U.S. Dollar Falls As Trump Pauses Mexico's Tariffs

03 Febbraio 2025 - 3:53PM

RTTF2

The U.S. dollar weakened against its major counterparts in the

New York session on Monday, as risk sentiment improved after US

President Donald Trump and Mexican President Claudia Sheinbaum

agreed to suspend tariffs for one month.

Sheinbaum said Mexico will immediately reinforce its northern

border with 10,000 members of its National Guard to prevent drug

trafficking from Mexico to the United States, particularly

fentanyl.

U.S. stocks rebounded following the news.

Over the weekend, Trump imposed tariffs on imports from Mexico,

Canada and China.

A statement from the White House said Trump is taking "bold

action to hold Mexico, Canada, and China accountable to their

promises of halting illegal immigration and stopping poisonous

fentanyl and other drugs from flowing into our country."

The greenback declined to 1.2436 against the pound, 0.9103

against the franc and 154.00 against the yen, from an early nearly

2-week high of 1.2248, 3-week high of 0.9196 and a 6-day high of

155.88, respectively. The greenback is seen finding support around

1.27 against the pound, 0.90 against the franc and 145.00 against

the yen.

The greenback fell to 0.6197 against the aussie and 1.4523

against the loonie, from an early 5-year high of 0.6087 and nearly

a 22-year high of 1.4793, respectively. The next possible support

for the greenback is seen around 0.65 against the aussie and 1.38

against the loonie.

The greenback dropped to 2-week lows of 1.0209 against the euro

and 0.5608 against the kiwi, from an early 3-week high of 1.0335

and a 2-1/2-year high of 0.5516, respectively. The greenback is

poised to challenge support around 1.06 against the euro and 0.60

against the kiwi.

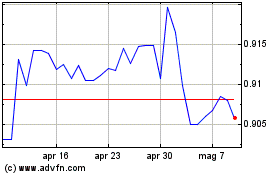

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Gen 2025 a Feb 2025

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Feb 2024 a Feb 2025