Pound Weakens After BoE Decision

21 Marzo 2024 - 11:13AM

RTTF2

The pound declined against its major counterparts in the

European session on Thursday, as the Bank of England left its

benchmark rate unchanged at a six-year for the fifth straight

session.

The Monetary Policy Committee, led by Governor Andrew Bailey,

voted 8-1 to keep the bank rate unchanged at 5.25 percent. The rate

was the highest since early 2008.

Swati Dhingra sought a quarter point reduction to 5.00 percent.

Dhingra assessed that waiting for more reassurance before reducing

Bank Rate would weigh further on living standards and supply

capacity.

The policymakers said the MPC remained prepared to adjust

monetary policy as warranted by economic data to return inflation

to the 2 percent target sustainably.

"…the Committee would keep under review for how long Bank Rate

should be maintained at its current level," the bank said.

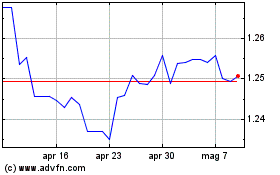

The pound fell to 1.2725 against the greenback, from a 1-week

high of 1.2803 seen at 3:10 am ET. At yesterday's close, the pair

was quoted at 1.2785. If the currency falls further, it is likely

to test support around the 1.24 region.

The pound declined to 192.24 against the yen from yesterday's

close of 193.38. Should the currency falls further, it is likely to

test support around the 183.00 region.

The pound eased to 1.1367 against the franc, from more than a

9-month high of 1.1459 hit at 4:35 am ET. The pair was worth 1.1338

at yesterday's close. The currency may locate support around the

1.11 level.

The pound dropped to near a 3-week low of 0.8573 against the

euro, from a 9-day high of 0.8528 seen at 5:30 am ET. The pair was

valued at 0.8542 at yesterday's close. The currency is seen finding

support around the 0.88 level.

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Apr 2023 a Apr 2024