Canadian Dollar Slides As Crude Oil Prices Slide

10 Ottobre 2024 - 7:44AM

RTTF2

The Canadian dollar weakened against other major currencies in

the early European session on Thursday, as crude oil prices fell

extending recent losses, as data showing an unexpected big jump in

crude inventories outweighed possible supply disruptions due to

Hurricane Milton and Middle East tensions.

West Texas Intermediate Crude oil futures for November ended

down $0.33 or about 0.45% at $73.24 a barrel.

Brent crude futures settled at $76.58 a barrel, down $0.60 or

about 0.78%.

Data from the Energy Information Administration (EIA) showed

crude inventories jumped by 5.8 million barrels to 422.7 million

barrels last week, nearly three times the expected increase of

about 2 million barrels.

A downward revision by EIA in its demand forecast for 2025

weighed as well on oil prices. The EIA is citing economic slowdowns

in China and North America as the reasons for the downward revision

in its oil demand forecast.

Traders remain cautious ahead of the release of key U.S.

inflation readings that could influence the Fed's rate trajectory.

Fed Minutes said a 50-bps rate cut was backed by the majority of

officials. Meanwhile, investors now see the Fed lowering interest

rates by a quarter point in November instead of a jumbo rate

cut.

In the European trading now, the Canadian dollar fell to nearly

a 2-month low of 1.3723 against the U.S. dollar, from an early high

of 1.3705. The loonie may test support near the 1.39 region.

Against the euro and the Australian dollar, the loonie slid to a

9-day low of 1.5008 and a 3-day low of 0.9240 from early highs of

1.4992 and 0.9204, respectively. If the loonie extends its

downtrend, it is likely to find support around 1.51 against the

euro and 0.94 against the aussie.

The loonie edged down to 108.63 against the yen, from an early

high of 109.09. On the downside, 110.00 is seen as the next support

levels for the loonie.

Looking ahead, the European Central Bank publishes the account

of the monetary policy meeting of the governing council held on

September 11 and 12, at 7:30 am ET. At the meeting, the bank had

lowered its key interest rates by 25 basis points.

In the New York session, U.S. CPI data for September and U.S.

weekly jobless claims data are slated for release.

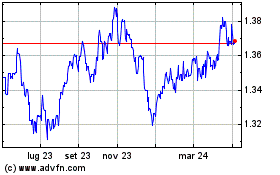

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Nov 2024 a Dic 2024

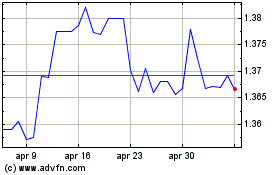

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Dic 2023 a Dic 2024