TIDMBHL

RNS Number : 9714K

Bradda Head Lithium Ltd

31 August 2023

31 August 2023

Bradda Head Lithium Ltd

("Bradda Head", "Bradda", or the "Company")

Unaudited Interim Results for the three months ended 31 May

2023

Bradda Head Lithium Ltd (AIM: BHL), the North America-focused

lithium development group, is pleased to announce that it has today

published its unaudited financial results for the three months

ended 31 May 2023, and the Management's Discussion and Analysis for

the same period.

Both of the above have been posted on the Company's website

www.braddaheadltd.com and are also available on SEDARplus (

www.sedarplus.ca/landingpage ).

Financial and operational highlights for the first quarter

-- the Company commenced sonic drilling at the Basin project on

16 March 2023, with up to 25 holes planned at Basin East Extension

("BEE"), Basin East ("BE") and Basin North ("BN");

-- Highlights from the first set of assay results received during May 2023 includes:

- 63.12m @ 954ppm Li in BES-23-03 with 24.32m @ 1,327ppm

- 66.92m @ 1,077ppm Li in BES-23-04, with 18.30m @ 1,602 ppm

- 63.71m @ 944ppm Li in BES-23-05, with 32.93m @ 1,029ppm

- The highest-grade assay received to date of 2,676ppm Li over

1.8m was recorded in hole BES-23-05 at a depth of 109.32m.

-- Concluded a claims dispute mediation with Arizona Lithium

Limited ("AZL"). Following the settlement, AZL will transfer 66

federal lode unpatented mining claims to Bradda Head, and Bradda

Head will transfer 55 federal lode unpatented mining claims to AZL,

increasing the total land package in the Wikieup area to

approximately 46km(2) . The Company expects the transfer of title

to be completed during H2 2023;

-- Completed a maiden drill programme at the Company's San

Domingo pegmatite project on 10 March 2023. Highlights from second

and third/final set of assays include:

- Central Claims

-- 9.54m @ 1.85% Li(2) O, 3.02m @1.49% Li(2) O, and 2.90m @ 3.03% Li(2) O in SD-DH23-037

-- 7.35m @ 0.68% Li(2) O, 4.79m @ 0.87% Li(2) O, 3.20m @ 1.22%

Li(2) O, and 3.21m @ 0.75% Li(2) O in SD-DH23-036

-- 9.85m @ 0.86% Li(2) O in SD-DH23-034

-- 4.02m @ 1.27% Li(2) O in SD-DH23-035

-- 5.94m @ 1.22% Li(2) O in SD-DH23-046

-- 4.72m @ 0.67% Li2O in SD-DH23-038a

- Northern Claims

-- 3.75m @ 2.37% Li2O, 0.85m @ 2.44% Li2O, 1.10m @ 0.82% Li2O,

and 0.67m @ 1.77% Li2O in SD-DH22-025

-- 6.52m @ 1.24% Li2O in SD-DH23-041

-- 2.74m @ 2.12% Li2O in SD-DH23-042

-- 1.77m @ 1.10% Li2O in SD-DH23-040

-- The Company strengthened its land package at the San Domingo

project by acquiring a 100% interest in three inlier lode claims in

the middle of its Central San Domingo claim block, for a total

increase in land area owned by 60 acres;

-- Appointed Panmure Gordon (UK) as joint broker, with Panmure

having a wealth of expertise in the mining and the lithium

space.

Ian Stalker, Chairman of Bradda Head, commented:

"The first quarter of the financial year has been very busy for

the Company. Drilling finished at our San Domingo pegmatite asset,

with promising assay results received which have been used to

design a second drill programme in the district, which commenced

during Q2 2023. We also commenced our fourth drill programme at our

Basin lithium in clay project during March 2023, with very

promising assay results received to date, which include our

highest-grade assay received to date. Post quarter end, drilling at

Basin finished with the results being fed into an upgraded Mineral

Resource Estimate which is anticipated in mid-September 2023.

The pace of development will continue through the the second

half of the year, and we look forward to updating our shareholders

as we receive the exploration results."

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU No.596/2014) AS IT FORMS PART OF

UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018. UPONTHE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY

INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOWCONSIDERED TO BE

IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE

IN POSSESSION OF INSIDEINFORMATION.

For further information please visit the Company's website:

www.braddaheadltd.com

For further information, please contact:

Bradda Head Lithium Limited +44 (0) 1624 639 396

Ian Stalker, Chairman

Denham Eke, Finance Director

Beaumont Cornish (Nomad)

James Biddle/Roland Cornish +44 20 7628 3396

Panmure Gordon (Joint Broker) +44 20 7886 2500

John Prior

Hugh Rich

Shard Capital (Joint Broker) +44 207 186 9927

Damon Heath

Isabella Pierre

Red Cloud (North American Broker) +1 416 803 3562

Joe Fars

Tavistock (PR) + 44 20 7920 3150

Nick Elwes braddahead@tavistock.co.uk

Adam Baynes

About Bradda Head Lithium Ltd.

Bradda Head Lithium Ltd. is a North America-focused lithium

development group. The Company currently has interests in a variety

of projects, the most advanced of which are in Central and Western

Arizona: The Basin Project (Basin East Project, and the Basin West

Project) and the Wikieup Project.

The Basin East Project has an Indicated Mineral Resource of 21.2

Mt at an average grade of 891 ppm Li and 3.5% K for a total of 100

kt LCE and an Inferred Mineral Resource of 73.3 Mt at an average

grade of 694 ppm Li and 3.2% K for a total of 271 kt LCE. In the

rest of the Basin Project SRK has estimated an Exploration Target

of between 300 to 1,300 Mt of material grading between 600 to 850

ppm Li which is equivalent to a range of between 1 to 6 Mt LCE. The

Group intends to continue to develop its three phase one projects

in Arizona, whilst endeavouring to unlock value at its other

prospective pegmatite and brine assets in Arizona, Nevada, and

Pennsylvania. All of Bradda Head's licences are held on a 100%

equity basis and are in close proximity to the required

infrastructure.

The Mineral Resource statement for the Basin Project was

authored by Martin Pittuck, CEng, MIMMM, FGS who works for SRK

Consulting (UK) Ltd, an independent mining consultancy. Mr. Pittuck

has over 25 years' experience undertaking and reviewing Mineral

Resource estimates and has worked on lithium clay estimates for

over 5 years. Mr. Pittuck consents to the inclusion of the

technical information in this press release and context in which

they appear. Reference is made to the report entitled "Independent

technical report on the Basin and Wikieup Lithium clay projects,

Arizona, USA" dated October 18, 2022 with an effective date of June

10, 2022 was prepared by Martin Pittuck, CEng, MIMMM, FGS, and

Kirsty Reynolds MSci, PhD, FGS and reviewed by Nick Fox MSc, ACA,

MIMMM. The Report is available for review on SEDARplus (

www.sedarplus.ca/landingpage ) and the Company's website

www.braddaheadltd.com .

Bradda Head is quoted on the AIM of the London Stock Exchange

with the ticker of BHL, on the TSX Ventures exchange with a ticker

of BHLI, and on the US OTCQB market with a ticker of BHLIF.

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release. This News Release includes certain "forward-looking

statements" which are not comprised of historical facts.

Forward-looking statements include estimates and statements that

describe the Company's future plans, objectives or goals, including

words to the effect that the Company or management expects a stated

condition or result to occur. Forward-looking statements may be

identified by such terms as "believes", "anticipates", "intends

to", "expects", "estimates", "may", "could", "would", "will", or

"plan". Since forward-looking statements are based on assumptions

and address future events and conditions, by their very nature they

involve inherent risks and uncertainties. Although these statements

are based on information currently available to the Company, the

Company provides no assurance that actual results will meet

management's expectations. Risks, uncertainties and other factors

involved with forward-looking information could cause actual

events, results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking

information. Forward looking information in this news release

includes, but is not limited to, following: The Company's

objectives, goals or future plans. Factors that could cause actual

results to differ materially from such forward-looking information

include, but are not limited to: failure to identify mineral

resources; failure to convert estimated mineral resources to

reserves; delays in obtaining or failures to obtain required

regulatory, governmental, environmental or other project approvals;

political risks; future operating and capital costs, timelines,

permit timelines, the market and future price of and demand for

lithium, and the ongoing ability to work cooperatively with

stakeholders, including the local levels of government;

uncertainties relating to the availability and costs of financing

needed in the future; changes in equity markets, inflation, changes

in exchange rates, fluctuations in commodity prices; delays in the

development of projects, capital and operating costs varying

significantly from estimates; an inability to predict and

counteract the effects of COVID-19 on the business of the Company,

including but not limited to the effects of COVID-19 on the price

of commodities, capital market conditions, restriction on labour

and international travel and supply chains; and the other risks

involved in the mineral exploration and development industry, and

those risks set out in the Company's public documents filed on

SEDAR. Although the Company believes that the assumptions and

factors used in preparing the forward-looking information in

this news release are reasonable, undue reliance should not be

placed on such information, which only applies as of the date of

this news release, and no assurance can be given that such events

will occur in the disclosed time frames or at all. The Company

disclaims any intention or obligation to update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise, other than as required by

law.

Bradda Head Lithium Limited

Management discussion and analysis for the three-month period

ended May 31, 2023

This management's discussion and analysis ("MD&A") reports

on the operating results and financial condition of the Company for

the three-month ended May 31, 2023, and is prepared as of August

31, 2023. The MD&A should be read in conjunction with Bradda

Head Lithium Limited's (the "Company" or "Bradda Head") audited

consolidated financial statements for the year ended February 28,

2023, and the notes thereto which were prepared in accordance with

International Financial Reporting Standards ("IFRS").

All dollar amounts referred to in this MD&A are expressed in

United States dollars except where indicated otherwise.

(a) Overview

Bradda Head Lithium Limited was incorporated on October 28,

2009, in the British Virgin Islands under the British Virgin

Islands Companies Act with registered number 1553975 with the name

Copper Development Corporation. On October 5, 2015, the Company

changed its name from Copper Development Corporation to Life

Science Developments Limited, and on April 18, 2018, the Company

changed its name to Bradda Head Holdings Limited. On September 15,

2021, the Company changed its name to Bradda Head Lithium

Limited.

The Company has one business segment, being mineral exploration.

T he Company is focused on appraising and developing lithium mining

projects within North America and currently has interests in a

variety of projects in the United States.

Corporate and Exploration Highlights

Exploration Highlights

Set forth in this section is a description of the Company's

material mineral projects. All scientific and technical data

contained in this MD&A has been reviewed and approved by Joey

Wilkins, B.Sc., P.Geo., who is Chief Operating Officer at Bradda

Head and a Qualified Person as defined by National Instrument

43-101 - Standards of Disclosure for Mineral Projects ("NI

43-101").

Arizona Sedimentary Hosted Lithium Projects

Basin Project

On 16 March 2023, the Company commenced sonic drilling at the

Basin project. As part of the 2023 Basin drill programme, the

Company expects to drill up to 25 holes in the coming months at

Basin East Extension ("BEE"), Basin East ("BE") and Basin North

("BN"). The goal of the 2023 Basin drill programme is to increase

coverage over as much of the Project's 17km(2) area as possible. To

date, approximately 1.4km(2) of the area has been drilled, leading

to a Mineral Resource of 371kt of LCE, as noted below.

During the drilling programme the Company will continue to

guarantee that all efforts are focused on ensuring that work is

carried out in these areas with as little disturbance as possible.

Bradda Head is using sonic drilling, which is more environmentally

sensitive as it uses very little water compared to diamond core or

reverse circulation drilling.

During May 2023, the assay results from the first five drill

holes were received. This set of results delivered the highest

grade assays from all four drill programmes to date, and confirms

that lithium bearing clay continues and thickens to the west,

northwest and north into its BEE lease.

Highlights from the first set of assay results includes:

-- 63.12m @ 954ppm Li in BES-23-03 with 24.32m @ 1,327ppm

-- 66.92m @ 1,077ppm Li in BES-23-04, with 18.30m @ 1,602 ppm

-- 63.71m @ 944ppm Li in BES-23-05, with 32.93m @ 1,029ppm

The highest-grade assay received to date of 2,676ppm Li over

1.8m was recorded in hole BES-23-05 at a depth of 109.32m.

The first four drill holes (south of the creek) located in BEE

and BE have continued to demonstrate that the upper clay unit is

significantly higher grade than the lower clay unit, and thickens

to the North and North-west direction into BEE. Drill holes 05, 06

and 07 (the first on the north side of the Creek) confirm this,

have a similar upper clay thickness to drill holes 03 and 04, and

also demonstrate the upper clay thickens to the north, northwest,

and west as well towards Basin West ("BW"). Drill hole 07, on the

western border of BEE and BW, confirms the upper clay unit

continues to thicken to the west, which is very positive for

resource expansion potential into BW. The total upper clay unit is

78m, 67m, 69m, and 79m, thick for an average of 73m, in drill holes

03, 04, 05, and 06 respectively. To put that in context, the

average thickness of the upper clay unit is 34m in all the previous

34 holes that intercepted upper clay in the last 3 drill programmes

(2018, 2021 and 2022).

The Company expects to provide the geological results of the

remaining drill holes and assays when received, and a revised

resource estimate will follow once the drill programme is

completed.

Positive progress is also being made on the metallurgical

testing side of our lithium-bearing clays at Basin. New and

existing technologies are being trialled, which may qualify for

funding grants under the Biden administration's recent clean energy

initiatives.

Basin East 2023 Mineral Resource Estimate

Classification Domain Tonnes Mean Grade Contained Metal

Mt Li (ppm) K (%) LCE (kt) K (Mt)

------- --------- ------ --------- -------

Indicated Upper Clay 16.0 738 3.6 63 0.6

--------------- ------- --------- ------ --------- -------

Upper Clay HG 5.2 1,354 3.0 38 0.2

-------------------------------- ------- --------- ------ --------- -------

Lower Clay - - - - -

--------------- ------- --------- ------ --------- -------

Sub Total 21.2 891 3.5 100 0.7

-------------------------------- ------- --------- ------ --------- -------

Inferred Upper Clay 31.7 767 3.6 129 1.2

--------------- ------- --------- ------ --------- -------

Upper Clay HG 2.3 1,448 3.5 18 0.1

-------------------------------- ------- --------- ------ --------- -------

Lower Clay 39.3 592 2.9 124 1.1

-------------------------------- ------- --------- ------ --------- -------

Sub Total 73.3 694 3.2 271 2.4

-------------------------------- ------- --------- ------ --------- -------

Total 94.5 738 3.3 371 3.1

------- --------- ------ --------- -------

- Mineral Resource statement has an effective date of 13 October 2022.

- A Mineral Resource is reported using a cut-off grade of 300

ppm Li and constraining the model to an optimised open pit shell,

which was generated using the following assumptions: lithium

carbonate metal prices of 18,000 USD/tLCE; State of Arizona royalty

(selling cost) of 6%; operating costs of 5,000 USD/ tLCE or 27 USD/

tore; Li recovery of 75%; mining dilution and recovery of 5% and

95%; and pit slope angle of 45deg.

- Tonnages are reported in metric units.

- Rounding as required by reporting guidelines may result in

apparent summation differences between tonnes, grade and contained

metal content.

- Conversion factor of Li metal to lithium carbonate equivalent (LCE) = 5.323

Wikieup Project

On March 1, 2023, the Company announced the conclusion of a

claims dispute mediation with Arizona Lithium Limited ("AZL"). The

mediation process was initiated by Bradda Head during 2021 (as

disclosed in the AIM Admission document and the Company's Listing

Application for purposes of its listing on the TSX Venture

Exchange). A final binding confidential settlement agreement and

mutual release has been executed. Bradda Head and AZL reached a

mutually agreeable claim exchange, allowing both parties to proceed

with the development of each of their respective lithium projects

in the area.

Following the settlement, AZL will transfer 66 federal lode

unpatented mining claims to Bradda Head, and Bradda Head will

transfer 55 federal lode unpatented mining claims to AZL. The

transfer of the 55 claims to AZL will not have any material effect

on the development of the Company's Wikieup lithium project, with

the Company holding a total land package in Wikieup area of

approximately 46km(2) . As of May 31, 2023, the process of

transfering the claim ownership is still in progress.

The updated claims map can be found on the Company website here:

https://www.braddaheadltd.com/media

Arizona Pegmatite District

San Domingo Project

The second and third (being the final) assay results were

received during March and May 2023 from the maiden drill programme,

which was completed on March 10, 2023, at the Company's San Domingo

pegmatite project. F urther significant intercepts of high grade

lithium bearing minerals have been identified at multiple locations

from the second set of assay results. Lithium bearing minerals

(spodumene and some lepidolite) have been identified in c.60% of

the total holes completed, and importantly the programme has only

tested just over 1% of the 23km(2) that Bradda Head holds at the

San Domingo project.

Out of the planned 7,000m, 7,300m (47 holes completed) have been

drilled with positive results demonstrating high-grade

intersections.

Highlights from second and third/final set of assays

include:

Central Claims

-- 9.54m @ 1.85% Li (2) O, 3.02m @1.49% Li (2) O, and 2.90m @ 3.03% Li (2) O in SD-DH23-037

-- 7.35m @ 0.68% Li (2) O, 4.79m @ 0.87% Li (2) O, 3.20m @ 1.22%

Li (2) O, and 3.21m @ 0.75% Li (2) O in SD-DH23-036

-- 9.85m @ 0.86% Li (2) O in SD-DH23-034

-- 4.02m @ 1.27% Li (2) O in SD-DH23-035

-- 5.94m @ 1.22% Li (2) O in SD-DH23-046

-- 4.72m @ 0.67% Li2O in SD-DH23-038a

Northern Claims

-- 3.75m @ 2.37% Li2O, 0.85m @ 2.44% Li2O, 1.10m @ 0.82% Li2O,

and 0.67m @ 1.77% Li2O in SD-DH22-025

-- 6.52m @ 1.24% Li2O in SD-DH23-041

-- 2.74m @ 2.12% Li2O in SD-DH23-042

-- 1.77m @ 1.10% Li2O in SD-DH23-040

Large spodumene crystals with scattered lepidolite are observed

in all six holes drilled on the Jumbo target. Results from Jumbo

include 9.54m @ 1.85% Li (2) O in SD-DH23-037 and 4.02m @ 1.27% Li

(2) O in SD-DH23-035, both at shallow depths.

Based on the success of Phase 1 at the Northern Claim block, as

detailed above, Phase 2 commenced at the Central Claim block, which

included a detailed soil survey over the 23km(2) San Domingo land

package. The wider soil survey programme was completed in late

February 2023. The soil sampling assay results received during May

2023 are very promising, showing priority targets along the

complete 9km mineralised trend. Bradda Head's geologists have begun

ground-truthing the identified soil anomalies, finding new

spodumene bearing outcrops not previously recorded, and further

strengthening the district scale potential at San Domingo.

In order to further strengthen the land package held at the San

Domingo project, the Company acquired 100% of three inlier lode

claims in the middle of its Central San Domingo claim block, for a

total increase in land area owned by 60 acres. No royalties are

associated with the lode claims or any of Bradda's San Domingo

claims and leases.

The lode claim owners granted written permission for Bradda Head

to drill on their claims prior to acquisition, upon which the final

hole, SD-DH23-046, was drilled into a pegmatite (Lower Jumbo

Target) and encountered abundant visible spodumene, with assays

pending.

The Lower Jumbo mine (which is located on the border of one of

the inlier lode claims) has a 1.5m long spodumene cast in outcrop

and historic mining that reportedly produced c.155 tonnes at a

grade of 5.3% Li(2) O in the 1950's. The acquisition of the inlier

claims allows Bradda Head to fully explore the whole 9km trend

without encumbrance.

Nevada Lithium Brine Projects

Wilson Project

A gravity survey was undertaken over the project with lines run

East-West. The data and depth of basin is consistent with the MT

(magnetotellurics). A decision to drill for brine mineralization is

pending.

Eureka Project

No significant work has been undertaken on this project during

the 3-month period.

Corporate Highlights

On April 26, 2023, the Company announced the appointment of

Panmure Gordon (UK) as joint broker. Panmure have a wealth of

expertise in mining and the lithium space, and the Company looks

forward to working with them as we progress our work programmes

across our portfolio of assets.

Issuance of Stock Options and director share dealings

On April 6, 2023, the Company announced that it awarded a total

of 4,800,000 options to acquire ordinary shares (the "Options") at

an exercise price of GBP0.06 to management and certain Board

members. Options for management and directors, are subject to the

following conditions:

- Options vest immediately;

- The options have no performance or non-performance conditions attached to them;

- Are exercisable for a period of five years from date of issue; and

- The options issued to each participant should lapse upon any

participant no longer being an employee or connected person

remunerated by the Company.

Directors included in the award are detailed in the table

below:

Director Total options Total options Total shares Total diluted

awarded held at May held at May percentage holding

31, 2023 31, 2023 at May 31, 2023

Ian Stalker 1,000,000 18,250,000 3,870,140 5.66%

-------------- -------------- ------------- --------------------

Charlies

FitzRoy 1,000,000 11,000,000 13,265 2.82%

-------------- -------------- ------------- --------------------

Joey Wilkins 1,500,000 1,500,000 - 0.38%

-------------- -------------- ------------- --------------------

Piotr Schabik 250,000 1,000,000 - 0.26%

-------------- -------------- ------------- --------------------

Total 3,750,000 31,750,000 3,883,765 9.12%

-------------- -------------- ------------- --------------------

On April 14, 2023, James Mellon, a director and shareholder of

the Company, acquired 8,000,000 ordinary shares on the open market.

The shares were acquired by Galloway Limited, which is indirectly

wholly owned by James Mellon and of which Denham Eke is a

director.

Director Holding of Number of Number of Total diluted

Existing Ordinary Shares Purchased Ordinary Shares percentage holding

Shares held following at May 31, 2023

Purchase

James Mellon 65,097,004 8,000,000 73,097,004 18.71%

------------------- ------------------ ----------------- --------------------

(b) Selected Financial Information

The following table sets forth selected financial information

with respect to the Company for the 3-month period ended May 31,

2023 and the year ended February 28, 2023. The selected financial

information has been derived from the audited financial statements

for the period indicated. The following should be read in

conjunction with the said financial statements and related notes

that are available on the Company's website -

www.braddaheadltd.com.

The annual financial statements and interim financial statements

are presented in US dollars and are prepared in accordance with

IFRS, See "Summary Financial Data" and "Currency Information".

Period ended May 31, 2023 Year ended February 28, 2023

(Audited) (Audited)

(US$) (US$)

-------------------------- -----------------------------

Statement of Operations:

-------------------------- -----------------------------

Total Operating Expenses (net of other income) (1,143,294) (3,899,858)

-------------------------- -----------------------------

Net Finance income 59,102 12,270

-------------------------- -----------------------------

Net Loss (1,084,192) (3,887,588)

-------------------------- -----------------------------

Loss per Share (cents) (0.278) (1.018)

-------------------------- -----------------------------

Balance Sheet Data:

-------------------------- -----------------------------

Cash & cash equivalents, including cash deposits 4,998,440 7,746,519

-------------------------- -----------------------------

Total Assets 16,630,429 18,198,559

-------------------------- -----------------------------

Total Liabilities 549,059 1,213,619

-------------------------- -----------------------------

Accumulated Deficit (14,535,003) (13,631,433)

-------------------------- -----------------------------

Total Shareholder's Equity 16,081,370 16,984,940

-------------------------- -----------------------------

MANAGEMENT DISCUSSION AND ANALYSIS: QUARTERED MAY 31, 2023

(c) Introduction

(d) This interim Management Discussion and Analysis (the "

interim MD&A ") should be read in conjunction with the audited

financial statements of the Company for the year ended February 28,

2023, and related notes. This MD&A is made as of August 31,

2023.

(e) Results of Operations for the three-months ended May 31, 2023

The Company's net loss after tax for the three-month period to

May 31, 2023 was US$ 1,084,192, compared to a profit of US$ 120,089

for the comparative period ended May 31, 2022. The major expenses

for the three-month period ended May 31, 2023 were operational

expenses incurred on the Company's exploration projects, and are

broken down in the respective projects as follows:

Project Expensed Exploration Expenditure

Three-Month Period Ended May 31, 2023 Three-Month Period Ended May 31, 2022

(Unaudited) (Unaudited)

US$ US$

-------------------------------------- --------------------------------------

Basin Project 249,399 367,757

-------------------------------------- --------------------------------------

San Domingo Project 286,782 56,758

-------------------------------------- --------------------------------------

Wikieup Project 12,274 65,542

-------------------------------------- --------------------------------------

Other projects 3,413 75,769

-------------------------------------- --------------------------------------

TOTAL 551,868 565,826

-------------------------------------- --------------------------------------

During this time period, the Company incurred and capitalised

exploration expenditures of US$ 1,228,739, compared to US$ 607,185

for the comparative three-month period to May 31, 2022.

The capitalied exploration costs for the three-month period

ended May 31, 2023 have been allocated amongst the Company's

exploration projects in approximately the following amounts:

Project Capitalised Capitalised Capitalised Capitalised

exploration costs expenditures for exploration costs expenditires for

licences and permits licences and permits

Three-Month Period Three-Month Period Three-Month Period Three-Month Period

Ended May 31, 2023 Ended May 31, 2023 Ended May 31, 2022 Ended May 31, 2022

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

US$ US$ US$ US$

---------------------- ---------------------- ----------------------- ----------------------

Basin Project 421,013 - 187,714 9,740

---------------------- ---------------------- ----------------------- ----------------------

San Domingo Project 527,432 250,000 42,130 13,062

---------------------- ---------------------- ----------------------- ----------------------

Wikieup Project - - 69,722 -

---------------------- ---------------------- ----------------------- ----------------------

Other Project - 30,294 13,195 271,622

---------------------- ---------------------- ----------------------- ----------------------

TOTAL 948,445 280,294 312,761 294,424

---------------------- ---------------------- ----------------------- ----------------------

The exploration expenditures have been primarily costs

associated with drilling, assaying, resource and mining

consultants, metallurgical testing, environmental studies, project

team fees, acquisition of new leases, and annual renewal of

existing leases.

General and administrative expenses for the three-month period

to May 31, 2023 totalled US$ 1,258,841, compared to US$ 1,205,529

for the comparative three-month period to May 31, 2022. General and

administrative expenses are broken down as follows:

Project General and administrative expenditures

Three-Month Period Ended May 31, 2023 Three-Month Period Ended May 31, 2022

(Unaudited) (Unaudited)

US$ US$

-------------------------------------- --------------------------------------

Auditors' fees 19,600 81,841

-------------------------------------- --------------------------------------

Directors and management fees and

salaries 137,541 132,674

-------------------------------------- --------------------------------------

Legal and accounting 83,613 100,306

-------------------------------------- --------------------------------------

Contractor costs 551,868 565,826

-------------------------------------- --------------------------------------

Professional and marketing costs 204,203 307,328

-------------------------------------- --------------------------------------

Other administrative costs 262,016 17,554

-------------------------------------- --------------------------------------

TOTAL 1,258,841 1,205,529

-------------------------------------- --------------------------------------

During the three-month period to May 31, 2023, there have been

no changes in financial performance or other elements that relate

to non-core business activities and operations.

(f) Cash flows

During the three-month period ended May 31, 2023, the Company

had net cash outflows of US$ 6,790,136, compared to inflows of US$

9,154,462 during the comparative three-month period to May 31,

2022. Net cash outflows for the current 3-month period ended May

31, 2023, include placing cash amounts on short term deposits,

totalling US$ 3,905,582. The cashflows for the two periods are

shown below:

Three-Month Period Ended May 31, 2023 Three-Month Period Ended May 31, 2022

(Unaudited) (Unaudited)

US$ US$

Statement of cashflows

-------------------------------------- --------------------------------------

Cash flows from operating activities (1,581,692) (1,935,866)

-------------------------------------- --------------------------------------

Cash flows from investing activities (1,225,489) (665,856)

-------------------------------------- --------------------------------------

Cash flows from financing activities

* (3,846,480) 11,756,184

-------------------------------------- --------------------------------------

Net cash flows during the period (6,653,661) 9,154,462

-------------------------------------- --------------------------------------

Cash balances at beginning of the

period 7,746,519 7,327,303

-------------------------------------- --------------------------------------

Effect of foreign exchange on cash

balances - (316,171)

-------------------------------------- --------------------------------------

Cash balances at the end of the

period 1,092,858 16,165,594

-------------------------------------- --------------------------------------

* includes US$ 3,905,582 placed on short term deposit.

(g) Liquidity and Capital Resources

As at May 31, 2023, the Company had cash and cash equivalents

(including short term cash deposits) of US$ 4,998,440, and a

working capital surplus of US$ 5,003,874. As of February 28, 2023,

the Company had cash and cash equivalents of US$ 7,746,519, and a

working capital surplus of US$ 7,135,119.

(h) Outstanding Share Data

As of May 31, 2023, the following securities were

outstanding:

Shares 390,609,439

Warrants 81,698,305

------------

Stock options 37,831,304

------------

Fully diluted shares outstanding 510,139,048

------------

The Company's objectives when managing capital are to safeguard

its ability to continue as a going concern, so that it can continue

to provide returns for shareholders, benefits for other

stakeholders and to maintain an optimal capital structure to reduce

the cost of capital.

The capital structure of the Company includes cash and cash

equivalents, equity attributable to equity holders comprised of

contributed equity, reserves and accumulated losses. In order to

maintain or adjust the capital structure, the Company may issue new

shares, sell assets or adjust the level of activities undertaken by

the Company.

The Company monitors capital based on cash flow requirements for

operational, exploration and evaluation expenditures. The Company

has no debt or other borrowings as at the date of this Application.

The Company will continue to use capital market issuances to

satisfy anticipated funding requirements.

The availability of equity capital, and the price at which

additional equity could be issued, is dependent upon the success of

the Company's exploration activities, and upon the state of the

capital markets generally. Additional financing may not be

available on terms favourable to the Company or at all. If the

Company does not receive future financing, it may not be possible

for the Company to advance the exploration and development of its

mineral exploration properties. If the Company is not able to fund

these minimum expenditures, it may not be able to maintain part or

all of its mineral exploration property interests. See "Risk

Factors".

(i) Off-Balance Sheet Arrangements

The Company does not have any off-balance sheet

arrangements.

(j) Transactions with Related Parties

The Company has conducted transactions with officers, directors

and persons or companies related to directors or officers and paid

or accrued amounts as follows:

Edgewater Associates Limited ("Edgewater")

During the three-month period ended May 31, 2023, Directors' and

Officers' insurance was obtained on an arms-length basis through

Edgewater, which is a 100% subsidiary of Manx Financial Group

("MFG"). James Mellon and Denham Eke are Directors of both the

Company and MFG.

During the period, the premium payable on the policy was US$ Nil

(year ended February 28, 2023: US$ 49,318). A total of US$ 1,699

was prepaid as at the period end (February 28, 2023: US$

14,497).

(k) Critical Accounting Estimates

The preparation of financial statements in conformity with IFRS

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial

statements and reported amounts of revenues and expenses during the

reporting period. Such estimates and assumptions affect the

carrying value of assets, and impact decisions as to when

exploration and development costs should be capitalized or

expensed.

As at May 31, 2023, the Company had incurred capitalised

exploration expenditures, including capitalised licence and permit

costs, of US$ 10,803,005. Changes in management's judgment as to

the prospective nature, assessment of the existence or otherwise of

economically recoverable reserves, technical feasibility and/or

commercial viability of the relevant tenements and the Company's

intentions with respect to the relevant tenements, could affect the

assessment of the recoverable amount.

The Company regularly reviews its estimates and assumptions:

however, actual results could differ from these estimates and these

differences could be material.

Bradda Head Lithium Limited

Unaudited Condensed Consolidated Interim Financial

Statements

For the three-month period ended May 31, 2023

Condensed Interim Consolidated Statement of Comprehensive

Income

for the period ended May 31, 2023

Three-month period ended May 31, 2023 Three-month period ended May 31, 2022

(unaudited) (unaudited)

Notes US$ US$

Expenses

General and administrative 2 (1,258,841) (1,205,529)

Share based payment and

warrant expense 10 (180,622) (1,194,204)

Foreign exchange gain/(loss) 136,475 (310,522)

---------------- ----------------

Operating loss (1,302,988) (2,710,255)

Other income

Warrant fair value

re-measurement 11 146,585 2,830,344

Unrealised gain on Investment 13,109 -

at fair value through profit

or loss

---------------- ----------------

(Loss)/profit before finance

income (1,143,294) 120,089

Finance income 59,102 -

---------------- ----------------

(Loss)/profit before income

tax (1,084,192) 120,089

Income tax expense - -

---------------- ----------------

Total comprehensive

(loss)/profit for the period (1,084,192) 120,089

Basic and diluted

(loss)/profit per share (US

cents) 12 (0.278) 0.04

The accompanying notes are an integral part of these

consolidated interim financial statements.

Condensed Interim Consolidated Statement of Financial

Position

as at May 31, 2023

Notes May 31, 2023 February 28, 2023

(unaudited) (audited)

US$ US$

Non-Current assets

Deferred mining and exploration costs 3 8,410,296 7,461,851

Exploration permits and licences 4 2,392,709 2,112,415

Plant and equipment 8 118,681 79,602

Advances and deposits 6 50,941 104,192

Investment at fair value through profit or loss 104,869 91,761

-------------- --------------

Total non-current assets 11,077,496 9,849,821

-------------- --------------

Current assets

Cash and cash equivalents 3,905,582 7,746,519

Cash deposits 1,092,858 -

Advances and deposits 6 385,624 385,624

Trade and other receivables 6 168,869 216,595

-------------- --------------

Total current assets 5,552,933 8,348,738

-------------- --------------

Total assets 16,630,429 18,198,559

Equity

Share premium 9 30,616,373 30,616,373

Retained deficit (14,535,003) (13,631,433)

-------------- --------------

Total equity 16,081,370 16,984,940

--------------

Current liabilities

Trade and other payables 7 465,443 983,418

Warrant liability 11 83,616 230,201

-------------- --------------

Total current liabilities 549,059 1,213,619

-------------- --------------

Total equity and liabilities 16,630,429 18,198,559

The accompanying notes are an integral part of these

consolidated interim financial statements.

These condensed interim consolidated financial statements were

approved by the Board of Directors on August 30, 2023 and were

signed on their behalf by:

Denham Eke

Director

Condensed Interim Consolidated Statement of Changes in

Equity

for the period ended May 31, 2023

Share premium Retained deficit Total

US$ US$ US$

Balance at March 1, 2023 (audited) 30,616,373 (13,631,433) 16,984,940

Total comprehensive loss for the period

Loss for the period - (1,084,192) (1,084,192)

------------ -------------- --------------

Total comprehensive loss for the period - (1,084,192) (1,084,192)

Transactions with owners of the Company

Equity settled share-based payments (note 10) - 180,622 180,622

------------ -------------- ------------

Total transactions with owners of the Company - 180,622 180,622

------------ -------------- ------------

Quarter ended May 31, 2023 (unaudited) 30,616,373 (14,535,003) 16,081,370

The accompanying notes are an integral part of these

consolidated interim financial statements.

Condensed Interim Consolidated Statement of Changes in

Equity

for the period ended May 31, 2023 (continued)

Share premium Retained deficit Total

US$ US$ US$

Balance at 1 March 2022 (audited) 23,434,385 (11,177,220) 12,257,165

Total comprehensive profit for the period

Profit for the period - 120,089 120,089

------------ -------------- --------------

Total comprehensive income for the period - 120,089 120,089

Transactions with owners of the Company

Issue of ordinary shares (note 9 and note 11) 7,581,351 - 7,581,351

Share issue costs capitalised (note 9) (547,916) - (547,916)

Equity settled share-based payments (note 10) - 1,194,204 1,194,204

------------ -------------- ------------

Total transactions with owners of the Company 7,033,435 1,194,204 8,227,639

------------ -------------- ------------

Quarter ended 31 May 2022 (unaudited) 30,467,820 (9,862,927) 20,604,893

The accompanying notes are an integral part of these

consolidated interim financial statements.

Condensed Interim Consolidated Statement of C ash Flows

for the period ended May 31, 2023

Three-month period ended May 31, 2023 Three-month period ended May 31, 2022

Notes (unaudited) (unaudited)

US$ US$

Cash flows from operating activities

(Loss)/profit before income tax (1,084,192) 120,089

Adjusted for non-cash and non-operating

items:

Depreciation 8 10,921 4,643

Unrealised (gain)/loss on investment (13,109) -

Interest income (59,102) -

Equity settled share based payments

expense 10, 11 180,622 1,194,204

Warrant fair value re-measurement 11 (146,585) (2,830,344)

Unrealised FX gain on cash balances - 316,171

-------------- --------------

(1,111,445) (1,195,237)

Change in trade and other receivables 47,727 10,996

Change in trade and other payables (517,974) (751,625)

-------------- --------------

Net cash flows used by operating

activities (1,581,692) (1,935,866)

Cash flows from investing activities

Amounts paid for deferred mining and

exploration costs 3 (948,445) (312,761)

Amounts paid for licences and permits 4 (280,294) (294,424)

Equipment purchased 8 (50,000) (58,671)

Advances and deposits - cash returned 53,250 -

-------------- --------------

Net cash flows used by investing

activities (1,225,489) (665,856)

Cash flows from financing activities

Cash received from shares and warrants

issued 9, 11 - 12,304,100

Share issue costs paid 9 - (547,916)

Interest income received 59,102 -

Bank deposits not considered cash and (3,905,582) -

cash equivalents (net)

-------------- --------------

Net cash flows from financing

activities (3,846,480) 11,756,184

-------------- --------------

Increase / (decrease) in cash and cash

equivalents (6,653,661) 9,154,462

Cash and cash equivalents at beginning

of period 7,746,519 7,327,303

Effect of foreign exchange on cash

balances - (316,171)

-------------- --------------

Cash and cash equivalents at end of

period 1,092,858 16,165,594

The accompanying notes are an integral part of these

consolidated interim financial statements.

Bradda Head Lithium Limited

Notes to the condensed consolidated interim financial statements

for the period ended May 31, 2023

1 Reporting Entity and basis of preparation

Bradda Head Lithium Limited (the "Company") is a company

domiciled in the British Virgin Islands. The address of the

Company's registered office is Craigmuir Chambers, Road Town,

Tortola, British Virgin Islands. The Company and its subsidiaries

together are referred to as the "Group".

The Company is a lithium exploration Group focused on developing

its projects in the USA.

These interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting and should be

read in conjunction with the last annual consolidated financial

statements as at and for the year ended February 28, 2023 ("last

annual financial statements"). They do not include all of the

information required for a complete set of IFRS financial

statements. However, selected explanatory notes are included to

explain events and transactions that are significant to an

understanding of the changes in the Group's financial position and

performance since the last annual financial statements.

The financial information in this report has been prepared in

accordance with the Company's accounting policies and in

consistency with the last annual financial statements. Full details

of the accounting policies adopted by the Company are contained in

the financial statements included in the Company's annual report

for the year ended February 28, 2023, which is available on the

Group's website: www.braddheadltd.com , and on SEDARplus (

www.sedarplus.ca/landingpage ). These unaudited condensed

consolidated interim financial statements should be read in

conjunction with the audited Consolidated Financial Statements for

the year ended February 28, 2023.

2 General and administrative

The Group's general and administrative expenses include the

following:

Three-month period ended May 31, 2023 Three-month period ended May 31, 2022

(unaudited) (unaudited)

US$ US$

Auditors' fees 19,600 81,841

Directors and management fees and

salaries 137,541 132,674

Legal and accounting 83,613 100,306

Contractor costs 551,868 565,826

Professional and marketing costs 204,203 307,328

Other administrative costs 262,016 17,554

-------------- --------------

Total 1,258,841 1,205,529

3 Deferred mine exploration costs

The schedule below details the exploration costs capitalised to

date:

Total

US$

Cost and net book value

At February 28, 2022 (audited) 4,183,744

Capitalised during the year 3,278,107

--------------

At February 28, 2023 (audited) 7,461,851

--------------

Capitalised during the period 948,445

--------------

At May 31, 2023 (unaudited) 8,410,296

Cost and net book value

At May 31, 2023 (unaudited) 8,410,296

At February 28, 2023 (audited) 7,461,851

The recoverability of the carrying amounts of exploration and

evaluation assets is dependent on the successful development and

commercial exploitation or sale of the respective area of interest,

as well as maintaining the assets in good standing. The Group

assessed the DMEC relating to areas for which licenses and permits

are held, for impairment as at May 31, 2023. The Board concluded

that no facts and circumstances have been identified which suggest

the recoverable amount of these assets would not exceed the

carrying amount and, as such, no impairment was recognised during

the period.

During the year ended February 28, 2023, an impairment charge of

US$ Nil was recognised.

4 Exploration permits and licences

The schedule below details the exploration permit and licence

costs capitalised to date:

Total

US$

Cost and net book value

At February 28, 2022 (audited) 1,549,076

Capitalised during the year 582,809

Impairment (19,470)

--------------

At February 28, 2023 (audited) 2,112,415

Capitalised during the period 280,294

--------------

At May 31, 2023 (unaudited) 2,392,709

Cost and net book value

At May 31, 2023 (unaudited) 2,392,709

At February 28, 2023 (audited) 2,112,415

The Group assessed the carrying amount of the licences and

permits held for impairment as at May 31, 2023. The Board concluded

that no facts and circumstances have been identified which suggest

the recoverable amount of these assets would not exceed the

carrying amount and, as such, no impairment was recognised during

the period.

During the year ended February 28, 2023, an impairment charge of

US$ 19,470 was recognised as a result of project licences and

permits that were not renewed.

5 Investment in subsidiary undertakings

As at May 31, 2023, the Group had the following

subsidiaries:

Name of company Place of Ownership Principal activity

incorporation interest

Bradda Head Limited* BVI 100% Holding company of entities

below

Zenolith (USA) LLC USA 100% Holds USA lithium licences

and permits

Verde Grande LLC USA 100% Holds USA lithium licences

and permits

Gray Wash LLC USA 100% Holds USA lithium licences

and permits

San Domingo LLC USA 100% Holds USA lithium licences

and permits

* Held directly by the Company. All other holdings are

indirectly held through Bradda Head Limited

The condensed interim consolidated financial statements include

the results of the subsidiaries for the full interim period from

March 1, 2023 to May 31, 2023, and up to the date that control

ceases.

6 Trade and other receivables and advances and deposits

Non-current

May 31, 2023 February 28, 2023

(unaudited) (audited)

US$ US$

Advances and deposits 50,941 104,192

Current

May 31, 2023 February 28, 2023

(unaudited) (audited)

US$ US$

Prepayments and other debtors 168,869 216,595

Advances and deposits 385,624 385,624

7 Trade and other payables

May 31, 2023 February 28, 2023

(unaudited) (audited)

US$ US$

Trade payables 367,370 904,944

Accrued expenses and other payables 98,073 78,474

------------ ------------

465,443 983,418

8 Plant and equipment

Motor vehicle Total

Cost US$ US$

As at March 1, 2022 (audited) 55,718 55,718

Additions during the year 58,672 58,672

------------ ------------

As at February 28, 2023 (audited) 114,390 114,390

Additions during the period 50,000 50,000

------------ ------------

As at May 31, 2023 (unaudited) 164,390 164,390

Motor vehicle Total

Accumulated depreciation US$ US$

As at March 1, 2022 (audited) (1,548) (1,548)

Depreciation charge for the year (33,240) (33,240)

------------ ------------

As at February 28, 2023 (audited) (34,788) (34,788)

Depreciation charge for the period (10,921) (10,921)

------------ ------------

As at May 31, 2023 (unaudited) (45,709) (45,709)

Carrying amount

As at May 31, 2023 (unaudited) 118,681 118,681

As at February 28, 2023 (audited) 79,602 79,602

9 Share premium

Authorised

The Company is authorised to issue an unlimited number of nil

par value shares of a single class.

Shares Share capital Share premium

Issued ordinary shares of US$0.00 each US$ US$

At February 28, 2022 (audited) 317,413,879 - 23,434,385

Shares issued for cash 73,195,560 - 7,729,904

Share issue costs capitalised - - (547,916)

-------------- -------------- --------------

At February 28, 2023 (audited) 390,609,439 - 30,616,373

At May 31, 2023 (unaudited) 390,609,439 - 30,616,373

On 13 April 2022, the Company completed a fundraise, issuing

73,195,560 ordinary shares for gross proceeds of US$ 12.9 million

and issued 73,195,560 warrants for ordinary shares to participating

shareholders. Refer to note 11.

10 Equity settled share based payments

The cost of equity settled transactions with certain Directors

of the Company and other participants ("Participants") is measured

by reference to the fair value at the date on which they are

granted. The fair value is determined based on the Black-Scholes

option pricing model.

Options and warrants

The total number of share options and warrants in issue as at

the period end is set out below.

Recipient Grant Term Exercise Number at Number Issued Number Lapsed/ Number May 31, 2023 Fair value

Date in Price March 1, 2023 cancelled/expired Exercised (unaudited)

years (audited)

Options US$

Directors and

Participants April 2018 5 US$ 0.15668 1,606,304 - - - 1,606,304 24,028

Directors and

Participants June 2021 5 US$ 0.048 18,000,000 - - - 18,000,000 1,110,556

Directors and

Participants September 2021 5 GBP0.09 3,500,000 - - 3,500,000 314,962

Directors and

Participants April 2022 5 GBP0.18 8,925,000 - - 8,925,000 1,089,312

Directors and

Participants December 2022 5 GBP0.105 1,000,000 - - 1,000,000 273,727

Directors and

Participants April 2023 5 GBP0.060 - 4,800,000 - - 4,800,000 180,622

Warrants

Supplier warrants July 2021 5 GBP0.0550 1,818,182 - - - 1,818,182 124,482

Supplier warrants July 2021 3 GBP0.0825 2,254,545 - - - 2,254,545 8,275

Shareholder

warrants December 2021 2 GBP0.0885 1,185,687 - - - 1,185,687 44,858

Supplier

warrants April 2022 2 GBP0.1350 3,244,331 - - - 3,244,331 284,918

-------------- -------------- -------------- -------------- -------------- --------------

41,534,049 4,800,000 - - 46,334,049 3,455,740

10 Equity settled share based payments (continued)

The amount expensed in the income statement has been calculated

by reference to the fair value at the grant date of the equity

instrument and the estimated number of equity instruments to vest

after the vesting period.

Three-month period ended May 31, 2023 Three-month period ended May 31, 2022

(unaudited) (unaudited)

US$ US$

Share based payments charge 180,622 1,194,204

The inputs used in the measurement of the fair values at grant

date of the equity-settled share-based payment plans issued during

the period are as follows:

April 2023 options

Award date and exercise price

Fair value at grant date GBP0.030

Exercise price GBP0.060

Weight average expected volatility 78.50%

Weighted average expected life (years) 5

Risk-free interest rate (based on comparable companies) 3.82%

Terms of the issued options are as follows:

- 4,800,000 options have been granted that vest fully on grant

date. All un-exercised options expire after a period of 5 years

from admission date. It is assumed that options are exercised

within 5 years from date of grant. The applied volatility is based

on historical volatility.

11 Warrants

The cost of equity warrants granted during the period are

measured by reference to the fair value at the date on which they

are granted. The fair value is determined based on the

Black-Scholes option pricing model.

During the three-month period ended May 31, 2023, no new

warrants were issued.

The total number of warrants in issue as at the period end is

set out below.

Recipient Grant Term Exercise Warrants at Number of Number of Number of Number of Fair value

Date in Price March 1, 2023 Warrants Warrants Lapsed/ Warrants Warrants at

years (audited) Issued cancelled/expired Exercised May 31, 2023

(unaudited)

Warrants US$

Shareholder April

warrants 2022 2 GBP0.2100 73,195,560 - - - 73,195,560 83,616

-------------- -------------- -------------- -------------- -------------- --------------

73,195,560 - - - 73,195,560 83,616

The fair value applied to the shareholder warrants has been

classified as a financial liability. At the date of grant the fair

value of shareholder warrants of US$ 4,748,671 was deducted from

the gross proceeds raised against share premium. At period end, the

warrant liability has been re-measured to fair value, with a

corresponding entry to profit and loss of US$ 146,585 (31 May 2022:

US$ 2,830,344) within Warrant Fair Value Re-Measurement.

Reconciliation of warrant liability fair value:

Fair value

US$

Balance at March 1, 2023 230,201

Fair value re-measurement (146,585)

--------------

Balance at May 31, 2023 83,616

11 Warrants (continued)

April 2022 shareholder warrants

Grant date fair value Award date and exercise

price

Fair value at grant date GBP0.0492

Exercise price GBP0.21

Weight average expected volatility 81.90%

Weighted average expected life (years) 2

Risk-free interest rate (based on comparable

companies) 0.80%

May 31, 2023 fair value Award date and exercise

price

Fair value GBP0.00009

Exercise price GBP0.21

Weighted average expected volatility 79.2%

Weighted average expected life remaining

(years) 0.88

Risk-free interest rate (based on comparable

companies) 4.40%

As part of the fundraise completed during April 2022, all

participating shareholders received a warrant on 1:1 basis for

shares acquired. As a result, 73,195,560 warrants have been issued.

All un-exercised warrants expire after a period of 2 years from

grant date. It is assumed that warrants are exercised within 2

years from date of grant. The applied volatility is based on

historical volatility.

12 Basic and diluted loss per share

The calculation of the basic loss per share is based on the

earnings attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year.

The calculation of diluted earnings per share is based on the

basic earnings per share, adjusted to allow for the issue of

shares, on the assumed conversion of all dilutive share

options.

An adjustment for the dilutive effect of share options in the

current year has not been reflected in the calculation of the

diluted loss per share, as the effect would have been

anti-dilutive, due the Company recognising a loss for the year.

May 31, 2023 May 31, 2022

(unaudited) (unaudited)

US$ US$

--------------------------------------------------------- ------------ --------------

(Loss)/profit for the period (1,084,192) 120,089

--------------------------------------------------------- ------------ ------------

No. No.

--------------------------------------------------------- ------------ --------------

Weighted average number of ordinary shares in issue 390,609,439 342,690,043

Dilutive element of share options if exercised (note 15) 37,831,304 32,031,304

--------------------------------------------------------- ------------ --------------

Diluted number of ordinary shares 428,440,743 374,721,347

--------------------------------------------------------- ------------ --------------

Basic (loss)/earnings per share (cents) (0.278) 0.04

--------------------------------------------------------- ------------ ------------

Diluted (loss)/earnings per share (cents) (0.278) 0.04

--------------------------------------------------------- ------------ ------------

For the period ended May 31, 2023, the earnings applied are the

same for both basic and diluted earnings calculations per share as

there are no dilutive effects to be applied.

13 Related party transactions and balances

Edgewater Associates Limited ("Edgewater")

During the three-month period ended May 31, 2023, Directors' and

Officers' insurance was obtained on an arms-length basis through

Edgewater, which is a 100% subsidiary of Manx Financial Group

("MFG"). James Mellon and Denham Eke are Directors of both the

Company and MFG.

During the period, the premium payable on the policy was US$ Nil

(year ended February 28, 2023: US$ 49,318). A total of US$ 1,699

was prepaid as at the period end (February 28, 2023: US$

14,497).

14 Commitments and contingent liabilities

The Group has certain obligations to expend minimum amounts on

exploration works on mining tenements in order to retain an

interest in them, equating to approximately US$ 432,029 during the

next 12 months. This includes annual fees in respect of licence

renewals. These obligations may be varied from time to time,

subject to approval and are expected to be filled in the normal

course of exploration and development activities of the

Company.

15 Events after the reporting date

No post balance sheet events have occurred that required

disclosure.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFKZGFRLMKGFZG

(END) Dow Jones Newswires

August 31, 2023 06:25 ET (10:25 GMT)

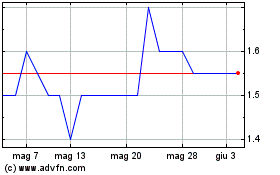

Grafico Azioni Bradda Head Lithium (LSE:BHL)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Bradda Head Lithium (LSE:BHL)

Storico

Da Mag 2023 a Mag 2024