U.S. Dollar Rises Ahead Of Inflation Data

09 Settembre 2024 - 1:52PM

RTTF2

The U.S. dollar strengthened against its most major counterparts

in the New York session on Monday, as expectations for larger Fed

rate cuts faded and investors awaited August inflation data due

later this week.

The U.S. Labour Department will release the consumer price index

early Wednesday and the producer price index before Thursday's

open. Tame readings could give policymakers ammo for making a

50-bps rate cut on Sept. 18.

CME Group's FedWatch Tool is currently indicating a 75.0 percent

chance the Fed will lower rates by 25 basis points and a 25.0

percent chance of a 50 basis point rate cut.

Elsewhere, the governing council of the European Central Bank

will meet on Thursday, and it is widely expected that the board

will reduce interest rates for the second time this year.

The greenback climbed to a 6-day high of 1.1034 against the

euro, 5-day high of 0.8494 against the franc and near a 3-week high

of 1.3067 against the pound, off its early lows of 1.1091, 0.8427

and 1.3143, respectively. The currency is seen finding resistance

around 1.06 against the euro, 0.92 against the franc and 1.27

against the pound.

The greenback advanced to more than a 3-week high of 0.6647

against the aussie and near a 3-week high of 0.6124 against the

kiwi, from its early lows of 0.6689 and 0.6186, respectively. The

currency is likely to locate resistance around 0.63 against the

aussie and 0.60 against the kiwi.

The greenback rose to 1.3577 against the loonie. If the currency

strengthens further, it is likely to test resistance around the

1.38 region.

Meanwhile, the greenback retreated against the yen and was

trading at 142.73. The currency is poised to challenge support

around the 141.00 level.

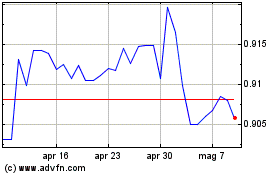

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Nov 2024 a Dic 2024

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Dic 2023 a Dic 2024