TIDMAMAT

RNS Number : 8926O

Amati AIM VCT PLC

06 October 2023

Amati AIM VCT plc (the "Company")

Legal Entity Identifier: 213800HAEDBBK9RWCD25

Half-yearly Report for the six months ended 31 July 2023

Highlights

Investment Objective

The investment objective of Amati AIM VCT plc (the "Company") is

to generate tax free capital gains and income on investors' funds,

through investment primarily in AIM-traded companies. The Company

will manage its portfolio to comply with the requirements of the

rules and regulations applicable to Venture Capital Trusts. The

Company's policy is to hold a diversified portfolio across a broad

range o sectors to mitigate risk.

Dividend Policy

The Board aims to pay annual dividends of around 5% of the

Company's Net Asset Value at its immediately preceding financial

year end, subject to distributable reserves and cash resources and

with the authority to increase or decrease this level at the

directors' discretion.

Key Data

6 months 6 months Year

ended ended

31/07/23 31/07/22 ended

(unaudited) (unaudited) 31/01/23

(audited)

---------------------------------------- --------------- -------------- -------------

Net Asset Value ("NAV") GBP166.4m GBP222.5m GBP201.3m

Shares in issue 151,201,269 151,939,444 151,548,993

NAV per share 110.0p 146.5p 132.8p

Share price 102.5p 136.5p 123.5p

Market capitalisation GBP155.0m GBP207.4m GBP187.2m

Share price discount to NAV 6.8% 6.8% 7.0%

NAV Total Return (assuming re-invested

dividends) -14.6% -16.4% -22.2%

Numis Alternative Markets Total

Return Index* -11.3% -16.4% -20.7%

Ongoing charges** 2.0% 2.0% 1.9%

Dividends paid and declared in respect

of the year 2.5p 3.5p 7.0p

---------------------------------------- --------------- -------------- -------------

* Numis Alternative Markets Index is included as a comparator

benchmark for performance as this index includes all companies

listed on qualifying UK alternative markets

** Ongoing charges calculated in accordance with the Association

of Investment Companies' ("AIC's") guidance

Table of investor returns to 31 July 2023

Numis Alternative

NAV Total Markets Total

Return with Return

dividends Index

Date re-invested

------------------------------------ ----------------- -------------- ------------------

NAV following re-launch of the

VCT under management of Amati 9 November

Global Investors ("Amati") 2011* 104.5% 16.2%

------------------------------------ ----------------- -------------- ------------------

NAV following appointment of Amati

as Manager of the VCT, which was

known as ViCTory VCT at the time 25 March 2010 114.5% 19.5%

------------------------------------ ----------------- -------------- ------------------

*Date of the share capital reconstruction when the NAV was

re-based to approximately 100p per share.

A table of historic returns is included below.

Chairman's Statement

Overview

In the first half of 2023, markets continued to be hostile for

early-stage businesses on AIM, especially for those requiring to

raise further capital. In addition, the sharp rise in interest

rates and inflationary environment have created more difficult

trading conditions for some of the larger, more mature companies.

Consequently, this has impacted negatively on performance, with

several of the larger holdings in the portfolio being de-rated.

The number of companies raising money on AIM was much reduced,

as often happens during periods of market stress. However, GBP8.8m

was invested in new qualifying investments during the period. This

was across a mixture of IPO and secondary fund raises on AIM,

including three small follow-on investments into companies already

held, and one investment in a pre-IPO company. Details of these

investments are provided in the Fund Manager's Review. Cash levels

have remained high as the Manager made some sales from the

qualifying portfolio, amounting to GBP8.3m. Cash is being actively

managed with exposure to both money market funds and

interest-bearing bank deposits, in order to maximise income whilst

new investments are being sought.

Investment Performance and Dividend

The NAV total return for the period was -14.6%, which compares

to a return of -11.3% for the Numis Alternative Markets Index. Full

details are provided in the Fund Manager's Review.

The Board aims to pay annual dividends of around 5% of the

Company's Net Asset Value at its immediately preceding year end,

subject to the Company's available distributable reserves and cash

resources, and with the authority to increase or decrease this

level at the Directors' discretion. In line with this, the Board is

declaring an interim dividend of 2.5p per share, to be paid on 24

November 2023 to shareholders on the register on 20 October 2023.

The ex-dividend date will be 19 October 2023.

Corporate Developments

In June, the Company held its AGM and the Manager's Investor

Afternoon for a second year at Barber-Surgeons' Hall. The day was

well attended and a recording of the event remains available to

view on the Manager's website at:

https://www.amatiglobal.com/storage/1203/Amati-AIM-VCT-Annual-Report.pdf

.

With cash levels remaining high and the rate of new investments

still running at relatively low levels, the Board is not planning

to raise funds in the current financial year, although the Dividend

Re-investment Scheme (DRIS) remains open to shareholders who wish

to make use of it. The last day for the Dividend Re-investment

Scheme elections will be 8 November 2023.

VCT Legislation

The current VCT legislation contains a "Sunset Clause" which

effectively brings income tax relief to an end for new

subscriptions after 5 April 2025. This was agreed in 2015 by the UK

government to secure ongoing EU approval of the VCT and EIS

schemes, which have been a crucial source of funding for new and

innovative businesses in the UK. It has always been the case that

the extension of the scheme was bound up with the resolution of

issues around the Northern Ireland Protocol and potentially

achieving a further ratification of the schemes from the EU, so

that they can also continue to operate in Northern Ireland after

2025.

The Chancellor of the Exchequer had previously set out an

intention to continue the scheme and the subsequent publication of

the Windsor Framework on 27 February 2023 left the removal of the

Sunset Clause solely within the control of HM Treasury. Since then,

there have been no updates from the Government, but on 24 July

2023, the Treasury Committee published its Report on Venture

Capital calling for the Government to take urgent action to detail

and implement an extension. The Report contained other

recommendations around continued support for the VCT and EIS

sectors to encourage greater social inclusion within the Venture

Capital sector.

Outlook

Whilst the high rate of inflation in the UK now seems to be

easing, the rapid rise in interest rates during 2023 has tightened

liquidity conditions everywhere. This now requires a period of

adjustment, as market prices respond to what has been a very abrupt

end to the era of cheap money amidst the advent of war, potential

shortages of natural resources and a rising wave of sanctions on

international trade. None of this lessens the need for innovative

new businesses to underpin the future growth of the economy and

maintain competitiveness. However, it makes it harder for such

businesses to find funding and tends to slow down sales cycles,

making it more expensive for them to scale up. This makes the role

of VCTs more important than ever, being pools of capital which are

able to continue to invest in tougher times and support businesses

over the longer term. The need for clarity on the future of VCT

schemes is becoming ever more critical. Tougher markets also tend

to be good for the long run returns from new investments, so it is

to be hoped that the ability to continue investing will stand the

Company in good stead in the years to come. It is encouraging that

new opportunities for qualifying investments are appearing on AIM,

albeit in smaller numbers than previously.

Fiona Wollocombe

Chairman

5 October 2023

For any matters relating to your shareholding in the Company,

dividend payments, or the Dividend Re-investment Scheme, please

contact The City Partnership on 01484 240 910, or by email at

registrars@city.uk.com. For any other matters please contact Amati

Global Investors ("Amati") on 0131 503 9115 or by email at

info@amatiglobal.com .

Amati maintains an informative website for the Company -

www.amatiglobal.com - on which monthly investment updates,

performance information, and past company reports can be found.

Fund Manager's Review

Market Review

Russia's ongoing invasion of Ukraine and the daily horrors it

brings continues to weigh on investor sentiment, with additional

concerns about the ongoing potential for China to become more

bellicose and for Russia to continue to provoke political mayhem in

its spheres of influence abroad. In stock markets, headlines have

been dominated by the global fight against inflation with the US

Federal Reserve, the European Central Bank and the Bank of England

all simultaneously continuing to increase interest rates rapidly

from historically low levels. This 'normalisation' of policy

created a number of disruptions along the way. There was a notable

bump in the road in the US banking system with the collapse of SVB

Bank in March, closely followed by First Republic Bank and

Signature Bank. Of even greater importance was the subsequent

unravelling of Credit Suisse. However, the contagion effects of

these failures have been limited, with UBS riding to the rescue of

Credit Suisse and the US banks being bailed out by larger, better

capitalised institutions.

In this tightening environment government bond yields have

continued to rise globally, most notably in the US and the UK,

where interest rate rises have been most pronounced. The outlook

for global growth has deteriorated somewhat but most major

economies are bumping along the bottom and recession has largely

been avoided so far. The most notable change has been a marked

deterioration in Chinese growth prospects and this has led to falls

in commodities such as copper and iron ore. Other key commodities

such as gold and oil have been broadly flat in the period.

In recent months there has been some evidence that inflation is

now being brought under control, with the June G20 inflation rate

having fallen to 4.6%. The economic picture in the UK remains more

troubled and we continue to lag behind other leading economies in

the battle against inflation. However, the trend is finally heading

in the right direction, with key indicators such as the Price

Producer Index, food, construction materials and money supply all

beginning to head firmly downwards. Indeed, many commentators now

believe that Prime Minister Sunak will achieve his wish of sub-5%

inflation before the end of 2023. Investor anxiety over rising

interest rates has also begun to reduce somewhat, with rate

expectations now beginning to roll over. Gilt yields have risen

back to levels that we saw during the mini Budget crisis of last

September. While rising yields have supported a steady recovery in

sterling against both the Euro and the US Dollar, this time around

fiscal credibility has been maintained albeit government finance is

under pressure.

Global markets have recovered their poise in 2023, focused on

strong rallies in the handful of the world's largest tech companies

listed in the US. By contrast, the UK equity market remained in the

doldrums with the FT All Share index returning a paltry 0.6% over

the period. AIM continues to lag significantly, falling by 11% over

the six months, reflecting ongoing risk-aversion and tougher

trading conditions slowing down the growth of the more mature

companies. Liquidity at the lower end of the UK market remains

somewhat problematic and market sentiment towards UK equities is

fragile. There were continued outflows from open-ended UK equity

funds, continuing the weak trend of recent years, and there are

considerable challenges in re-establishing the UK market as an

attractive place for companies to list and raise capital. However,

we do detect a greater commitment from the Chancellor, the FCA and

others to address these increasingly urgent problems.

Performance Review

Over the rst half of the year the NAV Total Return fell by

14.6%, underperforming its benchmark which declined by 11.3%.

An environment of limited risk appetite amongst investors

continued to affect stock market liquidity, and this

disproportionately impacted share prices for even the largest

capitalisation companies within the portfolio. This was the case

for our biggest holding, video gaming services provider Keywords

Studios ("Keywords"), which fell by 38% in the period despite

reporting 10% organic growth and stable margins in its rst half

trading update at the end of the period, expecting this to continue

in its second half. This followed concerns that Generative Arti

cial Intelligence ("GenAI"), a technology for machine-created data

content such as text, images, sounds and animation, could be a

signi cant disruptor to the company's creative, testing and

localisation businesses. The shares have been sold short by some

hedge funds. It is too early to tell exactly how GenAI will impact

the video games industry, given the complex legal issues around IP

ownership, but it is likely that Keywords will be well placed to

adopt the best practices and unlikely that GenAI will lead to such

ef ciency gains that the market for the kinds of outsourced

services that Keywords provides diminishes. Another holding

impacted by GenAI fears was digital learning and talent management

specialist Learning Technologies, where machine-created education

is seen by some as a competitive threat. A greater in uence on the

share price, however, has been a slowdown in project-based and

transactional work amongst the company's nancial services and

technology clients. On the other hand, longer term contracts and

Software-as-a-Service ("SaaS") revenues have proven more robust in

softer economic conditions. The shares fell by 47%. Whilst GenAI

will undoubtedly have an eventual impact across the whole economy,

the precise business winners and losers from this technology will

likely emerge gradually, as was the case with the dot.com

revolution more than twenty years ago.

Polarean Imaging , the medical imaging specialist, which nally

received FDA approval for its drug device combination product,

XENOVIEW, last December, is pursuing a strategy of strategic

partnerships with pharmaceutical companies, magnetic resonance

imaging specialists, and Contract Research Organisations, in order

to fund commercial applications for its technology. This will

require additional equity funding, and this acted as an overhang on

the company's shares which fell by 50% in the period.

Other negative contributors included recently oated EnSilica and

Northcoders. Ensilica specialises in the design and supply of

Application Speci c Integrated Circuits ("ASICs") to a range of

automotive, satellite and industrial automation customers. After a

successful listing in May of last year, the shares initially

outperformed on the back of a series of contract awards. This new

business run rate exceeded original expectations, which prompted a

follow-on, non-qualifying placing in March to raise working

capital. The placing discount has since acted as a cap on the share

price, which fell by 36% across the period. Northcoders provides

training courses for IT novices and junior software engineers, in a

UK market where there is an acute shortage of coders and

developers. Recent interim results show revenues up over 50%,

driven by a number of contracts with large corporate clients, plus

further funding secured from the Department for Education. This

provides good forward visibility to the business. The share price

peaked late last year but has subsequently retrenched, falling 37%

in the period driven by limited liquidity and some small

selling.

Other weak performances included Velocys, the sustainable fuels

technology company, which fell by 65% as its shares suffered

headwinds from ongoing discussions to raise additional funding for

its US manufacturing facility. Whilst over GBP6m was raised in

June, a larger amount of GBP12m from a strategic investor is still

to be nalised; Eneraqua Technologies, a supplier of specialist

energy and water ef ciency solutions, fell by 62% having missed its

forecast revenues for nancial year 2023 but still reported a more

than 50% increase year on year. The miss was caused by local

authority and housing association clients re-prioritising their

capital budgets due to expensive re cladding commitments. This

meant some larger utility replacement projects were pushed into

2024, but they were not cancelled; and Aptamer, a developer of

custom binders for the life sciences industry, which sought

additional funding as customers delayed research projects and

ambitious forecasts for revenues moved out of reach. This funding

was completed late in the period, but poor investor appetite for

loss-making companies saw the shares fall by 96%. In February,

having realised that unquoted company Flylogix was unlikely to

resolve its operational issues with ying drones out over the North

Sea for methane emissions testing, we agreed with the company and

BP Ventures, the other principal investor in the business, that the

company be put into administration in order to protect the cash

remaining on the balance sheet. We expect this to return 20-25% of

our investment and wrote the equity and loan down accordingly.

The greatest positive contributor over the period was autonomous

vehicle specialist, Aurrigo International ("Aurrigo"). A successful

otation last September was followed up with positive operational

news. An initial agreement with Singapore's Changi Airport to

develop baggage handling technology has progressed to a formal

partnership to trial and test prototype Auto-Dolly and Auto-Dolly

Tug vehicles, together with Auto-Sim airport simulation software.

This multi-year partnership will allow Aurrigo to showcase its

technology to other airports and provides a solid platform for

future growth. The rapid recovery of global aviation to almost

pre-pandemic activity levels, is driving demand for ef ciencies,

decarbonisation, and solutions to staff shortages, all issues which

Aurrigo's products address. The company's original business in

automotive engineering design continues to generate solid revenues.

The shares gained 56%.

Following a disappointing period of trading, video games

developer and publisher Frontier Developments rebounded with its

shares rising 21% in the period. A full year update in June, whilst

in line with previous downgraded guidance, incorporated better

performance from the existing games portfolio. However, a strategic

decision was taken to cease all third-party title publishing after

poor results, and an exceptional charge for this caused an overall

loss. Frontier is now returning to its core business of in-house

games development and has two signi cant releases scheduled; a

Formula 1 Manager game and a real-time strategy game based on the

Warhammer Age of Sigmar IP.

SRT Marine Systems ("SRT") , the provider of maritime

surveillance, monitoring and management systems, made several

contract announcements during the period and achieved an

oversubscribed non-qualifying capital raise to fund working

capital. With applications in law enforcement, search & rescue,

sheries management and environmental monitoring, SRT has a growing

order book. The shares rose by 20%.

Other positive contributors included Glantus, the accounts

payable analytics software provider, which announced improved

trading and then a private equity bid approach, and its shares rose

by 111%; Equals, the FX payment services specialist, which

continues to trade strongly as it shifts its focus from consumer to

business customers, generating stronger growth and higher margins

and which saw its shares rise by 16%; Kinovo, the provider of

property services to the social housing sector, saw its shares rise

by 30% having announced several contract wins involving energy ef

ciency, re safety, electrical wiring and related building works;

and Creo Medical, the surgical endoscopy device specialist, whose

technology is seeing increasing adoption helped by an

oversubscribed, non-qualifying fund raise in February, in which the

TB Amati UK Listed Smaller Companies Fund participated. Its shares

rose by 64%.

Portfolio Activity

Over the course of the period under review, the Company made

four new investments and three follow-on investments. The new

investments comprised one Initial Public Offering ("IPO"), one

pre-IPO investment and two investments into companies already

quoted on AIM.

The Company participated in the otation of Fadel Partners, a

developer of cloud-based software for brand compliance and

royalties' management. Fadel's customers are licensors and

licensees across a range of markets covering media, entertainment,

publishing, consumer brands and technology. The products

incorporate sophisticated image and video recognition powered by AI

search tools. The business is long established, and has been

recently pro table, but is now entering a new growth phase which

will involve losses as it moves to build substantial global

revenues. An unquoted investment was made in 2 Degrees, alongside

Maven Capital Partners. The company provides large corporates and

their suppliers with an online SaaS platform to measure, manage and

reduce carbon within supply chains, thereby helping to achieve the

Green House Gas Protocol Scope 3 emissions standard. The platform

includes a planning tool and AI-driven recommendations for best

practices to reduce carbon. Current markets are in food retail and

automotive, with signi cant scope to grow beyond this.

Investments through secondary placings in existing AIM companies

involved Itaconix and Cordel. The former is a US developer of a

plant-based polymer used to decarbonise everyday consumer products.

The company has been on AIM since 2012, but only achieved

commercial breakthrough in 2020 with a bio-polymer ingredient for

dishwasher detergent. Close to 150 consumer products now use

Itaconix ingredients, involving major retailers such as Amazon,

Walmart, Aldi and Tesco. With opportunities to grow into personal

hygiene and beauty products, the company is forecast to breakeven

in its current nancial year. Cordel oated on AIM in 2018, and a

year later acquired its current business activity which is an AI

analytical software platform to automate inspection and management

of rail infrastructure. Using highly accurate Light Detection and

Ranging sensors mounted onto train rolling stock, the technology

replaces human surveying of vegetation infringements,

infrastructure clearances, crossings, drainage and ballast, in

order to meet regulatory requirements and prevent accidents.

Commercial success to date includes contracts with Network Rail,

Angel Trains and Amtrak. The company is forecast to breakeven in

the current nancial year.

A total of GBP7.9m was invested in these new investments in the

period. Three follow-on investments, totalling GBP0.9m, were made

in antibody developer Fusion Antibodies, re safety product

specialist Zenova, and sustainable biopesticides formulator Eden

Research. In each case, these were part of institutional placings

to provide working capital. The position in Amryt Pharmaceuticals

was sold following the recommended offer in January by Chiesi

Farmaceutici S.p.A. to acquire the company. Angle, the liquid

biopsy developer, was also sold on concerns that its technology

could be superseded by alternative circulating tumour DNA

diagnostics. The share price has fallen materially since then.

After strong performance from the shares, the opportunity was taken

to reduce our large holding in AB Dynamics, the designer and

supplier of testing and simulation technology to the automotive

industry. This crystallised GBP1.6m in gains. Allergy Therapeutics,

Bonhill, Falanx and Itsarm (formerly In the Style) were all exited

as they had become sub-scale positions.

Outlook

Post the period end, AIM has continued to exhibit weakness, as

markets remain wary about the near-term trajectory of key economic

indicators. Whilst investors continue to fear the impact of an

overtightening of interest rates by central banks, the current

picture in the UK is one of moderating in ationary pressures,

broadly robust employment levels, and better than anticipated GDP

growth. There have also been some signs of a return of bid

activity, but the dead hand of sustained redemptions from UK equity

funds continues to negatively impact stock market liquidity and

momentum.

With almost all yardsticks pointing to the relative

undervaluation of smaller companies within the UK market, and the

UK's cheapness in a global context, alongside concerns about

falling IPO activity, there are growing demands for policy measures

to improve the attractiveness of a UK listing. This has resulted in

the Chancellor's recent call for de ned contribution pension funds

to allocate at least 5% to unlisted equities (the de nition of

which includes AIM quoted stocks) by 2030. More detail on this will

be contained within the Chancellor's Autumn Statement, but there is

the potential for this reform to create a structural ow of investor

funds into smaller UK public equities. Should this measure become

more targeted and emphasise the UK government's priorities towards

growth sectors such as technology, life sciences and renewables,

then it might prove bene cial to the Company's investment

universe.

In early August, the Company made two further material

investments involving the IPO of an engineering oil sensor

developer, Tan Delta , and a follow-on placing in existing holding,

Velocity Composites , to fund working capital for its growing

pipeline of contracts to supply advanced aircraft material. This is

an encouraging start to the second half of the year and continues

to utilise the available cash balance within the portfolio. Whilst

weak stock market conditions are a headwind to investment

performance, they also provide attractively valued opportunities

for the Company to continue backing innovative growth

companies.

Dr Paul Jourdan, David Stevenson and Scott McKenzie

Amati Global Investors

5 October 2023

Investment Portfolio

as at 31 July 2023

Original Fair

Amati Value

VCT bookcost Movement

at 4 Aggregate in Market

May 2018(#) Cost* Cost** Valuation year*** Cap Dividend % of net

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBPm Sector Yield(NTM) assets

----------------- ------ -------------------------------- --------------------- ----------- ----------- ---------- -------- -------------- ------------ ----------

TB Amati

UK Smaller

Companies

Fund 3,331 6,581 9,912 11,715 (941) - Financials 2.7% 7.0

Keywords Information

Studios plc 1,3 323 4,851 5,174 8,955 (5,479) 1,392.8 Technology 0.2% 5.4

AB Dynamics

plc 1 151 1,721 1,872 5,902 51 415.1 Industrials 0.4% 3.6

Aurrigo

International

plc 1 - 2,019 2,019 5,258 1,968 52.1 Industrials - 3.2

Learning

Technologies Information

Group plc 1,3 780 3,771 4,551 5,175 (4,499) 593.0 Technology 2.2% 3.1

Polarean Health

Imaging plc 1 - 4,899 4,899 4,716 (4,808) 42.8 Care - 2.8

Frontier

Developments Communication

plc 1 341 4,357 4,698 3,659 642 231.7 Services - 2.2

Water

Intelligence

plc 2 180 1,038 1,218 3,585 (1,059) 76.4 Industrials - 2.2

Health

MaxCyte Inc. 1 449 1,536 1,985 3,510 (1,203) 360.7 Care - 2.1

Ensilica Information

plc 1 - 2,450 2,450 3,038 (1,715) 48.4 Technology - 1.8

Top Ten 33,223 38,778 55,513 (17,043) 33.4

----------------- ------ -------------------------------- --------------------- ----------- ----------- ---------- -------- -------------- ------------ ----------

Fadel Partners, Information

Inc 1 - 3,000 3,000 3,000 - 29.1 Technology - 1.8

Sosandar Consumer

plc 1 - 1,872 1,872 2,958 (225) 58.8 Discretionary - 1.8

Craneware Health

plc 2,3 298 3,601 3,899 2,922 (129) 480.2 Care 2.3% 1.8

Chorus

Intelligence

Limited

Ordinary Information

Shares 1,4 - 301 301 151 - - Technology - 0.1

Chorus

Intelligence

Limited 10%

Convertible Information

Loan Notes 1,4 - 2,699 2,699 2,699 - - Technology - 1.6

GB Group Information

plc 2 236 2,967 3,203 2,828 (1,149) 3,067.0 Technology 1.9% 1.7

Solid State

plc 2 260 260 520 2,688 (21) 147.4 Industrials 1.6% 1.6

Consumer

Nexteq plc 2 419 3,777 4,196 2,353 (488) 89.8 Discretionary 2.7% 1.4

Saietta Group Consumer

plc 1,3 - 5,100 5,100 2,307 (268) 44.3 Discretionary - 1.4

SRT Marine Information

Systems plc 1 709 465 1,174 2,117 346 105.7 Technology - 1.3

Northcoders Consumer

Group plc 1 - 2,111 2,111 2,093 (1,212) 15.2 Discretionary - 1.2

Top Twenty 59,376 66,853 81,629 (20,189) 49.1

----------------- ------ -------------------------------- --------------------- ----------- ----------- ---------- -------- -------------- ------------ ----------

Diaceutics Health

plc 1 - 1,557 1,557 2,049 (102) 84.5 Care - 1.2

2 Degrees Information

Limited A1 1 - 1,867 1,867 1,867 - - Technology - 1.1

2 Degrees Information

Limited A2 1 133 133 133 - - Technology - 0.1

Intelligent

Ultrasound Health

plc 1 - 2,194 2,194 1,982 (176) 29.4 Care - 1.2

Brooks Macdonald

Group plc 2,3 - 1,154 1,154 1,902 (72) 346.0 Financials 4.1% 1.1

Accesso

Technology Information

Group plc 1,3 - 221 221 1,665 (144) 311.8 Technology - 1.0

Arecor

Therapeutics Health

plc 1 - 1,910 1,910 1,604 (253) 58.2 Care - 1.0

Itaconix

plc 1 - 2,000 2,000 1,529 (471) 26.3 Industrials - 0.9

Belvoir Group

plc 1 404 379 783 1,512 64 70.8 Real Estate 5.2% 0.9

Equals Group

plc 1 - 1,137 1,137 1,472 208 183.9 Financials - 0.9

Clean Power

Hydrogen

plc 1 - 2,500 2,500 1,306 (28) 63.0 Industrials - 0.8

Eden Research

plc 1 - 1,056 1,056 1,005 63 22.9 Materials - 0.6

Health

Ixico plc 1 - 1,367 1,367 927 (195) 9.2 Care - 0.5

Kinovo plc 2 - 1,681 1,681 927 215 26.7 Industrials - 0.5

Velocys plc 1 - 2,248 2,248 869 (1,614) 26.6 Energy - 0.5

Cordel Group Information

plc 1 - 915 915 839 (76) 11.0 Technology - 0.5

Byotrol plc

Ordinary

shares 1,4 511 348 859 450 (50) 8.2 Materials - 0.3

Byotrol plc

9% Convertible

loan notes 1,4 - 350 350 350 (3) - Materials - 0.2

One Media

iP Group Communication

plc 1 - 1,240 1,240 797 (266) 10.0 Services - 0.5

Eneraqua

plc 1 - 1,955 1,955 776 (1,270) 36.5 Industrials 1.4% 0.5

Property

Franchise

Group plc

(The) 2 155 197 352 767 59 83.9 Real Estate 5.4% 0.5

Getech Group

plc 1 - 1,700 1,700 757 (325) 6.6 Energy - 0.5

Flylogix

Limited

Ordinary Information

shares 1,4 - 300 300 - - - Technology - -

Flylogix

Limited 10%

Convertible Information

loan notes 1,4 - 2,700 2,700 625 - - Technology - 0.4

Block Energy

plc 1 - 3,000 3,000 614 51 8.3 Energy - 0.4

Glantus Holdings Information

plc 1 - 3,000 3,000 559 294 9.7 Technology - 0.3

Information

Netcall plc 2 - 110 110 551 (31) 144.3 Technology 0.9% 0.3

Hardide plc 1 695 1,666 2,361 497 (90) 6.5 Materials - 0.3

Velocity

Composites

plc 1 496 307 803 483 (161) 15.5 Industrials - 0.3

Elexsys Energy

Ordinary Information

shares 1,4 - 200 200 - - - Technology - -

Elexsys Energy

8% Convertible Information

loan notes 1,4 - 1,800 1,800 450 (450) - Technology - 0.3

Science in Consumer

Sport plc 2 804 1,135 1,939 431 45 25.0 Staples - 0.3

Creo Medical Health

Group plc 1,3 - 1,613 1,613 413 161 115.6 Care - 0.2

Verici Dx Health

Limited 1 - 800 800 400 (40) 17.0 Care - 0.2

Zenova Group

plc 1 - 900 900 346 (218) 4.8 Materials - 0.2

Strip Tinning

Holdings

plc 1 - 1,054 1,054 285 (57) 7.7 Industrials - 0.2

Fusion

Antibodies Health

plc 1 565 1,829 2,394 209 (895) 3.7 Care - 0.1

Brighton

Pier Group Consumer

plc (The) 1 314 175 489 171 (99) 16.8 Discretionary - 0.1

MyCelx

Technologies

Corporation 1 440 205 645 170 48 9.7 Industrials - 0.1

Rosslyn Data

Technologies Information

plc 1 614 1,308 1,922 159 (88) 1.5 Technology - 0.1

Rua Life

Sciences Health

plc 1 - 930 930 155 (298) 4.4 Care - 0.1

Synectics Information

plc 2 - 342 342 143 (27) 18.7 Technology 3.7% 0.1

Health

Anpario plc 2 19 109 128 94 (694) 49.3 Care 5.4% 0.1

Trellus Health Health

plc 1 - 700 700 88 (52) 8.1 Care - 0.1

Aptamer Group Health

plc 1 - 3,672 3,676 47 (1,146) 1.0 Care - -

Merit Group Communication

plc 1 - 596 596 30 9 10.1 Services - -

FireAngel

Safety

Technology Consumer

Group plc 1 - 690 690 19 (36) 9.1 Discretionary - -

Investments

held at nil

value 691 - - - -

Total

investments 116,626 129,815 114,053 (28,399) 68.6

----------------- ------ -------------------------------- --------------------- ----------- ----------- ---------- -------- -------------- ------------ ----------

Money market

funds

Royal London

Short Term

Money Market

Fund 18,325 18,325 18,370 45

Goldman Sachs

Sterling

Liquid Reserves

Fund 9,868 9,868 9,868

Northern

Trust Global

The Sterling

Fund 9,868 9,868 9,868

----------------- ------ -------------------------------- --------------------- ----------- ----------- ---------- -------- -------------- ------------ ----------

Total money

market funds 38,061 38,061 38,106 22.9

----------------- ------ -------------------------------- --------------------- ----------- ----------- ---------- -------- -------------- ------------ ----------

Other net

current assets 14,224 8.5

----------------- ------ -------------------------------- --------------------- ----------- ----------- ---------- -------- -------------- ------------ ----------

Net assets 166,383 100.0

----------------- ------ -------------------------------- --------------------- ----------- ----------- ---------- -------- -------------- ------------ ----------

(1) Qualifying holdings.

(2) Part qualifying holdings.

(3) These investments are also held by other funds managed by Amati.

(4) The investments of Ordinary Shares and Convertible loan notes: Flylogix Limited ("Flylogix")

consists of 392 Ordinary Shares in Flylogix at fair value of nil and 10% Convertible Loan

Notes at fair value of GBP625,000. Flylogix was placed into administration on 2 March 2023.

The fair value of the investment held is the amount reasonably expected to be receivable from

the administrator. Elexsys Energy plc ("Elexsys") consists of 202,737 Ordinary Shares in Elexsys

at fair value of nil and 8% Convertible Loan Notes at fair value of GBP450,000. Interest at

8% on the convertible loan notes in Elexsys is being accrued and the interest receivable of

GBP120,000 to the Balance Sheet date has been accrued. If Elexsys is admitted to AIM with

a minimum equity raise of GBP5m, the Convertible Loan Notes are convertible into Ordinary

Shares after listing. Chorus Intelligence Limited ("Chorus") consists of 232 Ordinary Shares

in Chorus at fair value of GBP150,000 and 10% Convertible Loan Notes at fair value of GBP2,699,000.

Interest at 10% on the convertible loan notes in Chorusis being accrued and the interest receivable

of GBP372,000 to the Balance Sheet date is accrued. Byotrol plc ("Byotrol") consists of 25,000,001

Ordinary Shares in Byotrol at fair value of GBP450,000 and 9% Convertible Loan Notes at fair

value of GBP350,000. Interest at 9% on the convertible loan notes in Byotrol is being paid

with GBP16,000 received in the period and GBP3,000 accrued at the Balance Sheet date.

# This column shows the original book cost of the investments acquired from Amati VCT plc

on 4 May 2018.

*This column shows the bookcost to the Company as a result of market trades and events.

**This column shows the aggregate book cost to the Company either as a result of trades and

events or asset acquisition.

***This column shows the movement in fair value, the unrealised gains/(losses) on investments

during the year, see notes 1 and 8 below for further details.

NTM Next twelve months consensus estimate (Source: Refinitiv, Fidessa and Amati Global Investors)

The Manager rebates the management fee of 0.75% on TB Amati UK Smaller Companies Fund and

this is included in the yield.

All holdings are in ordinary shares unless otherwise stated.

Investments held at nil value: Celoxica Holdings plc(1) , Leisurejobs.com Limited(1) (previously

The Sportweb.com Limited), Rated People Limited(1), Sorbic International plc, TCOM Limited(1),

VITEC Global Limited(1).

As at 31 July 2023 the percentage of the Company's portfolio held in qualifying holdings for

the purposes of Section 274 of the Income and Corporation Taxes Act is 88.33%.

Principal and Emerging Risks

The Company's assets consist of equity (66%), xed interest

investments including convertible loan notes (2%), money market

funds (23%) and cash (9%). Its principal risks include investment

risk, venture capital approval risk, compliance risk, internal

control risk, nancial risk, economic risk, operational risk and

concentration risk. These risks and the ways in which they are

managed are described in Principal and Emerging Risks and notes 15

to 18 to the Financial Statements in the Company's Report and

Financial Statements for the year ended 31 January 2023. The war

between Russia and Ukraine continues to cause economic uncertainty.

Ongoing high levels of in ation and increased interest rates aimed

at reducing in ation cause stress to investee companies and affect

the ability of companies to raise nance in the market. The

Company's principal and emerging risks have not changed materially

since the date of that report.

Going Concern

The condensed financial statements have been prepared on a going

concern basis (Note 2 below).

Statement of Directors' Responsibilities

in respect of the half-yearly financial report

We confirm that to the best of our knowledge:

-- the condensed set of financial statements which has been

prepared in accordance with FRS 104 "Interim Financial Reporting"

gives a true and fair view of the assets, liabilities, financial

position and profit or loss of the Company;

-- the Chairman's Statement and Fund Manager's Review

(constituting the interim management report) include a true and

fair review of the information required by DTR4.2.7R of the

Disclosure Guidance and Transparency Rules, being an indication of

important events that have occurred during the first six months of

the financial year and their impact on the condensed set of

financial statements;

-- the Statement of Principal and Emerging Risks above is a fair

review of the information required by DTR4.2.7R, being a

description of the principal risks and uncertainties for the

remaining six months of the year; and

-- the nancial statements include a fair review of the

information required by DTR4.2.8R of the Disclosure Guidance and

Transparency Rules, being related party transactions that have

taken place in the rst six months of the current nancial year and

that have materially affected the nancial position or performance

of the Company during that period, and any changes in the related

party transactions described in the last annual report that could

do so (Note 10 below).

For and on behalf of the Board

Fiona Wollocombe

Chairman

5 October 2023

Income Statement (unaudited)

for the six months ended 31 July 2023

Six months ended Six months ended Year ended

31 July 2023 31 July 2022 31 January 2023

----- ------------------------------ ------------------------------ ------------------------------

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- --------- --------- -------- --------- --------- -------- --------- ---------

Loss on

investments - (28,903) (28,903) - (40,980) (40,980) - (55,748) (55,748)

Investment

income 6 1,486 - 1,486 489 - 489 1,810 - 1,810

Investment

management

fee (376) (1,127) (1,503) (497) (1,490) (1,987) (930) (2,788) (3,718)

Other expenses (283) - (283) (309) - (309) (588) - (588)

Profit/(loss)

on ordinary

activities

before

taxation 827 (30,030) (29,203) (317) (42,470) (42,787) 292 (58,536) (58,244)

Taxation on - - -

ordinary

activities - - - - - -

--------------- ----- -------- --------- --------- -------- --------- --------- -------- --------- ---------

Profit/(loss)

and total

comprehensive

income

attributable

to

shareholders 827 (30,030) (29,203) (317) (42,470) (42,787) 292 (58,536) (58,244)

--------------- ----- -------- --------- --------- -------- --------- --------- -------- --------- ---------

Basic and

diluted

earnings

/(loss) per

ordinary

share 4 0.55p (19.89)p (19.34)p (0.21)p (28.63)p (28.84)p 0.19p (38.99)p (38.80)p

--------------- ----- -------- --------- --------- -------- --------- --------- -------- --------- ---------

The total column of this Income Statement represents the profit

and loss account of the Company. The supplementary revenue and

capital columns have been prepared in accordance with The

Association of Investment Companies' Statement of Recommended

Practice. There is no other comprehensive income other than the

results for the period discussed above. Accordingly a Statement of

Total Comprehensive Income is not required.

All the items above derive from continuing operations of the

Company.

The accompanying notes are an integral part of the

statement.

Statement of Changes in Equity (unaudited)

Non-distributable reserves Distributable reserves

------------------------------------------------------------------ ----------------------------------------------------

Capital Capital

Share Share Merger redemption reserve Special Capital reserve Revenue Total

capital premium reserve reserve (non-distributable) reserve (distributable) reserve reserves

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- --------- --------- ----------- -------------------- --------- ----------------- --------- -----------

For the six

months ended

31 July 2023

Opening balance

as at 1

February

2023 7,578 940 425 908 12,918 177,385 3,108 (1,981) 201,281

---------------- --------- --------- --------- ----------- -------------------- --------- ----------------- --------- -----------

(Loss)/profit

and total

comprehensive

income for the

period - - - - (28,407) - (1,623) 827 (29,203)

---------------- --------- --------- --------- ----------- -------------------- --------- ----------------- --------- -----------

Total

comprehensive

income for the

period 7,578 940 425 908 (15,489) 177,385 1,485 (1,154) 172,078

Contributions

by and

distributions

to

shareholders:

Repurchase of

shares (62) - - 62 - (1,401) - - (1,401)

Shares issued 44 937 - - - - - - 981

Dividends paid - - - - - (5,275) - - (5,275)

(18) 937 - 62 - (6,676) - - (5,695)

Closing balance

as at 31 July

2023 7,560 1,877 425 970 (15,489) 170,709 1,485 (1,154) 166,383

---------------- --------- --------- --------- ----------- -------------------- --------- ----------------- --------- -----------

For the six months ended 31 July 2022

Opening balance

as at 1

February

2022 6,836 109,545 425 819 80,666 57,160 (6,104) (2,273) 247,074

---------------- --------- --------- --------- ----------- -------------------- --------- ----------------- --------- -----------

(Loss)/profit

and total

comprehensive

income for the

period - - - - (54,543) - 12,073 (317) (42,787)

---------------- --------- --------- --------- ----------- -------------------- --------- ----------------- --------- -----------

Total

comprehensive

income for the

period 6,836 109,545 425 819 26,123 57,160 5,969 (2,590) 204,287

Contributions

by and

distributions

to

shareholders:

Repurchase of

shares (36) - - 36 - (1,044) - - (1,044)

Shares issued 795 25,396 - - - - - - 26,191

Costs of share

issues - (116) - - - - - - (116)

Dividends paid - - - - - (6,803) - - (6,803)

---------------- --------- --------- --------- ----------- -------------------- --------- ----------------- --------- -----------

759 25,280 - 36 - (7,847) - - 18,228

Closing balance

as at 31 July

2022 7,595 134,825 425 855 26,123 49,313 5,969 (2,590) 222,515

---------------- --------- --------- --------- ----------- -------------------- --------- ----------------- --------- -----------

The accompanying notes are an integral part of the

statement.

Non-distributable reserves Distributable reserves

------------------------------------------------------------------- ----------------------------------------------------

Capital Capital

Share Share Merger redemption reserve Special Capital reserve Revenue Total

capital premium reserve reserve (non-distributable) reserve (distributable) reserve reserves

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ---------- --------- ----------- -------------------- --------- ----------------- --------- -----------

For the year ended 31

January

2023

Opening balance

as at 1

February

2022 6,836 109,545 425 819 80,666 57,160 (6,104) (2,273) 247,074

(Loss)/profit

and total

comprehensive

income for the

year - - - - (67,748) - 9,212 292 (58,244)

---------------- --------- ---------- --------- ----------- -------------------- --------- ----------------- --------- -----------

Total

comprehensive

income for the

year 6,836 109,545 425 819 12,918 57,160 3,108 (1,981) 188,830

Contributions

by and

distributions

to

shareholders:

Repurchase of

shares (89) - - 89 - (2,451) - - (2,451)

Shares issued 831 26,351 - - - - - - 27,182

Costs of share

issues - (132) - - - - - - (132)

Dividends paid - - - - - (12,110) - - (12,110)

Cancellation

of share

premium - (134,824) - - - 134,824 - - -

Expenses in

relation

to

cancellation

of share

premium

accounts - - - - - (38) - - (38)

---------------- --------- ---------- --------- ----------- -------------------- --------- ----------------- --------- -----------

742 (108,605) - 89 - 120,225 - - 12,451

Closing balance

as at 31

January

2023 7,578 940 425 908 12,918 177,385 3,108 (1,981) 201,281

---------------- --------- ---------- --------- ----------- -------------------- --------- ----------------- --------- -----------

The accompanying notes are an integral part of the

statement.

Condensed Balance Sheet (unaudited)

as at 31 July 2023

31 July 31 July 31 January

2023 2022 2023

Note GBP'000 GBP'000 GBP'000

Fixed assets

Investments held at fair value 8 114,053 157,405 142,354

--------------------------------------- ----- -------- -------- -----------

Current assets

Debtors 732 160 329

Cash and cash equivalents 53,109 66,058 59,595

Total current assets 53,841 66,218 59,924

--------------------------------------- ----- -------- -------- -----------

Current liabilities

Creditors: amounts falling due within

one year (1,511) (1,108) (997)

--------------------------------------- ----- -------- -------- -----------

(1,511) (1,108) (997)

-------- -------- -----------

Net current assets 52,330 65,110 58,927

Total assets less current liabilities 166,383 222,515 201,281

--------------------------------------- ----- -------- -------- -----------

Capital and reserves

Called-up share capital* 9 7,560 7,595 7,578

Share premium account* 1,877 134,825 940

Reserves 156,946 80,095 192,763

Equity shareholders' funds 166,383 222,515 201,281

Net asset value per share 5 110.0p 146.5p 132.8p

--------------------------------------- ----- -------- -------- -----------

* These reserves are not distributable.

The accompanying notes are an integral part of the balance

sheet.

Statement of Cash Flows (unaudited)

for the six months ended 31 July 2023

Six months Six months Year

ended ended ended

31 July 31 July 31 January

2023 2022 2023

GBP'000 GBP'000 GBP'000

------------------------------------------- ----------- ----------- -----------

Cash flows from operating activities

Investment income received 1,031 275 1,299

Investment management fees paid (1,655) (2,088) (3,910)

Other operating costs (295) (292) (572)

Net cash outflow from operating

activities (919) (2,105) (3,183)

----------- ----------- -----------

Cash flows from investing activities

Purchases of investments (8,116) (9,438) (12,422)

Sale of investments 8,244 27,774 31,166

Net cash inflow from investing activities 128 18,336 18,744

Net cash (outflow)/inflow before

financing (791) 16,231 15,561

-------------------------------------------- ----------- ----------- -----------

Cash flows from financing activities

Proceeds of share issues* - 24,931 24,931

Issue costs - (101) (132)

Share buy-backs (1,401) (1,294) (2,701)

Equity dividend paid (4,294) (5,542) (9,859)

Expenses in relation to cancellation

of share premium account - - (38)

Net cash (outflow)/inflow from

financing activities (5,695) 17,994 12,201

(Decrease)/increase in cash (6,486) 34,225 27,762

-------------------------------------------- ----------- ----------- -----------

Opening cash & cash equivalents 59,595 31,833 31,833

Closing cash & cash equivalents 53,109 66,058 59,595

----------- ----------- -----------

(*Adjusted to exclude non-cash dividends re-invested under the

Dividend Re-investment Scheme)

The accompanying notes are an integral part of the

statement.

Notes to the Financial Statements (unaudited)

for the six months ended 31 July 2023

1. Basis of Accounting

The Half-yearly nancial Report covers the six months ended 31

July 2023. The condensed nancial statements for this six month

period have been prepared in accordance with FRS 104 ("Interim

nancial reporting") and on the basis of the same accounting

policies as set out in the Company's Annual Report and Financial

Statements for the year ended 31 January 2023.

The comparative gures for the nancial year ended 31 January 2023

have been extracted from the latest published audited Annual Report

and Financial Statements. Those accounts have been reported on by

the Company's auditor and lodged with the Registrar of Companies.

The report of the auditor was (i) unquali ed, (ii) did not include

a reference to any matters to which the auditors drew attention by

way of emphasis without qualifying their report, and (iii) did not

contain a statement under section 498 (2) or (3) of the Companies

Act 2006.

The nancial information set out in this report has not been

audited and does not comprise full nancial statements within the

meaning of Section 434 of the Companies Act 2006. No statutory

accounts in respect of any period after 31 January 2023 have been

reported on by the Company's auditors.

2. Going concern

The nancial statements have been prepared on a going concern

basis and on the basis that approval as an investment trust company

will continue to be met.

The Directors have made an assessment of the Company's ability

to continue as a going concern and are satis ed that the Company

has the resources to continue in business for the foreseeable

future, being a period of at least 12 months from the date these

nancial statements were approved.

In making the assessment, the Directors of the Company have

considered the likely impacts of international and economic

uncertainties on the Company, operations and the investment

portfolio. These include, but are not limited to, the war in

Ukraine, political and economic instability in the UK and in

ationary pressures.

The Directors noted the Company's cash balance exceeds any short

term liabilities, it holds a portfolio of listed investments and is

able to meet the obligations of the Company as they fall due. The

surplus cash enables the Company to meet any funding requirements

and nance future additional investments. The Company is a closed

end fund, where assets are not required to be liquidated to meet

day to day redemptions.

The Directors have completed stress tests assessing the impact

of changes in market value and income with associated cash flows.

In making this assessment, they have considered plausible downside

scenarios. These tests have been 'stressed' for inflation, as well

as a severe but plausible and sudden downturn in market conditions

in which asset value and income are significantly impaired. The

conclusion was that in a plausible downside scenario the Company

could continue to meet its liabilities. Whilst the economic future

is uncertain, and the Directors believe that it is possible the

Company could experience further reductions in income and/or market

value, the opinion of the Directors is that this should not be to a

level which would threaten the Company's ability to continue as a

going concern.

The Directors are not aware of any material uncertainties that

may cast significant doubt upon the Company's ability to continue

as a going concern, having taken into account the liquidity of the

Company's investment portfolio and the Company's financial position

in respect of its

cash flows and investment commitments (of which there are none

of significance). Therefore, the financial statements have been

prepared on the going concern basis.

3. Segmental reporting

The directors are of the opinion that the Company is engaged in

a single segment of business, being investment business.

4. Earnings per share

Six months Six months ended 31 July Year ended 31 January

ended 31 July 2023 2022 2023

--------- ---------------------------------- ---------------------------------- -----------------------------------

Basic Basic Basic

and and and

diluted diluted diluted

Net Earnings Net Earnings Net Earnings

profit/ Weighted per profit/ Weighted per profit/ Weighted per

(loss) Average share (loss) Average share (loss) Average share

GBP'000 shares pence GBP'000 shares pence GBP'000 shares pence

--------- --------- ------------ --------- --------- ------------ --------- ---------- ------------ ---------

Revenue 827 0.55p (317) (0.21p) 292 0.19p

Capital (30,030) (19.89)p (42,470) (28.63p) (58,536) (38.99p)

--------- --------- ------------ --------- --------- ------------ --------- ---------- ------------ ---------

Total (29,203) 150,971,319 (19.34)p (42,787) 148,351,595 (28.84p) (58,244) 150,110,568 (38.80p)

--------- --------- ------------ --------- --------- ------------ --------- ---------- ------------ ---------

5. Net Asset Value ("NAV") per share

31 July 2023 31 July 2022 31 January 2023

---------- ---------------------------------- ---------------------------------- ----------------------------------

NAV NAV NAV

Net per Net per Net per

assets Ordinary share assets Ordinary share assets Ordinary share

GBP'000 shares pence GBP'000 shares pence GBP'000 shares pence

---------- --------- ------------ --------- --------- ------------ --------- --------- ------------ ---------

Ordinary

shares 166,383 151,201,869 110.0p 222,515 151,939,444 146.5p 201,281 151,548,993 132.8p

---------- --------- ------------ --------- --------- ------------ --------- --------- ------------ ---------

6. Income

Six months Six months ended Year ended

ended

31 July 2023 31 July 2022 31 January

2023

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------------------------------ ------------------------- ---------------------------- -----------------------

Dividends from UK

companies 425 478 843

Dividends from money

market funds 430 - -

UK loan stock interest 221 - 447

Interest from deposits 410 11 519

Other income - - 1

------------------------------------ -------------------------

1,486 489 1,810

------------------------------------ ------------------------- ---------------------------- -----------------------

7. Dividends

Six months Six months Year

ended ended ended

31 July 31 July 31 January

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

--------------------------------- -------------- -------------- ------------

Final dividend for the year

ended 31 January 2023 of 3.50p

per share paid on 21 July

2023 5,275 - -

Interim dividend for the year

ended 31 January 2023 of 3.50p

per share paid on 25 November

2022 - - 5,307

Final dividend for the year

ended 31 January 2022 of 4.50p

per share paid on 23 July

2021 - 6,803 6,803

--------------------------------- -------------- -------------- ------------

5,275 6,803 12,110

--------------------------------- -------------- -------------- ------------

8. Investments

Level 1

Traded on Level 3 Unquoted

AIM investments Total

GBP'000 GBP'000 GBP'000

----------------------------------------------------------- ----------- ----------------- ---------

Opening cost as at 1 February

2023 120,593 9,071 129,664

Opening investment holding

gains 17,246 (4,328) 12,918

Opening unrealised loss recognised

in realised reserve (228) - (228)

-----------------------------------------------------------

Opening fair value as at 1

February 2023 137,611 4,743 142,354

----------------------------------------------------------- ----------- ----------------- ---------

Analysis of transactions during

the period:

Purchases at cost 6,214 2,677 8,891

Disposals - proceeds received (8,263) (5) (8,268)

* realised loss on disposals (1,038) (10) (1,048)

* unrealised losses during the period (27,370) (506) (27,876)

-----------------------------------------------------------

Closing fair value as at

31 July 2023 107,154 6,899 114,053

----------------------------------------------------------- ----------- ----------------- ---------

Closing cost at 31 July 2023 118,097 11,718 129,815

Closing investment holding

losses as at 31 July 2023 (10,715) (4,819) (15,534)

Closing unrealised loss recognised

in realised reserve at 31

July 2023 (228) - (228)

-----------------------------------------------------------

Closing fair value as at

31 July 2023 107,154 6,899 114,053

----------------------------------------------------------- ----------- ----------------- ---------

Equity shares 107,154 2,775 109,929

Convertible loan notes - 4,124 4,124

----------------------------------------------------------- ----------- ----------------- ---------

Closing fair value as at

31 July 2023 107,154 6,899 114,053

----------------------------------------------------------- ----------- ----------------- ---------

There have been no level 2 investments during the period.

The Company measures fair values using the following fair value

hierarchy into which the fair value measurements are categorised. A

fair value measurement is categorised in its entirety on the basis

of the lowest level input that is signi cant to the fair value

measurement of the relevant asset as follows:

Level 1 - the unadjusted quoted price in an active market for

identical assets or liabilities that the entity can access at the

measurement date.

The Company's Level 1 investments are AIM traded companies and

fully listed companies.

Level 2 - inputs other than quoted prices included within Level

1 that are observable (i.e. developed using market data) for the

asset or liability, either directly or indirectly.

When the Company holds Level 2 assets they are valued using

models with signi cant observable market parameters.

Level 3 - inputs are unobservable (i.e. for which market data is

unavailable) for the asset or liability.

Level 3 fair values are measured using a valuation technique

that is based on data from an unobservable market. Discussions are

held with management, statutory accounts, management accounts and

cash ow forecasts are obtained, and fair value is based on

multiples of sales and earnings.

The valuation techniques used by the Company are explained in

the Annual Report and Financial Statements for the year ended 31

January 2023.

9. Called Up Share Capital

Ordinary shares (5p shares) 2023 2023

Number GBP'000*

------------------------------ ------------ ----------

Allotted, issued and fully

paid at 1 February 151,548,993 7,578

Issued during the period 882,833 44

Repurchase of own shares for

cancellation (1,230,557) (62)

------------------------------ ------------ ----------

At 31 July 151,201,269 7,560

------------------------------ ------------ ----------

(* Nominal value)

During the period to 31 July 2023, 882,833 Ordinary Shares (31

July 2022: 15,912,822; 31 January 2023: 16,617,329) were issued for

a net consideration of GBP981,000 (31 July 2022: GBP26,075,000; 31

January 2023: GBP27,050,000).

During the period to 31 July 2023, 1,230,557 Ordinary Shares (31

July 2022: 694,175; 31 January 2023: 1,789,133) were bought back

and cancelled for an aggregate consideration of GBP1,401,000 (31

July 2022: GBP1,044,000; 31 January 2023: GBP2,451,000).

10. Related parties

The Company retains Amati Global Investors as its Manager. The

number of ordinary shares in the Company (all of which are held

bene cially) by certain members of the management team are:

31 July

2023 shares

held

----------------- -------------

Paul Jourdan* 615,606

David Stevenson 26,753

(* includes 25,562 shares held by a Person Closely Associated to

Paul Jourdan)

Save as disclosed above there is no con ict of interest between

the Company, the duties of the directors, the duties of the

directors of the Manager and their private interests and other

duties.

11. Post balance sheet events

642,867 of the Company's shares have been bought back between 31

July 2023 and the date of this report.

Shareholder Information

Share price

The Company's shares are listed on the London Stock Exchange.

The bid price of the Company's shares can be found on Amati Global

Investors' website:

https://www.amatiglobal.com/fund/amati-aim-vct/fund-overview

Net Asset Value per Share

The Company normally announces its net asset value on a weekly

basis. Net asset value per share information can be found on Amati

Global Investors' website:

https://www.amatiglobal.com/fund/amati-aim-vct/fund-overview

Financial calendar

------------------- -------------------------------------------

31 January 2024 Year end

April 2024 Announcement of final results for the year

ended 31 January 2024

June 2024 Annual General Meeting

------------------- -------------------------------------------

Dividends

As disclosed in the Annual Report, the Company has now moved to

paying all cash dividends by bank transfer rather than by cheque.

Shareholders have the following options available for future

dividends:

-- Complete a bank mandate form and receive dividends via direct

credit to a UK domiciled bank account

-- Re-invest the dividends for additional shares in the Company

through the Dividend Re-investment Scheme (DRIS)

Shareholders who wish to complete a bank mandate form are

advised to contact The City Partnership on 01484 240910 or by

email: registrars@city.uk.com.

Shareholders may also register their bank account details and

register for the Dividend Re-investment Scheme themselves in the

Amati Investor Hub at https://amati-aim-vct.cityhub.uk.com.

Dividend Re-Investment Scheme

Shareholders who wish to have future dividends reinvested in the

Company's shares should contact The City Partnership (UK) Ltd on

01484 240 910 or email registrars@city.uk.com.

Shareholders may also register for the Dividend Re-investment

Scheme themselves in the Amati Investor Hub at

https://amati-aim-vct.cityhub.uk.com/

Table of Historic Returns from launch to 31 July 2023

attributable to shares issued by VCTs which have made up Amati AIM

VCT

Numis

NAV Total NAV Total Alternative

Return with Return Markets

dividends with dividends Total Return

Launch date Merger date re-invested not re-invested Index

---------------------- ---------------- --------------- -------------- ------------------ --------------

Singer & Friedlander

AIM 3 VCT ('C' 8 December

shares) 4 April 2005 2005 18.7% 10.2% -2.5%

Amati VCT plc 24 March 2005 4 May 2018 90.1% 59.7% -6.0%

Invesco Perpetual 8 November

AIM VCT 30 July 2004 2011 5.1% -14.3% 19.5%

Singer & Friedlander 29 January

AIM 3 VCT* 2001 n/a 8.2% 0.4% -30.0%

Singer & Friedlander 29 February 22 February

AIM 2 VCT 2000 2006 -17.1% -22.9% -64.3%

Singer & Friedlander 28 September 22 February

AIM VCT 1998 2006 -43.4% -25.2% 8.8%

---------------------- ---------------- --------------- -------------- ------------------ --------------

*Singer & Friedlander AIM 3 VCT changed its name to ViCTory

VCT on 22 February 2006, to Amati VCT 2 on 8 November 2011 and to

Amati AIM VCT on 4 May 2018.

Corporate Information

Directors Registrar

Fiona Wollocombe (Chairman) The City Partnership (UK) Limited

Julia Henderson The Mending Rooms

Brian Scouler Park Valley Mills

Meltham Road

Huddersfield

all of: HD4 7BH

8th Floor

100 Bishopsgate

London

EC2N 4AG

Secretary Auditor

LDC Nominee Secretary Limited BDO LLP

8th Floor, 100 Bishopsgate 55 Baker Street

London London

EC2N 4AG W1U 7EU

Fund Manager Solicitors

Amati Global Investors Limited Dickson Minto W.S.

8 Coates Crescent 16 Charlotte Square

Edinburgh Edinburgh

EH3 7AL EH2 4DF

VCT Status Adviser Bankers

Philip Hare & Associates LLP The Bank of New York Mellon

SA/NV

6 Snow Hill London Branch

London 160 Queen Victoria Street

EC1A 2AY London

EC4V 4LA

For enquiries relating to share certificates, shareholdings,

dividends or the Dividend Re-investment Scheme, please contact:

The City Partnership (UK) Limited

on +44 (0) 1484 240910

or email: registrars@city.uk.com

For enquiries relating to subscriptions and for general

enquiries, please contact:

Amati Global Investors

on +44 (0) 131 503 9115

or email: info@amatiglobal.com

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on this announcement (or

any other website) is incorporated into, or forms part of, this

announcement.

For further information, please contact the investor line at

Amati Global Investors on 0131 503 9115 or by email at

info@amatiglobal.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FSWFMIEDSEIS

(END) Dow Jones Newswires

October 06, 2023 02:00 ET (06:00 GMT)

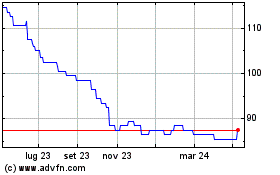

Grafico Azioni Amati Aim Vct (LSE:AMAT)

Storico

Da Apr 2024 a Mag 2024

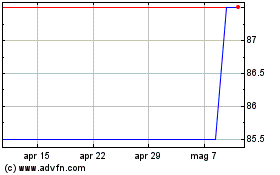

Grafico Azioni Amati Aim Vct (LSE:AMAT)

Storico

Da Mag 2023 a Mag 2024