U.S. Dollar Advances Ahead Of Key Inflation Data

11 Novembre 2024 - 1:55PM

RTTF2

The U.S. dollar climbed against its major counterparts in the

New York session on Monday, as investors await upcoming U.S.

inflation data and speeches by Federal Reserve officials for

additional clues to the Fed's rate trajectory.

U.S. reports on consumer and producer prices, retail sales and

industrial production due later in the week may provide further

insights into the health of the world's largest economy as the

Presidency and Senate falls into Republican hands, presenting a

clear path for Trump to enact any major policy changes.

Trump won a second term as president on a platform of steep

import taxes, including tariffs as high as 60 percent on China. The

focus is now on how quickly Trump will implement his fiscal and

protectionist trade policies.

Federal Reserve Bank of Minneapolis President Neel Kashkari

indicated at the weekend that tariffs would hurt long-term

inflation if global trade partners were to strike back.

According to CME Fedwatch, traders currently bet on a 65.9

percent chance for a 25-basis point rate cut in December, and a

34.1 percent chance that rates will remain unchanged.

The greenback climbed to near a 7-month high of 1.0628 against

the euro and a 5-day high of 1.2855 against the pound, off its

early lows of 1.0727 and 1.2925, respectively. The next possible

resistance for the currency is seen around 1.06 against the euro

and 1.26 against the pound.

The greenback advanced to a 4-day high of 153.94 against the yen

and a 3-1/2-month high of 0.8808 against the franc, from its early

lows of 152.61 and 0.8751, respectively. The currency is poised to

challenge resistance around 156.00 against the yen and 0.89 against

the franc.

The greenback touched 1.3950 against the loonie, setting a 5-day

high. If the currency rises further, it is likely to test

resistance around the 1.40 region.

The greenback recovered to 0.6565 against the aussie and 0.5952

against the kiwi, reversing from its early lows of 0.6598 and

0.5977, respectively. The currency is likely to locate resistance

around 0.64 against the aussie and 0.58 against the kiwi.

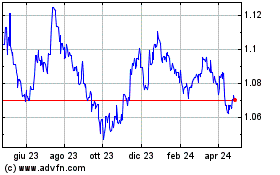

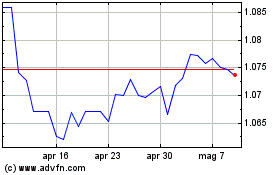

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Dic 2024 a Gen 2025

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Gen 2024 a Gen 2025