Fiinu PLC Operational Update (7840X)

28 Aprile 2023 - 8:00AM

UK Regulatory

TIDMBANK

RNS Number : 7840X

Fiinu PLC

28 April 2023

28 April 2023

Fiinu Plc

("Fiinu", the "Company" or the "Group")

Operational Update

Fiinu, a fintech company including the fully owned Fiinu Bank

Limited, creator of the Plugin Overdraft(R), today provides an

operational update.

Further to the announcement of 15 March 2023 in regard to the

issuance of equity it was noted that the Company had future funding

requirements necessary for Fiinu Bank Limited's anticipated exit

from mobilisation period and the commencement of operating without

restrictions. Continuing challenging capital market conditions have

impeded this fundraising process and whilst good progress has been

made with regard to our operational readiness for full banking

activity, the lack of full funding commitment at this stage has

slowed the necessary regulatory application processes such that the

Company together with Fiinu Bank Limited has determined a

preferential course of action is to make an application to withdraw

its licence aiming to re-apply after a short period of 2 - 3

months. This application has now been submitted to the PRA and FCA.

It is expected that the PRA and FCA will require a short period of

time to confirm their acceptance of the restricted licence being

withdrawn and the Company will provide further updates on

progress.

This action will allow the Company to focus on securing its exit

funding requirement which is estimated to be in the range of GBP34

- GBP42 million. Once this funding has been secured it is intended

for the application process to be resumed and completed promptly,

again subject to the necessary PRA and FCA approval.

Chris Sweeney, CEO of Fiinu, said :

"Since the update provided on 15 March excellent progress has

continued on our operational readiness, especially given the

completion of testing of our technology solution with the release

of the phone-based App to a limited internal group for trials. With

the exception of friends and family testing, which will now take

place once the licence application process recommences, we have

largely completed all requirements set for us by the PRA and FCA in

order to exit mobilisation. Evidence of this has been submitted to

the regulators for their review. We look forward to working closely

with the PRA, FCA and future strategic investors with the aim of

commencing full banking activity without restrictions."

Market Abuse Regulation ('MAR') Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of the

Market Abuse Regulation (EU) No 596/2014 ('MAR'), which is part of

UK law by virtue of the European Union (Withdrawal) Act 2018, until

the release of this announcement

ENDS

Enquiries:

Fiinu plc via Brazil London

Chris Sweeney, Chief Executive Officer (press office for

Philip Tansey, Chief Financial Officer Fiinu)

www.fiinu.com

SPARK Advisory Partners Limited (Nomad) Tel: +44 (0) 203 368

Mark Brady / Adam Dawes 3550

SP Angel Corporate Finance LLP (Joint Tel: +44 (0) 207 470

Broker) 0470

Matthew Johnson / Charlie Bouverat

(Corporate Finance)

Abigail Wayne / Rob Rees (Corporate

Broking)

Panmure Gordon (UK) Limited (Joint Tel: +44 (0)207 886

Broker) 2500

Stephen Jones / Atholl Tweedie (Corporate

Finance)

Tom Scrivens / Hugh Rich (Corporate

Broking)

Brazil London (press office for Fiinu) Tel: +44 (0) 207 785

Joshua Van Raalte / Christine Webb 7383

/ Jamie Lester Email: fiinu@agencybrazil.com

About Fiinu

Fiinu, founded in 2017, is a fintech group, including Fiinu

Bank({1}) , which is authorised by the Prudential Regulatory

Authority([1]) . Fiinu's Plugin Overdraft(R) is an unbundled

overdraft solution which allows customers to have an overdraft with

Fiinu Bank without changing their existing bank. The underlying

Bank Independent Overdraft(R) technology platform is bank agnostic,

allowing Fiinu Bank to serve all other banks' customers. Open

Banking allows Fiinu's Plugin Overdraft(R) to attach ("plugin") to

the customer's primary bank account, no matter which bank they may

use. Fiinu's vision is built around Open Banking, and it believes

that it increases competition and innovation in UK banking.

For more information, please visit

www.fiinu.com .

({1}) Fiinu Bank Limited obtained its UK deposit-taking banking

licence with restrictions from the Prudential Regulation Authority

(PRA) and with the consent of the Financial Conduct Authority (FCA)

in July 2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDZGZDLNGGFZM

(END) Dow Jones Newswires

April 28, 2023 02:00 ET (06:00 GMT)

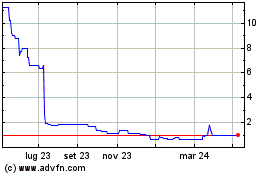

Grafico Azioni Fiinu (LSE:BANK)

Storico

Da Nov 2024 a Dic 2024

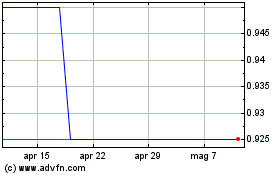

Grafico Azioni Fiinu (LSE:BANK)

Storico

Da Dic 2023 a Dic 2024