Aussie Falls As Soft Australia Inflation Data Signals RBA Rate Cut

29 Gennaio 2025 - 2:57AM

RTTF2

The Australian dollar weakened against other major currencies in

the Asian session on Wednesday, as softer Australian inflation data

signaled a potential interest rate cut by the RBA in February.

The Reserve Bank of Australia or the RBA has maintained the

Official Cash Rate (OCR) at 4.35 percent since November 2023,

stating that any rate reduction cannot be contemplated until

inflation has "sustainably" returned to its goal range of 2% to

3%.

Data from the Australian Bureau of Statistics showed that

Australia's consumer price inflation eased in December to the

lowest since early 2021 on falling electricity and auto fuel

prices.

Consumer prices logged an annual increase of 2.4 percent in the

December quarter, following a 2.8 percent rise in the preceding

period. This was the lowest rate since March 2021.

On a quarterly basis, the consumer price index rose 0.2 percent,

the same pace of growth as seen in the September quarter.

The statistical office also released the December monthly CPI

indicator today, which rose 2.5 percent on a yearly basis in

December, which was faster than the 2.3 percent rise in

November.

Traders remain cautious ahead of the U.S. Fed's interest rate

decision later in the day.

The Fed is widely expected to leave interest rates unchanged,

but traders will pay watch for the accompanying statement for clues

about the outlook for rates.

Recent economic data has led to concerns about the Fed leaving

rates on hold for a prolonged period, but many economists still

expect the central bank to resume cutting rates sometime in the

first half of the year.

CME Group's FedWatch Tool is currently indicating a 74.5 percent

chance rates will be lower by at least a quarter point following

the Fed's June meeting.

In the Asian trading today, the Australian dollar fell to a

2-day low of 96.81 against the yen and a 4-week low of 1.6751

against the euro, from yesterday's closing quotes of 97.25 and

1.6680, respectively. If the aussie extends its downtrend, it is

likely to find support around 95.00 against the yen and 1.69

against the euro.

Against the U.S., the Canada and New Zealand dollars, the aussie

dropped to an 8-day low of 0.6227, a 1-week low of 0.8971 and a

1-month low of 1.1006 from Tuesday's closing quotes of 0.6252,

0.9004 and 1.1038, respectively. The aussie may test support near

0.60 against the greenback, 0.88 against the loonie and 1.09

against the kiwi.

Looking ahead, the European Central Bank is slated to issue euro

area monetary aggregates for December at 4:00 am ET. M3 is expected

to rise 3.9 percent annually after a 3.8 percent rise in

November.

In the New York session, U.S. mortgage approvals data, goods

trade balance for December, retail and wholesale inventories data

for December and U.S. EIA crude oil data are slated for

release.

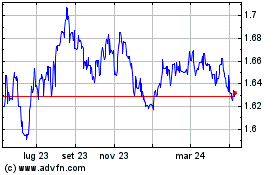

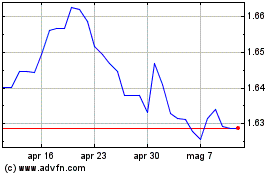

Grafico Cross Euro vs AUD (FX:EURAUD)

Da Dic 2024 a Gen 2025

Grafico Cross Euro vs AUD (FX:EURAUD)

Da Gen 2024 a Gen 2025