TIDMAPTD

RNS Number : 1714H

Aptitude Software Group PLC

26 July 2023

26 July 2023

APTITUDE SOFTWARE GROUP plc

('Aptitude Software' or 'the Group')

Interim Results for the six months ended

30 June 2023

Aptitude Software Group plc (LSE: APTD), the specialist provider

of finance digitization and subscription management software,

reports its unaudited results for the six months ended 30 June

2023.

Financial Highlights

Six months ended 30 June H1 2023 H1 2022 % Change

Annual Recurring Revenue (1) ('ARR') at

30 June GBP49.8m GBP48.2m +3%

---------- ---------- ----------

* Year-on-Year ARR Growth (Constant Currency (2) ) 3% 28%

---------- ---------- ----------

* Year-on-Year ARR Growth (Organic (3) and Constant

Currency (2) ) 3% 10%

---------- ---------- ----------

Recurring Revenue (4) GBP27.0m GBP24.4m +11%

---------- ---------- ----------

Implementation Revenue GBP10.5m GBP11.7m -10%

---------- ---------- ----------

Total Revenue GBP37.5m GBP36.1m +4%

---------- ---------- ----------

Adjusted Operating Profit(5) GBP4.2m GBP4.0m +5%

---------- ---------- ----------

Adjusted Operating Margin(5) 11.2% 11.1% +0.1%

---------- ---------- ----------

Statutory Operating Profit GBP1.7m GBP2.1m -19%

---------- ---------- ----------

Cash and Cash Equivalents GBP24.5m GBP23.6m +4%

---------- ---------- ----------

Net Funds (6) GBP12.2m GBP10.7m +14%

---------- ---------- ----------

Interim Ordinary Dividend per Share 1.8p 1.8p -

---------- ---------- ----------

-- Year-on-year constant currency growth in ARR of 3%, with the unusually

higher churn levels seen in 2022 persisting in this period for Subscription,

Billing and Revenue Management

-- Recurring revenue, a key strategic focus of the Group, grew 11% to GBP27.0

million (H1 2022: GBP24.4 million) and now represents 72% of total revenue

(H1 2022: 68%)

-- Adjusted Operating Profit increased to GBP4.2 million (H1 2022: GBP4.0

million), with focused cost reductions undertaken in the period to underpin

the Board's profit expectations for FY 2023 and improve operating leverage

going forward

-- Balance sheet strength with cash of GBP24.5 million (30 June 2022: GBP23.6

million) and net funds(5) of GBP12.2 million (30 June 2022: GBP10.7 million)

as the Group's heritage products continue to generate strong cash returns

Strategic and Operational Highlights:

-- First Fynapse go-live successfully achieved with the Telco charter client,

demonstrating the viability of our newest product and marking the first

step in our aspirations for its deployment across prospects and clients

-- Ongoing new business success across the Group's strategic products and

across geographical regions

-- Go-lives achieved across the base of clients with the Aptitude Insurance

Calculation Engine, with 70% of clients live by the end of H1, underpinning

future revenue opportunity particularly in the Group's solution management

service 'Assure'

-- Strengthening pipeline across Aptitude's strategic partnerships and through

traditional avenues with growing confidence in the Fynapse opportunity

particularly, underpinned by the Microsoft partnership, supporting future

revenue growth expectations

-- Alex Curran, formerly the Regional Chief Executive Officer for North

America, appointed Acting Chief Executive Officer, with former Chief

Executive Officer Jeremy Suddards leaving the Group

-- The Board is confident in delivering profit expectations for FY23, and

believes that the combination of Fynapse's capabilities and the partnership

with Microsoft will be a material accelerator for growth in 2024 and

beyond

Commenting on the results, Ivan Martin, Chairman, said: -

'Aptitude is well positioned to realise the opportunities across

Finance Digitalization and Subscription Management. The strategic

partnership with Microsoft to integrate Fynapse and Dynamics 365,

in particular, presents a significant global opportunity for the

Group.

Recent changes within the organisation, particularly the

appointment of Alex Curran as Acting Chief Executive Officer, will

drive the business to execute on the growing opportunity presented

by its Fynapse platform. Alex brings a strategic sales focus and

long term experience with the Group's clients and partners that

provides a strong platform to higher performance.

Recognising the impact of economic uncertainty, the Board took

action to reduce cost in the first half of 2023 to underpin its

profit expectations for the remainder of the year and increase

operational efficiency in future years. Throughout the period,

investment was protected in areas of strategic focus, including

Fynapse and its go to market capabilities.

The Group has demonstrated resilience against the challenging

economic backdrop, continuing to generate new business across each

strategic growth driver and in geographically diverse locations.

Aptitude remains financially robust and has strong revenue

visibility, providing a solid foundation for future growth.'

Contacts

Aptitude Software Group plc

Ivan Martin, Chairman 020-3687-3200

Alex Curran, Acting Chief Executive Officer

Mike Johns, Chief Financial Officer

Alma PR

Caroline Forde / Hilary Buchanan 020-3405-0205

Throughout this announcement:

(1) Annual Recurring Revenue ('ARR') is the value of Aptitude

Software's recurring revenue at a specific point in time,

normalised to a one-year period. ARR includes recurring revenues

contracted but yet to commence and excludes recurring revenues

which are currently being received but are known to be terminating

in the future. Included in ARR are recurring revenues from the

Group's solution management services.

(2) Constant currency is calculated by comparing the H1 2023

results with H1 2022 results retranslated at the rates of exchange

prevailing during H1 2023. Items within the Financial Highlights

table indicated by this superscript reference are calculated on a

constant currency basis.

(3) Organic growth excludes the contribution from the

acquisition of MPP Global in October 2021

(4) Recurring Revenue includes, for the first time, revenues

from the Group's solution management services, comparatives have

been adjusted accordingly

(5) Adjusted Operating Profit, Adjusted Operating Margin and

Adjusted Basic Earnings per Share exclude non-underlying operating

items, unless stated to the contrary. Further detail in respect of

the non-underlying operating items can be found within Note 6.

(6) Net funds represents cash and cash equivalents less finance

obligations, which are currently limited to capital lease

obligations

Certain non-IFRS financial measures (e.g. Adjusted Operating

Profit) are included which assist management in comparing

performance on a consistent basis

About Aptitude Software

Aptitude Software helps complex organisations automate and

transform their financial business models. Our core areas of focus

are the accelerating digitization of the finance function, and the

global drive to deploy and manage subscription offerings. Aptitude

Software also continues to support clients through complex

regulations which often form the catalyst for broader finance

transformation.

Aptitude's finance digitization products enable enterprise

finance professionals to improve the speed of their function,

enhance the quality of its outcomes, and do so at a lower cost.

Aptitude draws data from complex, often siloed systems, automate

its processing through complex accounting calculations, and create

a unified view of finance. Businesses are left with a transparent

view of their data, delivered at extreme performance and at a lower

cost of ownership improving their finance functions' ability to

support their business objectives.

Aptitude's subscription management products are a rapidly

increasingly critical driver for new and traditional businesses

alike, who need to launch new offerings frequently, in ways which

appeal to their customers and allow them to outperform their peers.

Aptitude Software's products power the acquisition, monetization,

and retention of subscribers straight through to revenue

reporting.

Our global client base includes some of the world's largest

companies, typically organisations with complex business models,

large volumes of data, and numerous internal systems. Aptitude

Software is headquartered in London, has a strong and growing North

American presence, and is powered by Global Innovation Centres in

Poland and the North West of England. Sales, support and

implementation services are provided from offices in the United

States, the United Kingdom, Canada, and Singapore.

www.aptitudesoftware.com

Overview

Aptitude Software showed modest revenue and adjusted operating

profit growth in the first half of 2023. The Group maintained

investment levels in areas of strategic focus, most notably in its

Fynapse platform and go to market capabilities, while driving cost

efficiencies to underpin profitability for FY 2023.

Overall, ARR increased year-on-year by 3% on a constant currency

basis to GBP49.8 million on 30 June 2023 (31 December 2022: GBP50.5

million, 30 June 2022: GBP48.2 million). As previously announced,

ARR growth was moderated by a combination of higher than usual

churn continuing into H1 2023, and elongated sales cycles as a

result of the uncertainty caused by the wider economic environment

and is reflected in the net retention rate of 98% (H1 2022: 103%

organic). Despite a difficult economic backdrop and the impact of

certain customer consolidation, growth from continuing clients has

been strong, particularly through the sale of new Assure contracts.

The Group also generated new business success in each of its

strategic products.

The recent first go-live of Fynapse at the US Telco charter

client represents a key milestone in the development and rollout of

the platform, with performance in line with expectations. The Group

is confident that Fynapse will accelerate the Group's growth in the

medium and long term whilst also generating higher gross margins

due to the cloud native technologies on which the platform is

built. Fynapse provides differentiated finance digitization

capability to a market in which the Group already has outstanding

credentials with the successful Aptitude Accounting Hub. The Group

continues to expand the capabilities of the platform and is seeing

a strengthening pipeline.

The integration of eSuite and the MPP Global team was completed

in the early months of 2023, with operational efficiencies

generated through the combination of both businesses.

The partnership program continues to develop. The Group has been

working with Microsoft in line with its strategic partnership

agreement to deeply integrate Fynapse and Dynamics 365 so that both

organisations can present an end-to-end solution to prospective

customers. In addition, work has been progressing to support and

optimise the sale of the combined solution by both parties. Fynapse

is now available on both of Microsoft's online marketplaces,

AppSource and the Azure Marketplace, enabling Microsoft's other

partners to work with the Group to expand customer acquisition

opportunities for the product. With firm foundations in place, the

Group is confident that the combination of Fynapse's capabilities

and the partnership with Microsoft will be a material accelerator

for growth in 2024 and beyond.

Investment in product management, research & development in

the six months ended 30 June 2023 increased to GBP8.6 million (H1

2022: GBP7.9 million), an increase of 9%, which is principally

related to Fynapse and the effect of higher inflation on the

Group's cost base.

Although headline ARR growth rates have been disappointing in H1

2023, the Board takes confidence in the work performed to underpin

the foundations of future growth in the first half of the year and

is confident that the performance in 2023 will be in line with its

expectations.

Corporate Strategy

Aptitude's strategy is focused on providing innovative finance

digitalization and subscription management software to a growing

number of C-suite stakeholders in a growing number of clients.

Finance digitization allows finance leaders to improve the

operational efficiency of their organisation by streamlining

processes and automating manual tasks, enhance the quality of its

outcomes, and do so at a dramatically lower total cost of ownership

for a modern finance function in organisations that are becoming

increasingly complex. Aptitude's products take data from complex,

often siloed systems, automate its processing through complex

accounting calculations, and create a unified view of business

performance. Businesses are left with a transparent view of their

finance data, delivered on a near real time basis and at a lower

cost of ownership.

Subscription based revenues are an increasingly critical driver

for new economy and traditional businesses alike. Aptitude's

Subscription Management solutions now power the acquisition,

billing, and retention of subscribers straight through to revenue

reporting. With Aptitude Software, businesses can take new product

subscriptions to market quickly, retain their high-value recurring

revenue, and stay ahead of the competition.

Finance Digitization

Market Drivers

Quality of data, speed of reporting and cost continue to be the

top drivers on the CFO's agenda as they are increasingly challenged

by the demands of operating in a digital world with growing

complexity, regulatory and cost pressures. These demands result in

an increase in the volume and number of sources of finance data,

and the increasing requirement for decision making to move at the

pace that the business requires. Aptitude's product set is

specifically designed to address these priorities and

requirements.

Finance Digitization Products

Fynapse, the Group's next generation digital finance platform,

was originally launched in March 2022 with significant milestones

achieved since that launch. New business success also continues to

be achieved with the established Aptitude Accounting Hub

application.

Fynapse is a modular, cloud native, high performance finance

platform addressing an enterprise's need to drive finance

digitization to underpin the transformation of their wider

businesses . The platform builds on the successful Aptitude

Accounting Hub, centralising and automating finance, accounting and

reporting processes, creating a deep level of operational

intelligence for our clients. It delivers a brand-new user centric

interface with a consolidated, yet highly granular, view of

financial data which enhances business insights to assist decision

making. The capabilities of the product drive even greater

automation of manual accounting processes, reducing on-going

operational costs and driving an improved total cost of ownership

for the finance function.

The modular design and ease of integration also allows the

market opportunity to extend beyond our current industries into

adjacent verticals, shortening implementation cycles and allowing

our partner network to implement efficiently, with minimal risk,

and delivering a faster time to value for enterprise customers.

Fynapse was successfully delivered to the charter client in the

US telco market in 2022 and a multi-year subscription agreement is

now in place. The charter client has made good progress with their

implementation, with a successful go-live achieved in July 2023.

Fynapse is delivering significantly increased processing speeds,

efficiency of processing and an enhanced user experience for the

charter client. The go-live of Fynapse at the charter client

demonstrates the effectiveness of Fynapse and reinforces the

Group's confidence in Fynapse's ability to drive future revenue

growth.

A strategic global partnership with Microsoft, signed in

December 2022, is expected to be a material contributor to the

success of Fynapse globally in the medium and longer term across

all industry sectors. Under this agreement Fynapse will be the only

product available on the market with capabilities deeply integrated

with Microsoft Dynamics 365 Finance and operating on the Microsoft

Azure cloud platform. This combined solution will provide Aptitude

and Microsoft clients with the ability to unify data from various

financial systems to increase scalability, gain the ability to

rapidly adopt new regulations, automate manual processes whilst

delivering better business insights and reduce the cost of the

finance function.

In addition to the Microsoft partnership there is a strong

interest from large consultancy firms who are attracted to the open

design of Fynapse. This open design provides partners with the

opportunity to co-create and license their own IP built on the

Fynapse platform, further accelerating and differentiating their

services. It is pleasing to report that this capability is proving

an attractive proposition for the Big-4 accountancy firms and is

highly differentiated from the more generalist providers in the

market.

The strategic investment continues to enhance the capabilities

of Fynapse with development performed at the Aptitude Global

Technology Centre in Wroclaw, Poland. Investment levels as a

proportion of revenue are expected to peak in 2023 before

moderating in future years.

The Group has every confidence in the success of Fynapse which

is expected to be a key growth driver for the business in future

years.

The Group achieved new business success with the Aptitude

Accounting Hub in the first half of 2023, with the signature of a

large European bank. Whilst further sales of AAH will be achieved,

particularly when used in conjunction with our other regulatory

focused applications, we do expect that an increasing number of

clients seeking to automate and transform their finance function

will opt for Fynapse in the future.

Additionally, successful go-lives have been achieved across 70%

of Aptitude's base of clients with the Aptitude Insurance

Calculation Engine in the first half of the year following the

arrival of the IFRS compliance deadline, with the remaining

projects continuing to make good progress. A key focus for the

remainder of the year will be upgrading AICE users to Assure,

Aptitude's increasing popular solution management service.

Subscription Management

Market Drivers

The subscription economy is continuing to expand into new

sectors as the benefits of subscription based recurring revenue are

increasingly valued more than traditional non-recurring revenues.

The Group has seen this phenomenon in a broader range of sectors

such as high-tech advanced industries, medical devices and

automotive. As organisations move to these business models they

require new systems to manage these subscriptions and require new

capabilities to address the complexities of revenue recognition

inherent with complex subscriptions.

Aptitude's solutions are focused on the needs of the world's

largest companies, organisations with highly complex business

models and data processing requirements which generalist providers

are unable to address.

Subscription Management Products

Whilst good levels of new business success and growth of

existing accounts were achieved, overall Annual Recurring Revenue

growth was subdued due to an unusually high level of churn.

Impacting all products within Subscription Management there are

several underlying reasons for the elevated level of terminations,

including business failure of some customers and corporate events

which are more prevalent in the markets particularly targeted by

the Subscription Management product set. Whilst there has been a

negative impact from the dynamic nature of the markets that are the

focus of the Subscription Management product set, this dynamism has

historically delivered strong organic opportunities within the

existing base and is expected to do so again in the future.

In the period, new business success was achieved with the sale

of eSuite to a large German publisher. The Group now serves six

German publishers with the eSuite platform, with the DACH region a

growing focus for new business activity. Further new business

success has been achieved with AREV in the period with the

signature of a leading consumer products subscription business.

The eSuite team is now fully integrated with the remainder of

the business and benefitting from the expertise and processes of

the wider group. This together with the pipeline of new eSuite

opportunities and the Annual Recurring Revenue once the recently

acquired clients go-live, is expected to lead to an improved

performance from this product.

Solution Management Services ('Aptitude Assure')

Aptitude Insurance Calculation Engine clients continued to

contract for Aptitude Assure as they reach their go-live dates.

These contracts contributed to the year-on-year growth of 18% in

the Annual Recurring Revenue derived from Assure to GBP4.5 million

(30 June 2022: GBP3.8 million).

Implementation Services

Aptitude Software provides implementation services to its

clients, with the scale of such services depending on the nature of

the application, the size of the opportunity and the balance of

responsibilities between Aptitude Software and its partners. The

Group's services are provided by a significant pool of highly

skilled individuals, providing deep domain and technical expertise

which is highly valued by our clients and provide a differentiator

compared with our competitors. Demand for implementation services

from the Group's on-going projects has been strong in the first

half of the year, with clients frequently requesting additional

services.

Partner Network

The growth and development of Aptitude Software's high-quality

partner network is a strategic priority. Whilst many prospects are

sourced directly by the Group's own sales and marketing teams, the

global reach of our partners and the depth of their relationships

with large businesses provide Aptitude Software with an increasing

number of advanced opportunities, enhanced market coverage and

intelligence. In addition to the new business benefits provided by

the partner network, the implementation expertise and capabilities

of our partners supports the Group's strategic drive to increase

software fees faster than its services, leading to a richer revenue

mix.

An agreement to provide finance automation to a Big-4

accountancy firm's mergers and acquisitions practice continues to

generate strong pipeline. The agreement enables the organisation to

accelerate the post-acquisition integration of their clients'

finance functions.

Whilst the Big-4 accounting firms have global reach, for

specific applications in specific jurisdictions it can be

beneficial to work closely with more specialised partner

organisations. The benefits of this approach are demonstrated by

the success the Group is having with eSuite in the German

publishing and Japanese motor manufacturing markets, two markets

which would be challenging to unlock without the assistance of our

partners. We are engaged with these partners on both on-going

projects as well as several additional new business

opportunities.

Aptitude Innovation Centres

The Group has maintained the level of investment in its two

innovation centres in Poland and the North West of England. Overall

there were 226 employees at the Innovation Centre in Poland at 30

June 2023 (30 June 2022: 212) with a further 50 employees (30 June

2022: 47) focused on design, development, implementation and

support based in the North West of England. Investment remains

focused on both Fynapse and eSuite in these two centres.

The Group's talent acquisition team allows the Group to attract

new talent to the business despite increased competition for

technologists in both locations. In the current competitive talent

market the Group continues to invest in its people, including the

initiatives described below.

Our People

The Board wishes to thank its employees for the excellent

support and commitment they are providing to the business and to

our clients and partners.

Aptitude Software continues to progress its approach to

diversity and inclusion with its established advocacy group with

representation from across our global team. The business is

committed to creating a working environment that recognises

diversity, supporting everyone to thrive.

Overall Group headcount has decreased to 524 (31 December 2022:

527, 30 June 2022: 531) with increased investment in Fynapse offset

by reductions through cost efficiency action undertaken in the

period.

Focus areas

The Group is focused on delivery of the opportunity within

finance digitization and subscription management.

The focus of the Group is the ongoing development of the

additional capabilities of its Fynapse platform to address the

wider market opportunity, both directly and through our Tier 1

partners, whilst continuing to develop and progress demand for our

new application. In parallel, the Group will realise the continuing

opportunity for Aptitude Accounting Hub for those organisations

which have an immediate requirement for the capabilities of this

application.

Financial Performance

The Group delivered a solid financial performance in the period

with growth of its recurring revenues despite economic

headwinds.

The strength of the Group's balance sheet, high levels of

recurring revenue and strong cash generation provide the Group with

considerable financial strength with which to execute on its growth

strategy.

Revenue

Recurring Revenues

Aptitude Software's Annual Recurring Revenue ('ARR') at 30 June

2023 totalled GBP49.8 million (31 December 2022: GBP51.6 million,

30 June 2022: GBP49.1 million) representing overall year-on-year

growth of 1%. On a constant currency basis, overall year-on-year

ARR growth was 3% (31 December 2022: GBP50.5 million, 30 June 2022:

GBP48.2 million). Included within ARR is the value of the Group's

recurring solution management services contracts ('Assure') (30

June 2023: GBP4.5 million, 31 December 2022: GBP4.3 million, 30

June 2022: GBP3.8 million).

The value of recurring contracts for the Group's solution

management service included within ARR is GBP4.5 million (31

December 2022: GBP4.3 million, 30 June 2022: GBP3.8 million on a

constant currency basis).

Net retention in the 12 months to 30 June 2023 was 98% (H1 2022:

103% organic) (measured by the total value of on-going ARR at the

period-end from clients in place twelve months earlier as a

percentage of the opening ARR from those clients on a constant

currency basis ) . The net retention rate in the period was

moderated by higher than usual churn in Subscription, Billing and

Revenue Management.

A significant majority of the Group's recurring revenue

contracts include the ability to increase ARR for clients by

relevant consumer price index rises ('CPI'). There are a small

number of contracts with variations to this mechanism which may

delay the ability to pass on the full impact of CPI to clients in

the short term. While inflation remains high, many of the Group's

renewals are weighted toward the second half of the year. The

increase attributable to CPI for the period 1 January 2023 to 31

December 2023 is expected to be higher given continued high

inflation, but may moderate should inflation fall to target levels

before the end of the year.

Recurring revenues recognised in the six months ended 30 June

2023 increased by 11% to GBP27.0 million (H1 2022: GBP24.4

million). These now represent 72% of overall revenue (H1 2022:

68%). It is a key part of the Group's strategy to increase this

percentage whilst maximising the growth rate of Aptitude Software's

ARR, a strategy which in due course will lead to growth in

operating margin given the margin differential between software,

the largest element of recurring revenue, and implementation

services.

Implementation Services

Services revenue totalled GBP10.5 million for the six months

ended 30 June 2023 (H1 2022: GBP11.7 million) Implementation

services revenues continued to benefit from the strong demand from

the Group's existing client base.

Research and Development Expenditure

Total expenditure on product management, research and

development in the six months ended 30 June 2023 increased to

GBP8.6 million (H1 2022: GBP7.9 million), an increase of 9%. The

increase in research and development relates to the ongoing

investment in Fynapse and the effect of higher inflation on the

Group's cost base .

The Board has determined that none of the internal research and

development costs incurred during the first half of the year meet

the criteria for capitalisation. Consequently, these have been

expensed as incurred through the income statement.

Operating Profit and Margins

Adjusted Operating Profit for the six months ended 30 June 2023

was GBP4.2 million (H1 2022: GBP4.0m). Operating profit on a

statutory basis was GBP1.7 million (H1 2022: GBP2.1 million).

Adjusted Operating Margin for the six months ended 30 June 2023 was

11.2% (H1 2022: 11.1%).

Foreign Exchange

With 53% (H1 2022: 51%) of the Group's revenues being generated

from North American clients, the majority of which are invoiced in

US Dollars, the financial results are impacted by changes in the US

dollar exchange rate. The Group's Annual Recurring Revenue at 30

June 2023 decreased by GBP1.0 million in the first half by

unfavourable exchange rate movements. Aptitude Software's H1 2022

revenue and Adjusted Operating Profit would have been reported at

GBP36.5 million and GBP4.1 million respectively on a constant

currency basis (compared to actual result of GBP36.1 million and

GBP4.0 million). Constant currency is calculated by comparing the

2022 results with 2023 results retranslated at the rates of

exchange prevailing during 2023.

Non-Underlying Items

Non-underlying items of GBP2.5 million (H1 2022: GBP1.9 million)

comprises intangible amortisation and reorganisation costs.

Taxation

The total tax charge of GBP0.4 million (H1 2022: GBP0.4 million)

represents 22% of the Group's profit before tax (H1 2022: 19%).

Statutory Results

The Group reported a profit for the period attributable to

equity shareholders of GBP1.3 million (H1 2022: GBP1.5

million).

Earnings per Share

Increased investment in the business led to Adjusted Basic

Earnings per Share and Basic Earnings per Share reducing to 5.7

pence and 2.3 pence (H1 2022: 5.2 pence and 2.6 pence).

Dividend

An interim dividend of 1.8 pence per share is proposed (2022:

1.8 pence). The interim dividend will be payable on 25 August 2023

to shareholders on the register at the close of business on 4

August 2023.

Balance Sheet

The Group has a strong balance sheet with net assets at 30 June

2023 of GBP59.6 million (H1 2022: GBP58.7 million), including cash

of GBP24.5 million (H1 2022: GBP23.6 million) and net funds of

GBP12.2 million (H1 2022: GBP10.7 million). Trade receivables (net)

have decreased to GBP11.0 million (H1 2022: GBP14.9 million). Of

the balance of GBP11.0 million, collections following the period

end have totalled GBP4.2 million. Deferred income decreased to

GBP26.7 million at 30 June 2023 (H1 2022: GBP30.1 million), which

was primarily a result of a small number of high value multi-year

payments made by clients in 2021 and 2022.

The Group's cash flow is seasonal due to the timing of the

invoicing and collection of the Group's recurring revenue which,

together with a weighting of a number of other payments in the

first half of the year (e.g. bonus), contribute to a weaker cash

performance in the first half of any year. Cash outflow from

operating activities in the first half of the year was GBP0.8m (H1

2022: GBP3.5m), an improvement partly driven through collection of

outstanding amounts from the end of 2022. Given the seasonality of

cashflow the Group is confident that full year cash flow conversion

for 2023 will return to historic levels.

Statement on Principal Risks and Uncertainties

Pursuant to the requirements of the Disclosure and Transparency

Rules the Group provides the following information on its principal

risks and uncertainties. The Group considers strategic, operational

and financial risks and identifies actions to mitigate those risks.

These risk profiles are updated at least annually. The principal

risks and uncertainties detailed within the Group's 2022 Annual

Report remain applicable for the first six months of the financial

year. The Group's 2022 Annual Report is available from the Aptitude

Software website: www.aptitudesoftware.com/investor-relations/

Related party transactions during the period are disclosed in

Note 18.

CONDENSED CONSOLIDATED INTERIM INCOME STATEMENT

For the six months ended 30 June 2023

Unaudited six months ended 30 Jun 2023 Unaudited six months ended 30 Jun 2022 Audited year ended 31 Dec 2022

Before Non- Before Non- Before Non-

non-underlying underlying non-underlying underlying non-underlying underlying

Note items items Total items items Total items items Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 5 37,536 - 37,536 36,123 - 36,123 74,394 - 74,394

Operating

costs 5/6 (33,300) (2,488) (35,788) (32,121) (1,883) (34,004) (66,887) (3,822) (70,709)

---------------

Operating

profit 5/6 4,236 (2,488) 1,748 4,002 (1,883) 2,119 7,507 (3,822) 3,685

Finance

income 81 - 81 3 - 3 18 - 18

Finance

costs (163) - (163) (247) - (247) (498) - (498)

Profit

before

income

tax 4,154 (2,488) 1,666 3,758 (1,883) 1,875 7,027 (3,822) 3,205

--------------- ----------- --------- --------------- ----------- --------- --------------- ----------- ---------

Income tax

expense 7 (911) 542 (369) (754) 400 (354) (1,481) 871 (610)

Profit for

the

period 3,243 (1,946) 1,297 3,004 (1,483) 1,521 5,546 (2,951) 2,595

=============== =========== ========= =============== =========== ========= =============== =========== =========

Earnings

per share

Basic 8 2.3p 2.6p 4.5p

--------- --------- ---------

Diluted 8 2.2p 2.6p 4.5p

--------- --------- ---------

CONDENSED CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE

INCOME

For the six months ended 30 June 2023

Unaudited six months Unaudited six months Audited year ended 31 Dec

ended 30 Jun 2023 ended 30 Jun 2022 2022

GBP000 GBP000 GBP000

Profit for the period 1,297 1,521 2,595

-------------------------- -------------------------- --------------------------

Other comprehensive

income/(expense)

Items that will or may be

reclassified to profit or

loss:

Cash flow hedges

reclassified to income

statement (520) - 187

Gain on effective cash flow

hedges 739 267 1,445

Deferred tax on cash flow

hedges (185) - (335)

Currency translation

difference (466) 1,334 1,972

-------------------------- -------------------------- --------------------------

Other comprehensive

income/(expense) for the

period, net of tax (432) 1,601 3,269

-------------------------- -------------------------- --------------------------

Total comprehensive income

for the period 865 3,122 5,864

========================== ========================== ==========================

CONDENSED CONSOLIDATED INTERIM BALANCE SHEET

As at 30 June 2023

Unaudited as at 30 June Unaudited as at 30 June Audited as at 31 Dec

2023 2022 2022

Notes GBP000 GBP000 GBP000

ASSETS

Non-current assets

Property, plant and

equipment including

right-of-use assets 11 4,911 4,250 5,103

Goodwill 46,006 46,006 46,006

Intangible assets 19,430 22,812 21,120

Other long-term assets 1,474 1,451 1,307

Deferred tax assets 423 115 423

72,244 74,634 73,959

------------------------- ------------------------- -------------------------

Current assets

Trade and other

receivables 12 13,312 16,740 12,297

Financial assets -

derivative financial

instruments 1,558 150 1,339

Current income tax

assets 1,488 1,189 1,352

Cash and cash

equivalents 24,506 23,611 29,245

40,864 41,690 44,233

Total assets 113,108 116,324 118,192

------------------------- ------------------------- -------------------------

LIABILITIES

Current liabilities

Financial liabilities

- borrowings 14 (1,250) (938) (1,250)

- derivative financial

instruments - (177) -

Trade and other payables 13 (35,001) (38,096) (38,146)

Capital lease

obligations 15 (424) (329) (553)

Current income tax

liabilities (74) (353) (119)

Provisions 16 - - (114)

------------------------- ------------------------- -------------------------

(36,749) (39,893) (40,182)

------------------------- ------------------------- -------------------------

Net current

assets/(liabilities) 4,115 1,797 4,051

------------------------- ------------------------- -------------------------

Non-current liabilities

Financial liabilities -

borrowings 14 (7,733) (8,959) (8,347)

Capital lease

obligations 15 (2,921) (2,679) (3,196)

Provisions 16 (211) (300) (202)

Deferred tax liabilities (5,909) (5,811) (5,724)

(16,774) (17,749) (17,469)

------------------------- ------------------------- -------------------------

NET ASSETS 59,585 58,682 60,541

========================= ========================= =========================

CONDENSED CONSOLIDATED INTERIM BALANCE SHEET

As at 30 June 2023

Unaudited as at 30 Unaudited as at 30 Audited as at 31 Dec

June 2023 June 2022 2022

Notes GBP000 GBP000 GBP000

SHAREHOLDERS' EQUITY

Share capital 17 4,204 4,204 4,204

Share premium account 17 11,959 11,959 11,959

Capital redemption reserve 12,372 12,372 12,372

Other reserves 35,171 34,169 35,199

(Accumulated losses)/retained

earnings (3,748) (3,477) (3,286)

Foreign currency translation

reserve (373) (545) 93

TOTAL EQUITY 59,585 58,682 60,541

======================= ======================= =======================

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN

EQUITY

For the six months ended 30 June 2023

Attributable to owners of the Parent

Share Share Accumulated Foreign Capital Other Total Equity

capital premium losses currency redemption reserves

translation reserve

reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Group

Balance at 1

January 2023 4,204 11,959 (3,286) 93 12,372 35,199 60,541

------------- ------------- ------------- ------------ ------------ ------------- -------------

Profit for the

year - - 1,297 - - - 1,297

Cash flow

hedges

reclassified

to income

statement - - - - - (520) (520)

Gain on

effective

cash flow

hedges 739 739

Deferred tax

on cash flow

hedges (185) (185)

Exchange rate

adjustments - - - (466) - - (466)

Total

comprehensive

income for

the year - - 1,297 (466) - 34 865

------------- ------------- ------------- ------------ ------------ ------------- -------------

Shares issued

under

employee

benefit trust - - (163) - - (62) (225)

Share options

- value of

employee

service - - 468 - - - 468

Dividends to

equity

holders of

the company - - (2,064) - - - (2,064)

Total

Contributions

by and

distributions

to owners of

the company

recognised

directly in

equity - - (1,759) - - (62) (1,821)

------------- ------------- ------------- ------------ ------------ ------------- -------------

Balance at 30

June 2023

(unaudited) 4,204 11,959 (3,748) (373) 12,372 35,171 59,585

============= ============= ============= ============ ============ ============= =============

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN

EQUITY

For the six months ended 30 June 2022

Attributable to owners of the Parent

Share Share Accumulated Foreign Capital Other Total Equity

capital premium losses currency redemption reserves

translation reserve

reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Group

Balance at 1

January 2022 4,194 11,946 (3,346) (1,879) 12,372 33,902 57,189

------------- ------------- ------------- ------------ ------------ ------------- -------------

Profit for the

period - - 1,521 - - - 1,521

Cash flow - - - - - - -

hedges

Gain on

effective

cash flow

hedges - - - - - 267 267

Exchange rate

adjustments - - - 1,334 - - 1,334

Total

comprehensive

income for

the period - - 1,521 1,334 - 267 3,122

------------- ------------- ------------- ------------ ------------ ------------- -------------

Shares issued

under share

option

schemes 10 13 - - - - 23

Share options

- value of

employee

service - - 409 - - - 409

Dividends to

equity

holders of

the company - - (2,061) - - - (2,061)

Total

Contributions

by and

distributions

to owners of

the company

recognised

directly in

equity 10 13 (1,652) - - - (1,629)

------------- ------------- ------------- ------------ ------------ ------------- -------------

Balance at 30

June 2022

(unaudited) 4,204 11,959 (3,477) (545) 12,372 34,169 58,682

============= ============= ============= ============ ============ ============= =============

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CASH FLOWS

For the six months ended 30 June 2023

Unaudited six months Unaudited six months Audited year ended 31 Dec

ended 30 June 2023 ended 30 June 2022 2022

Note GBP000 GBP000 GBP000

Cash flows from

operating activities

Cash generated

from/(used in)

operations 9 (25) (2,995) 5,272

Interest paid (163) (247) (498)

Income tax (paid) (562) (283) (1,597)

Net cash flows generated

from/(used in)

operating activities (750) (3,525) 3,177

------------------------ ------------------------ ----------------------------

Cash flows from

investing activities

Purchase of property,

plant and equipment,

excluding right-of-use

assets 11 (495) (379) (831)

Interest received 81 3 18

Net cash (used in) from

investing activities (414) (376) (813)

------------------------ ------------------------ ----------------------------

Cash flows from

financing activities

Net proceeds from

issuance of ordinary

shares 17 - 23 23

Purchase of shares under (186) -

employee benefit trust -

Dividends paid to

company's shareholders 10 (2,064) (2,061) (3,093)

Repayments of loan (625) - (313)

Repayment of capital

lease obligations (199) (181) (405)

Net cash generated (used

in) financing

activities (3,074) (2,219) (3,788)

------------------------ ------------------------ ----------------------------

Net (decrease) in cash

and cash equivalents (4,238) (6,120) (1,424)

Cash, cash equivalents

and bank overdrafts at

beginning of period 29,245 29,064 29,064

Exchange rate

gains/(losses) on cash

and cash equivalents (501) 667 1,605

Cash and cash

equivalents at end of

period 24,506 23,611 29,245

======================== ======================== ============================

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

1. General information

Aptitude Software Group plc (the 'Company') and its subsidiaries

(together, the 'Group') is a specialist provider of finance

digitization and subscription management software.

The Company is a public limited company incorporated and

domiciled in England and Wales with a primary listing on the London

Stock Exchange. The address of its registered office is 8(th)

Floor, 138 Cheapside, London EC2V 6BJ.

These condensed consolidated interim financial statements were

approved for issue on 25 July 2023.

These condensed consolidated interim financial statements do not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006. Statutory accounts for the year ended 31

December 2022 were approved by the Board of directors on 20 March

2023 and delivered to the Registrar of Companies. The report of the

auditors on those accounts was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under section 498 of the Companies Act 2006.

2. Basis of preparation

These condensed consolidated interim financial statements for

the six months ended 30 June 2023 have not been audited or reviewed

by the auditors. The interims have been prepared in accordance with

the Disclosure and Transparency Rules of the Financial Services

Authority and with IAS 34, 'Interim financial reporting'. These

condensed consolidated interim financial statements should be read

in conjunction with the annual financial statements for the year

ended 31 December 2022, which have been prepared in accordance with

UK adopted international accounting standards and company law.

3. Accounting policies

The accounting policies adopted are consistent with those of the

previous financial statements, except as described below.

Taxes on income in the interim periods are accrued using the tax

rate that would be applicable to expected total annual profits.

New and amended standards and interpretations need to be adopted

in the first interim financial statements issued after their

effective date. There are no new IFRSs or IFRICs that are effective

for the first time for this interim period that would be expected

to have a material impact on the financial statements.

4. Estimates

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets, liabilities, income and expense. Actual results

may differ from these estimates. In preparing these condensed

consolidated interim financial statements, the significant

judgements made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty were the

same as those that applied to the consolidated financial statements

for the year ended 31 December 2022, with the exception of changes

in estimates that are required in determining the provision for

income taxes.

Fair value estimation

Financial instruments not measured at fair value

Financial instruments not measured at fair value includes cash

and cash equivalents, trade and other receivables, trade and other

payables, and loans and borrowings. However, due to their

short-term nature and ability to be liquidated at short notice

their carrying value approximates to their fair value.

Financial instruments measured at fair value

The fair value hierarchy of the financial instruments measured

at fair value is provided below.

Level 2 inputs

Unaudited Unaudited

six months six months

ended ended

30 Jun 2023 30 Jun 2022

GBP'000 GBP'000

Financial assets

Derivative financial assets (designated hedge instruments) 1,558 150

1,558 150

============= =============

Financial liabilities

Derivative financial liabilities (designated hedge instruments) - (177)

- (177)

===================================================================== ======

The derivative financial assets and liabilities have been valued

using the market approach and are considered to be Level 2 inputs.

There were no changes to the valuation techniques used in the year.

There were no transfers between levels during the year.

5. Segmental information

Business segments

The only business segment during both periods presented was

Aptitude Software and therefore certain segmental analysis is not

required.

Geographical segments

The Group has two geographical segments for reporting purposes,

the United Kingdom and the Rest of the World.

The following table provides an analysis of the Group's sales by

origin and by destination.

Sales revenue by origin Sales revenue by destination

Unaudited six Unaudited six

months ended 30 months ended 30 Unaudited six months Unaudited six months

June 2023 June 2022 ended 30 June 2023 ended 30 June 2022

Continuing operations GBP000 GBP000 GBP000 GBP000

United Kingdom 16,224 19,504 5,990 7,753

Rest of World 21,312 16,619 31,546 28,370

37,536 36,123 37,536 36,123

==================== ==================== ===================== =====================

The Group derives revenue from the transfer of goods and

services in the following major categories and geographical

regions, these being the United Kingdom ('UK') and Rest of the

World ('RoW'):

Unaudited six months ended 30 June 2023

Recurring revenue Non-recurring revenue

UK RoW Total UK RoW Total Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

from

external

clients 4,844 22,154 26,998 1,147 9,391 10,538 37,536

======================== ========== ========= =========== =========== ========== ==========

Unaudited six months ended 30 June 2022

Recurring revenue Non-recurring revenue

UK RoW Total UK RoW Total Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

from

external

clients 5,728 18,695 24,423 2,025 9,675 11,700 36,123

======================== ========== ========= =========== =========== ========== ==========

All of the revenue displayed in the above table is recognised

over time in line with the Group's accounting policy detailed on

pages 98 to 101 of the Aptitude Software Group plc 2022 Annual

Report and has been generated from contracts with clients.

The following is an analysis of the carrying amount of

non-current assets (excluding deferred tax assets), and additions

to property, plant and equipment and intangible assets (excluding

right-of-use asset additions resulting from property lease

agreements) and intangible assets, analysed by the geographical

area in which the assets are located.

Carrying amount of non-current assets Capital expenditure

Unaudited six months Unaudited six months Unaudited six months Unaudited six months

ended 30 June 2023 ended 30 June 2022 ended 30 June 2023 ended 30 June 2022

GBP000 GBP000 GBP000 GBP000

United Kingdom 56,194 55,703 91 132

Rest of World 15,627 18,816 404 247

71,821 74,519 495 379

====================== ====================== ====================== ======================

The Company's business is to invest in its subsidiaries and,

therefore, it operates in a single segment.

6. Non-underlying items

Unaudited six months ended 30 Jun Unaudited six months ended Audited year ended 31 Dec

2023 30 Jun 2022 2022

GBP000 GBP000 GBP000

Continuing

operations

Amortisation of

acquired

intangibles 1,690 1,883 3,382

Acquisition and

associated

reorganisation

costs 798 - 440

2,488 1,883 3,822

================================== =========================== ==========================

7. Income tax expense

Income tax expense is recognised based on management's estimate

of the weighted average income tax rate expected for the full

financial year of 22% (the estimated tax rate for the six months

ended 30 June 2022 was 19%). The increase against H1 2022 levels is

due to the increase of the UK income tax rate to 25% from 1 April

2023 from 19% as part of the March 2021 Bill.

8. Earnings per share

Audited

Unaudited six months ended Unaudited six months ended year ended

30 Jun 2023 30 Jun 2022 31 Dec 2022

pence pence pence

Earnings per share

Basic 2.3 2.6 4.5

------------------------------- ----------------------------- ----------------------------

Diluted 2.2 2.6 4.5

------------------------------- ----------------------------- ----------------------------

Audited

Unaudited six months ended Unaudited six months ended year ended

30 Jun 2023 30 Jun 2022 31 Dec 2022

pence pence pence

Adjusted earnings per

share

Basic 5.7 5.2 4.5

------------------------------- --------------------------- ----------------------------

Diluted 5.5 5.2 9.9

------------------------------- --------------------------- ----------------------------

To provide an indication of the underlying operating performance

the adjusted earnings per share calculation above excludes

intangible amortisation and other non-underlying items and has a

tax charge based on the effective rate.

Audited

Unaudited six months ended Unaudited six months ended year ended

30 Jun 2023 30 Jun 2022 31 Dec 2022

pence pence pence

Basic earnings

per share 2.3 2.6 4.5

Non-underlying

items 3.4 2.6 5.2

Prior years'

tax credit - - 0.6

Recognition of

tax losses - - (0.4)

Adjusted

earnings per

share 5.7 5.2 9.9

====================================== ============================ ============================

9. Cash generated from operations

Unaudited six months Unaudited six months Audited year ended 31 Dec

ended 30 Jun 2023 ended 30 Jun 2022 2022

GBP000 GBP000 GBP000

Profit before tax for the

period 1,666 1,875 3,205

Adjusted for:

Depreciation 514 551 1,132

Amortisation 1,690 1,690 3,382

Share-based payment

expense 468 409 695

Finance income (81) (3) (18)

Finance costs 163 247 498

Changes in working

capital:

(Increase) in receivables (1,194) (5,497) (1,485)

(Decrease) in payables (3,146) (2,188) (2,137)

(Decrease) in provisions (105) (79) -

Cash (used in)/generated

from operations (25) (2,995) 5,272

========================== ========================== ===========================

10. Dividends

The interim dividend of 1.8 pence per share (2022: 1.8 pence per

share) was approved by the Board on 25 July 2023. It is payable on

25 August 2023 to shareholders on the register at 4 August 2023.

This interim dividend has not been included as a liability in this

interim financial information. It will be recognised in

shareholders' equity in the year to 31 December 2023. A final

dividend of GBP2,064,000 was paid in June 2023 and relates to the

year ending 31 December 2022 (2022: final dividend

GBP2,061,000).

11. Property, plant and equipment including right-of-use assets

Unaudited six months ended 30 Unaudited six months ended 30

Jun 2023 Jun 2022

GBP000 GBP000

Opening net book amount 1 January 5,103 4,261

Additions 495 379

Disposals (117) -

Exchange movements (56) 161

Depreciation (514) (551)

Closing net book amount 30 June

(unaudited) 4,911 4,250

================================= =================================

The Group has not placed any contracts for future capital

expenditure which have not been provided for in the financial

statements.

12. Trade and other receivables

Unaudited six months ended 30 Unaudited six months ended 30

Jun 2023 Jun 2022

GBP000 GBP000

Trade receivables - net 10,994 14,901

Other receivables 62 130

Prepayments 1,540 1186

Accrued income 716 523

Closing net book amount 30 June

(unaudited) 13,312 16,740

================================= =================================

Contract assets and contract liabilities only comprise accrued

and deferred income respectively. Within the trade receivables

balance of GBP10,994,000 (30 June 2022: GBP14,901,000), there are

balances totalling GBP2,977,000 (30 June 2022: GBP3,191,000) which,

at 30 June 2023 were overdue for payment. The decrease of

GBP3,907,000 in trade receivables from prior period levels is due

to the timing of receipt of annual licence fee and subscription

invoices issued. During July 2023, significant receipts totalling

GBP4.2 million were collected against the total receivables balance

at 30 June 2023.

13. Trade and other payables

Unaudited six months ended 30 Unaudited six months ended 30

Jun 2023 Jun 2022

GBP000 GBP000

Trade payables 871 541

Other tax and social security

payable 1,379 1,903

Other payables 9 -

Accruals 6,009 5,511

Deferred income 26,733 30,141

Closing net book amount 30 June

(unaudited) 35,001 38,096

================================= =================================

14. Financial liabilities - borrowings

Unaudited six months ended 30 Unaudited six months ended 30

Jun 2023 Jun 2022

GBP000 GBP000

Bank Loan 8,983 9,897

================================= =================================

The borrowings are repayable as

follows:

Within one year 1,250 938

In the second year 7,812 1,250

In the third to fifth years

inclusive - 7,812

--------------------------------- ---------------------------------

9,062 10,000

Unamortised prepaid facility

arrangement fees (79) (103)

As at 30 June (unaudited) 8,983 9,897

================================= =================================

On 15 October 2021, the Group and Company entered into a loan

agreement with Bank of Ireland consisting of a GBP10 million term

loan in addition to a revolving credit facility of GBP10 million.

The loan is secured on all the assets of the Group. Operating

covenants are limited to the Group's net debt leverage and interest

cover. The term loan is repayable over three years with an initial

12-month repayment holiday followed by annual capital repayments of

GBP1,250,000. The Group can request a further one year extension to

the loan. At the end of the term, a bullet payment for the

remaining balance of the loan is due. The loan is denominated in

Pound Sterling and carries interest at SONIA plus 1.75%. The Group

entered into an interest swap on 2 November 2021, effectively

fixing the interest rate at 2.95% over the term of the loan.

15. Capital lease obligations

Unaudited six months ended 30 Unaudited six months ended 30

Jun 2023 Jun 2022

GBP000 GBP000

Amounts payable under capital lease

arrangements:

Within one year 538 440

Within two to five years 2,091 1,574

After five years 1,206 1,529

--------------------------------- ---------------------------------

Total 3,835 3,543

Less: future finance charges (490) (535)

--------------------------------- ---------------------------------

Present value of lease obligations 3,345 3,008

Less: Amount due for settlement

within 12 months (shown under

current liabilities (424) (329)

As at 30 June (unaudited) 2,921 2,679

================================= =================================

Unaudited six months ended 30 Unaudited six months ended 30

Jun 2023 Jun 2022

GBP000 GBP000

The present value of financial lease

liabilities is split as follows:

Within one year 424 329

Within two to five years 1,781 1263

After five years 1,140 1,416

3,345 3,008

================================= =================================

16. Provisions

Unaudited six months ended 30 Jun 2023 Unaudited six months

ended 30 Jun 2022

GBP000 GBP000

At 1 January 316 379

Debited/(credited) to income statement (104) (80)

Exchange movements (1) 1

As at 30 June (unaudited) 211 300

======================================= =====================

Unaudited six months ended 30 Jun Unaudited six months ended 30 Jun

2023 2022

GBP000 GBP000

Current - -

Non-current 211 300

As at 30 June (unaudited) 211 300

==================================== =====================================

GBP 167,000 of the total provision at 30 June 2023 of GBP211

,000 relates to the cost of dilapidations in respect of its

occupied leasehold premises (30 June 2022: GBP252,000).

17. Share capital

Unaudited six months ended 30 June 2023 Unaudited six months ended 30 June 2022

Ordinary share capital

at 7 1/3 pence each Number of shares Ordinary shares Number of shares Ordinary shares

Issued and fully paid: 000 GBP000 000 GBP000

Opening balance as at 1

January 57,337 4,204 57,199 4,194

Shares issued under

share option schemes - - 138 10

As at 30 June

(unaudited) 57,337 4,204 57,337 4,204

===================== =================== ===================== ===================

During the year, the Company established an Employee Benefit

Trust ("EBT") for the benefit of the Group's employees. At 30 June

2023, the Company holds 17,710 shares in the Employee Benefit Trust

("EBT"), recognised as a deduction in equity.

Share premium

Unaudited six months ended 30 Unaudited six months ended 30

Jun 2023 Jun 2022

GBP000 GBP000

Opening balance as at 1 January 11,959 11,946

Movement in relation to share options

exercised - 13

As at 30 June (unaudited) 11,959 11,959

================================= =================================

18. Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation.

There were no related party transactions during the six-month

period ended 30 June 2023 (30 June 2022: GBP22,000), as defined by

International Accounting Standard No 24 'Related Party

Disclosures', except for key management compensation. The related

party transactions for the year ended 31 December 2022 as defined

by International Accounting Standard No 24 'Related Party

Disclosures' are disclosed in note 32 of the Aptitude Software

Group plc Annual Report for the year ended 31 December 2022.

19. Statement of directors' responsibilities

The Directors confirm that these condensed interim financial

statements have been prepared in accordance with International

Accounting Standard 34, 'Interim Financial Reporting', as adopted

by the European Union and that the interim management report

includes a fair review of the information required by DTR 4.2.7 and

DTR 4.2.8, namely:

- an indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

- material related-party transactions in the first six months

and any material changes in the related-party transactions

described in the last annual report.

The Directors of Aptitude Software Group plc are listed in the

Aptitude Software Group plc Annual Report for 31 December 2022. A

list of current directors is maintained on the Aptitude Software

Group plc website: www.aptitudesoftware.com/investor-relations/

Copies of this statement are available on the investor relations

page of our website ( www.aptitudesoftware.com/investor-relations/

).

By order of the Board

Michael Johns

25 July 2023

Chief Financial Officer

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEMFWIEDSEDW

(END) Dow Jones Newswires

July 26, 2023 02:00 ET (06:00 GMT)

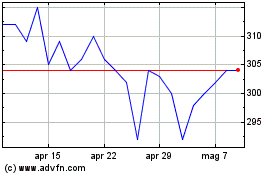

Grafico Azioni Aptitude Software (LSE:APTD)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Aptitude Software (LSE:APTD)

Storico

Da Mag 2023 a Mag 2024