Pound Drops As BoE Signals Peak In Inflation

02 Febbraio 2023 - 9:46AM

RTTF2

The pound fell against its major counterparts in the European

session on Thursday, as the Bank of England lifted its key rate as

expected, but indicated that inflation had probably peaked.

The Monetary Policy Committee voted 7-2 to raise the bank rate

by 50 basis points to 4.00 percent, the highest since 2008.

"If there were to be evidence of more persistent pressures, then

further tightening in monetary policy would be required," the MPC

said.

Global consumer price inflation remained high, although it is

likely to have peaked across many advanced economies, including in

the United Kingdom, the central bank noted.

In the monetary policy report, the BoE said inflation is

expected to fall quickly this year and the recession would be much

shallower than projected in November.

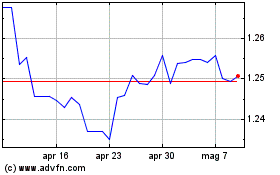

The pound fell to 1.2279 against the greenback, from a 3-day

high of 1.2401 seen at 6 pm ET. The pair had finished Wednesday's

deals at 1.2373. The pound may face support around the 1.21 region,

should it falls again.

The pound touched 1.1165 against the franc, its lowest level

since January 6. At Wednesday's close, the pair was worth 1.1226.

The pound is seen facing support around the 1.10 level.

The pound depreciated to a fresh 3-week low of 157.98 against

the yen from yesterday's close of 159.49. Next near term support

for the currency is seen around the 153.00 level.

The pound moved down to more than a 4-month low of 0.8948

against the euro from the previous close of 0.8880. The pound is

likely to find support around the 0.92 region.

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Mar 2024 a Apr 2024

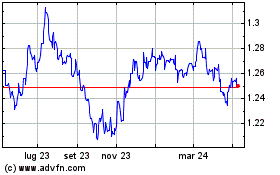

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Apr 2023 a Apr 2024