U.S. Dollar Advances As Soaring Inflation Bolsters Hopes For Faster Tightening

11 Marzo 2022 - 4:32AM

RTTF2

The U.S. dollar strengthened against its major rivals in the

Asian session on Friday amid rising risk aversion, as strong U.S.

inflation data fueled hopes for aggressive rate hikes by the

Federal Reserve and a lack of progress in peace talks between

Russia and Ukraine escalated geopolitical risks.

Overnight data showed that U.S. inflation accelerated to 7.9

percent in February from 7.5 percent in January, the highest

reading since 1982.

The Fed meeting is due next week, with economists forecasting a

rate hike of a quarter-point to curb inflation.

The peace talks between the foreign ministers of Russia and

Ukraine failed to reach a deal on evacuation corridors or a

ceasefire.

Ukrainian Foreign Minister Dmytro Kuleba said that Russia

indicated it would continue attacks until Ukraine meets its

demands, and the least of its demands is surrender.

The greenback edged higher to 0.9309 against the franc, after

dropping to 0.9286 at 5 pm ET. Next immediate resistance for the

greenback is possibly seen around the 0.95 level.

The greenback climbed to 1.3069 against the pound, its strongest

level since November 2020. Against the yen, it touched more than a

5-year high of 116.79. The greenback is seen finding resistance

around 1.28 against the pound and 118.5 against the yen.

The greenback rebounded to 0.7328 against the aussie and 0.6834

against the kiwi, off its early low of 0.7367 and a 4-day low of

0.6875, respectively. The greenback may locate resistance around

0.70 against the aussie and 0.66 against the kiwi.

The greenback remained higher against the euro, with the pair

trading at 1.0987. On the upside, 1.06 is possibly seen as its next

resistance level.

In contrast, the greenback retraced its early gains against the

loonie and was trading at 1.2773. If the greenback extends decline,

1.26 is likely seen as its next support level.

Looking ahead, Canada jobs data for February and University of

Michigan's preliminary U.S. consumer sentiment index for March are

due out in the New York session.

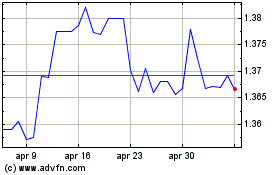

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Mar 2024 a Apr 2024

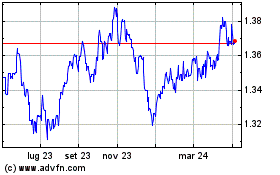

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Apr 2023 a Apr 2024