TIDMARTL

RNS Number : 5224U

Alpha Real Trust Limited

24 November 2023

LEI: 213800BMY95CP6CYXK69

24 November 2023

ALPHA REAL TRUST LIMITED ("ART" OR THE "COMPANY" OR "THE

GROUP")

ART ANNOUNCES ITS HALF YEAR RESULTS FOR THE SIX MONTHSED 30

SEPTEMBER 2023

-- NAV per ordinary share 214.3p as at 30 September 2023 (31 March 2023: 216.8p).

-- Basic earnings for the six months ended 30 September 2023 of

1.5p per ordinary share (six months ended 30 September 2022: basic

earnings of 0.4p per ordinary share).

-- Adjusted earnings for the six months ended 30 September 2023

of 4.6p per ordinary share (six months ended 30 September 2022:

adjusted earnings of 3.3p per ordinary share)*.

-- Declaration of a quarterly dividend of 1.0p per ordinary

share expected to be paid on 24 January 2024.

-- Robust financial position: ART remains on a robust financial

footing and is well positioned to take advantage of new investment

opportunities.

-- Investment targets: the Company is currently focussed on

managing risk in its loan portfolio and opportunistically extending

its wider investment strategy to target investments offering

inflation protection via index linked income adjustments and

investments that have potential for capital gains.

-- Addition to long leased property portfolio: in August 2023,

ART acquired a hotel and public house in Yardley, Birmingham for

GBP5.1 million (including acquisition costs) with inflation linked

rentals.

-- Diversified portfolio of secured senior and secured mezzanine

loan investments: as at 30 September 2023, the size of ART's drawn

secured loan portfolio was GBP57.9 million, representing 46.4% of

the investment portfolio.

-- The senior portfolio has an average Loan to Value ('LTV')**

of 60.1% based on loan commitments (with mezzanine loans having an

LTV range of between 49.5% and 68.0% whilst the highest approved

senior loan LTV is 65.6%).

-- Loan commitments: including existing loans at the balance

sheet date and loans committed post period end, ART's current total

committed but undrawn loan commitments amount to GBP3.4

million.

-- H2O Madrid: three Inditex group brands entered into updated

lease contracts to extend the footprint of existing stores and

extend the lease terms.

-- Cash management: including investments post period end, the

Company has invested GBP12.0 million in short term UK Treasury

Bonds (Gilts) and GBP7.1 million in UK Treasury Bills to enhance

returns on its liquid holdings.

* The basis of the adjusted earnings per share is provided in

note 8

** See below for more details

William Simpson, Chairman of Alpha Real Trust, commented:

"ART's investment portfolio benefits from diversification across

geographies, sectors, and asset types. As inflationary pressures

and interest rate policy continue to shape the economic backdrop in

which the Company operates, ART remains on a robust financial

footing and is well placed to capitalise on new investment

opportunities.

ART remains committed to growing its diversified investment

portfolio. In recent years the Company focused on reducing exposure

to direct development risk and recycling capital into cashflow

driven investments. The Company is currently focussed on its loan

portfolio and also on its wider investment strategy which targets

investments offering inflation protection via index linked income

adjustments and investments that have potential for capital

gains."

The Investment Manager of Alpha Real Trust is Alpha Real Capital

LLP.

For further information please contact:

Alpha Real Trust Limited

William Simpson, Chairman, Alpha Real Trust +44 (0) 1481 742

742

Gordon Smith, Joint Fund Manager, Alpha Real Trust +44 (0) 207

391 4700

Brad Bauman, Joint Fund Manager, Alpha Real Trust +44 (0) 207

391 4700

Panmure Gordon, Broker to the Company

Atholl Tweedie +44 (0) 20 7886 2500

Notes to editors:

About Alpha Real Trust

Alpha Real Trust Limited targets investment, development,

financing and other opportunities in real estate, real estate

operating companies and securities, real estate services,

infrastructure, infrastructure services, other asset-backed

businesses and related operations and services businesses that

offer attractive risk-adjusted total returns.

Further information on the Company can be found on the Company's

website: www.alpharealtrustlimited.com .

About Alpha Real Capital LLP

Alpha Real Capital is a value-adding international property fund

management group. Alpha Real Capital is the Investment Manager to

ART. Brad Bauman and Gordon Smith of Alpha Real Capital are joint

Fund Managers to ART. Both have experience in the real estate and

finance industries throughout the UK, Europe and Asia.

For more information on Alpha Real Capital please visit

www.alpharealcapital.com .

Company's summary and objective

Strategy

ART targets investment, development, financing and other

opportunities in real estate, real estate operating companies and

securities, real estate services, infrastructure, infrastructure

services, other asset-backed businesses and related operations and

services businesses that offer attractive risk-adjusted total

returns.

ART currently selectively focusses on asset-backed lending, debt

investments and high return property investments in Western Europe

that are capable of delivering strong risk adjusted returns.

The portfolio mix at 30 September 2023, excluding sundry

assets/liabilities, was as follows:

30 September 31 March 2023

2023

High return debt: 46.4% 44.5%

High return equity in property investments: 29.7% 26.5%

Other investments: 14.3% 15.2%

Cash: 9.6% 13.8%

The Company is currently focussed on risk managing its loan

portfolio and opportunistically extending its wider investment

strategy to target high return mezzanine and property investments

offering inflation protection via index linked income adjustments

and investments that have potential for capital gains.

The Company's Investment Manager is Alpha Real Capital LLP

("ARC").

Dividends

The current intention of the Directors is to pay a dividend and

offer a scrip dividend alternative quarterly to all

shareholders.

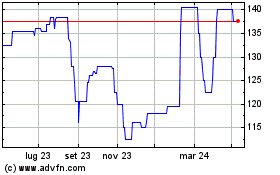

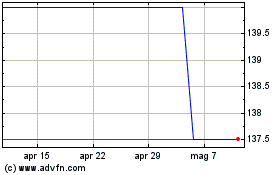

Listing

The Company's shares are traded on the Specialist Fund Segment

("SFS") of the London Stock Exchange ("LSE"), ticker ARTL: LSE.

Management

The Company's Investment Manager is Alpha Real Capital LLP

('ARC'), whose team of investment and asset management

professionals focus on the potential to enhance earnings in

addition to adding value to the underlying assets, and also focus

on the risk profile of each investment within the capital structure

to best deliver attractive risk adjusted returns.

Control of the Company rests with the non-executive Guernsey

based Board of Directors.

Financial highlights

6 months 12 months 6 months

ended ended ended

30 September 31 March 30 September

2023 2023 2022

------------------------------------ -------------- ---------- --------------

Net asset value (GBP'000) 125,354 125,067 125,025

------------------------------------ -------------- ---------- --------------

Net asset value per ordinary share 214.3 216.8p 219.6

------------------------------------ -------------- ---------- --------------

Earnings per ordinary share (basic

and diluted) (adjusted)* 4.6p 7.7p 3.3p

------------------------------------ -------------- ---------- --------------

Earnings per ordinary share (basic

and diluted) 1.5p 1.1p 0.4p

------------------------------------ -------------- ---------- --------------

Dividend per ordinary share (paid

during the period) 2.0p 4.0p 2.0p

* The adjusted earnings per share includes adjustments for the

effect of the fair value revaluation of investment property and

indirect property investments, capital element on Investment

Manager's fees, the fair value movements on financial assets and

deferred tax provisions: full analysis is provided in note 8 to the

accounts.

Chairman's statement

I am pleased to present the Company's half year report and

accounts for the six months ended 30 September 2023.

ART's investment portfolio benefits from diversification across

geographies, sectors and asset types and the Company remains on a

robust financial footing and is well placed to capitalise on new

investment opportunities.

Inflationary pressures and persistently relatively high central

bank interest rates continue dominate the economic backdrop in

which the Company operates and clouds the outlook for the real

estate market. The uncertain market will offer opportunities in the

medium term for ART to grow its diversified investment portfolio.

The Company is currently focussed on risk managing its loan

portfolio and opportunistically extending its wider investment

strategy to target mezzanine opportunities as companies seek to

refinance and recapitalise. The Company is also investing in assets

offering inflation protection via index linked income adjustments

and investments that have potential for capital appreciation.

ART's investment portfolio benefits from diversification across

geographies, sectors and asset types. We continue to take a

cautious approach to new investment, including new lending, as we

observe ongoing pressures in the economy. Recently the Company has

again focused on recycling capital into more conservative asset

backed lending while reducing exposure to development risk. In this

time of heightened uncertainty, the Company is benefiting from that

strategy and it has placed the Company on a robust financial

footing.

ART continues to adhere to its disciplined strategy and

investment underwriting principles which seek to manage risk

through a combination of operational controls, diversification and

an analysis of the underlying asset security.

Long leased assets

The Company's portfolio of long leased properties, comprising

three hotels leased to Travelodge in the UK and an industrial

facility in Hamburg, Germany, leased to a leading industrial group

are well positioned in the current inflationary environment. The

leased assets have inflation linked rent adjustments which offer

the potential to benefit from a long term, predictable, inflation

linked income stream and the potential for associated capital

growth.

During the period ART acquired a hotel and public house in

Yardley, Birmingham, United Kingdom for GBP5.1 million (including

acquisition costs), leased to Travelodge Hotels Limited reflecting

an initial yield of 8.3% p.a. ART has acquired the asset for

cash.

The property is let until November 2060 with a tenant only break

option in 2035, providing 12 years term certain to the break clause

and the rent has inflation linked adjustments.

The 64-bedroom hotel and public house is held freehold and is

situated to the east of Birmingham City Centre off the A45. The

hotel is in a well-connected location equidistant between

Birmingham City Centre to the west and Birmingham Airport to the

east.

Diversified secured lending investment

The Company invests in a diversified portfolio of secured senior

and mezzanine loan investments. The loans are typically secured on

predominately residential real estate investment and development

assets with attractive risk adjusted income returns. As at 30

September 2023, ART had committed GBP67.6 million across eighteen

loans, of which GBP57.9 million (excluding a GBP5.1 million

provision for Expected Credit Loss discussed below) was drawn.

The Company's debt portfolio comprises predominately floating

rate loans. Borrowing rates are typically set at a margin over Bank

of England ('BoE') Base Rate and benefit from rising interest rates

as outstanding loans deliver increasing returns as loan rates track

increases in the BoE Base Rate.

During the quarter ended 30 September 2023, one new loan was

drawn for GBP0.8 million and additional drawdowns of GBP5.0 million

were made on existing loans, one loan totalling GBP0.5 million

(including accrued interest and exit fees) was fully repaid and a

further GBP5.0 million (including accrued interest) was received as

part repayments.

Post period end, GBP1.5 million of drawdowns were made on

existing loans, one loan was fully repaid for GBP1.5 million

(including accrued interest and applicable fees) and part payments

were received amounting to GBP4.5 million (including accrued

interest).

As at 30 September 2023, 68.6% of the Company's loan investments

were senior loans and 31.4% were mezzanine loans. The portfolio has

an average LTV of 60.1% based on loan commitments (with mezzanine

loans having a LTV range of between 49.5% and 68.0% whilst the

highest approved senior loan LTV is 65.6%). Portfolio loans are

underwritten against value for investment loans or gross

development value for development loans as relevant and

collectively referred to as LTV in this report.

The largest individual loan in the portfolio as at 30 September

2023 is a senior loan of GBP10.2 million which represents 15.1% of

committed loan capital and 8.1% of the Company's NAV.

Four loans in the portfolio have entered receivership: ART is

closely working with stakeholders to maximise capital recovery. The

Company has considered the security on these loans (which are a

combination of a first charge and a second charge over the

respective assets and personal guarantees) and has calculated an

Expected Credit Loss ('ECL') on these four loans of approximately

GBP3.7 million; the Group have also provided for an ECL on the

remainder of the loans' portfolio for an additional GBP1.4 million:

in total, the Group have provided for an ECL of GBP5.1 million in

its consolidated accounts.

Aside from the isolated cases of receivership, illustrated

above, the Company's loan portfolio has proved to be resilient

despite the recent extended period of heightened uncertainty and

risk. In terms of debt servicing, allowing for some temporary

agreed extensions, interest and debt repayments have been received

in accordance with the loan agreements. Where it is considered

appropriate, on a case-by-case basis, underlying loan terms may be

extended or varied with a view to maximising ART's risk adjusted

returns and collateral security position. The Company's loan

portfolio and new loan targets continue to be closely reviewed to

consider the potential impact on construction timelines, building

cost inflation and sales periods.

The underlying assets in the loan portfolio as at 30 September

2023 had geographic diversification with a London and South East

focus. London accounted for 25.4% and the South East of England

accounted for 17.1% of the committed facilities within the loan

investment portfolio.

H2O, Madrid

ART has a 30% stake in a joint venture with CBRE Investment

Management in the H2O shopping centre in Madrid.

H2O occupancy, by area, as at 30 September 2023 was 91.5%. The

centre's visitor numbers remain below pre-Covid highs; however, a

recovery is evident. In the calendar year to 30 September 2023,

visitor numbers were approximately 6.8% below those in 2019

(pre-Covid) and 7.0% above 2022.

During the period, a notable asset management action included

the signing of contracts with three existing Inditex group brands

within the centre to extend the footprint of existing stores and

extend the lease terms. The works to deliver the new 3,000 square

metre store for anchor retailer Primark continue to advance on

schedule. The store is expected to be delivered during 2024.

Other investments

Investment in listed and authorised funds

The Company has invested (value as at 30 September 2023: GBP4.1

million) across three investments that offer potential to generate

attractive risk adjusted returns. Current market volatility and

rises in interest rates have impacted the capital value of these

investments. The investment yield offers a potentially accretive

return to holding cash while the Company deploys capital in

opportunities in line with its investment strategy. These funds

invest in ungeared long-dated leased real estate, debt and

infrastructure.

Cash management

The Company adopts an active approach to enhance returns on its

cash balances .

As at 30 September 2023, the Company had invested a total of

GBP6.0 million in short dated UK Treasury Bonds (Gilts) (annualised

yield to maturity of 4.8% with maturity in September 2024) and

GBP7.1 million in UK Treasury Bills (annualised yield to maturity

of 5.5% with maturity in March 2024). These government backed short

term investments offer the Company enhanced returns over cash

balances.

Post period end, the Company invested further GBP6.0 million in

short dated UK Treasury Bonds (Gilts) with an annualised yield to

maturity of 4.9% with maturity in October 2025.

During the period, the Company also invested GBP6.0 million in

the Morgan Stanley GBP Liquidity Fund, which invests in high

quality short-term money market instruments denominated in

sterling, offers same day liquidity and earns an annualised return,

net of Morgan Stanley's fees, of 5.3%.

Results and dividends

Results

Basic earnings for the six months ended 30 September 2023 are

GBP0.9 million (1.5 pence per ordinary share, see note 8 of the

financial statements).

Adjusted earnings, which the Board believe is a more appropriate

assessment of the operational income accruing to the Group's

activities, for the six months ended 30 September 2023 are GBP2.7

million: this represents 4.6 pence per ordinary share, which

compares with adjusted earnings of 3.3 pence per ordinary share in

the same period of last year (see note 8 of the financial

statements). Earnings have increased primarily due to enhanced

revenues from new long income investments and accretion from

cash/treasury management.

The net asset value per ordinary share at 30 September 2023 is

214.3 pence per share (31 March 2023: 216.8 pence per ordinary

share) (see note 9 of the financial statements). The net asset

values reflects the fair value movement on the investment property

and listed and authorised funds, an increase in the ECL provisions

on the loan portfolio mitigated by positive earnings in excess of

dividends.

Dividends

The Board announces a dividend of 1.0 pence per ordinary share

which is expected to be paid on 24 January 2024 (ex-dividend date 7

December 2023 and record date 8 December 2023).

The dividends paid and declared in respect of the twelve month

period ended 30 September 2023 totalled 4.0 pence per ordinary

share representing an annual dividend yield of 3.0% p.a. by

reference to the average closing share price over the twelve months

to 30 September 2023.

During the period, GBP105,561 dividends were paid in cash and

GBP1,052,519 settled by scrip issue of shares.

Scrip dividend alternative

Shareholders of the Company have the option to receive shares in

the Company in lieu of a cash dividend, at the absolute discretion

of the Directors, from time to time.

The number of ordinary shares that an Ordinary Shareholder will

receive under the Scrip Dividend Alternative will be calculated

using the average of the closing middle market quotations of an

ordinary share for five consecutive dealing days after the day on

which the ordinary shares are first quoted "ex" the relevant

dividend.

The Board has elected to offer the scrip dividend alternative to

Shareholders for the dividend for the quarter ended 30 September

2023 . Shareholders who returned the Scrip Mandate Form and elected

to receive the scrip dividend alternative will receive shares in

lieu of the next dividend. Shareholders who have not previously

elected to receive scrip may complete a Scrip Mandate Form (this

can be obtained from the registrar: contact Computershare (details

below)), which must be returned by 9 January 2024 to benefit from

the scrip dividend alternative for the next dividend.

Financing

As at 30 September 2023 the Group has one direct bank loan of

EUR9.5 million (GBP8.2 million), with no financial covenant tests,

to a subsidiary used to finance the acquisition of the Hamburg

property. The loan is secured over the Hamburg property and has no

recourse to the other assets of the Group.

Further details of individual asset financing can be found under

the individual investment review sections later in this report.

Share buybacks

Following the Annual General Meeting held on 7 September 2023

the Company has the authority to buy back 14.99% of its share

capital (assessed on 29 June 2023) for a total of 8,709,579 shares.

No shares have been yet bought back under this authority.

During the period and post period end, the Company did not

purchase any shares in the market.

As at the date of this announcement, the ordinary share capital

of the Company is 66,629,772 (including 7,717,581 ordinary shares

held in treasury) and the total voting rights in the Company is

58,912,191.

Foreign currency

The Company monitors foreign exchange exposures and considers

hedging where appropriate. Foreign currency balances have been

translated at the period end rates of GBP1:EUR1.154 as

appropriate.

Russian invasion of Ukraine and going concern

As previously stated, ART has no investments in Ukraine, Russia,

nor exposure to any companies that have investments in, or links

to, Ukraine or Russia. ART has no arrangements with any person

currently on (or potentially on) any sanctions list, or links to

Ukraine or Russia. The Board continues to monitor the global

political and economic situation regularly assessing impacts

arising from inflation and interest rate changes for a potential

material impact on ART's portfolio.

The Company has adopted a prudent short-term strategy to move to

cash conservation and a cautious approach to commitments to new

investments over this uncertain time. Alert to the impact of

potentially reducing income returns, this approach has supported a

robust balance sheet position. The Company continues to adopt this

cautious approach to new investment and is conserving cash because

of the uncertainty that has characterised the past few months; this

ensures the Company retains a robust financial footing, making it

well positioned to take advantage of new investment

opportunities.

As noted above, the Company held approximately (as at 30

September 2023) 9.6% of its assets (excluding sundry net assets) in

cash (including the investment in the Morgan Stanley GBP Liquidity

Fund ) and 10.5% in highly liquid UK Treasury Bonds and Bills with

limited current contractual capital commitments. While there is

external financing in the Group's investment interests, this is

limited and non-recourse to the Company; the borrowings in these

special purpose vehicles are compliant with their banking

covenants. See the investment review section for more details on

relevant investments.

Bearing in mind the nature of the Group's business and assets,

after making enquiries, with the support of revenue forecasts for

the next twelve months and considering the above, the Directors

consider that the Group has adequate resources to continue in

operational existence for the foreseeable future. For this reason,

they continue to adopt the going concern basis in preparing the

financial statements.

Strategy and outlook

ART's investment portfolio benefits from diversification across

geographies, sectors, and asset types. As inflationary pressures

and interest rate policy continue to shape the economic backdrop in

which the Company operates, ART remains on a robust financial

footing and is well placed to capitalise on new investment

opportunities.

ART remains committed to growing its diversified investment

portfolio. In recent years the Company focused on reducing exposure

to direct development risk and recycling capital into cashflow

driven investments. The Company is currently focussed on its loan

portfolio and also on its wider investment strategy which targets

investments offering inflation protection via index linked income

adjustments and investments that have potential for capital

gains.

William Simpson

Chairman

23 November 2023

Investment review

Portfolio overview & risk analysis as at 30 September

2023

Investment name

Investment type Carrying Income Investment Property type / underlying security Investment notes % of Notes

value return location portfolio(1) **

p.a. *

--------------------- ----------- ---------- ---------- --------------------------------------------------------------------------------------------- ------------------------------------------------- ------------- -----

High return debt (46.4%)

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ -------------

Secured senior

finance

Senior secured loans

(excluding committed

but undrawn

facilities of GBP4.6 GBP39.7m

million) (2) 9.8% (3) UK Diversified loan portfolio focussed on real estate investments and developments Senior secured debt 31.8% 13

Secured mezzanine finance

Second charge GBP18.2m 18.6% (3) UK Diversified loan portfolio focussed on real estate investments and developments Secured mezzanine debt and subordinated debt 14.6% 13

mezzanine loans (2)

--------------------- ----------- ---------- ---------- --------------------------------------------------------------------------------------------- ------------------------------------------------- ------------- -----

High return equity in property investments (29.7%)

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ ------------- -----

H2O shopping centre

Indirect property GBP17.4m 5.1% (4) Spain Dominant Madrid shopping centre and separate development site 30% shareholding; moderately geared bank finance 14.0% 12

(EUR 20.1m) facility

--------------------- ----------- ---------- ---------- --------------------------------------------------------------------------------------------- ------------------------------------------------- ------------- -----

Long leased industrial facility, Hamburg

Direct property GBP8.4m (5) 8.9% (4) Germany Long leased industrial complex in major European industrial and logistics hub with RPI linked Long term moderately geared bank finance facility 6.7% 10

rent

(EUR9.7m)

--------------------- ----------- ---------- ---------- --------------------------------------------------------------------------------------------- ------------------------------------------------- ------------- -----

Long leased hotel, Wadebridge

Direct property GBP3.6m 5.3% (6) UK Long leased hotel to Travelodge, a large UK hotel group with CPI linked rent No external gearing 2.9% 10

--------------------- ----------- ---------- ---------- --------------------------------------------------------------------------------------------- ------------------------------------------------- ------------- -----

Long leased hotel, Lowestoft

Direct property GBP2.7m 5.2% (6) UK Long leased hotel to Travelodge, a large UK hotel group with RPI linked rent No external gearing 2.2% 10

--------------------- ----------- ---------- ---------- --------------------------------------------------------------------------------------------- ------------------------------------------------- ------------- -----

Long leased hotel, Yardley

Direct property GBP4.8m 7.7% (6) UK Long leased hotel to Travelodge, a large UK hotel group with RPI linked rent No external gearing 3.9% 10

--------------------- ----------- ---------- ---------- --------------------------------------------------------------------------------------------- ------------------------------------------------- ------------- -----

Other investments (14.3%)

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ -------------

Listed and authorised

fund investments GBP4.1m UK & Commercial real estate, infrastructure and debt funds Short to medium term investment in listed and

6.2% (4) Channel authorised funds 3.3% 11

Islands

Affordable housing

Residential

Investment GBP0.6 m n/a UK High-yield residential UK portfolio 100% shareholding; no external gearing 0.5% 10

--------------------- ----------- ---------- ---------- --------------------------------------------------------------------------------------------- ------------------------------------------------- ------------- -----

UK Treasury Bonds GBP6.0m 4.8% (7) UK UK government bonds - 4.8% 11

2.8% (8)

--------------------- ----------- ---------- ---------- --------------------------------------------------------------------------------------------- ------------------------------------------------- ------------- -----

UK Treasury Bills GBP7.1m 5.5% (7) UK UK government bonds - 5.7% 11

--------------------- ----------- ---------- ---------- --------------------------------------------------------------------------------------------- ------------------------------------------------- ------------- -----

Cash and short-term investments (9.6%)

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ -------------

Cash (9) GBP6.0 m 1.5% (10) UK 'On call' and current accounts - 4.8% -

--------------------- ----------- ---------- ---------- --------------------------------------------------------------------------------------------- ------------------------------------------------- -------------

Sterling Liquidity

Fund GBP6.0m 5.3% UK Money market fund, daily liquidity - 4.8% 16

--------------------- ----------- ---------- ---------- --------------------------------------------------------------------------------------------- ------------------------------------------------- ------------- -----

* Return from underlying investments excluding Fund fees

** See notes to the financial statements

(1) Percentage share shown based on NAV excluding the company's

sundry assets/liabilities

(2) Including accrued interest/coupon at the balance sheet

date

(3) The income returns for high return debt are the annualised

actual finance income return over the period shown as a percentage

of the average committed

capital over the period

(4) Yield on equity over 12 months to 30 September 2023

(5) Property value including sundry assets/liabilities, net of

associated debt

(6) Annualised monthly return

(7) Annualised yield to maturity

(8) Fixed annual coupon

(9) Group cash of GBP7.1m excluding cash held with the Hamburg

holding company of GBP1.1m

(10) Weighted average interest earned on call accounts

High return debt

Overview

ART has a portfolio of secured loan investments which contribute

a diversified return to the Company's earnings position. The

portfolio comprises high return senior (first charge) loans and

mezzanine (second charge) loans secured on real estate investment

assets and developments. ART loan underwriting is supported by the

Investment Manager's asset-backed lending experience, developer and

investor relationships and knowledge of the underlying assets and

sectors, in addition to the Group's partnerships with specialist

debt providers.

Secured Finance

Investment Investment Carrying Income Property type Investment

type value return / underlying notes

p.a. security

================== ============== ========= ======== ================== ==============

Secured senior First charge GBP39.7m 9.8%** Diversified Secured debt

finance secured * loan portfolio

loans focussed on

real estate

investments

and developments

================== ============== ========= ======== ================== ==============

Secured mezzanine Second charge GBP18.2m 18.6%** Diversified Second charge

finance secured * loan portfolio secured debt

loans focussed on and secured

real estate subordinated

investments debt

and developments

================== ============== ========= ======== ================== ==============

* Including accrued interest/coupon at the balance sheet date

** The income returns for high return debt are the annualised

actual finance income return over the period shown as a percentage

of the average committed capital over the period

These loans are typically secured on real estate investment and

development assets with attractive risk-adjusted income returns

from either current or capitalised interest or coupons.

As at 30 September 2023, ART had invested a total amount of

GBP57.9 million across eighteen loans. Over the past twelve months

the loan portfolio has increased by 20.4%.

During the six months to 30 September 2023, one new loan was

drawn for GBP0.8 million and additional drawdowns of GBP8.9 million

were made on existing loans; two loans for GBP2.1 million

(including accrued interest and exit fees) were fully repaid and a

further GBP7.3 million (including accrued interest) was received as

part repayments.

Post period end, GBP1.5 million of drawdowns were made on

existing loans, one loan was fully repaid for GBP1.5 million

(including accrued interest and applicable fees) and part payments

were received amounting to GBP4.5 million (including accrued

interest).

Each loan will typically have a term of up to two years, a

maximum 75% loan to gross development value ratio and be targeted

to generate attractive risk-adjusted income returns. As at 30

September 2023 , the senior portfolio has an average LTV of 59.5%

based on loan commitments (with mezzanine loans having an LTV range

of between 49.5% and 68.0% whilst the highest approved senior loan

LTV is 65.6%).

Four loans in the portfolio have entered receivership: ART is

closely working with stakeholders to maximise capital recovery. The

Company has considered the security on these loans (which are a

combination of a first charge and a second charge over the

respective assets and personal guarantees) and have calculated an

ECL on these four loans of approximately GBP3.7 million; the Group

have also provided for an ECL on the remainder of the loans'

portfolio for an additional GBP1.4 million: in total, the Group

have provided for an ECL of GBP5.1 million in its consolidated

accounts.

Current loan investment examples:

Location Total Loan type Loan term Current Underlying security

commitment LTV

MezzanineDevelopment Development of eight

Fleet, Hampshire GBP1,400,000 Loan 18 55.00% new build apartments

=============== ====================== ========== ======== =========================

St. Lawrence, Senior Development Development of eleven

Jersey GBP11,731,000 Loan 24 63.00% new build apartments

=============== ====================== ========== ======== =========================

Temple Fortune, Senior Development Development of eight

London GBP8,600,000 Loan 19 63.00% new build houses

=============== ====================== ========== ======== =========================

Throughout Senior Investment Refinance of a portfolio

the UK GBP12,000,000 Loan 36 60.58% of six care homes

================== =============== ====================== ========== ======== =========================

High return equity in property investments

Overview

ART continues to remain focused on investments that offer the

potential to deliver attractive risk-adjusted returns by way of

value enhancement through active asset management, improvement of

income, selective deployment of capital expenditure and the ability

to undertake strategic sales when the achievable price is accretive

to returns.

H2O Shopping Centre, Madrid

Investment Investment Carrying Income Property type Investment

type value return / underlying notes

p.a. security

=========== =========== ============ ======== ================= ==================

H2O Indirect GBP17.4m 5.1%* High-yield, 30% shareholding;

property (EUR20.1m) dominant Madrid 6-year term

shopping centre bank finance

and separate facility

development

site

=========== =========== ============ ======== ================= ==================

* Yield on equity over twelve months to 30 September 2023, excluding Fund fees

ART has a 30% stake in joint venture with CBRE Investment

Management in the H2O shopping centre in Madrid. H2O was opened in

2007 and built to a high standard providing shopping, restaurants

and leisure around a central theme of landscaped gardens and an

artificial lake. H2O has a gross lettable area of approximately

55,000 square metres comprising over 100 retail units. In addition

to a multiplex cinema, supermarket (let to leading Spanish

supermarket operator Mercadona) and restaurants, it has a large

fashion retailer base, including some of the strongest

international fashion brands, such as Nike, Zara, Mango, JD Sports,

Cortefiel, H&M and C&A.

H2O occupancy, by area, as at 30 September 2023 was 92.6%. The

centre trading levels remain below the pre-covid highs, however a

recovery is evident. In the calendar year to 30 September 2023,

visitor numbers were approximately 6.8% below those of the same

period in 2019 (pre-Covid) and 7.0% above the same period in

2021.

During the period, a notable asset management action included

the signing of contracts with three existing Inditex group brands

within the centre to extend the footprint of existing stores and

extend the lease terms. The works to deliver the new 3,000 square

metre store for anchor retailer Primark continue to advance on

schedule. The store is expected to be delivered during 2024.

The asset management highlights are as follows:

-- Valuation: 30 September 2023: EUR120.0 million (GBP103.9

million) (31 March 2023: EUR119.3 million (GBP104.9 million)).

-- Centre occupancy: 92.6% by area as at 30 September 2023.

-- Weighted average lease length to next break of 2.3 years and

7.9 years to expiry as at 30 September 2023.

Long leased industrial facility, Hamburg

Investment Investment Carrying Income Property type Investment

type value return / notes

p.a. underlying

security

==================================== ================ =========== ======== ================= ====================

Industrial Direct property GBP8.4 8.9% ** High return Long leased

facility, m* industrial investment with

Werner-Siemens-Straße (EUR9.7m) facility in moderately geared,

Hamburg, Germany Hamburg Germany long term, bank

finance facility

==================================== ================ =========== ======== ================= ====================

* Property value including sundry assets/liabilities and cash, net of associated debt

** Yield on equity over twelve months to 30 September 2023, excluding Fund fees

ART has an investment of EUR9.7 million (GBP8.4 million) in an

industrial facility leased to a leading international group.

The property is held freehold and occupies a site of 11.8 acres

in Billbrook, a well-established and well-connected industrial area

located approximately 8 kilometres south-east of Hamburg centre.

Hamburg is one of the main industrial and logistics markets in

Germany.

The property is leased to Veolia Umweltservice Nord GmbH, part

of the Veolia group, an international industrial specialist in

water, waste and energy management, with a 23-year unexpired lease

term. Under the operating lease, the tenant is responsible for

building maintenance and the rent has periodic inflation linked

adjustments.

The Hamburg asset is funded by way of a EUR9.5 million (GBP8.2

million) non-recourse, fixed rate, bank debt facility which matures

in 31 July 2028. The facility carries no financial covenant

tests.

This investment offers the potential to benefit from a long term

secure and predictable inflation-linked income stream which is

forecast to generate stable high single digit income returns. In

addition, the investment offers the potential for associated

capital growth from an industrial location in a major German

logistics and infrastructure hub.

Long leased hotel, Wadebridge, Cornwall

Investment Investment Carrying Income Property type Investment

type value return / notes

p.a. underlying

security

================== ================ ========= ======== ====================== ============

Hotel, Wadebridge Direct property GBP3.6 5.3% * Long leased No external

Cornwall, UK m hotel to Travelodge, gearing

a large UK

hotel group

with RPI linked

rent

================== ================ ========= ======== ====================== ============

* Annualised monthly return, excluding Fund fees

ART has an investment of GBP3.6 million (property valuation as

at 30 September 2023) in a 55-bedroom property, which is held

freehold and is situated on the outskirts of Wadebridge in the

county of Cornwall. The hotel is in a well-connected location in

close proximity to the A39.

The property is leased to Travelodge Hotels Limited on a 20 year

unexpired lease term. Under the lease, the tenant is responsible

for building maintenance

The passing rent of GBP0.3 million p.a. has inflation linked

adjustments.

Long leased hotel, Lowestoft

Investment Investment Carrying Income Property type Investment

type value return / notes

p.a. underlying

security

================== ================ ========= ======== ====================== ============

Hotel, Lowestoft, Direct property GBP2.7 5.2% * Long leased No external

UK m hotel to Travelodge, gearing

a large UK

hotel group

with RPI linked

rent

================== ================ ========= ======== ====================== ============

* Annualised monthly return, excluding Fund fees

ART has an investment of GBP2.7 million (property valuation as

at 30 September 2023) in a 47-bedroom property, which is held

freehold and occupies a site of 1.08 acres in Lowestoft, a well

established and well connected area located in close proximity to

the A47 which runs to Norwich.

The property is leased to Travelodge Hotels Limited on an 18

year unexpired lease term. Under the lease, the tenant is

responsible for building maintenance.

The passing rent of GBP0.2 million p.a. has inflation linked

adjustments.

Long leased hotel, Yardley, Birmingham

Investment Investment Carrying Income Property type Investment

type value return / notes

p.a. underlying

security

================ ================ ========= ======== ====================== ============

Hotel, Yardley, Direct property GBP4.8 7.7% * Long leased No external

UK m hotel to Travelodge, gearing

a large UK

hotel group

with RPI linked

rent

================ ================ ========= ======== ====================== ============

* Annualised monthly return, excluding Fund fees

ART has an investment of GBP4.8 million in a 64-bedroom

property, which is held freehold and occupies a site of 1.42 acres

and has 116 car parking spaces in Yardley. The hotel is situated to

the east of Birmingham City Centre off the A45. The hotel is in a

well-connected location equidistant between Birmingham City Centre

to the west and Birmingham Airport to the east.

The property is leased to Travelodge Hotels Limited until

November 2060 with a tenant only break option in 2035. Under the

lease, the tenant is responsible for building maintenance.

The passing rent of GBP0.4 million p.a. has inflation linked

adjustments.

Other Investments

Listed and authorised fund investments

Investment Investment Carrying Income Property type Investment

type value return / underlying notes

p.a. * security

==================== =============== ========== ======== ================== ========================

Sequoia Economic Listed equity GBP2.3m 6.1% Listed investment FTSE 250 infrastructure

Infrastructure fund debt fund

Income Fund

Limited

==================== =============== ========== ======== ================== ========================

GCP Infrastructure Listed equity GBP0.9m 6.7% Listed investment FTSE 250 infrastructure

Investments fund fund

Limited

==================== =============== ========== ======== ================== ========================

GCP Asset Backed Listed equity GBP0.9m 6.1% Listed investment Diversified

Income Fund fund asset back

Limited debt fund

==================== =============== ========== ======== ================== ========================

Total GBP4.1m 6.2%

===================================== ========= ======== ================== ========================

*Yield on equity based on 12 months to 30 September 2023

The Company invested (value as at 30 September 2023: GBP4.1

million) across three investments that offer potential to generate

attractive risk adjusted returns. Current market volatility and

rise in interest rates has impacted the capital value of these

investments. The investment yield offers a potentially accretive

return to holding cash while the Company deploys capital in

opportunities in line with its investment strategy. These funds

invest in ungeared long-dated leased real estate, debt and

infrastructure.

Affordable Housing

The Company's wholly owned investment, RealHousingCo Limited

("RHC") has obtained successful registration with the Regulator of

Social Housing as a For Profit Registered Provider of affordable

homes. This status provides RHC with a platform to undertake future

investment in the affordable housing sector which offers scope to

generate long term, inflation-linked returns while addressing the

chronic undersupply of affordable homes in the UK.

RHC owns a residential property located in Liverpool (UK), which

is comprised of seven units, all of which are occupied by private

individuals, each with a six month term contract. The fair value of

the Liverpool property as at 30 September 2023 was GBP0.6

million.

UK Treasury Bonds (Gilts) and Bills

Investment Investment Carrying Income Property type Investment

type value return / underlying notes

p.a. * security

=========== ============ ========= ======== ================== =================

Gilts UK Treasury GBP6.0m 4.8% Liquid Government Short dated

Bonds security (maturity in

September 2024)

=========== ============ ========= ======== ================== =================

Treasuries UK Treasury GBP7.1m 5.5% Liquid Government Short dated

Bills security (maturity in

March 2024)

=========== ============ ========= ======== ================== =================

Total GBP13.1m 5.2%

**

=========== ============ ========= ======== ================== =================

* Annualised yield to maturity

** Weighted average

These government backed short term investments offer the Company

enhanced returns over cash balances.

During the period, GBP7.0m in Gilts matured and earned a yield

to maturity of 4.0% and GBP7.1m in UK Treasury Bills matured and

earned a yield to maturity of 4.2%. Post period end, the Company

invested further GBP6.0 million in short dated Gilts with an

annualised yield to maturity of 4.9% with maturity in October

2025.

Cash balances

Investment Investment Carrying Income Property type Investment

type value return / underlying notes

p.a. security

==================== ============ ========= ======== ================== ===========

Cash balance Cash GBP6.0m 1.5% ** 'On call' and n/a

* current accounts

==================== ============ ========= ======== ================== ===========

Morgan Stanley Short-term GBP6.0m 5.3% Money market n/a

Sterling Liquidity investment fund, daily

Fund liquidity

==================== ============ ========= ======== ================== ===========

* Group cash of GBP7.1m excluding cash held with the Hamburg holding company of GBP1.1m

** weighted average interest earned on call accounts

As at 30 September 2023, the Group had cash balances of GBP6.0

million, excluding cash held with the Hamburg holding company of

GBP1.1 million.

The Group's cash is held with established banks with strong

credit ratings.

Summary

ART has a diversified portfolio focussed on asset-backed lending

and property investments in Western Europe.

The Company is currently focussed on risk managing its loan

portfolio and extending its wider investment strategy to

opportunistically target investments in mezzanine and assets

offering inflation protection via index linked income adjustments

and investments that have potential for capital gains.

Brad Bauman and Gordon Smith

For and on behalf of the Inv estment Manager

23 November 2023

Principal risks and uncertainties

The principal risks and uncertainties facing the Group can be

outlined as follows:

-- Rental income, fair value of investment properties (directly

or indirectly held) and fair value of the Group's equity

investments are affected, together with other factors, by general

economic conditions and/or by the political and economic climate of

the jurisdictions in which the Group's investments and investment

properties are located.

-- The Group's loan investments are exposed to credit risk which

arise by the potential failure of the Group's counter parties to

discharge their obligations when falling due; this could reduce the

amount of future cash inflows from financial assets on hand at the

balance sheet date; the Group receives regular updates from the

relevant investment manager as to the performance of the underlying

investments and assesses their credit risk as a result.

-- The Russian invasion of Ukraine is also considered to be a

significant risk and uncertainty for the Group: this is discussed

on the first paragraph of the above going concern section.

The Board believes that the above principal risks and

uncertainties, which are discussed more extensively in the annual

report for the year ended 31 March 2023, would be equally

applicable to the remaining six month period of the current

financial year.

Statement of Directors' Responsibilities

The Directors confirm that to the best of their knowledge:

-- the condensed consolidated financial statements have been

prepared in accordance with IAS 34 'Interim Financial Reporting',

as adopted by the European Union; and

-- the half year report includes a fair review of the

information required by DTR 4.2.7R, being an indication of the

important events that have occurred during the first six months of

the financial year, and their impact on the half year report, and a

description of the principal risks and uncertainties for the

remaining six months of the financial year; and

-- the half year report includes a fair review of the

information required by DTR 4.2.8R, being the related parties

transactions that have taken place in the first six months of the

current financial year and that have materially affected the

financial position or the performance of the Group during that

period; and any changes in the related parties transactions

described in the last annual report that could have a material

effect on the financial position or performance of the enterprise

in the first six months of the current financial year.

The Directors of ART are listed below.

By order of the Board

William Simpson

Chairman

23 November 2023

Independent review report

To Alpha Real Trust Limited

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed consolidated set of

financial statements in the half-yearly financial report for the

six months ended 30 September 2023 is not prepared, in all material

respects, in accordance with International Accounting Standard 34,

as adopted by the European Union, and the Disclosure Guidance and

Transparency Rules of the United Kingdom's Financial Conduct

Authority.

We have been engaged by the company to review the condensed

consolidated set of financial statements in the half-yearly

financial report for the six months ended 30 September 2023 which

comprises the condensed consolidated statement of comprehensive

income, condensed consolidated balance sheet, condensed

consolidated cash flow statement, condensed consolidated statement

of changes in equity and related notes.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 2, the annual financial statements of the

group are prepared in accordance with International Financial

Reporting Standards ("IFRSs") as adopted by the European Union. The

condensed set of financial statements included in this half-yearly

financial report has been prepared in accordance with International

Accounting Standard 34, "Interim Financial Reporting".

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the group to cease to continue as a going concern.

Responsibilities of directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the Disclosure Guidance and

Transparency Rules of the United Kingdom's Financial Conduct

Authority.

In preparing the half-yearly financial report, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the company a conclusion on the condensed set of

financial statement in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority and for no other purpose. No person is

entitled to rely on this report unless such a person is a person

entitled to rely upon this report by virtue of and for the purpose

of our terms of engagement or has been expressly authorised to do

so by our prior written consent. Save as above, we do not accept

responsibility for this report to any other person or for any other

purpose and we hereby expressly disclaim any and all such

liability.

BDO Limited

Chartered Accountants

Place du Pré

Rue du Pré

St Peter Port

Guernsey

23 November 2023

Condensed consolidated statement of comprehensive income

For the six months ended For the six months ended

30 September 2023 30 September 2022

(unaudited) (unaudited)

---------------------------------------------------- ------------------------------- -------------------------------

Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Income

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Revenue 3 4,218 - 4,218 2,977 - 2,977

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Change in the revaluation of investment

properties 10 - (867) (867) - 143 143

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

(Losses)/gains on financial assets and

liabilities held at fair value through

profit or loss 5 (62) (48) (110) 272 (1,406) (1,134)

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Total income/(expense) 4,156 (915) 3,241 3,249 (1,263) 1,986

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Expenses

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Expected credit losses (277) (779) (1,056) - (608) (608)

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Property operating expenses (41) - (41) (41) - (41)

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Investment Manager's fee 21 (1,158) - (1,158) (1,189) - (1,189)

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Other administration costs (546) - (546) (476) - (476)

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Total operating expenses (2,022) (779) (2,801) (1,706) (608) (2,314)

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Operating profit/(loss) 2,134 (1,694) 440 1,543 (1,871) (328)

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Share of profit/(loss) of joint ventures

and associates 12 167 (120) 47 525 324 849

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Finance income 4 481 4 485 44 - 44

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Finance costs (102) - (102) (100) (66) (166)

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Profit/(loss) before taxation 2,680 (1,810) 870 2,012 (1,613) 399

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Taxation 6 (18) 23 5 (66) (112) (178)

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Profit/(loss) after taxation 2,662 (1,787) 875 1,946 (1,725) 221

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Other comprehensive income/(expense) for

the period

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Items that may be reclassified to profit

or loss in subsequent periods:

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Exchange differences arising on

translation of foreign operations - (443) (443) - 1,478 1,478

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Other comprehensive (expense)/income for

the period - (443) (443) - 1,478 1,478

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Total comprehensive income/ (expense) for

the period 2,662 (2,230) 432 1,946 (247) 1,699

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Earnings per ordinary share

(basic & diluted) 8 1.5p 0.4p

------------------------------------------- ------- --------- --------- --------- --------- --------- ---------

Adjusted earnings per ordinary

share (basic & diluted) 8 4.6p 3.3p

The total column of this statement represents the Group's

statement of comprehensive income , prepared in accordance with

IFRS. The revenue and capital columns are supplied as supplementary

information permitted under IFRS. All items in the above statement

derive from continuing operations.

The accompanying notes form an integral part of these financial

statements.

Condensed consolidated balance sheet

Notes 30 September 2023 31 March 2023

(unaudited) (audited)

GBP'000 GBP'000

------------------------------ ------- ------------------- ---------------

Non-current assets

------------------------------ ------- ------------------- ---------------

Investment property 10 27,506 23,496

------------------------------ ------- ------------------- ---------------

Investment in joint ventures

and associates 12 17,441 17,654

------------------------------ ------- ------------------- ---------------

Loans advanced 13 10,296 16,051

------------------------------ ------- ------------------- ---------------

55,243 57,201

------------------------------ ------- ------------------- ---------------

Current assets

------------------------------ ------- ------------------- ---------------

Investments held at fair

value 11 17,214 18,310

------------------------------ ------- ------------------- ---------------

Derivatives held at fair 243 -

value through profit or

loss

------------------------------ ------- ------------------- ---------------

Loans advanced 13 47,583 39,385

------------------------------ ------- ------------------- ---------------

Collateral deposit 14 1,131 1,143

------------------------------ ------- ------------------- ---------------

Trade and other receivables 15 471 414

------------------------------ ------- ------------------- ---------------

Cash and cash equivalents 16 13,092 18,455

------------------------------ ------- ------------------- ---------------

79,734 77,707

------------------------------ ------- ------------------- ---------------

Total assets 134,977 134,908

------------------------------ ------- ------------------- ---------------

Current liabilities

------------------------------ ------- ------------------- ---------------

Derivatives held at fair

value through profit or

loss - (171)

------------------------------ ------- ------------------- ---------------

Trade and other payables 17 (1,088) (986)

------------------------------ ------- ------------------- ---------------

Corporation tax (26) (34)

------------------------------ ------- ------------------- ---------------

Bank borrowings 18 (31) (30)

------------------------------ ------- ------------------- ---------------

Total current liabilities (1,145) (1,221)

------------------------------ ------- ------------------- ---------------

Total assets less current

liabilities 133,832 133,687

------------------------------ ------- ------------------- ---------------

Non-current liabilities

------------------------------ ------- ------------------- ---------------

Bank borrowings 18 (8,157) (8,271)

------------------------------ ------- ------------------- ---------------

Deferred tax 6 (321) (349)

------------------------------ ------- ------------------- ---------------

(8,478) (8,620)

------------------------------ ------- ------------------- ---------------

Total liabilities (9,623) (9,841)

------------------------------ ------- ------------------- ---------------

Net assets 125,354 125,067

------------------------------ ------- ------------------- ---------------

Equity

------------------------------ ------- ------------------- ---------------

Share capital 19 - -

------------------------------ ------- ------------------- ---------------

Special reserve 61,564 60,550

------------------------------ ------- ------------------- ---------------

Translation reserve 9 452

------------------------------ ------- ------------------- ---------------

Capital reserve 38,360 40,147

------------------------------ ------- ------------------- ---------------

Revenue reserve 25,421 23,918

------------------------------ ------- ------------------- ---------------

Total equity 125,354 125,067

------------------------------ ------- ------------------- ---------------

Net asset value per ordinary

share 9 214.3p 216.8p

The financial statements were approved by the Board of Directors

and authorised for issue on 23 November 2023. They were signed on

its behalf by William Simpson.

William Simpson

Director

The accompanying notes form an integral part of these financial

statements.

Condensed consolidated cash flow statement

For the six months For the six months

ended ended 30 September

30 September 2023 2022

(unaudited) GBP'000 (unaudited) GBP'000

-------------------------------------- --------------------- ---------------------

Operating activities

-------------------------------------- --------------------- ---------------------

Profit for the period after

taxation 875 221

-------------------------------------- --------------------- ---------------------

Adjustments for:

-------------------------------------- --------------------- ---------------------

Change in revaluation of investment

property 867 (143)

-------------------------------------- --------------------- ---------------------

Net losses on financial assets

and liabilities held at fair

value through profit or loss 110 1,134

-------------------------------------- --------------------- ---------------------

Taxation (5) 178

-------------------------------------- --------------------- ---------------------

Share of profit of joint ventures

and associates (47) (849)

-------------------------------------- --------------------- ---------------------

Interest receivable on loans

to third parties (3,398) (2,394)

-------------------------------------- --------------------- ---------------------

Expected credit losses 1,056 608

-------------------------------------- --------------------- ---------------------

Finance income (485) (44)

-------------------------------------- --------------------- ---------------------

Finance cost 102 166

-------------------------------------- --------------------- ---------------------

Operating cash flows before

movements in working capital (925) (1,123)

-------------------------------------- --------------------- ---------------------

Movements in working capital:

-------------------------------------- --------------------- ---------------------

Movement in trade and other

receivables (42) (123)

-------------------------------------- --------------------- ---------------------

Movement in trade and other

payables 93 (43)

-------------------------------------- --------------------- ---------------------

Cash flows used in operations (874) (1,289)

-------------------------------------- --------------------- ---------------------

Loan interest received 678 1,091

-------------------------------------- --------------------- ---------------------

Loans granted to third parties (9,739) (9,581)

-------------------------------------- --------------------- ---------------------

Loans repaid by third parties 8,710 10,359

-------------------------------------- --------------------- ---------------------

Cash returned from escrow for

loans granted post year end - 1,928

-------------------------------------- --------------------- ---------------------

Interest received 131 44

-------------------------------------- --------------------- ---------------------

Interest paid (93) (91)

-------------------------------------- --------------------- ---------------------

Tax paid (30) (29)

-------------------------------------- --------------------- ---------------------

Cash flows (used in)/generated

from operating activities (1,217) 2,432

-------------------------------------- --------------------- ---------------------

Investing activities

-------------------------------------- --------------------- ---------------------

Acquisition of investment property (5,118) (7,403)

-------------------------------------- --------------------- ---------------------

Investment in UK Treasury Bonds (13,140) -

and Bills

-------------------------------------- --------------------- ---------------------

Redemption of UK Treasury Bonds 14,130 -

and Bills

-------------------------------------- --------------------- ---------------------

Investment in Morgan Stanley (5,990) -

Sterling Liquidity Fund

-------------------------------------- --------------------- ---------------------

Redemption on investments - 5,348

-------------------------------------- --------------------- ---------------------

Capital return from joint venture

in arbitration - 5,868

-------------------------------------- --------------------- ---------------------

Dividend income from joint

ventures and associates - 411

-------------------------------------- --------------------- ---------------------

Dividend income from investments 187 178

-------------------------------------- --------------------- ---------------------

Income from UK Treasury Bonds 163 -

and Bills

-------------------------------------- --------------------- ---------------------

Dividend income from Morgan 33 -

Stanley Sterling Liquidity Fund

-------------------------------------- --------------------- ---------------------

Collateral deposit increase 12 (348)

-------------------------------------- --------------------- ---------------------

Cash flows (used in)/generated

from investing activities (9,723) 4,054

-------------------------------------- --------------------- ---------------------

Financing activities

-------------------------------------- --------------------- ---------------------

Share issue costs - (78)

-------------------------------------- --------------------- ---------------------

Share buyback - (9,553)

-------------------------------------- --------------------- ---------------------

Share buyback costs (39) (49)

-------------------------------------- --------------------- ---------------------

Cash paid on maturity of foreign (202) -

exchange forward

-------------------------------------- --------------------- ---------------------

Ordinary dividends paid (106) (250)

-------------------------------------- --------------------- ---------------------

Cash flows used in financing

activities (347) (9,930)

-------------------------------------- --------------------- ---------------------

Net decrease in cash and cash

equivalents (11,287) (3,444)

-------------------------------------- --------------------- ---------------------

Cash and cash equivalents at

beginning of period 18,455 41,250

-------------------------------------- --------------------- ---------------------

Exchange translation movement (66) 128

-------------------------------------- --------------------- ---------------------

Cash and cash equivalents at

end of period 7,102 37,934

The accompanying notes form an integral part of these financial

statements.

Condensed consolidated statement of changes in equity

For the six months ended Notes Special Translation Capital Revenue Total

30 September 2023 reserve reserve reserve reserve equity

(unaudited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2023 60,550 452 40,147 23,918 125,067

------ --------- ------------ --------- --------- ---------

Total comprehensive income/(expense)

for the period

------ --------- ------------ --------- --------- ---------

Loss/(profit) for the period - - (1,787) 2,662 875

------ --------- ------------ --------- --------- ---------

Other comprehensive expense

for the period - (443) - - (443)

------ --------- ------------ --------- --------- ---------

Total comprehensive (expense)/income

for the period - (443) (1,787) 2,662 432

------ --------- ------------ --------- --------- ---------

Transactions with owners

------ --------- ------------ --------- --------- ---------

Cash dividends 7 - - - (106) (106)

------ --------- ------------ --------- --------- ---------

Scrip dividends 7 1,053 - - (1,053) -

------ --------- ------------ --------- --------- ---------