Pound Drops Amid Debt Ceiling Deadlock

24 Maggio 2023 - 11:01AM

RTTF2

The pound fell against its major counterparts in the European

session on Wednesday, as a lack of progress in negotiations on

raising the debt limit dampened risk sentiment.

The U.S. Treasury Department has asked federal agencies whether

they can make upcoming payments at a later date, the Washington

Post reported, citing two people familiar with the matter.

U.S. Treasury Secretary Janet Yellen previously warned lawmakers

that a default in early June is "highly likely."

On the economic front, official data showed U.K. consumer price

inflation slowed in April, but the core rate accelerated

unexpectedly.

The consumer price index registered an annual increase of 8.7

percent in April after a 10.1 percent gain in March. Inflation was

forecast to ease to 8.3 percent.

Input price inflation hit its lowest level since February 2021

while factory gate inflation reached the weakest since July

2021.

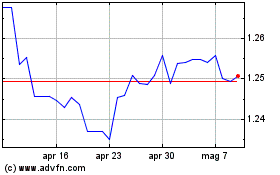

The pound edged down to 0.8700 against the euro and 1.1169

against the franc, off its early more than 5-month high of 0.8648

and a 6-day high of 1.1240, respectively. Next immediate support

for the currency is seen around 0.89 against the euro and 1.10

against the franc.

The pound weakened to near a 5-week low of 1.2364 against the

greenback and a 2-day low of 171.22 against the yen, from its early

2-day high of 1.2469 and more than a 7-year high of 172.79,

respectively. The pound is seen challenging support around 1.21

against the greenback and 163.00 against the yen.

Federal Open Market Committee (FOMC) will issue minutes from its

meeting of May 2-3 in the New York session.

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Apr 2023 a Apr 2024