pommery Monopole :

Franck Delval, Directeur des Contrôles Financiers

+33 3 26 61 62 34, comfi@vrankenpommery.fr |

Press

Laurent Poinsot, +33 1 53 70 74 77, lpoinsot@image7.fr

Caroline Simon, +33 1 53 70 74 65, caroline.simon@image7.fr |

|

|

|

- Press release VPM 2024 H1 Results

- Press release VPM 2024 H1 Results

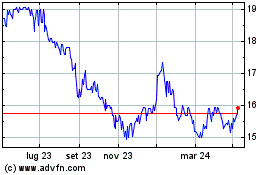

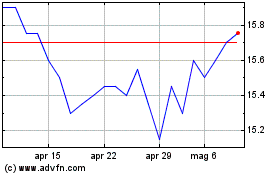

Grafico Azioni Vranken Pommery Monopole (EU:VRAP)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Vranken Pommery Monopole (EU:VRAP)

Storico

Da Nov 2023 a Nov 2024