TIDMALT

RNS Number : 8323U

Altitude Group PLC

28 November 2023

28 November 2023

Altitude Group plc

("Altitude", the "Company" or the "Group")

UNAUDITED INTERIM RESULTS FOR THE SIX MONTHSED 30 SEPTEMBER

2023

Altitude Group Plc (AIM: ALT), the leading end-to-end solutions

provider for branded merchandise, is pleased to announce its

unaudited interim results for the six months to 30 September 2023

("HY24").

As reported on 27 October 2023, The Group's financial

performance in HY24 demonstrates significant year-on-year growth,

surpassing the figures from HY23 by over 50% on revenue and nearly

40% on Adjusted Operating Profit. The Group has benefited from

strong growth in its diversified Merchanting Division and

continuing solid performance in its Services Division.

As of September 2023, the contracts that had been awarded to the

Adjacent Market Programmes (AMPs) have all been successfully

launched on time and in multiple locations across the United

States. Commercial trading within these spaces has recently

commenced. Additionally, the business development team remains

active and the pipeline continues to be robust. The Group is on

track to achieve record year-end results in FY24.

Financial Highlights

-- Group revenues increased by 53.5% to GBP11.8 million (HY23:

GBP7.7 million) and 59.3% at constant currency

-- Services revenue grew by 7.0% reflecting consistent growth

and performance across the AIM network

-- Merchanting revenue grew by 100.4% reflective of new

affiliate signings and expansion of AMPs

-- Gross profit increased 24.8% to GBP4.9 million (HY23: GBP3.9 million)

-- Merchanting gross margin increased to 14.6% (HY23 9.0%) due to the growth of AMPs

-- Gross margin of 41.8% (HY23: 51.4%) is reflective of blended

revenues across the Group's programmes

-- Group adjusted operating profit* increased in HY24 by 38.8%

to GBP1.1 million (HY23: GBP0.8 million) and 46.8% at constant

currency

-- Adjusted basic earnings per share** increased by 61% to 0.71 pence (HY23: 0.44 pence)

-- Investment of GBP1.1 million in AMPs within working capital

GBP0.7 million, intangible assets of GBP0.3 million and tangible

assets of GBP0.1 million

-- Pre AMPs investment a net cash inflow of GBP0.4 million with

a post investment net cash outflow of GBP0.7 million (HY23 GBP0.2

million outflow)

-- The Group's balance sheet remains strong with gross cash of

GBP0.4 million (HY23: GBP0.8 million) supported by $1.4 million

(HY23: $0.7m) of remaining loan facility, which provides sufficient

working capital for the group's existing needs

* Operating profit before share-based payment charges,

amortisation of intangible assets, depreciation of tangible assets

and exceptional charges

** Adjusted basic earnings per share from continuing operations

is calculated using profit after tax but before share-based payment

charges, amortisation of acquired intangible assets and exceptional

charges with the weighted average number of equity voting shares in

issue

Highlights & Key Corporate Developments

Strong HY24 growth in Merchanting programmes underpinned by key

Services programmes

Services:

-- Continued growth in Services revenue in HY24 showcasing 7%

YOY growth. This growth is primarily driven by membership activity,

an increase in throughput revenue, and the AIM membership package

programme growth which includes SaaS technology subscriptions,

marketing services and art services

-- In-network preferred partner sales continued to rise during

the period showing an increase of c. 4% in the period

Merchanting:

-- Merchanting expansion continues to advance and drive strong revenue growth for the Group

-- All previously announced awarded AMPs contracts have been

successfully launched on time and in multiple locations across the

United States

-- At HY24 we have 15 AMPs contracts with an annualised expected gross revenue of at least $7m

-- In our AMPs programme, we have successfully built a strong

brand name and reputation which will accelerate our success into

the future

-- Our current AMPs pipeline has gained in strength, value and

early momentum compared with this time last year with the main

announcement of new contracts expected between March and June in

2024 when contracts are finalised

-- Within ACS we are achieving c13% organic growth and

benefiting from the full year impact of the significant affiliate

recruitment in FY23

Technology:

The Group's unwavering commitment to excellence within its

proprietary technology platforms is evident in our ongoing

investments to continually optimise these platforms. Key highlights

during the first half of this financial year are:

-- Expansion of our technological capabilities by adding further

integrations with accounting, webstores, and analytics platforms,

further enhancing the technological possibilities available to our

users

-- Implementation of platform configuration and security

enhancements to facilitate rapid expansion both online and in-store

within our AMP's division

-- Customised adaptation of our US platform specifically

designed for seamless utilisation within the Canadian promotional

product market

-- Over 200 integrations facilitating streamlined electronic

data exchange across our preferred partner platforms, users on

member and affiliate platforms, and complementary platforms

-- Robust technology-driven operational improvements and process

enhancements designed to facilitate scalable growth within the ACS

business

Outlook

Revenue and adjusted operating profit* are in line with market

expectations which we believe is a strong position given the

current macro-economic environment in addition to gaining

experience and building brand reputation within a new market. We

are committed to delivering growth and shareholder value and will

continue to keep the market informed of our progress.

Nichole Stella , Group CEO of Altitude, said:

"The first half of our current financial year has been a period

of intense focus and hard work, achieving significant expansion for

the Group. I am very proud of the team and their continued

attention to growth and delivery. This continuous upward momentum

and successful entry into new verticals, especially during

challenging macro-economic times, is a testament to the entire

team's talent, care, and commitment. We remain focused on both

scaling through new contract awards and gearing the business for

long-term success. Revenue and adjusted operating profit* are in

line with market expectations, which we believe is a strong

position given the current macro-economic environment in addition

to gaining experience and building brand reputation within a new

market. The Group is well placed for continued accelerated future

growth, and the Board is confident in the long-term success of the

business. It is very pleasing to note that the momentum we showed

in the first half of the year has continued into this period and we

look forward to updating shareholders in the New Year."

Enquiries:

Altitude Group plc Via Zeus

Nichole Stella, Chief Executive Officer

Graham Feltham, Chief Financial Officer

Zeus (Nominated Adviser & Broker) Tel: 0203 829

Dan Bate / David Foreman / James Edis (Investment 5000

Banking)

Dominic King (Corporate Broking)

Chief Executive's statement

Interim results for the 6 months ended 30 September 2023

During the initial half of this financial year, the Group was

extremely active with a concentrated focus on the delivery of our

new AMPs contracts to meet our launch date targets for HY24. I am

pleased to report we achieved those targets delivering widespread

expansion and growth for the Group. Our teams played a crucial role

in successfully safeguarding our core business while achieving

this. As a result, we drove growth across all Services and

Merchanting programmes and were able to increase Group revenues by

53.5% (59.3% at constant currency) to GBP11.8 million (HY23: GBP7.7

million) and Group adjusted operating profit* by 38.8% (46.8% at

constant currency) to GBP1.1 million (HY23: GBP0.8 million).

A significant part of the Group's growth has been a continual

investment into new business development and vertical market entry.

We believe this is critical to creating long-term shareholder value

and our continued investments in pipeline growth, business

infrastructure, and technology-driven efficiency, have set the

stage for continued scalable growth in revenue and profit. We are

confident in our ability to scale successfully via investments in

technology, operational gearing and talent. Both Services and

Merchanting programmes maintain robust business development

pipelines, providing the Group with continued expansion

opportunities through new partner agreements across all our key

business areas.

Who Are We

Altitude is a diversified portfolio group that is t he leading

end-to-end solutions provider for branded merchandise across a

variety of sectors from the corporate and print vertical markets to

the higher-education and collegiate sector.

We deliver products and services in two distinct areas -

Services and Merchanting. Services are derived from operating

distributor/vendor networks in the promotional products industry

comprising of technology and software applications, membership

subscriptions, Preferred Partner programmes, and marketing services

programmes. Our Merchanting programmes focus on the sale of

promotional products and includes AIM Capital Solutions (ACS) and

our AMPs.

Technology is at our core, and we support our Services and

Merchanting divisions with our proprietary technology platforms

providing product search engines, order management tools, design

applications, and e-commerce sites that deliver innovative

solutions. Our trading platform facilitates the execution of both

offline and online transactions. With an eye ever on the future we

continue to innovate and develop our systems to drive efficiency

and scalability - today Artificial Intelligence (AI) presents a

great opportunity to deliver new tools to drive efficiency and

scale.

What's New

-- Services

o Services demonstrated continued growth, increasing revenue by

7%, achieving GBP4.1 million (HY23: GBP3.9 million)

o Global membership network stands at 2489 (FY23: 2476), with a

self-reported average individual annual turnover of GBP1.2

million

o Successful onboarding of new members following the successful

go live of our strategic partnership with Fully Promoted across

membership and technology

-- Merchanting Revenue experienced a 100.4% increase, totalling

GBP7.6 million (HY23: GBP3.8 million).

o AMPs contracts

-- Our AMPs division is growing quickly, with the successful

delivery of all our new contracts in H1. We now have 15 contracts

with an annualised expected gross revenue of at least $7m.

-- We categorise our AMP accounts into 4 levels ranging from

Small to Extra Large with our existing contracts falling into the

small to large range. As the relationships deepen, we develop

closer strategic partnerships and this provides organic growth for

the Group, which will further enhance our levels of operational

gearing.

-- We are actively engaged in the annual pitching season added

to by referrals as our brand reputation strengthens. Today, our

pipeline is strong, growing, and inclusive of all 4 levels of

accounts Small to Extra Large.

o ACS affiliates

-- In FY23, we doubled our affiliate base for ACS, to c$14m

which is benefiting our top line growth. In HY24 this growth

normalised and is in line with industry trends and growth rates. We

place strong emphasis on recruitment of high-quality affiliates and

our commitment to maintaining exceptional quality standards and are

achieving c13% organic growth in our annual expected revenue.

What Do We Do - Merchanting

Gear Shops: The Group secures long term contracts within the

higher-education and collegiate sectors to provide, technology

& e-commerce solutions, marketing tools, supply chain know-how,

and innovative retail experiences across the US markets.

Additionally, via a partner, we provide access to textbooks to

deliver a seamless, single on-campus solution. As a result, Gear

Shops:

-- Provide specialist expertise on branded merchandise with

access to full product ranges from our Preferred Partners

-- Provide e-commerce, marketing solutions and modern/innovative

spaces to drive brand awareness and community engagement

-- In specialised partnership, seamlessly deliver a single Gear

Shop solution, delivering both branded merchandise with course

materials and text books

ACS Affiliates: The Group recruits high-calibre sales

professionals to affiliate (Affiliates) with the Group which:

-- Enables Affiliates to focus on sales activities, which is

their skillset, and to become part of a corporate business driving

growth and profitability, which is our skillset, which helps them

exceed their stand-alone potential

-- Full utilisation of technology is both advantageous and mandatory

-- Provides scalable expansion and growth for the Group

What Do We Do - Services

We deliver Services to our members and Preferred Partners that

helps them to drive sales growth and increase cost savings while

improving their efficiency and ease of doing business.

Services - Member benefits: In addition to our marketplace

platform, the Group delivers highly sought-after business benefits

to members and affiliates such as:

-- Preferred Partner pricing benefits

-- Freight programmes and shipping discounts

-- Community & networking opportunities

-- Education & professional development

-- Expanded marketing services, products and tools

Services - Preferred Partner: The Group provides vendors and

suppliers with services to expand their visibility and sales to the

AIM and ACS community through:

-- Top level visibility across our marketplace product search engine

-- Preferred technology integration opportunities

-- Guaranteed participation in publications, catalogues,

educational product programmes and merchandise campaigns

-- Expanded access to AIM community via social media and events

Services - Technology: Our marketplace platform delivers

important opportunities and efficiencies to our members and

affiliates, improving profitability through:

-- Efficiency - providing an intuitive online ordering

experience for buyers coupled with the back-end technology stack to

support the quick fulfilment of orders for branded merchandise

-- Effectiveness - ensuring product availability whenever and

wherever you are, with 24/7/365 uptime and a mobile first

approach

-- Experience - delivering the right experience and high degree

of satisfaction for members, affiliates, partners, and

end-buyers

-- Trust - providing a compliant and reliable service from start to finish

Technology

Altitude's technology platforms remain pivotal, serving as the

nexus for our activities within both the Services and Merchanting

segments. Our unwavering commitment to excellence is reflected in

the ongoing investments made to continually optimise these

platforms. The primary objective is to enhance operational

efficiency and scalability, extract meaningful data insights, and

uphold best-in-industry integrations and systems.

Altitude continues to experience increased utilisation of the

core AIM Tech Suite and ACS proprietary platforms, with continuing

increases in high value, higher quality users, and the active

onboarding of end-to-end users who conduct their order cycles

through the platform. As a result, our emphasis remains on driving

operational efficiencies and insights for all users, partner

suppliers and internal teams and addressing the evolving needs of

their businesses.

During the initial six months of FY24, significant technological

progress was made within our proprietary AIM and ACS Tech Suite.

Notably, targeted enhancements were implemented to facilitate

localised customisations, offering a solution tailored for Canadian

users. This resulted in the immediate adoption of the AIM Tech

Suite, which is now operational with Canadian users utilising the

platform for search and order processing, which is customised to

meet their specific requirements.

A specific focus during this period has been on enhancing

scalability within the Merchanting segment. Substantial progress

has been achieved, particularly in realising efficiency gains

within the ACS division for both Affiliates and our internal

processing teams. Additionally, there has been a swift and

concentrated effort to deploy technology solutions and establish

secure environments to accommodate the rapid growth within the AMP

division and its multi-channel retail approach. Both technological

and operational gearing have been strategically designed to support

the dynamic expansion of this key segment of our business.

Financial Results

Group revenue for the period increased by GBP4.1m to GBP11.8m

(HY23: GBP7.7m), an increase of 53.5%.

Services have grown by GBP0.3 million or 7%, driven from

increased levels of network activity and throughput. We continue to

outperform against published market data from ASI Central, which

reported c.4% average quarter-on-quarter growth. Industry reports

are mixed but are relatively consistent that there is increased

uncertainty in the Industry for the calendar year 2023 with

macro-economic events impacting confidence.

Merchanting has been positively impacted by an additional GBP3.8

million revenue and GBP0.8 million gross profit from the full

impact of ACS affiliates recruitment and the successful onboarding

of new AMPs contracts in the educational sector. The new AMPs

contracts were onboarded throughout the period with a number

commencing trading in August and September.

Gross profit increased by GBP1.0m, or by 24.8%, to GBP4.9m

(HY23: GBP3.9m), with gross margin reducing to 41.8% (HY23: 51.4%)

reflecting an increased mix of merchanting especially within our

ACS affiliate programme. Merchanting gross profit increased to

14.6% (HY23: 9.0%) from the higher margin AMPs contracts. Services

gross margin remained strong at 92.5% (HY23: 93.5%).

Administration expenses before share-based payments,

amortisation, depreciation and exceptional charges increased by

GBP0.7m to GBP3.9m (HY23: GBP3.2m). The increase is driven by the

implementation of AMPs operations, procurement and support teams.

Central costs remain flat year on year.

Adjusted operating profit* increased by 38.8%% to GBP1.1m (HY23:

GBP0.8m) and the profit before taxation increased by GBP0.2m to

GBP0.1m (HY23: loss GBP0.1m).

Basic and diluted profit per share improved by 0.17p to 0.07p

(HY23: loss 0.10p).

Net operating cash flow before exceptional items reduced by

GBP0.2m to a GBP0.2m inflow (HY23: inflow GBP0.4m) driven from a

GBP0.3m improved operating cashflow before working capital

countered by GBP0.5m investment predominantly in inventory for the

new AMPs contracts. Net cash outflow from investing activities was

GBP1.0m (HY23: GBP0.4m outflow), primarily comprising of

capitalised software development costs of GBP0.5m (HY23: GBP0.4m)

and AMPs contract investments of GBP0.4m (HY23: GBPnil), which are

made up of equipment and deferred contract assets. Net cash

outflows from financing activities of GBP0.1m were mainly comprised

of lease repayments and interest (HY23: GBP0.1m) with the drawdown

of the revolving facility being an inflow of GBP0.2m (HY23:

GBPnil). The prior period activities of a GBP0.1m outflow includes

a credit for issue of shares for cash (net of expenses).

Total net cash outflow was GBP0.7m (HY23: GBP0.2m outflow). The

bank facility of $1.7m, secured in FY23, was put in place to fund

short-term working capital fluctuations and investment in

inventory, equipment and fitting out costs as a result of our

growth in Merchanting.

* Operating profit before share-based payment charges,

amortisation of intangible assets, depreciation of tangible assets

and exceptional charges

Outlook

The first half of our current financial year has been a period

of intense focus and hard work, achieving significant expansion for

the Group. I am very proud of the team and their continued

attention to growth and delivery. This continuous upward momentum

and successful entry into new verticals, especially during

challenging macro-economic times, is a testament to the entire

team's talent, care, and commitment.

We remain focused on both scaling through new contract awards

and gearing the business for long-term success. Revenue and

adjusted operating profit* are in line with market expectations,

which we believe is a strong position given the current

macro-economic environment in addition to gaining experience and

building brand reputation within a new market. The Group is well

placed for continued accelerated future growth, and the Board is

confident in the long-term success of the business. It is very

pleasing to note that the momentum we showed in the first half of

the year has continued into this period and we look forward to

updating shareholders in the New Year.

Nichole Stella

Chief Executive Officer

28 November 2023

Consolidated income statement for the six months ended 30

September 2023

Unaudited Audited Unaudited

6 months 12 months 6 months

Note 30 Sep 31 Mar 30 Sep

2023 2023 2022

GBP'000 GBP'000 GBP'000

Revenue 3 11,768 18,761 7,666

Cost of sales (6,846) (10,156) (3,723)

------------------------------------------------------- ----- ---------- ---------- ----------

Gross profit 4,922 8,605 3,943

Administrative expenses before share based

payment charges, depreciation amortisation

and exceptional expenses (3,863) (6,648) (3,180)

Operating profit before share based payment

charges, depreciation, amortisation and exceptional

charges 1,059 1,957 763

Share based payment charges (305) (511) (231)

Depreciation and amortisation (634) (1,131) (562)

Exceptional charges (69) (101) (76)

---------- ---------- ----------

Total administrative expenses (4,871) (8,391) (4,049)

------------------------------------------------------- ----- ---------- ---------- ----------

Operating profit/(loss) 51 214 (106)

Finance expenses (20) (62) (27)

------------------------------------------------------- ----- ---------- ---------- ----------

Profit / (loss) before taxation 31 152 (133)

Taxation 17 238 60

------------------------------------------------------- ----- ---------- ---------- ----------

Profit /(loss) attributable to the equity

shareholders of the Company 48 390 (73)

------------------------------------------------------- ----- ---------- ---------- ----------

Earnings per ordinary share attributable

to the equity shareholders of the Company:

------------------------------------------------------- ----- ---------- ---------- ----------

- Basic and diluted (pence) 4 0.07p 0.55p (0.10p)

------------------------------------------------------- ----- ---------- ---------- ----------

Consolidated statement of changes in equity for the six months

ended 30 September 2023

Foreign

Exchange

Share Share Retained Translation

Capital Premium Earnings Reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 March 2022 283 20,194 (11,962) (410) 8,105

Profit for the period attributable

to equity shareholders - - (73) - (73)

Foreign exchange differences - - - 1,225 1,225

------------------------------------ --------- --------- ---------- ------------- --------

Total comprehensive income - - (73) 1,225 1,152

------------------------------------ --------- --------- ---------- ------------- --------

Transactions with owners recorded

directly in equity:

Share based payment charges - - 231 - 231

Total transactions with owners - - 231 - 231

------------------------------------ --------- --------- ---------- ------------- --------

At 30 September 2022 283 20,194 (11,804) 815 9,488

------------------------------------ --------- --------- ---------- ------------- --------

Profit for the period attributable

to equity shareholders - - 463 - 463

Foreign exchange differences - - - (800) (800)

------------------------------------ --------- --------- ---------- ------------- --------

Total comprehensive income - - 463 (800) (337)

------------------------------------ --------- --------- ---------- ------------- --------

Transactions with owners recorded

directly in equity:

Share based payment credit - - 280 - 280

Total transactions with owners - - 280 - 280

------------------------------------ --------- --------- ---------- ------------- --------

At 31 March 2023 283 20,194 (11,061) 15 9,431

Profit for the period attributable

to equity shareholders - - 48 - 48

Foreign exchange differences - - - 102 102

------------------------------------ --------- --------- ---------- ------------- --------

Total comprehensive income - - 48 102 150

------------------------------------ --------- --------- ---------- ------------- --------

Transactions with owners recorded

directly in equity:

Share based payment charges - - 305 - 305

Total transactions with owners - - 305 - 305

------------------------------------ --------- --------- ---------- ------------- --------

At 30 September 2023 283 20,194 (10,708) 117 9,886

------------------------------------ --------- --------- ---------- ------------- --------

Consolidated balance sheet as at 30 September 2023

Unaudited Audited Unaudited

6 months 12 months 6 months

30 Sep 31 Mar 30 Sep

2023 2023 2022

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant & equipment 266 202 137

Right of use assets 437 471 667

Intangibles 2,976 2,652 2,614

Goodwill 2,969 2,934 3,219

Deferred tax 400 458 467

---------------------------------------------- ---------- ---------- ----------

Total non-current assets 7,048 6,717 7,104

---------------------------------------------- ---------- ---------- ----------

Current assets

Inventory 1,054 361 93

Trade and other receivables 5,645 5,521 4,654

Corporation tax receivable 218 91 59

Cash and cash equivalents 441 1,173 814

---------------------------------------------- ---------- ---------- ----------

Total current assets 7,358 7,146 5,620

---------------------------------------------- ---------- ---------- ----------

Total assets 14,406 13,863 12,724

---------------------------------------------- ---------- ---------- ----------

LIABILITIES

Current liabilities

Revolving facility (213) - -

Trade and other payables (3,514) (3,699) (2,341)

---------------------------------------------- ---------- ---------- ----------

(3,727) (3,699) (2,341)

--------------------------------------------- ---------- ---------- ----------

Net current assets 3,631 3,447 3,279

---------------------------------------------- ---------- ---------- ----------

Non-current liabilities

Deferred tax liabilities (268) (347) (374)

Lease liabilities (525) (386) (521)

---------------------------------------------- ---------- ---------- ----------

Total non-current liabilities (793) (733) (895)

---------------------------------------------- ---------- ---------- ----------

Total liabilities (4,520) (4,432) (3,236)

---------------------------------------------- ---------- ---------- ----------

Net assets 9,886 9,431 9,488

---------------------------------------------- ---------- ---------- ----------

EQUITY

Called up share capital 283 283 283

Share premium 20,194 20,194 20,194

Retained earnings (10,591) (11,046) (10,989)

---------------------------------------------- ---------- ---------- ----------

Total equity attributable to equity holders

of the parent 9,886 9,431 9,488

---------------------------------------------- ---------- ---------- ----------

Consolidated cash flow statement for the six months ended 30

September 2023

Unaudited Audited Unaudited

6 months 12 months 6 months

30 Sep 31 Mar 30 Sep

2023 2023 2022

GBP'000 GBP'000 GBP'000

Operating Profit /(loss) 51 214 (106)

Amortisation of intangible assets 480 901 450

Depreciation 154 230 112

Share based payment (credit) /charge 305 511 231

Exceptional items 69 101 76

------------------------------------------------ ---------- ---------- ----------

Operating cash flow before changes in working

capital 1,059 1,957 763

------------------------------------------------ ---------- ---------- ----------

Movement in Inventory (669) (339) (55)

Movement in trade and other receivables (218) (1,532) (175)

Movement in trade and other payables 38 1,404 (90)

------------------------------------------------ ---------- ---------- ----------

Changes in working capital (849) (467) (320)

------------------------------------------------ ---------- ---------- ----------

Net operating cash flow before exceptional

items 210 1,490 443

------------------------------------------------ ---------- ---------- ----------

Exceptional items (69) (84) (76)

------------------------------------------------ ---------- ---------- ----------

Net operating cash flow activities

after exceptional items 141 1,406 367

------------------------------------------------ ---------- ---------- ----------

Income tax received (26) 144 -

------------------------------------------------ ---------- ---------- ----------

Net cash flow from operating activities 115 1,550 367

------------------------------------------------ ---------- ---------- ----------

Cash flows from investing activities

Purchase of tangible assets (108) (119) (46)

Purchase of intangible assets (846) (986) (345)

------------------------------------------------ ---------- ---------- ----------

Net cash flow from investing activities (954) (1,105) (391)

------------------------------------------------ ---------- ---------- ----------

Cash flows from financing activities

Repayment of lease borrowings (84) (163) (105)

Lease interest paid (18) (47) (25)

Other interest paid (2) (15) (6)

Drawdown of Revolving facility 213 - -

Net cash flow from financing activities 109 (225) (136)

------------------------------------------------ ---------- ---------- ----------

Net increase/(decrease) in cash and

cash equivalents (730) 220 (160)

------------------------------------------------

Cash and cash equivalents at the beginning

of the period 1,173 902 902

------------------------------------------------ ---------- ---------- ----------

Effect of foreign exchange rate changes on

cash and cash equivalents (2) 51 72

Cash and cash equivalents at the end

of the period 441 1,173 814

------------------------------------------------ ---------- ---------- ----------

Notes to the half yearly financial information

1. Basis of preparation

This consolidated half yearly financial information for the half

year ended 30 September 2023 has been prepared in accordance with

the AIM rules and applying the accounting policies and presentation

that were applied in the preparation of the Group's published

consolidated financial statements for the period ended 31 March

2023. The Group's accounting policies are based on the recognition

and measurement principles of UK-adopted international accounting

standards. The financial information is presented in Sterling and

has been rounded to the nearest thousand (GBP000).

The consolidated half yearly report was approved by the Board of

Directors on 28 November 2023.

The financial information contained in the interim report has

not been reviewed or audited, and does not constitute statutory

accounts for the purpose of Section 434 of the Companies Act 2006,

and does not include all of the information or disclosures required

and should therefore be read in conjunction with the Group's FY23

consolidated financial statements, which have been prepared in

accordance with UK-adopted international accounting standards. The

financial information relating to the period ended 31 March 2023 is

an extract from the latest published financial statements on which

the auditor gave an unmodified report that did not contain

statements under Section 498 (2) or (3) of the Companies Act 2006

and which have been filed with the Registrar of Companies.

2. Accounting policies

The condensed, consolidated financial statements in this

half-yearly financial report for the six months ended 30 September

2023 have been prepared in accordance with the AIM Rules for

Companies and on a basis consistent with the accounting policies

and methods of computation consistent with those set out in the

Annual Report and financial statements for the period ended 31

March 2023, except as described below. The Group has chosen not to

adopt IAS 34 'Interim Financial Statements' in preparing these

interim financial statements and therefore the Interim financial

information is not in full compliance with International Financial

Reporting Standards.

In preparing the condensed, consolidated financial statements,

management are required to make accounting assumptions and

estimates. The assumptions and estimation methods are consistent

with those applied to the Annual Report and financial statements

for the period ended 31 March 2023. Additionally, the principal

risks and uncertainties that may have a material impact on

activities and results of the Group remain materially unchanged

from those described in that Annual Report. The financial

statements have been prepared on a going concern basis. The Group's

business activities, together with the factors likely to affect its

future development, performance and position are set out in the

strategic report and Chairman's statement in the Annual Report and

financial statements for the period ended 31 March 2023.

The Financial Reporting Council issued "Going Concern and

Liquidity Risk: Guidance for Directors of UK Companies" in 2009,

and "Guidance on the Going Concern Basis of Accounting and

Reporting on Solvency and Liquidity Risks" in 2016. The Directors

have considered these when preparing the interim financial

statements.

The current economic conditions have created uncertainty

particularly over the level of demand for the Group's products and

services and over the availability of finance which the directors

are mindful of. The Board is confident that the Group has

sufficient liquidity to trade through to more normalised trading

conditions. The interim financial statements have therefore been

prepared on a going concern basis. The directors have taken steps

to ensure that they believe the going concern basis of preparation

remains appropriate. The key conditions are summarised below:

-- The Directors have prepared cash flow forecasts extending to

November 2024. These show that the Group has sufficient funds

available to meet its trading requirements.

-- The Group's year to date financial performance has been

factored into the cash flow forecasts.

-- The Group has a financing facility in place of $1.7m which

provides additional comfort and headroom to the cash forecasts. We

expect that with future additional growth this facility can be

increased to support any excess working capital requirements.

-- The Directors have considered the position of the individual

trading companies in the Group to ensure that these companies are

also in a position to continue to meet their obligations as they

fall due.

-- There are not believed to be any contingent liabilities which

could result in a significant impact on the business if they were

to crystallise.

Based on the above indications and assumptions, the Directors

believe that it remains appropriate to prepare the financial

statements on a going concern basis. The financial statements do

not include any adjustments that would result from the basis of

preparation being inappropriate.

Revenue recognition

The Group has a number of different revenue streams which are

described below.

Services Revenue

Includes a range of member and member-related revenues as well

as legacy software license revenue.

Member subscription revenues

AIM distributor members pay a monthly subscription fee for basic

membership which confers immediate access to a range of commercial

benefits at no additional cost to the member. Members may elect to

upgrade their membership to access a range of enhanced services

provided by AIM in exchange for an increased monthly subscription

fee. Subscription revenues are recognised on a monthly basis over

the membership period.

Other discretionary services

Certain other services are made available to AIM members on a

discretionary usage basis such as artwork processing services,

catalogues and merchandise boxes. These revenues are recognised

upon performance of the service or delivery of the product. For

example, catalogue and merchandise box revenues are recognised on

dispatch of the products to members.

Events and exhibitions revenues

AIM promotes and arranges events for AIM members and groups of

supplier customers to meet and build relationships. Revenue from

these events is recognised once the performance obligations have

been satisfied, typically on completion of an event or

exhibition.

Preferred Partner revenues

AIM provides services to vendors within the promotional products

industry whereby Preferred Partners are actively promoted to AIM

members via a variety of methods including utilising the AIM

technology platform, webinars, email communications and quarterly

publications.

Revenues are variable and depend on the value of purchases made

and services utilised by the AIM members from Preferred Partners.

Revenue is recognised over time by reference to the value of

transactions in the period. Payment for AIM's marketing services is

made by Preferred Partner customers on a calendar quarter or annual

basis. Revenue is recognised to the extent that it is highly

probable that it will not reverse based on historic fact pattern

and latest market information.

Software and technology services revenues

Revenues in respect of software product licences and associated

maintenance and support services are recognised evenly over the

period to which they relate. An element of technology services

revenue is dependent on the value of orders processed via the

Group's technology platforms. Revenue is accrued based on the value

of underlying transactions and the relevant contractual

arrangements with the customer. Revenue is constrained to the

extent that is that it is highly probable that it will not

reverse.

Merchanting revenues

Merchanting revenues arise when group companies contract with

customers to supply promotional products. By far the most

significant operation that carries out merchanting is within ACS.

ACS bears the risk of the transaction as Principal, provisioning of

orders and contracting with the customer, determining the

transaction price, provision of fulfilment and supplier contracts

and pricing, performing credit control and processing payments. The

sale of the promotional products including branded merchandise,

with the related costs of goods supplied, freight and AIM

affiliates selling commission recognised as the cost of goods sold.

The revenue is recognised on the shipment of the goods from the

supplier and as notified by the supplier invoice which are raised

following shipment. The Directors accept that the technical

transfer of risks and rewards to the customer occur on delivery of

the goods which are usually delivered within 2-5 days of shipment.

The Directors use a proxy of the shipment date as the trigger for

recognising revenue.

3. Segmental Performance

The chief operating decision maker has been identified as the

Board of Directors and the segmental analysis is presented in the

Group's internal reporting to the Board. At 30 September 2023, the

Group has two operating segments, North America, and the United

Kingdom.

Service revenues are derived from servicing our AIM membership

base and generating throughput with our contracted Preferred

Partners. Merchanting revenues are from the sale of promotional

products.

Unaudited Unaudited Unaudited Unaudited

6 months 6 months 6 months 6 months

30-Sep-23 30-Sep-23 30-Sep-23 30-Sep-23

GBP'000 GBP'000 GBP'000 GBP'000

---------- ---------- ---------- ----------

Group North UK and Central

America Europe

Services

Turnover 4,120 3,562 558 -

Cost of Sales (312) (221) (90) -

Gross Profit 3,809 3,341 467 -

------------------------------------- ---------- ---------- ---------- ----------

Merchanting

Turnover 7,648 7,648 - -

Cost of Sales (6,534) (6,534) - -

Gross Profit 1,114 1,114 - -

------------------------------------- ---------- ---------- ---------- ----------

Group

Turnover 11,768 11,210 558 -

Cost of Sales (6,846) (6,756) (90) -

Gross Profit 4,922 4,455 467 -

------------------------------------- ---------- ---------- ---------- ----------

Adjusted* Operating Profit/(Loss) 1,059 1,867 (60) (747)

Share-based payment charges (305) - - (305)

Depreciation (480) (79) (402) -

Amortisation (154) (123) (30) -

Exceptional charges (69) (19) (38) (11)

Finance charges (20) (16) (3) -

Segmental profit before income tax 31 1,629 (534) (1,064)

------------------------------------- ---------- ---------- ---------- ----------

* Operating profit before share-based payment charges,

amortisation of intangible assets, depreciation of tangible assets

and exceptional charges

Unaudited Unaudited Unaudited Unaudited

6 months 6 months 6 months 6 months

30-Sep-22 30-Sep-22 30-Sep-22 30-Sep-22

GBP'000 GBP'000 GBP'000 GBP'000

---------- ---------- ---------- ----------

Group North UK and Central

America Europe

Services

Turnover 3,850 3,179 671 -

Cost of Sales (250) (222) (28) -

Gross Profit 3,600 2,957 643 -

----------------------------- ---------- ---------- ---------- ----------

Merchanting

Turnover 3,816 3,816 - -

Cost of Sales (3,473) (3,473) - -

Gross Profit 343 343 - -

----------------------------- ---------- ---------- ---------- ----------

Group

Turnover 7,666 6,995 671 -

Cost of Sales (3,723) (3,695) (28) -

Gross Profit 3,943 3,300 643 -

----------------------------- ---------- ---------- ---------- ----------

Adjusted* Operating

Profit/(Loss) 763 1,312 190 (739)

Share-based payment charges (231) - - (231)

Depreciation (112) (82) (30) -

Amortisation (450) (84) (366) -

Exceptional charges (76) - (66) (10)

Finance charges (27) (21) (6) -

Segmental profit before

income tax (133) 1,125 (278) (980)

----------------------------- ---------- ---------- ---------- ----------

* Operating profit before share-based payment charges,

amortisation of intangible assets, depreciation of tangible assets

and exceptional charges

4. Basic and diluted earnings per share

The calculation of earnings per ordinary share is based on the

profit or loss for the period divided by the weighted average

number of equity voting shares in issue.

Unaudited Audited* Unaudited

6 months 12 months 6 months

Profit / (loss) attributable to the equity 30-Sep-23 31-Mar-23 30-Sep-22

shareholders of the Company:

---------- ---------- ----------

Continuing operations (GBP000) 48 390 (73)

Weighted average number of shares (number

'000) 70,813 70,813 70,778

Fully diluted weighted average number of

shares (number '000) 71,128 71,198 71,236

Basic and diluted profit / (loss) per ordinary

share (pence)

Continuing operations 0.07 0.55 (0.10)

Adjusted profit / (loss) per ordinary share

(pence) on continuing operations

Continuing operations (GBP000) 48 390 (73)

add back:

Share based payments 305 511 231

Amortisation on acquired intangibles 78 151 75

Exceptional charges 69 100 76

Adjusted earnings 500 1,152 309

Adjusted basic and diluted earnings per

ordinary share (pence) on continuing operations 0.71 1.63 0.44

Share options that could potentially dilute basic earnings per

share in the future were not included in the calculation of diluted

earnings per share because they are antidilutive for the six months

ended 30 September 2023.

5. Key performance indicators

The Group ' s key performance indicators have been updated to

align with external market sentiment including incentives for the

Executive and Senior Management.

Unaudited Audited Unaudited

6 months 12 months 6 months

31 Mar 30 Sep

30-Sep-23 2023 2022

GBP'000 GBP'000 GBP'000

---------- ---------- ----------

Revenue 11,768 18,761 7,666

Gross Profit 4,922 8,605 3,943

Adjusted EBITDA* 1,059 1,957 763

Statutory loss before tax 31 152 (133)

Adjusted profit before tax** 483 915 249

Gross Margin (per cent.) 41.8% 45.9% 51.4%

Adjusted basic earnings per

share (pence)*** 0.71 1.63 0.44

*Operating profit before share-based payment charges,

amortisation of intangible assets, depreciation of tangible assets

and exceptional charges. 'Adjusted EBITDA' is a consistent measure

used to show the performance of the revenue generating activities

and the related costs involved in the delivery of revenue for the

current year.

**Adjusted profit before tax is profit before tax adjusted for

share based charges, exceptional costs and amortisation on acquired

intangibles. This metric is introduced to review the performance of

the underlying business including depreciation and amortisation of

development costs and is aligned with the principle of underlying

total shareholder return.

*** Basic adjusted earnings per share from continuing operations

is calculated using profit after tax but before share-based payment

charges, amortisation of acquired intangible assets and exceptional

charges with the weighted average number of equity voting shares in

issue. This provides a metric that is used when evaluating

shareholder return combined with the underlying performance of the

business.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FEUEEWEDSEEF

(END) Dow Jones Newswires

November 28, 2023 02:00 ET (07:00 GMT)

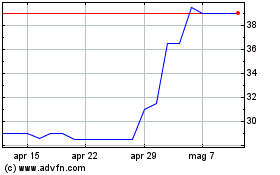

Grafico Azioni Altitude (LSE:ALT)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Altitude (LSE:ALT)

Storico

Da Nov 2023 a Nov 2024