TIDMAPEO

RNS Number : 8949Z

abrdn Private Equity Opp Trst plc

17 January 2024

abrdn Private Equity Opportunities Trust plc

Legal Entity Identifier (LEI): 2138004MK7VPTZ99EV13

17 January 2024

abrdn Private Equity Opportunities Trust plc ("APEO" or "the

Company") announces its estimated net asset value ("NAV") at 31

December 2023

-- Estimated NAV at 31 December 2023 was 763.2 pence per share

(estimated NAV at 30 November 2023 was 761.4 pence per share), a

0.2% increase from the month of November

-- Excluding new investments, 95.9% by value of portfolio dated

30 September 2023 (estimated NAV at 30 November 2023 was 95.9%

dated 30 September 2023)

-- APEO received GBP16.8 million of distributions from

investments and paid GBP16.5 million of drawdowns to existing

commitments during the month of December

-- One follow-on commitment into an existing co-investment made during December

-- Outstanding commitments of GBP653.5 million at 31 December 2023

-- Liquid resources (cash balances plus undrawn credit

facilities) were GBP 230.9 million as at 31 December 2023

APEO's valuation policy for private equity funds and

co-investments is based on the latest valuations reported by the

managers of the funds and co-investments in which the Company has

interests. In the case of APEO's valuation at 31 December 2023,

excluding new investments, 95.9% by value of the portfolio

valuations were dated 30 September 2023. The value of the portfolio

is therefore generally calculated as the 30 September 2023

valuation, adjusted for subsequent cashflows over the period to 31

December 2023.

This is substantially unchanged from the estimated NAV at 30

November 2023, whereby 95.9% of the portfolio valuations, excluding

new investments, were dated 30 September 2023, adjusted for

subsequent cashflows over the period to 30 November 2023.

Estimated NAV

At 31 December 2023, APEO's estimated NAV was 763.2 pence per

share (estimated net assets GBP1,173.4 million), representing a

0.2% per share increase from the estimated NAV at 30 November 2023

of 761.4 pence per share (estimated net assets GBP1,170.6 million).

The 1.8 pence increase in NAV per share reflected gains arising

primarily from a 0.5% appreciation in the euro versus sterling

during December, partially offset by a 0.7% depreciation in the

dollar versus sterling during December.

Drawdowns and distributions

APEO received GBP16.8 million of distributions from investments

and paid GBP16.5 million of drawdowns to existing commitments

during the month of December.

Distributions in the month generated realised gains and income

of GBP5.2 million and largely related to realisations in APEO's

underlying portfolio of companies. Notable realisations related to

the full sales of Meadow Foods (a B2B player in sustainable dairy,

confectionery and plant-based ingredients) by Exponent Private

Equity Partners Fund III and Aspia (provider of technology-enabled

accounting, payroll, tax and advisory services) by IK Fund VIII. A

partial sale of Burger King France (a Quick Service Restaurant

chain) by Bridgepoint Europe Fund V also closed during the month.

In addition, Advent International GPE VIII sold shares in two of

its listed portfolio companies, following respective IPOs in

2021.

Drawdowns were largely used for new and follow-on investments in

the underlying portfolio, as well as fund management fees and

expenses. Notable drawdowns in the portfolio during the month

related to Investindustrial Growth Fund III (to fund a follow-on

investment in Arterex, a medical device contract manfacturing

platform) and IK Fund IX (to fund the acquisition of Medica Group,

a provider of teleradiology and imaging solutions).

Investment activity

A $6.0m follow-on commitment has been made to APEO's existing

co-investment holding in Visma (a provider of cloud-based, mission

critical business software), alongside lead investor Hg.

Commitments

The Company had GBP653.5 million of outstanding commitments at

31 December 2023. The Manager believes that around GBP94.7 million

of the Company's existing outstanding commitments are unlikely to

be drawn.

Credit facility and cash balances

The Company has a GBP300.0 million syndicated revolving credit

facility provided by The Royal Bank of Scotland International

Limited, Societe Generale and State Street Bank International GmbH,

and it expires in December 2025. The Company repaid a total of

GBP8.7 million to the credit facility during the month of December,

reducing the total drawn balance to GBP91.0 million at 31 December

2023. The remaining undrawn balance of the facility at 31 December

2023 was therefore GBP209.0 million.

In addition, the Company had cash balances of GBP21.9 million at

31 December 2023 . Liquid resources, calculated as the total of

cash balances and the undrawn balance of the credit facility, were

therefore GBP230.9 million as at 31 December 2023.

Future announcements

The Company is expecting to announce its annual results on 31

January 2024. Further details on the valuation of the portfolio as

at 30 September 2023 will be provided at that time.

The Company is expecting to announce its estimated NAV at 31

January 2024 on or around 14 February 2024.

Additional detail about APEO's NAV and investment

diversification can be found on APEO's website. Neither the

contents of the Company's website nor the contents of any website

accessible from hyperlinks on the Company's website is incorporated

into, or forms part of, this announcement.

For further information please contact Alan Gauld at abrdn

Capital Partners LLP (0131 528 4424)

Notes:-

abrdn Private Equity Opportunities Trust plc is an investment

company managed by abrdn Capital Partners LLP, the ordinary shares

of which are admitted to listing by the UK Listing Authority and to

trading on the Stock Exchange and which seeks to conduct its

affairs so as to qualify as an investment trust under sections

1158-1165 of the Corporation Tax Act 2010.

The Company intends to release regular estimated NAV updates

around ten business days after each month end. A breakdown of

APEO's portfolio can be obtained in the latest monthly factsheet,

which is published on APEO's website at:

www.abrdnpeot.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVBFMFTMTJBBRI

(END) Dow Jones Newswires

January 17, 2024 02:00 ET (07:00 GMT)

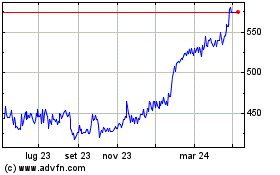

Grafico Azioni Abrdn Private Equity Opp... (LSE:APEO)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Abrdn Private Equity Opp... (LSE:APEO)

Storico

Da Nov 2023 a Nov 2024