Canadian Dollar Drops As BoC Cuts Interest Rates

05 Giugno 2024 - 2:42PM

RTTF2

The Canadian dollar declined against its major counterparts in

the New York session on Wednesday, as the Bank of Canada lowered

interest rates by 25 basis points.

The Bank of Canada reduced its target for the overnight rate to

4.75 percent, with the bank rate at 5.0 percent and the deposit

rate at 4.75 percent.

The widely expected decision comes as recent data has increased

the Canadian central bank's confidence that inflation will continue

to move towards its 2 percent target.

The bank's accompanying statement noted its preferred measures

of core inflation has slowed, while three-month measures suggest

continued downward momentum.

Nonetheless, the Bank of Canada noted risks to the inflation

outlook remain and said its Governing Council is closely watching

the evolution of core inflation.

The Governing Council remains particularly focused on the

balance between demand and supply in the economy, inflation

expectations, wage growth, and corporate pricing behavior, the bank

said.

The loonie reached as low as 0.9115 against the aussie. The

currency is likely to face support around the 0.92 region, if it

falls again.

The loonie fell to near a 2-week low of 1.3741 against the

greenback and more than a 6-month low of 1.4929 against the euro,

off its early highs of 1.3665 and 1.4856, respectively. The

currency may locate support around 1.39 against the greenback and

1.50 against the euro.

The loonie eased against the yen and was trading at 113.93. The

currency is seen finding support around the 108.00 level.

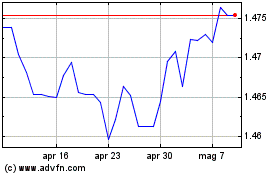

Grafico Cross Euro vs CAD (FX:EURCAD)

Da Mag 2024 a Giu 2024

Grafico Cross Euro vs CAD (FX:EURCAD)

Da Giu 2023 a Giu 2024