U.S. Dollar Falls As Bank Worries Recede

17 Marzo 2023 - 6:48AM

RTTF2

The U.S. dollar declined against its major counterparts in the

early European session on Friday amid risk appetite, as concerns

over a global banking crisis eased following multi-billion-dollar

lifelines for troubled U.S. and European banks.

Large US banks deposited $30 billion into First Republic Bank to

shore up the beleaguered lender.

The Swiss National Bank's financial support for Credit Suisse

helped restore some calm to financial markets.

Markets are pricing in another 25 basis point hike from the U.S.

Federal Reserve when it meets next week.

The dollar index that tracks the greenback against a basket of

other currencies fell to a 2-day low of 103.89.

The greenback fell to 2-day lows of 1.2176 against the pound and

1.0669 against the euro, from its prior highs of 1.2090 and 1.0604,

respectively. The greenback may find support around 1.25 against

the pound and 1.08 against the euro.

The greenback depreciated to 2-day lows of 0.6258 against the

kiwi and 1.3677 against the loonie, after rising to 0.6182 and

1.3736, respectively in early deals. The currency is seen finding

support around 0.64 against the kiwi and 1.32 against the

loonie.

The greenback edged down to 0.9240 against the franc and 132.74

against the yen, retreating from its early highs of 0.9301 and

133.74, respectively. The greenback is poised to test support

around 0.90 against the franc and 128.00 against the yen.

The greenback touched 0.6724 against the aussie, its weakest

level since March 7. On the downside, 0.69 is possibly seen as its

next support level.

Looking ahead, Canada PPI for February, U.S. industrial

production for February and Michigan's preliminary consumer

sentiment index for March are slated for release in the New York

session.

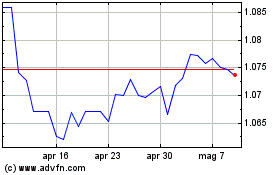

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Mar 2024 a Apr 2024

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Apr 2023 a Apr 2024