U.S. Dollar Declines As Non-farm Payrolls Data In Focus

30 Agosto 2022 - 8:49AM

RTTF2

The U.S. dollar fell against its most major counterparts in the

European session on Tuesday, after rallying on Federal Reserve

Chair Jerome Powell's hawkish remarks on inflation and rate

hikes.

Investors await non-farm payrolls report due on Friday, which

will provide hints about the possibility of another 75 basis-point

rate hike in September.

Economists expect employment to rise by 300,000 jobs in August,

after a gain of 528,000 jobs last month.

The unemployment rate is expected to remain unchanged at 3.5

percent.

U.S. treasury yields dropped, with the benchmark yield on

10-year note touching 3.058 percent. Yields move inversely to bond

prices.

The greenback edged down to 138.14 against the yen, from a high

of 138.77 seen at 6:00 pm ET. The greenback may find support around

the 120.5 level.

The greenback fell to 4-day lows of 1.0055 against the euro and

1.1760 against the pound, after rising to 0.9982 and 1.1687,

respectively in early deals. The greenback is likely to find

support around 1.09 against the euro and 1.23 against the

pound.

The greenback touched 4-day lows of 0.6956 against the aussie,

0.6194 against the kiwi and 1.2972 against the loonie, reversing

from its early highs of 0.6873, 0.6131 and 1.3025, respectively.

The next possible support for the greenback is seen around 0.71

against the aussie, 0.63 against the kiwi and 1.26 against the

loonie.

In contrast, the greenback climbed to 0.9723 against the franc,

its highest level since July 21. If the currency rises further, it

may find resistance around the 1.00 level.

Looking ahead, at 8:00 am ET, German preliminary CPI for August

is scheduled for release.

U.S. S&P/Case-Shiller home price index and FHFA's home price

index for June and consumer confidence for August are set for

release in the New York session.

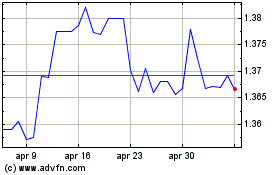

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Mar 2024 a Apr 2024

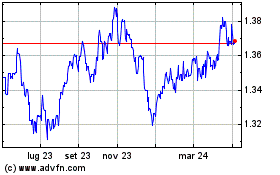

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Apr 2023 a Apr 2024