TIDM88E

RNS Number : 2588F

88 Energy Limited

18 March 2022

88 ENERGY LIMITED

ASX LODGEMENT OF ANNUAL REPORT

88 Energy Limited (ASX:88E; AIM:88E) ("88 Energy" or "Company")

advises that a copy of the Company's Annual Report for the year

ended 31 December 2021 (the "Annual Report") has been lodged on the

ASX along with the Company's 2021 year-end Corporate Governance

Statement and Appendix 4G.

The Annual Report, which was sent to shareholders today, is

available on the Company's website at www.88energy.com along with

copies of each of these other documents.

Set out below is the Chairman's Statement as included in the

Annual Report.

Also, set out below is a summary of the Company's audited

financial information for the year ended 31 December 2021 as

extracted from the Annual Report, being:

-- Consolidated Statement of Comprehensive Income;

-- Consolidated Statement of Financial Position;

-- Consolidated Statement of Changes in Equity; and

-- Consolidated Statement of Cash Flows.

Media and Investor Relations:

88 Energy Ltd

Ashley Gilbert, Managing Director

Tel: +61 8 9485 0990

Email:investor-relations@88energy.com

Finlay Thomson, Investor Relations Tel: +44 7976 248471

Fivemark Partners , Investor and Tel: +61 410 276 744

Media Relations Tel: +61 422 602 720

Andrew Edge / Michael Vaughan

EurozHartleys Ltd Tel: +61 8 9268 2829

Dale Bryan

Cenkos Securities Tel: +44 131 220 6939

Neil McDonald / Derrick Lee

CHAIRMAN'S STATEMENT

Dear Shareholders,

It is my pleasure to write to you after joining 88E in early

August 2021 as Non-Executive Chairman. I was attracted to 88E as a

function of the quality of both its prospects and people. At the

time of writing, I am more enthused than ever with the outlook for

our business.

The past year has been one of substantial achievement for 88E.

Against a backdrop of persistent COVID-19 related challenges, the

business has advanced its plans efficiently, significantly, and

rapidly. This progress has been delivered alongside a resurgence in

global energy prices, as the world increasingly recognises the

significant role that hydrocarbons must continue to play in

servicing transitional energy needs.

Our most significant exploration activity during 2021 was

drilling the Merlin-1 exploration well on our Project Peregrine

acreage. Merlin-1 was spudded in March 2021 with drilling

operations completed in April 2021. Final interpretation of results

was completed in August 2021 with post well evaluation successfully

demonstrating the presence of light oil in the N20, N19 and N18

targets. This outcome was a highly significant one for 88E and has

given us great confidence in aggressively pursuing further

exploration work at Project Peregrine, including the upcoming

drilling of the Merlin-2 appraisal well.

In June 2021, we announced the successful acquisition of the

residual 50% working interest in Project Peregrine from Alaska

Peregrine Development Company. This was an outstanding outcome in

delivering us full control of, and upside from, future Project

Peregrine activities, while still retaining flexibility to

potentially farm-out to a partner with greater operational

capability at a future point.

That same month, 88E executed an agreement to sell its Alaskan

Oil and Gas Credits for US$18.7 million. This sale accelerated the

timeframe of our value realisation from the Tax Credits and enabled

the full repayment of our outstanding debt of US$16.1 million. With

its debt free balance sheet, 88E now holds significant flexibility

with respect to future funding and capital management initiatives.

In September 2021, we also raised A$24 million via an equity

placement to domestic and international institutional and

sophisticated investors. These funds are being directed towards

drilling of the Merlin-2 appraisal well and general corporate

activities.

At the time of writing, 88E had recently received the Permit to

Drill for the Merlin-2 appraisal well, mobilised the Arctic Fox rig

to the drilling location, and excitingly, spudded the Merlin-2 well

on 7 March 2022. This well is located to the east of Merlin-1,

where the multiple stacked sequences within the Brookian Nanushuk

Formation are expected to be of enhanced thickness and quality. We

look forward to updating you regularly on the progress of Merlin-2

drilling and results.

We have also been closely monitoring activity adjacent to the

northern border of our Project Icewine acreage, where the Kuparuk

was reported from the Talitha-A well drilled last year by Pantheon

Resources. This may have positive implications for the same

formation in our Icewine acreage. Further, at the time of writing,

Pantheon is undertaking flow testing activities on Talitha-A, as

well as undertaking drilling and planned testing of the Theta West

well.

During Q1 2021, 88E acquired the Umiat Oil Field to the

immediate south of Project Peregrine. As part of the acquisition,

we received the Umiat 3D seismic data. Further analysis of this

data has provided a better understanding of the Peregrine reservoir

geometries to the north as well as highlighting the potential for

future development of an Ultra-Low Sulphur Diesel (ULSD) production

facility at Umiat.

The past year has also seen evolution in the leadership of our

business. I congratulate Ashley Gilbert on his elevation to the

role of Managing Director and CEO. I hold Ashley in the highest

esteem and believe that he is already demonstrating himself an

excellent executive leader for our business. I would also like to

take this opportunity to thank our previous CEO, the long-serving

David Wall, for his commitment and energy to 88E. We wish David all

the best in his future endeavours.

We also welcomed Joanne Kendrick to the 88E Board as

Non-Executive Director and Rob Benkovic and Oli Mortensen to the

roles of Chief Operating Officer and Chief Financial Officer,

respectively. Thank you also to my predecessor as Chairman, Michael

Evans, for his lengthy and committed service to the business.

I would like to recognise the Department of Natural Resources,

the Alaska Oil and Gas Conservation Commission, the North Slope

Borough, Bureau of Land Management and other regulatory agencies

that have facilitated our exploration efforts on the North Slope.

Thank you also to all 88E personnel and contractors who have worked

hard, in sometimes trying conditions, to deliver the successes of

last year. We have a first-class team of truly committed

professionals who strongly believe in the potential of our acreage

and our approach to exploring it.

Finally, I would also like to thank you, our shareholders, for

your ongoing support. The 88E business model has always focussed on

targeting large-scale hydrocarbon deposits. The size of the prizes

we are pursuing is large, and sometimes the accompanying patience

required is also. I thank our shareholders for pursuing this

journey with us and we look forward to further unlocking the huge

potential value residing in our world-class Alaskan acreage. Stay

well.

Yours faithfully,

Philip Byrne

Non-Executive Chairman

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

FOR THE FINANCIAL YEARED 31 DECEMBER 2021

Note 2021 2020

$ $

Revenue from continuing operations

Other income 3(a) 4,448,699 246,778

Administrative expenses 3(b) (3,048,444) (1,399,215)

Occupancy expenses (86,765) (60,664)

Employee benefit expenses 3(c) (1,958,388) (1,841,758)

Share-based payment expense 18 (738,965) (122,870)

Depreciation and amortisation expense (84,449) (93,387)

Finance cost (1,195,703) (2,595,406)

Other expenses 3(d) (48,471) (16,218,575)

Foreign exchange (loss) / gain 302,297 51,463

------------

Loss before income tax (2,410,189) (22,033,633)

Income tax expense 4 - -

----------- ------------

Loss after income tax for the year (2,410,189) (22,033,633)

----------- ------------

Other comprehensive income / (loss) for

the year

Items that may be reclassified to profit

or loss

Exchange differences on translation of

foreign operations 4,855,236 (7,120,022)

----------- ------------

Other comprehensive income / (loss) for

the year, net of tax 4,855,236 (7,120,022)

----------- ------------

Total comprehensive income / (loss) for

the year attributable to members of 88

Energy Limited 2,445,047 (29,153,655)

----------- ------------

Loss per share for the year attributable

to the members of 88 Energy Limited:

Basic and diluted loss per share 5 (0.0001) (0.003)

The Consolidated Statement of Profit or Loss and Other

Comprehensive Income should be read in conjunction with the notes

to the financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2021

Note 2021 2020

$ $

ASSETS

Current Assets

Cash and cash equivalents 6 32,317,887 14,845,347

Trade and other receivables 7 935,930 5,079,630

Other Current Asset 7 10,224,959

------------- -------------

Total Current Assets 43,478,776 19,924,977

------------- -------------

Non-Current Assets

Plant and equipment 8 9,675 4,641

Exploration and evaluation expenditure 9 101,357,767 48,213,290

Other Assets 10 936,536 17,216,644

-------------

Total Non-Current Assets 102,303,978 65,434,576

-------------

TOTAL ASSETS 145,782,754 85,359,552

------------- -------------

LIABILITIES

Current Liabilities

Trade and other payables 11 5,796,350 5,326,634

Provisions 12 146,270 339,199

Total Current Liabilities 5,942,620 5,665,833

-------------

Non-Current Liabilities

Borrowings 13 - 20,782,366

Total Non-Current Liabilities - 20,782,366

------------- -------------

TOTAL LIABILITIES 5,942,620 26,448,199

------------- -------------

NET ASSETS 139,840,134 58,911,353

------------- -------------

EQUITY

Contributed equity 14 285,809,214 208,963,513

Reserves 15 23,074,244 16,580,975

Accumulated losses (169,043,324) (166,633,135)

-------------

TOTAL EQUITY 139,840,134 58,911,353

------------- -------------

The Consolidated Statement of Financial Position should be read

in conjunction with the notes to the financial statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

Issued Accumulated

Capital Reserves Losses Total

$ $ $ $

------------ ------------ -------------- -------------

At 1 January 2021 208,963,513 16,580,975 (166,633,135) 58,911,353

------------ ------------ -------------- -------------

Loss for the year - - (2,410,189) (2,410,189)

Other comprehensive

income - 4,855,236 - 4,855,236

------------ ------------ -------------- -------------

Total comprehensive

income/(loss) for the

year after tax - 4,855,236 (2,410,189) 2,445,047

Transactions with owners

in their capacity as

owners:

Issue of share capital 80,305,041 - - 80,305,041

Issue of Options - 1,072,790 - 1,072,790

Settlement of vested

PR's (173,722) (173,722)

Share-based payments - 738,965 - 738,965

Share issue costs (3,459,340) - - (3,459,340)

------------ ------------ -------------- -------------

Balance at 31 December

2021 285,809,214 23,074,244 (169,043,324) 139,840,134

------------ ------------ -------------- -------------

At 1 January 2020 185,619,885 23,578,127 (144,599,502) 64,598,510

------------ ------------ -------------- -------------

Loss for the year - - (22,033,633) (22,033,633)

Other comprehensive

loss (7,120,022) - (7,120,022)

------------ ------------ -------------- -------------

Total comprehensive

income/(loss) for the

year after tax - (7,120,022) (22,033,633) (29,153,655)

Transactions with owners

in their capacity as

owners:

Issue of share capital 24,130,013 - - 24,130,013

Share-based payments 122,870 - 122,870

Share issue costs (786,386) - - (786,386)

------------ ------------ -------------- -------------

Balance at 31 December

2020 208,963,513 16,580,975 (166,633,135) 58,911,353

------------ ------------ -------------- -------------

The Consolidated Statement of Changes in Equity should be read

in conjunction with the notes to the financial statements.

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE FINANICAL YEAR ENDED 31 DECEMBER 2021

Note 2021 2020

$ $

Cash flows from operating activities

Payment to suppliers and employees (4,594,024) (3,141,403)

Interest received 841 2,634

Interest & finance costs (1,052,539) (2,237,210)

Other Income - 259,072

Net cash flows used in operating activities 6(b) (5,645,722) (5,116,907)

------------ ------------

Cash flows from investing activities

Payments for exploration and evaluation

activities (41,791,086) (41,521,267)

Contribution from JV Partners in relation

to Exploration 20,816,000 32,184,152

Payments for Bonds (112,730) -

Proceeds from sale of tax credits 24,233,263 -

Net cash flows generated from/used in investing

activities 3,145,447 (9,337,115)

------------ ------------

Cash flows from financing activities

Proceeds from issue of shares 14 42,521,478 14,870,000

Share issue costs (2,523,150) (840,000)

Payment of borrowing (20,909,692) (398,880)

Net cash flows from financing activities 19,088,636 13,631,120

------------ ------------

Net increase/(decrease) in cash and cash

equivalents 16,588,361 (822,902)

Cash and cash equivalents at the beginning

of the year 14,845,347 15,903,117

Effect of exchange rate fluctuations on

cash held 884,179 (234,868)

------------ ------------

Cash and cash equivalents at end of year 6(a) 32,317,887 14,845,347

------------ ------------

The Consolidated Statement of Cash Flows should be read in

conjunction with the notes to the financial statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR MZGMFVRRGZZG

(END) Dow Jones Newswires

March 18, 2022 03:01 ET (07:01 GMT)

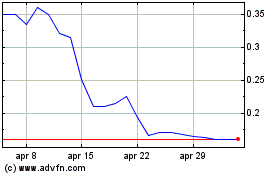

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Apr 2023 a Apr 2024