U.S. Dollar Down Amid Disappointing Economic Data

30 Marzo 2023 - 3:03PM

RTTF2

The U.S. dollar fell against its most major counterparts in the

New York session on Thursday, as the economy grew slightly less

than previously estimated in the fourth quarter and weekly jobless

claims increased moderately last week, supporting expectations that

the Federal Reserve may pause interest rate hikes at the meeting in

May.

Data from the Commerce Department showed that real gross

domestic product shot up by 2.6 percent in the fourth quarter

compared to the previously reported 2.7 percent jump. Economists

had expected the pace of growth to be unrevised.

Data from the Labor Department showed that initial jobless

claims rose to 198,000, an increase of 7,000 from the previous

week's unrevised level of 191,000. Economists had expected jobless

claims to inch up to 196,000.

CME Group's FedWatch Tool currently indicates a 48.2 percent

chance the Fed will leave rates unchanged at its next meeting in

early May and a 51.8 percent chance of a 25 basis point

increase.

The dollar index that tracks the greenback against a basket of

other currencies fell to a 1-week low of 102.07.

The greenback touched 1.3524 against the loonie, its lowest

level since February 23. The pair had closed Wednesday's deals at

1.3558. The greenback is likely to face support around the 1.33

region, if it falls again.

The greenback weakened to 1-week lows of 0.9125 against the

franc and 1.0926 against the euro, from yesterday's closing values

of 0.9184 and 1.0843, respectively. The greenback is seen finding

support around 0.89 against the franc and 1.12 against the

euro.

The greenback edged down to 0.6259 against the kiwi, from a

2-day high of 0.6203 hit at 9:30 pm ET. At yesterday's trading

close, the pair was quoted at 0.6223. Next key support for the

greenback is likely seen around the 0.61 level.

The greenback depreciated to near a 2-month low of 1.2384

against the pound, from a 2-day high of 1.2293 seen at 9:00 pm ET.

At yesterday's close, the pair was valued at 1.2311. Should the

greenback falls further, it is likely to test support around the

1.27 region.

In contrast, the greenback was up against the yen, at an 8-day

high of 132.96. The pair was worth 132.85 when it ended deals on

Wednesday. The greenback is likely to find resistance around the

139.00 level.

The greenback rebounded to 0.6687 against the aussie, from a

1-week low of 0.6718 it touched at 4:05 am ET. The greenback may

locate resistance around the 0.64 level.

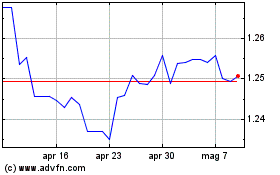

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Apr 2023 a Apr 2024